How To Invest In IPOs? How do IPOs Work?

Initial Public Offerings – or simply IPOs, allow you to buy shares in a company before it first gets listed on a stock exchange. This allows you to invest in the firm when it is at the very start of its journey as a PLC. However, it is often difficult (but not impossible) for everyday investors to gain access to IPOs, which is why you typically need to wait until the shares hit the secondary marketplace.

In this guide, we explain the ins and outs of how to invest in IPOs from the perspective of a UK retail client. We also show you the best brokers to do this with, and how you can get started with an IPO investment today.

-

-

What are IPOs?

When a firm decides to go from a limited liability company (LLC) to that of a public limited company (PLC) – it will need to go through an IPO process. In its most basic form, this allows the company to raise capital from outside investors. In return, those that invest money into the IPO will receive shares.

From then on – the shares will trade on a public stock exchange like the UK’s London Stock Exchange or the NASDAQ in the US. The overarching benefit of investing in an IPO is that typically, you stand the chance to buy the company’s shares at a discounted price.

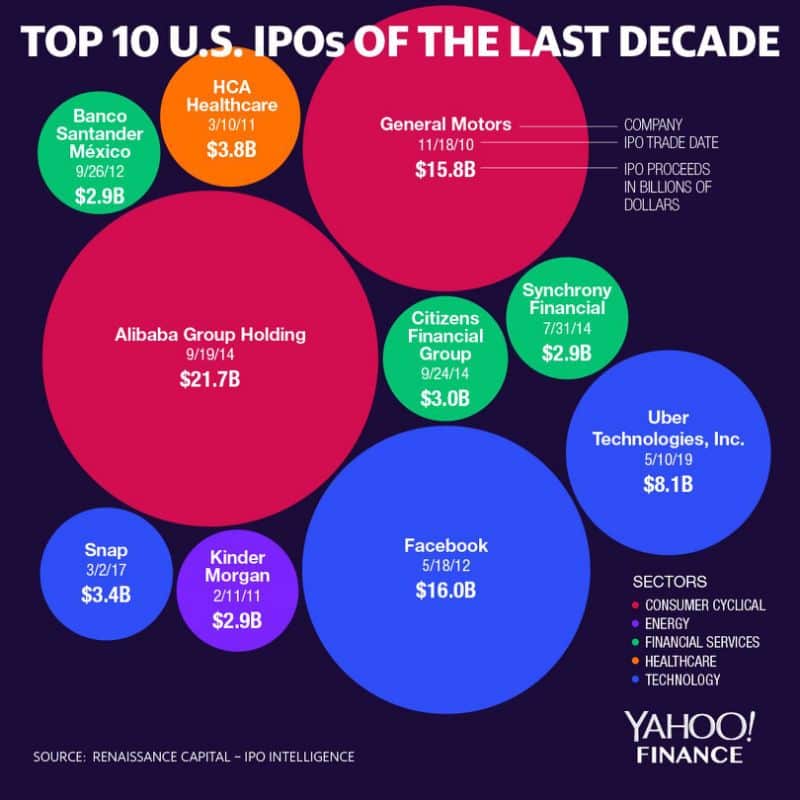

That is to say, newly listed companies will often encounter a surge in share value on the first day of trading. For example, when Pinterest had its IPO on the New York Stock Exchange in 2019, its shares rose 25% by the close of trading. It can often take established companies many years to experience stock market growth of this magnitude, which is why IPOs are so popular with investors.

With that being said, IPO investments won’t always go to plan, which is exactly what happened to those that backed Uber last year. The ride-sharing company opened its IPO at a share price of $45 – only to finish the trading day at $41.57 – representing a loss of 7.6%.

How do IPOs Work?

Before a company can initiate its IPO, it must first get the green light from its respective national regulator. In the UK this is the sole responsibility of the Financial Conduct Authority (FCA), and the Securities and Exchange Commission (SEC) in the US. Then – with the aid of a financial institution, the company will set a date to be listed on a public stock exchange.

The company also needs to determine what price it plans to list its shares at, as well as the number of stocks it wishes to circulate. In doing so, this will assign the company with a market valuation.

For example:

- Let’s suppose that company ABC plans to hold its IPO on the London Stock Exchange

- The company plans to issue 100 million shares

- It prices its IPO at £10 per share

- This means that company ABC is valued at £1 billion (100 million shares x £10 per share)

If you were to buy the stocks at £10 per share, you will need to find a stock broker that has direct access to the IPO in question. In truth, there are very few brokers in the UK space that allow you to do this, as it is far more efficient for companies to sell their shares to institutional buyers. This is because they can sell the shares at minimum lot sizes – which is often 6 or 7 figures.

What Happens After the IPO?

The IPO goes live on the morning of its public listing. This is 8 am on the London Stock Exchange, meaning that the shares will hit the secondary market as soon as the opening bell rings for trading. When it does, shares will change hands between buyers and sellers. Although we cover this in more detail further dow -as an everyday investor, this is your best chance to get in on the action early.

Nevertheless, from the moment the shares open for trading, the value of the stocks will go up and down much like any other publicly-listed firm. It is therefore hoped that your IPO investment will increase in value from day one. Of course, there is never any guarantee that this will be the case – just as it wasn’t for Uber in its 2019 listing.

What Does an IPO Investment Look Like?

Understanding how IPOs work as a newbie investor can be somewhat difficult at first glance. As such, below we give a real-world example of how an IPO investment would have worked had you backed Royal Mail in 2013.

- Royal Mail decided to go public in 2013. It wanted to provide access to everyday investors – so it paved the way for retail clients to invest in the pre-IPO directly. As a result, the IPO was heavily over-subscribed.

- Royal Mail required private investors to buy at least 227 shares. In total, 225 million shares were issued, at a price of 330p per share.

- This equated to a pre-IPO valuation of £3.3bn.

- Let’s suppose that you obtained the minimum allocation of 227 shares – meaning that you invested a total of £749.10. (227 shares x 330p).

- At 8 am on October 13th 2013, Royal Mail shares went live on the London Stock Exchange. This means that those holding the shares could sell them to new buyers on the secondary marketplace. As the stock exchange is based on market forces, this means that the price of shares are dictated by demand and supply.

- As supply significantly outweighed demand, Royal Mail shares closed the trading day at 455p each. This represents an increase of 38% in just a single day.

As you can see from the above example, those that made the decision to invest in Royal Mail’s IPO before the public listing made a very tidy profit of 38% after just one day of trading. Based on an initial investment of £749.10 (227 shares), selling your shares would have returned a total of £1,032.85.

How to Invest in an IPO?

As great as IPOs can be for your long-term investment goals, the overarching problem is that they are often difficult to access if you are an everyday investor. Sure, the likes of Royal Mail (and other companies that went through privatization like BT) opened its doors to retail clients, but rarely is this case.

As a result, you will need the assistance of a third-party broker. If this isn’t possible, the other option is to wait until the stocks hit the secondary marketplace. In certain cases, this can take days or even weeks before your chosen stock broker adds the shares to its trading platform.

With that being, let us elaborate on the main options that you will have at your disposal.

Option 1: Direct Investment into the IPO

Without a doubt, the easiest way to invest in an IPO is to go with the company directly, As we noted above, this is somewhat of a rarity in the investment space, as companies much prefer to deal with institutional clients in the pre-IPO phase. This is because they can sell large chunks of shares via a single transaction.

This is in stark contrast to selling to the general public, as investment levels are going to be much smaller. In turn, this ends up costing the company much more than it would do by dealing directly with the institutional arena. Nevertheless – if the company in question does permit access to retail clients, the process works as follows:

- The company in question will initiate a public marketing campaign that gives details of the IPO

- It will state the minimum and maximum investment amounts, and the price of each share

- You will need to submit an application detailing how much you wish to buy

- Once the deadline passes, the company will assess how much demand it has received. If the shares were undersubscribed, you will be instructed to make a payment.

- This can typically be done via the company’s website or over the phone. In the case of Royal Mail, the firm allowed the general public to invest via their local post office branch

- If the shares are oversubscribed, the company will likely distribute its shares on a first-come-first-served basis, meaning that late-comers might miss out (much like in the case of Royal Mail)

- Once the company has concluded its pre-IPO reconciliation, you will likely receive a copy of your share investment via email or the post.

It is important to note that a direct IPO investment is typically reserved for public companies that have been privatized. As such, in the vast majority of cases, this likely won’t be an option for you.

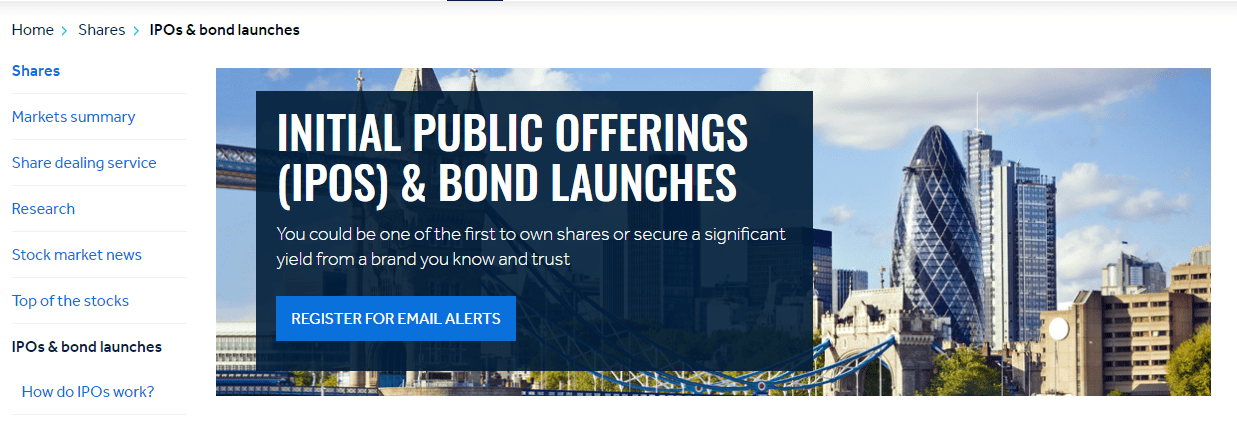

Option 2: Invest in Pre-IPOs via a UK Stock Broker

The second option at your disposal is to use a UK stock broker that has direct access to the IPO. The way this works is the stock broker will meet a minimum lot size with its own capital. For example, if the IPO states a minimum investment of £500,000 – the broker will purchase at least this amount. If demand is higher, it might choose to purchase even more.

In most cases, the stock broker will release information on its website about the IPO, subsequently allowing you to register your interest. Then, once the investment has been made and the shares have been distributed to the broker, you will receive them. As we briefly noted earlier, there are very few brokers in the UK that give everyday investors access to IPOs.

Nevertheless, we find that Hargreaves Lansdown is particularly strong in this arena. As such, below you will find a step-by-step guide on how to invest in an IPO with the platform.

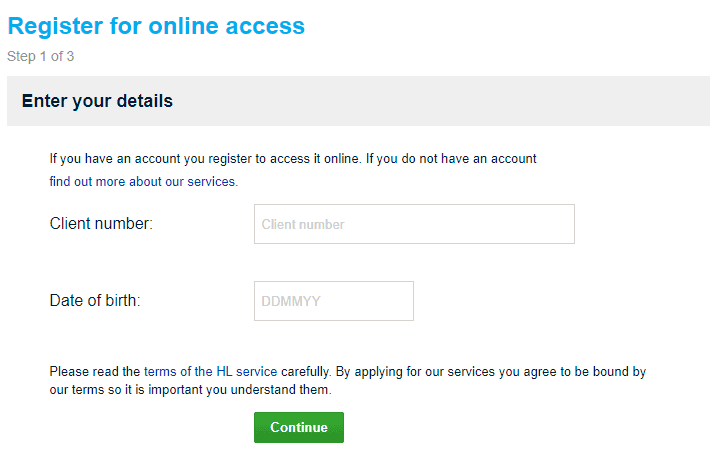

Step 1: Open an Account with Hargreaves Lansdown

Head over to the Hargeaves Lansdown website and elect to open an account. You will need to provide a range of personal information, such as your full name, home address, date of birth, national insurance number, and contact details.

Step 2: Deposit at least £1 to Verify Account

You will now be asked to deposit some funds. This is with the view of verifying your identity, albeit, you can do this from just £1. The verification deposit must be made with a UK debit card. Future deposits can also be made via a UK bank account or direct debit agreement.

Step 3: Register Interest in IPO

Once you have verified your Hargreaves Lansdown account, head over to the IPO section of the website. If there are any IPOs scheduled, the broker will list it on this page. You can then register your interest by stating the number of shares you wish to purchase. There will be a minimum and maximum investment amount, which will vary from IPO-to-IPO.

We would strongly suggest that you sign up for the IPO notification service offered by Hargreaves Lansdown. In doing so, you will be notified as soon as a new IPO is scheduled to take place with the broker.

Step 4: Pay for Your IPO Investment

As and when Hargreaves Lansdown confirms your IPO allocation, you will need to ensure you have enough money in your brokerage account. If you don’t, proceed to make a deposit with a debit card or UK bank account. Once the pre-IPO stage has been concluded and Hargreaves Lansdown receives the shares, this will be reflected in your account. You will then have the ability to sell the shares as soon as they hit the secondary marketplace.

Option 3: Wait for the IPO Shares to hit the Secondary Marketplace

You will often find that the only option available to you as a retail client is to wait until the shares hit the secondary marketplace. On the one hand, this does mean that you stand the chance of missing out on a more favorable share price. On the other hand, you can often buy the shares at the click of a button without needing to worry about meeting a larger minimum investment size.

In terms of where to go, not all UK stock brokers will list the IPO shares the second it hits the market. On the contrary, the broker itself will need to personally purchase the shares so that it has the capacity to sell them on to its account holders. Alternatively, you might want to consider a CFD broker if you are struggling to find a traditional share dealing site that offers the IPO shares.

Crucially, the underlying asset does not exist when you trade CFDs, so the platform in question can list the stocks as soon as they hit the secondary market. With this in mind, below you will find two brokers – one that allows you to buy IPO shares and one that allows you to trade them in the form of CFDs.

1. Plus500 – Commission-Free CFD Stock Trading Platform

The provider in question specializes exclusively in stock CFDs, meaning that you will not own the underlying asset. Instead, you will be speculating on the future direction of the stocks.

Crucially, CFD providers like Plus500 can list the IPO stock CFDs as soon as they hit the secondary marketplace, as there is no requirement to actually obtain the shares. By trading stock CFDs, you will also have the option of applying leverage.

This stands at 1:5 at the provider when trading share CFDs, and more on asset classes. This means a £100 deposit would permit a trade of £500. You will always have the option of placing buy and sell positions on the share CFDs, meaning that you can speculate on the value of the instrument going down. This would have been a shrewd move in the case of Uber!

In terms of the specifics, Plus500UK Ltd is authorized & regulated by the FCA (#509909). It requires a minimum deposit of £100, which you can do via a UK debit/credit card or bank account. Paypal is also supported – and neither payment methods will attract any deposit or withdrawal fees.

Pros:

- Commission-free CFD platform – only pay the spread

- Thousands of financial instruments across heaps of markets

- Retail clients can trade stock CFDs with leverage of up to 1:5

- You can short-sell a stock CFD if you think its value will go down

- Takes just minutes to open an account and deposit funds

Cons:

- CFDs only

- More suitable for experienced traders

72% of retail investors lose money trading CFDs at this site.

The Verdict?

In summary, investing in an IPO can be a challenging task as a retail client. There have been instances where newly listed companies allow the general public to invest directly – such as Royal Mail and BT. However, this is typically because the organization has been privatized by the government.

In most cases, you will need to use a third-party broker. As we have discussed in this guide, the likes of Hargreaves Lansdown is probably your best bet to invest in an IPO before it goes live.

FAQs

What is an IPO?

An IPO (Initial Public Offering) allows companies to raise money from new investors. In return, investors will receive shares in the company – proportionate to the amount they invest. Once the IPO concludes, the company will then be listed on a public stock exchange. This allows new buyers and sellers to enter the market, and the shares can change hands freely.

Why can’t the general public invest in IPOs?

Most companies will opt to sell their IPO shares to institutional investors, as it much more efficient to deal with minimum lot sizes. This is often 6 or 7 figures, which is why it is difficult for the Average Joe to get a look in.

What happens after the IPO?

Once the IPO has finished, the shares will be listed on a stock exchange. The value of the shares will then go up and down – much like any other stock.

Can I use a broker to invest in an IPO?

Potentially, but this will vary from broker-to-broker. The platform in question will usually gauge what demand is like from its members. If it finds that demand is sufficient, it will likely proceed to invest in the IPO, and then sell the shares off individually.

What is the minimum amount I can invest in an IPO?

There is no one size fits all answer to this question, as it can vary depending on the issuer, as well as the broker. In the case of Royal Mail’s IPO, this stood at a minimum of just under £750.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

When a firm decides to go from a limited liability company (LLC) to that of a public limited company (PLC) – it will need to go through an IPO process. In its most basic form, this allows the company to raise capital from outside investors. In return, those that invest money into the IPO will receive shares.

When a firm decides to go from a limited liability company (LLC) to that of a public limited company (PLC) – it will need to go through an IPO process. In its most basic form, this allows the company to raise capital from outside investors. In return, those that invest money into the IPO will receive shares.

As great as IPOs can be for your long-term investment goals, the overarching problem is that they are often difficult to access if you are an everyday investor. Sure, the likes of Royal Mail (and other companies that went through privatization like BT) opened its doors to retail clients, but rarely is this case.

As great as IPOs can be for your long-term investment goals, the overarching problem is that they are often difficult to access if you are an everyday investor. Sure, the likes of Royal Mail (and other companies that went through privatization like BT) opened its doors to retail clients, but rarely is this case.