How to Invest in Lithium UK

Over the past decades, lithium has become an essential commodity and in-demand product for technology firms and electric vehicle manufacturers. This is because lithium is an important component of batteries for mobile phones, laptops, and any other digital device.

In this article we’ll analyze lithium’s historical price performance, and some brokers that give users access to Lithium assets in the UK.

Lithium Investment Platforms

At the time of writing, there’s only one major exchange that is expected to launch lithium future contracts in the near future – The London Metal Exchange.

Below we review some popular UK brokers and investment apps that offer you a selection of lithium financial assets.

1. Plus500

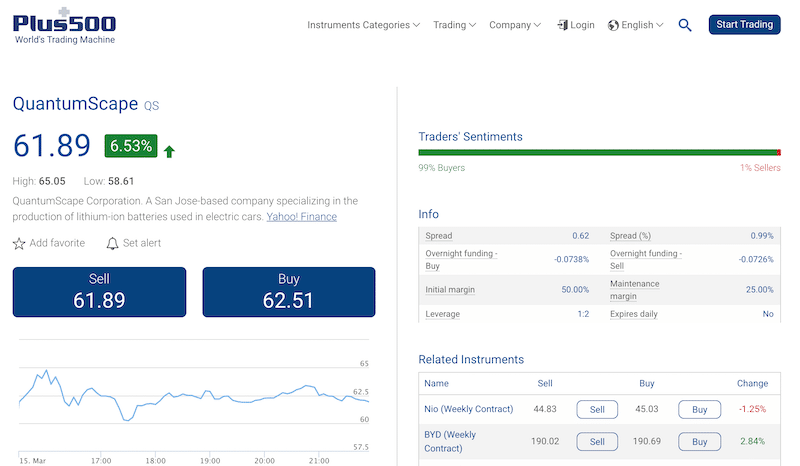

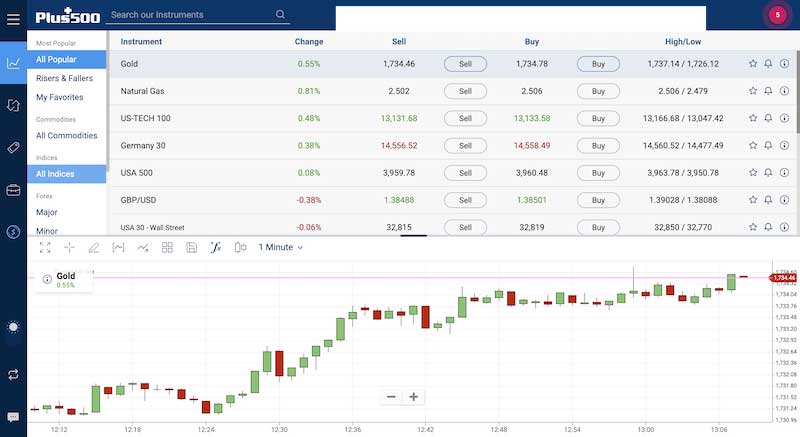

Among the stocks that Plus500 offers, you’ll be able to buy various lithium-related stocks like QuantumScape, which is a San Jose-based company specializing in the production of lithium-ion batteries for electric cars. Additionally, the broker offers the most well-known lithium ETF – the Global X Lithium & Battery Tech.

Plus500 is regulated by the FCA and thus, is allowing users to leverage their stock and ETF positions with up to 5:1. Also, Plus500 does not charge fixed fees for trading shares or any other financial instrument for that matter. Instead, the broker charges a spread and overnight fee only.

The minimum deposit to start investing in lithium via Plus500 is $100 (or currency equivalent). The broker also offers a paper trading account for potential users that want to test the platform before risking real capital.

Research Lithium Investment

Now that you have chosen a platform to utilize your trading activity, it’s time to make in-depth research about lithium and the ways in which you can invest in this material. In general, you need to see the big picture before you invest in Lithium and realize that this is not an ordinary investment.

Ways to Invest in Lithium

There are two primary ways in which you can get exposure to lithium – by investing in lithium production and mining public traded companies and ETFs that collect various stocks of lithium firms.

Lithium Stocks

In recent years, Lithium stocks have been soaring due to the increasing demand for electronic devices and electric cars.

Here are some popular lithium stocks to watch based on trading volumes:

- QuantumScape (NYSE: QS)

- Albemarle Corporation (NYSE:ALB)

- EnerSys (NYSE: ENS)

- Energizer Holdings, Inc (NYSE: ENR)

- Sociedad Química y Minera (NYSE: SQM)

- Livent Corporation (NYSE: LTHM)

- FMC Corporation (NYSE: FMC)

Lithium ETFs

Another option to invest in lithium is through exchange-traded funds (ETFs). Below, we have listed some popular lithium and battery tech Exchange Traded Funds you can invest in.

- The Global X Lithium & Battery Tech ETF (NASDAQ: LIT)

- ETFS Battery Tech & Lithium ETF (ASX: ACDC.AX)

- Amplify Lithium & Battery Technology ETF (NASDAQ: BATT)

Conclusion

in this guide on how to invest in lithium UK, we have covered the most crucial things you need to know about this material. We came to the conclusion that lithium, much like water, could be the new gold in the upcoming decades, particularly given the fact that electric vehicles from Tesla (TSLA), Nio, Ford Motors, and others are going to be a huge industry in the near future.

If you are looking for a way to invest in lithium, you’ll have to find an online trading platform that gives you access to shares of lithium producers and miners.