Amazon shares settled higher by the end of Monday’s stock trading session after a report from the Wall Street Journal revealed that the company is close to striking a deal to acquire MGM Studios. The deal weighs in at approximately $9 billion including debt to strengthen the content library of its Prime Video streaming service.

The production company, which co-owns the rights of multiple successful franchises and TV shows including James Bond, had been seeking buyers for a while now and has apparently found a suitable partner in Amazon (AMZN) as the company founded by Jeff Bezos keeps fighting to secure a place at the top of the streaming industry.

According to sources familiar with the matter, the deal could be announced as soon as this week and it would suppose the largest acquisition made by the e-commerce giant since it purchased Whole Foods back in 2017 for a total of $13.7 billion.

Media companies’ content battle is driving M&A activity

The deal comes only a few days after AT&T (T) and Discovery (DISCA) announced a merger between the telecom’s giant production and broadcasting company – WarnerMedia – and Discovery valued at $43 billion that would result in the creation of one of the largest independent media companies in the world.

According to the Journal, negotiations have been going on and off throughout this year and, although there are no guarantees that the deal will come through, the parties involved appear to agree that both will benefit from its completion.

Amazon has been ramping up its Prime Video content library lately by introducing a combination of original and third-party content. The acquisition of MGM would provide a boost to its resources by including hundreds of beloved titles and shows.

Meanwhile, the firm experienced an unexpected blowback recently when Sony Pictures agreed to sign a multi-year agreement with Netflix (NFLX) to allow the undisputed leader of the streaming industry to broadcast its popular films.

According to the latest data, Prime Video is the second-largest video streaming service in the globe as the 100 million users of Amazon Prime are automatically enrolled for the service.

This puts Prime at the same level as its closest rival, Disney+ but at a still fairly big distance from Netflix, since the Los Gatos-based streaming company currently has over 200 million paid subscribers.

How have Amazon shares performed so far this year?

Amazon shares responded positively to the news by advancing 1.3% yesterday at $3,244 per share although the performance of the stock is still under water for the year. Since 1 January, Amazon shares have lost 0.4%, effectively underperforming the tech-heavy Nasdaq 100 index by 5.4%.

Earlier this year, the famous co-founder of the e-commerce company, Jeff Bezos, announced that he will be stepping down from his role as the Chief Executive of the $1.65 trillion company. He will be replaced by Andy Jassy – the former CEO of Amazon Web Services and a close person to Bezos.

This change in leadership is expected to take place during the second half of 2021, which means that Jassy will be the person in charge of ensuring that a potential deal with MGM comes to fruition and delivers what investors expect from it.

What’s next for Amazon (AMZN)?

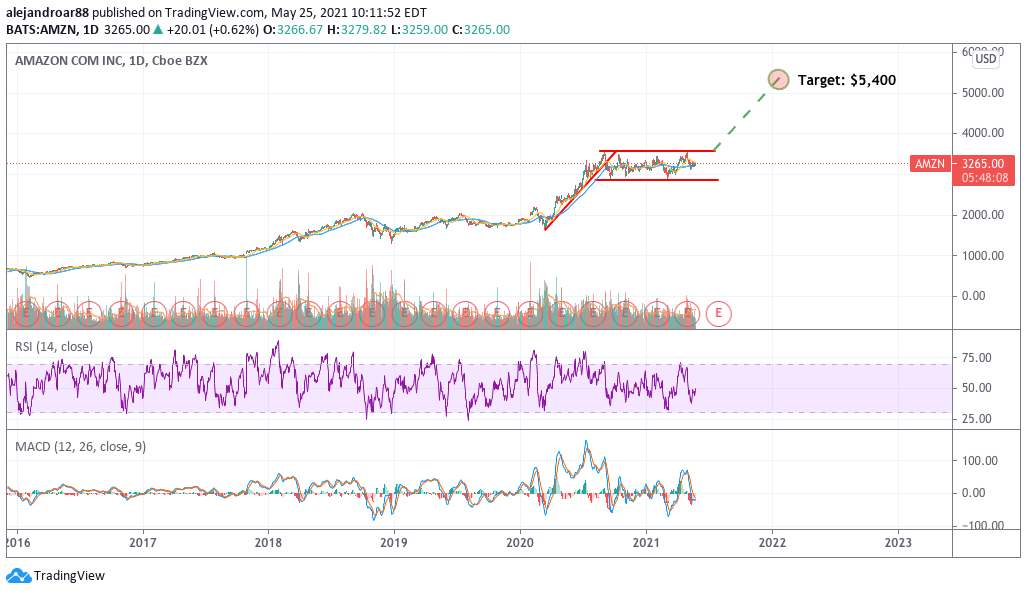

Amazon shares have been trading within a fairly wide price channel between $2,860 and $3,550 per share for the past eight months or so which indicates that the stock is undergoing a period of consolidation as market participants revisit the outlook for the business now that the pandemic is over.

The combination of this consolidation pattern along with the stock’s 2020 uptrend results in the formation of a bull flag – a price action continuation setup that could push the stock towards a first target of $5,400 if the $3,550 level is broken.

Meanwhile, Wall Street’s consensus for the stock currently sits at $4,245 per share, indicating a 31% potential upside if such a target is reached.

From a fundamental perspective, the company is currently trading at 57 times its next twelve-month earnings per share (EPS). This multiple reflects the accelerated rate at which the company’s net income has been growing lately.

From 2015 to 2019, Amazon managed to grow its net income by a compounded annual growth rate (CAGR) of 110%. Moreover, this rate is consistent with the firm’s annual earnings growth of 84% last year while analysts expect to see the company’s bottom-line jumping by 31% in 2021.

This results in a price-to-earnings-to-growth (PEG) ratio of 1.84. Although this ratio doesn’t qualify Amazon as an undervalued stock, it is important to note that analysts are expecting a deceleration in the firm’s growth this year amid the higher comparative baseline resulting from last year’s pandemic-inflated volumes.

If Amazon manages to maintain a growth rate that exceeds these historically low estimates, chances are that the stock will break this consolidation rectangle as analysts will revisit their estimates amid what could be a long-lasting tailwind for the company.

Question & Answers (0)