Best MT4 Brokers UK

MT4 is the most widely used trading platform not just in the UK – but globally. This popular platform – which comes packed with advanced trading tools and features, sits between you and your chosen broker.

In this guide, we review some of the popular MT4 brokers UK. We also walk you through the process of choosing a provider yourself and how to get started with a MetaTrader 4 brokerage account.

Popular MT4 Brokers UK List

The popular MT4 brokers UK that we came across can be found below. For a comprehensive review of each MT4 brokerage site – scroll down to the relevant section.

- Libertex

- Pepperstone

- IG

- FXCM

- CedarFX

- Forex.com

- ETX Capital

- CMC Markets

Popular MT4 Brokers Reviews

There are well over a thousand online brokers that offer full support for MT4. However, this does mean that you need to do some digging to see how each broker compares.

For example, what financial instruments can you trade via the MT4 broker, and what fees and commissions will you be charged. These – alongside a number of other key questions – are crucial in finding a suitable MT4 broker for you.

If you don’t have time to scour the internet for the popular MT4 brokers UK for 2022 – below you will find reviews on 10 popular MT4 Brokers to use in the UK.

1. Libertex

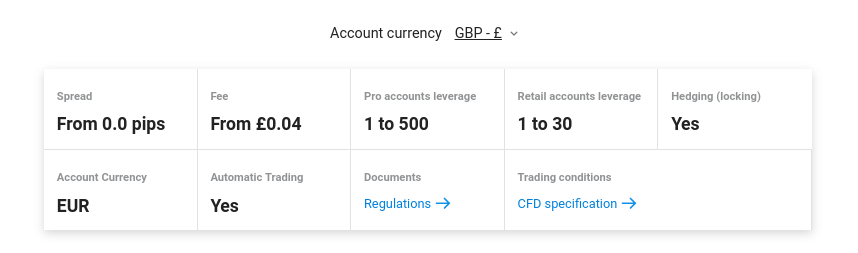

When searching for some of the popular MT4 broker UK for your needs – one of the main priorities should be fees and commissions. After all, this is set by the brokerage firm and not MT4 itself. With this in mind, it is well worth considering Libertex. This day trading platform – which was first launched over 23 years ago, allows you to trade with tight spreads.

This is fundamental, as it means you will get the same bid and ask price irrespective of how much you decide to stake. Across heaps of financial instruments, many markets at Libertex can also be traded commission-free. If a commission on your chosen market is required – rarely does this amount to more than 0.1% per slide.

Once you have connected your Libertex account to MT4, you can start trading straight away. You may opt for the demo account to enjoy a risk-free practice session or meet a minimum deposit of £100 to trade with real money. Either way, you’ll have access to a number of popular asset classes at this MT4 broker. This includes dozens of forex pairs, stocks, ETFs, commodities, and more.

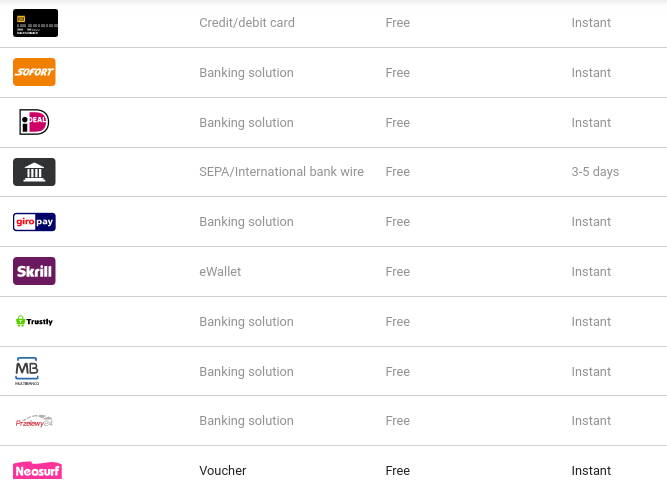

As Libertex specializes in CFD trading, this means that you may long or short on your chosen market. You may also apply leverage – in-line with FCA limits. In the funding department, there are several UK payment methods to choose from. This includes e-wallets, debit/credit cards, and bank transfers. From your second deposit onwards – you only need to meet a £10 minimum. Finally, Libertex can be accessed via MT4 through its website where you can download MT4 for Mac, downloadable software, or an iOS/Android trading app.

86% of retail investor accounts lose money when trading CFDs with this provider.

2. Pepperstone

If you’re looking for the popular MT4 broker UK for raw spread accounts – Pepperstone is a valuable option. Put simply, by opting for this account type – you will be able to trade a wide variety of markets without paying any spreads.

If you’re looking for the popular MT4 broker UK for raw spread accounts – Pepperstone is a valuable option. Put simply, by opting for this account type – you will be able to trade a wide variety of markets without paying any spreads.

This is comparable to an ECN broker account – as you will be buying and selling financial instruments directly with your market peers. The raw spread account at Pepperstone comes with a very small commission of £2.29 – which is payable at both ends of the trade.

It goes without saying that the raw spread account is most suited for seasoned traders that are staking larger amounts. With that said, Peppertone also offers a standard account. This does come alongside spreads, but you won’t pay any trading commissions. Either way, this MT4 broker offers a huge number of tradable markets.

This covers forex, commodities, bonds, stocks, and indices – all via CFDs. Pepperstone also offers a spread betting facility for those of you that wish to trade on a tax-free basis. In terms of payments, Pepperstone supports debit cards, Paypal, and a bank wire. Finally, this MT4 broker is authorized and regulated by the FCA.

75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

3. IG

IG is a trusted brokerage firm that has been offering investment services to UK traders since 1974. The provider offers a number of different asset classes – including traditional share and fund dealing, spread betting, and CFDs.

However, where this popular MT4 broker really stands out is in the forex department. This is because the platform gives you access to over 80 currency pairs of all shapes and sizes. While all major and minor pairs are covered, IG also provides an easy gateway to exotic currencies.

With all forex markets on the IG platform – you may trade via MT4 on a 24/7 basis. This is particularly useful for entering and exiting positions outside of standard hours. Leverage of up to 1:30 is offered to all UK traders on major forex markets and 1:20 on minors and exotics.

When it comes to trading fees, this MT4 broker is competitive. For example, all forex pairs can be traded on a commission-free basis – as fees are built into the spread. You have the option to get the spread down to just 0.6 pips on EUR/USD and AUD/USD during standard trading hours.

USD/JPY starts at just 0.7 pips while EUR/GBP and GBP/USD has a headline rate of 0.9 pips. If you like the sound of this MT4 trading platform, you will need to meet a minimum deposit of £250. You may, however, start off with the IG demo account to ensure the broker is right for you. Supported payments at this FCA broker include debit cards and bank transfers.

Your capital is at risk.

4. FXCM

As you likely know, if you’re planning to use a forex EA or automated trading robot – then MT4 is one of the most popular automated trading platform for this purpose. This is because most robots are designed exclusively for MT4 – so all you need to do is install the software file.

With that said, not all MT4 brokerage sites are supportive of forex EAs and trading robots – so you do need to check this before signing up. Fortunately, FXCM is a proponent of automated trading systems – as it offers a dedicated Virtual Private Server (VPS) that you may connect to the MT4.

This is for the sole objective of having your trading robot purchase and sell assets around the clock – as a VPS will ensure that your device isn’t overloaded. In fact, FXCM goes one step further by offering a number of automated trading strategies and apps that you connect to your MT4 robot.

FXCM also offers an MT4 demo account facility. This is ideal, as you test out your EA or robot in a 100% risk-free manner. In terms of supported assets – FXCM covers forex and CFDs in the form of stocks, indices, and commodities. The broker is regulated by the FCA and has been active in the brokerage scene for more than two decades.

Sponsored ad. There is no guarantee you will make money with this provider.

5. CedarFX

This means that you have the option to only purchase digital currencies in the traditional sense. However, if you still have an appetite to trade cryptocurrencies with leverage – then CedarFX might be worth considering. This is because the MT4 broker does not have any relationship with fiat currency – so it does not fall within the remit of FCA regulations.

Instead, CedarFX only allows you to deposit and withdraw funds via cryptocurrency. There is an option to use a debit/credit card through a third-party payment provider – but this will instantly be converting into Bitcoin. Nevertheless, if you are happy to fund your account with a crypto-asset – then CedarFX will offer a whopping 1:100 on crypto markets.

This means that the equivalent of £100 would permit a maximum trade value of £10,000. You may get even higher leverage when trading other assets at this MT4 broker. For example, hard metals and forex come with a limit of 1:500, while indices and commodities will get you 1:200.

In terms of the specifics, CedarFX requires a minimum Bitcoin deposit that is the equivalent of $10. There are no deposit charges other than that of the blockchain mining fee. Finally, CedarFX is a 100% commission-free MT4 broker – so all trading fees are built into the spread.

There is no guarantee you will make money with this provider.

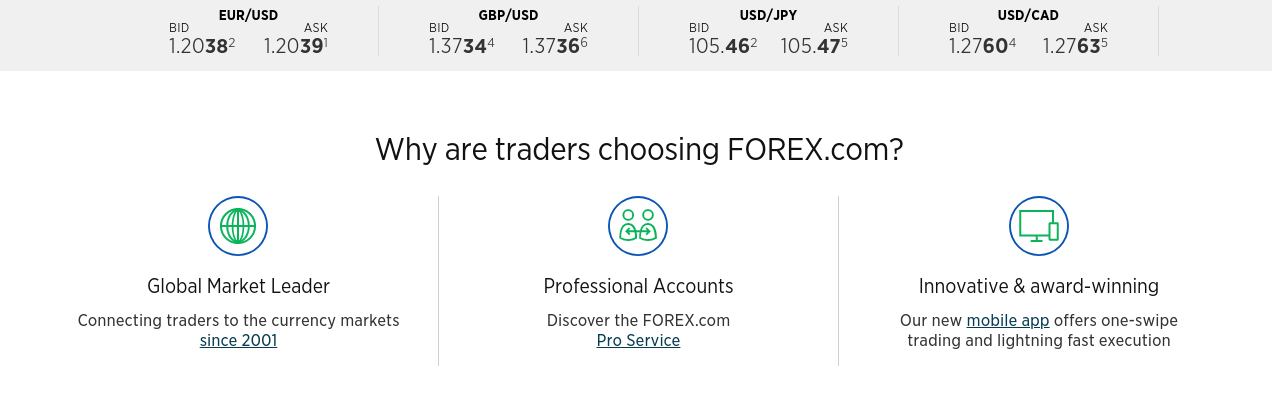

6. Forex.com

Forex.com has been active in the online trading scene for two decades. Primarily, this MT4 broker is the go-to platform for serious forex traders. This is because the broker supports dozens of currency pairs at competitive fees.

With that said, Forex.com also offers a range of other asset classes via CFDs. This includes a selection of hard metals, stocks, energies, and indices. Although Forex.com offers accounts to UK retail clients, this MT4 broker is arguably better suited for professional traders that are staking large sums.

This is because Forex.com offers an attractive STP Pro account that comes with spreads of just 0.1 pips on most major currencies. The commission that you will pay to trade via this account is just $60 per $1 million traded. Forex.com is also suitable for professional traders because it benefits from significant volumes of liquidity.

This is because the STP broker is used by seasoned traders from all over the world. In particular, Forex.com is also fully-compatible with high-frequency traders and automated robots. Regarding the former, the platform offers VPS hosting for MT4. In terms of payments, Forex.com supports bank transfers and debit/credit cards.

There is no guarantee you will make money with this provider.

7. ETX Capital

If you are looking for a popular spread betting broker – then ETX Capital is well worth looking into. The UK-based broker – which was launched over five decades ago, gives you access to over 5,000 spread betting markets.

This covers everything from indices and energies to shares and forex. You don’t need to be a seasoned pro to use ETX Capital, as it allows you to spread bet from just 10p per point. Fees on popular MT4 broker are also very competitive.

Like most of the platforms discussed today – ETX Capital doesn’t charge any trading commissions. When it comes to spreads, major forex pairs start at 0.8 pips and indices from 0.05%. The minimum deposit at this MT4 broker is just £100 – which you may fund with a debit card or e-wallet.

Your capital is at risk.

8. CMC Markets

In the stock department, for example, you have the option to trade more than 8,000 share CFDs. This largely centers on markets in the UK and US. We also like the customized ‘share baskets’ offered by the broker – which includes Big Tech, UK Banks, Gaming, Streaming, and more.

There are heaps of other asset classes available – including the likes of ETFs, US Treasuries, commodities, indices, and bonds. Much like ETX Capital, CMC Markets also offers a fully-fledged spread betting facility. When it comes to fees, there are no commissions at CMC Markets. Once again, this means that all fees are built into the spread.

In the forex department, spreads start at 0.7 pips. Both indices and commodities can be traded from 0.3 pips, while shares and ETFs start at 0.10%. All financial instruments at CMC Markets can be traded with leverage – with FCA limits in place for UK retail clients. Finally, CMC Markets is authorized and regulated by the FCA and there is no minimum deposit policy in place.

Your capital is at risk.

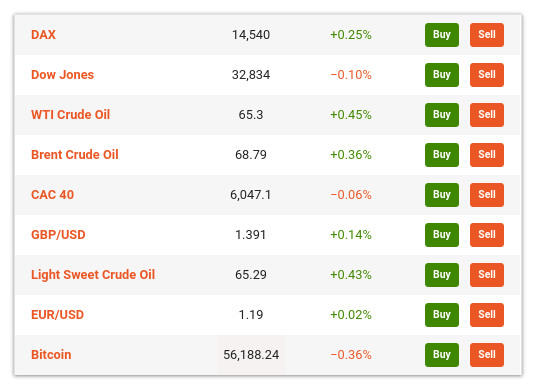

Popular Meta Trader 4 Brokers Fees Comparison

Below you will find an overview of the main fees discussed in our MT4 broker reviews.

| UK MT4 Broker | Commission | Spreads From | Platform Fee |

| Libertex | 0%-0.5% | ZERO | None |

| IG | 0% apart from stock CFDs | 0.6 pips | £24 per quarter if placing less than 3 trades |

| Pepperstone | 0% | 0 pips on Raw Account | None |

| FXCM | 0% | 0.01 pips (N.Gas) | None |

| CedarFX | 0% | 0.7 pips | None |

| Forex.com | 0% | 0.1 pips | None |

| ETX Capital | 0% | 0.8 pips | None |

| CMC Markets | 0% | 0.3 pips | None |

As we discuss shortly, there are other fees to look out for when reading MT4 broker reviews – such as those linked to overnight financing, deposits, withdrawals, and currency conversion.

What is MT4?

Launched in 2005 by MetaQuotes Software – MetaTrader 4, or simply MT4 – is a third-party trading platform. The platform forms an optional bridge between you and your chosen online broker. That is to say, rather than using the trading platform built by the brokerage site – you will be buying and selling assets through MT4.

This includes:

- Support for forex EAs and automated trading robots

- Advanced order types that might not be offered by your broker

- Dozens of technical indicators

- Fully customizable trading screen with multiple charts

- Chart drawing tools

- Trade complex instruments with micro-second execution times

- Copy Trading features

Ultimately, if you are a newbie trader with little to no experience in this space – MT4 is not going to suitable for you. Fortunately, most of the MT4 brokers discussed on this page also offer their own in-house trading platform that you may access through our web browser. These are typically tailored towards less-experienced traders.

How to Choose a MT4 Broker UK

As we briefly noted earlier, there more than 1,000 online trading sites that offer support for MT4. As such, you won’t be short of options. However, MT4 is merely a third-party platform that forwards your buy and sell orders to your chosen broker.

This means that the platform has no say over fees and commissions, supported markets, payment methods, customer service, and any other key metric that needs to be considered when choosing a brokerage site.

To ensure you choose an effective MT4 broker UK for your needs – here are a few factors to consider before choosing your broker.

Regulation

It goes without saying that the popular MT4 brokers in the UK are regulated by a global financial body. In fact, the vast majority of platforms discussed today are authorized and regulated by the Financial Conduct Authority (FCA).

This ensures that your capital is kept safe at all times and that you are able to trade in a fair and transparent environment. Other notable regulators that our popular MT4 brokers are licensed by, include ASIC (Australia), CySEC (Cyprus), FSA (South Africa), and the RFED (US).

The only exception to this rule is if you decide to use an MT4 broker like CedarFX that offers leveraged cryptocurrency instruments. As the broker only touches digital currency payments – it operates without a license. With that said, you should still tread with caution as you won’t have anywhere to turn if things don’t quite go to plan.

Supported Markets

MT4 is known for supporting a full range of financial markets. This covers forex and CFDs – with the latter expanding to stocks, indices, bonds, ETFs, commodities, and more.

However, just because MT4 supports it – this doesn’t mean that your preferred asset class is offered by the respective broker. As such, you need to check this before signing up.

Fees

All MT4 brokers charge fees as they are in the business of making money. If you read through our MT4 broker reviews – you will have noticed that fees can vary quite considerably. Not only in terms of how the charge is administered – but the competitiveness of the fee.

As such, below we break down the main fees that you will need to check in your search for a suitable MT4 broker UK.

Spreads

The only MT4 broker that we have come across that does charge a spread is Libertex. The only exception to this is if you open up a specialist Raw Spread Account or STP Account.

But, if you’re on a Standard Account that’s aimed at UK retail clients – you will pay a spread. This is the difference between the buy and sell price of the market you wish to trade. This will either be displayed in pips, points, or percentages. Either way, some of the popular MT4 brokers in the UK offer tight spreads – even to retail clients.

Commissions

As we covered in our MT4 broker reviews – the vast majority of platforms discussed on this page allow you to trade commission-free. There are, however, a number of exceptions to this rule.

- For example, IG allows you to trade commission-free on all CFDs apart from stocks.

- This starts at 0.10% per slide but will vary depending on the market.

- You then have Pepperstone and its Raw Spread Account.

- Although this permits ZERO spread trading – you will pay a small commission of £2.29 at each end of the position.

What you also need to check is whether or not a ‘minimum; commission is charged by your chosen MT4 broker. Sure, the actual commission rate might be low – but if a minimum is in place, then it might make the broker unviable for small stakes.

Overnight Financing

Irrespective of whether you are trading forex, CFDs, or spread betting instruments – all MT4 brokers in the UK charge overnight financing fees. This is because you will be trading leveraged financial products. As such, a fee will apply for each day that you keep the position open.

This fee will often increase over the weekend – which is why MT4 is a platform more suited for short-term speculators. The reason you don’t pay an overnight financing fee of traditional markets like shares or mutual funds is that you actually own the asset.

Other Fees

Other fees to look out for in your search for a suitable MT4 broker UK include:

- FX Conversion: If you are looking to trade non-UK markets – you might need to pay an FX fee.

- Platform Fee: Be sure to check whether or not you need to pay the MT4 broker is monthly, quarterly, or annual platform fee.

- Inactivity Fee: A lot of MT4 brokers will charge you an inactivity fee if your account remains dormant for a certain period.

- Transaction Fee: Some platforms will charge you a fee when you deposit and/or withdraw funds.

Payments

Before choosing an MT4 broker, it’s important to explore the payments department. First, check what the minimum deposit is as this can vary quite considerably. For example, some platforms have no minimum at all while others require in excess of £500. Next, ascertain what payment methods are supported.

Some brokers only support bank transfers – which means you might need to wait a few working days before the funds are available. Finally, it’s also wise to see if the MT4 broker publishes an averaged withdrawal timescale. The popular platforms in this space will process your withdrawal request within 24-48 hours.

Customer Service

You also need to have a firm idea of how competent the customer service department is at your chosen MT4 broker. After all, MT4 itself can not help you with any queries linked to your brokerage accounts – such as those involving verification, deposits, or withdrawals.

The notable platforms that we came across in our MT4 broker reviews offer a 24/7 Live Chat facility. Some platforms also offer a telephone support line while others only respond to email inquiries.

How to Get Started with an MT4 Broker

If you are ready to start trading with a popular MT4 broker UK, then follow our step-by-step investing guide to begin trading.

Create Account

Getting started takes a matter of minutes. Simply make your way to your brokerage’s website and begin the sign-up process. This will open a sign-up form and you’ll be required to enter your name, email address, as well as choose a username and password for your new trading account.

Verification

Users may be required to complete a simple KYC process, if they invest with a regulated broker. Upload a copy of your passport or driving license as proof of identity, and a copy of a recent utility bill or bank statement as proof of address.

Deposit Funds

With a fully verified account, you’re one step closer to start trading a range of assets with the click of a button. Depending on the broker you choose, you can transfer funds using a debit card, credit card, bank wire transfer, as well as e-wallets such as PayPal, Neteller and Skrill.

Choose your preferred payment method and deposit your funds into the account.

Open Trade

Now, type in the name of the asset you wish to make a spread in. Once you search the asset name, enter the amount of money you wish to deposit into the trade, and confirm your transaction.

Download MT4 (If Applicable)

If you want to use MT4 on your desktop device via software – you can proceed to download it directly through the site of your chosen brokerage.

Irrespective of whether you decide to trade via your web browser or through desktop software – you will need to log in to MT4. Take note – the login credentials are those that you created when you signed up for your trading account.

Search for Asset and Place Order

Finally, now that you are logged into MT4 with an active account balance – you can start trading. The easiest way to find your chosen asset is to search for it. Once you have found a market that interests you, set up an order.

This works in much the same way as any other trading platform, as you need to choose from a buy/sell order to illustrate which way you think the asset price will go. Additionally, you might also consider a limit, stop-loss, and take-profit order, to ensure you enter your position in a risk-averse manner.

Finally, confirm your order on MT4. The trade will then be reflected in your trading account.

Conclusion

In summary, there are heaps of online brokers that offer support for third-party platforms like MT4, MT5, and cTrader. As such, finding a broker in this respect is easy. However, no-two MT4 brokers are the same – especially when it comes to commissions, tradable markets, account types, payments, and customer support.

This is why, users should properly review and analyse each broker to compare and see which platform best suits to their trading needs.

FAQs

What are popular Meta Trader 4 brokers for leverage?

How do you use an EA on MT4?

Can I use MT4 without a broker?

Does MetaTrader 4 use real money?