Investing in Gold UK – Popular Strategies for 2026

Gold is a store of value that has held its own for thousands of years.

We’ll explain the many different ways in which you can invest in gold in the UK, how its value is determined, what risks you need to research.

-

-

Basics of Investing in Gold

By investing in gold, you will be looking to achieve one or more goals. In most cases, this centres on growing your investment as the value of gold increases. After all, the value of gold is determined by demand and supply – much like any other asset class. In other words, as the demand for gold increases over time, as will its real-world value.

In addition to this, gold is a finite asset – meaning that eventually there will be nothing left to mine. This once again adds to the attraction of investing in gold as a means to make money. With that being said, some people in the UK investment in gold for purposes other than just financial gain.

For example, many investors will turn to gold during times of economic uncertainties. This has become evident in virtually every global recession to date. This is because investors are scared to hold on to stocks and shares when the markets are bearish, so they instead look to purchase safe-haven assets like gold.

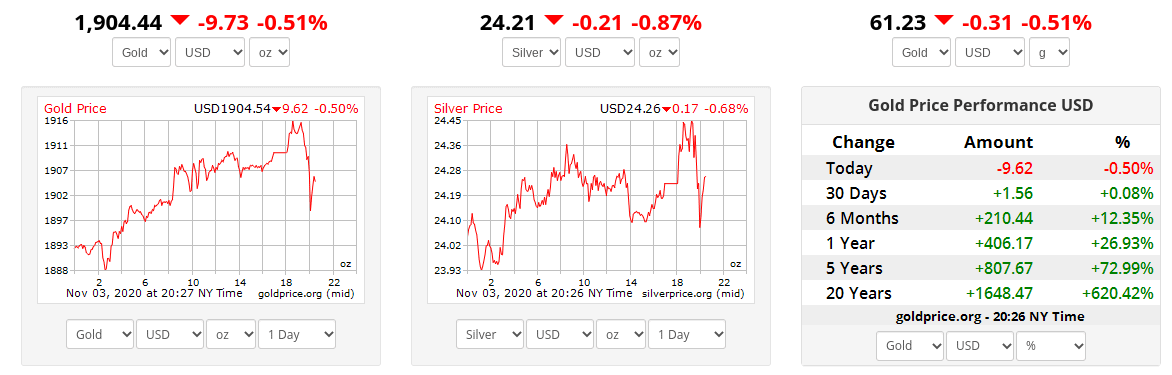

Then, when the time is right, said investors will sell their gold positions and re-enter the stock markets at a more favourable price. Nevertheless, we should note that there are many ways to value gold – for example, per gram or ounce. However, the global standard is to price it per ounce, in US dollars. As such, the remainder of this guide will discuss gold price levels in this manner.

Gold Prices – How Does it Work?

Before you take the plunge by investing in gold in the UK, it is crucial that you have an understanding of how the value of your investment will change over time. This is because there is a lot more to think about in comparison to other assets.

Similarly, an ETF that tracks real estate would increase when the respective housing market appreciates. In some ways, this is a fairly simple concept. However, in the case of gold, the underlying fundamentals are based purely on demand and supply. With this in mind, you need to know some of the reasons why gold might increase or decrease in demand.

Safe Haven Asset

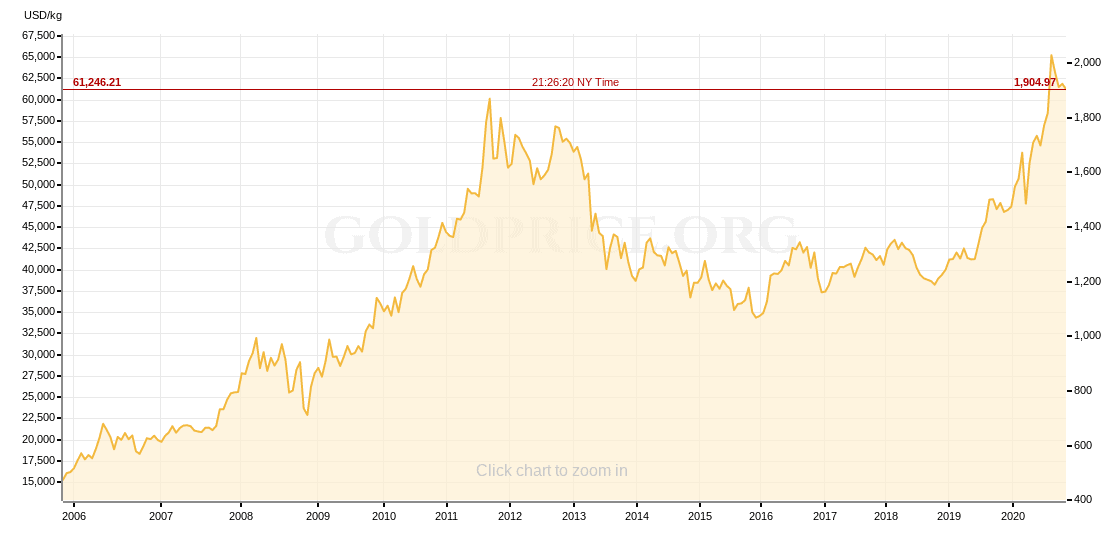

One such example – and as we mentioned earlier, is an impending bear market or recession. This is because investors will turn to safe assets to ensure that they protect their wealth while the downward trend remains in place.

- For example, in the midst of the financial crisis in 2008, gold was priced at lows of $712/oz.

- But, as fear and uncertainty spiralled out of the control, gold price levels went on a parabolic upswing swing.

- In fact, by September of 2011, the price of gold stood at highs of $1,869/oz

- This means that in just under three years of holding gold, you would have grown your investment by over 162%

Supply is Also Important

Like any tradable asset class, you also need to consider the supply side of the equation. It goes without saying that when the supply of gold increases – may be due to a new mining discovery, this can negatively impact the value of the precious metal. With that being said, an increase in supply via gold mining operations is typically a short-term situation.

This is because, in the grand scheme of things, there is not an unlimited supply of gold. On the contrary, a recent BBC article noted that by some estimates – just 20% of the world’s gold is left to be mined.

Look at China

Make no mistake about it – China is a major player in the context of gold price levels. This is because the Eastern powerhouse has been involved in a major gold purchasing spree for several years now. In just the last 10 months alone, China has increased its gold supplies by an additional 100 tonnes.

Market commentators argue that this is one of the main factors that has been driving the price of gold up. In fact, during the aforementioned 10-month period, gold has increased in value by over 31%.

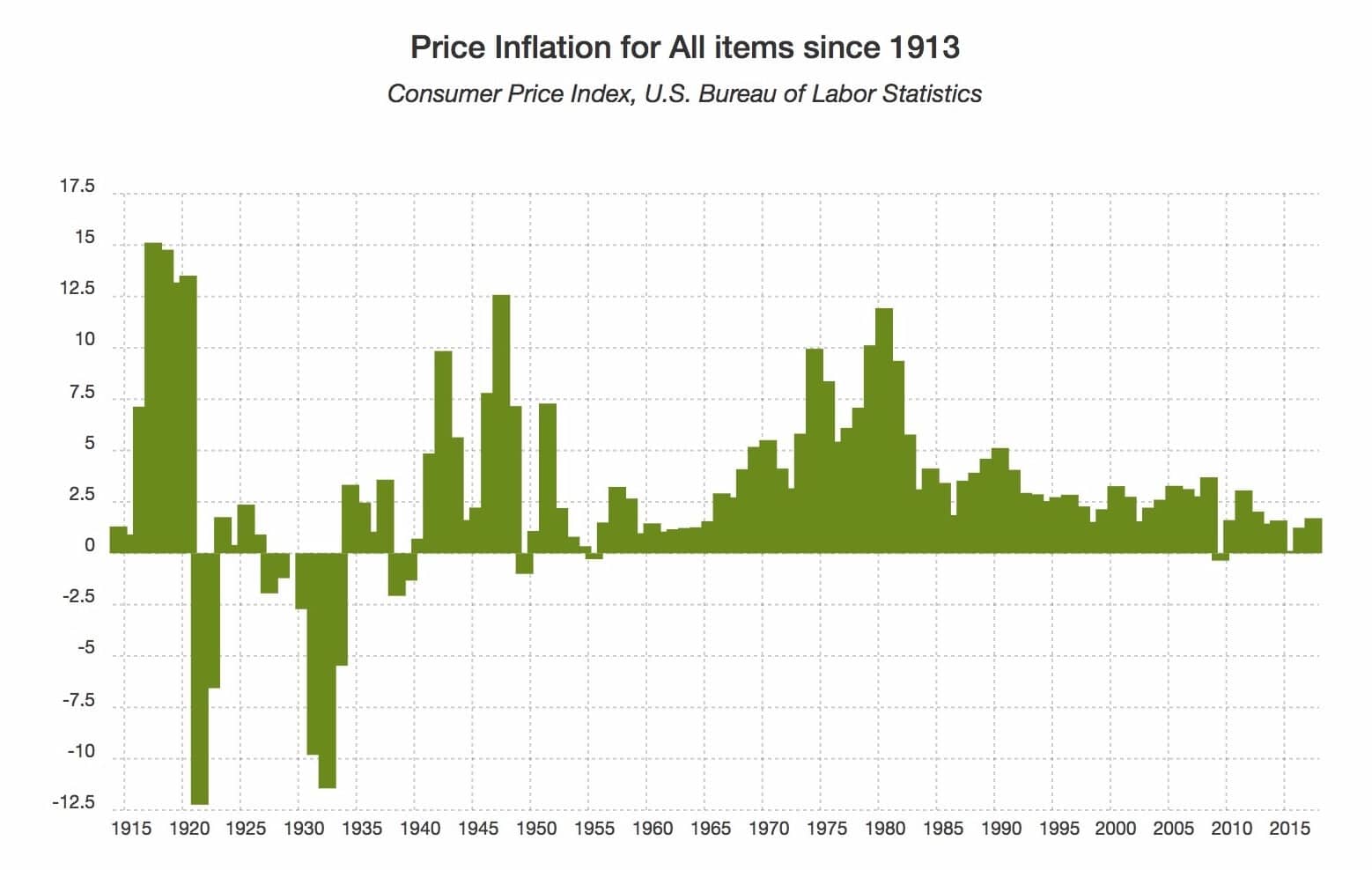

Rising Inflation

If you’re looking to invest in gold from the UK, it is also important that you keep an eye on inflation levels. In particular, you should focus on inflation in major economies like the US. This is because the history of times suggests that when inflation is on the rise, this has a positive impact on the value of gold.

Once again, this reverts back to the safe haven characteristics of gold that we mentioned earlier. At the other end of the spectrum, when inflation levels are low, this often results in gold price levels being restrained.

Fundamentals of Investing in Gold

So now that you know the basics of how gold is priced and what can influence its value, we are now going to discuss the many ways in which you can invest in this precious metal from the UK.

Investing in Physical Gold

Before we get to the fundamentals of how this can be achieved, it is important to note that storing gold yourself is not only costly and high risk, but it can have a hugely detrimental impact on the value of your investment. This is because gold needs to be kept in specialist storage facilities to ensure it is not exposed to natural elements.

In addition to this, you face the risk of having your physical gold stolen. As you can also imagine, transporting large quantities of gold to and from your preferred location can result in huge costs.

There are heaps on online platforms that allow you to invest from just a few pounds. The gold bars are kept in specialist vaults – often in New York, London, or Switzerland. You will retain 100% ownership of the gold and in most cases, you can exit your position at the click of a button.

Investing in Gold ETFs

ETFs are managed by financial institutions that collect funds from thousands of investors. The ETF will personally purchase assets to track a specific market – for example, stocks, bonds, or gold.

Gold Shares

It is also possible to gain exposure to precious metals by investing in gold-related shares. In most cases, this comes in the form of gold mining companies. In theory, as the value of gold increases, this should have a positive impact on the shares in question.

After all, gold mining companies are in the business of selling their findings on the secondary market. As such, they are able to generate larger profit margins when the price of gold is on the rise.

One such example of a popular gold mining company that you can invest in is that of Newmont Corporation. The firm – which is based in the US and publicly listed on the New York Stock Exchange, has the largest gold reserve base globally. It has mining operations in several US states, Canada, Australia, Peru, and Mexico.

Investing in Gold CFDs, Futures, and Options

Gold CFDs

CFDs (contracts-for-differences) are financial instruments that allow you to trade assets without taking ownership. This is because CFDs are pegged to the real-world market value of the asset. For example, if gold is priced at $1,801/oz, as will the CFD instruments at your chosen broker. Although you won’t own the gold itself, opting for CFDs comes with a number of benefits.

For example:

- Leverage: You can trade gold CFDs with leverage. This means that you can trade with more than you have in your CFD broker account. UK retail traders can apply leverage of up to 1:20 on gold CFDs – which is huge. This means that a £100 account balance would allow you to place a trade worth £2,000.

- Long or Short: Unlike traditional gold investments, CFDs give you the option of going ‘long’ or ‘short’. If you go long, this means that you are predicting that the price of gold will increase. If going short, you are predicting that the value of gold will decrease. This allows you to profit from both rising and falling gold markets.

- 0% Commission: If using a low-cost trading platform, you can trade gold CFDs in a 100% commission-free manner. This allows you to target smaller profit margins as you won’t get hammered with trading fees.

- Fully Regulated: All CFD brokers offering trading markets to UK residents must be licensed. This means that you will benefit from the protection of the FCA. This isn’t something that you will get when you use an offshore gold bullion broker.

Gold Futures

Futures are even more complex than CFD instruments. As such, you should only consider gold futures contracts if you have an understanding of how they work.

The fundamentals are as follows:

- Futures contracts will always expire and they typically last for three months.

- When you purchase futures, you can sell them at any point before the date of expiry

- If you are still holding the gold futures when they expire, you have a legal obligation to purchase the asset

- Most gold futures are settled in cash, meaning that you wouldn’t need to take physical delivery of the asset

Popular Gold Investment Platforms UK

Once you know the type of gold investment that you plan to make, you then need to find an online broker that can facilitate your trade. There are many gold investment platforms in the UK, so you need to do some homework before signing up.

In particular, not only do you need to ensure that your chosen gold market is supported, but you also need to look at fees, commissions, payment methods, withdrawal times, and regulations.

1. IG

IG is a traditional old-school brokerage firm that was first launched in the 1970s. The company has grown exponentially over the past decade and it boasts a £3 billion valuation on the London Stock Exchange. This FCA broker wins hands-down for the number of tradable markets it gives you access to. This includes over 12,000 shares, ETFs, and investment funds.

As such, whether you are interested in investing in gold mining companies in the UK or abroad, IG has you covered. This is also the case with gold ETFs. You will pay £8 per trade, which you need to pay when you invest and again when you exit your position. This £8 fee is reduced to £3 if you place three or more trades in the prior month.

In addition to its traditional share and fund department, IG offers 17,000 CFD and spread betting markets. This allows you to trade gold CFDs with leverage. You can also choose from buy and sell orders – both of which are commission-free. If opting to spread bet gold, you can avoid paying capital gains tax on your profits. IG requires a minimum deposit of £250 to get started, which you fund with a debit/credit card or bank transfer.

Sponsored ad. Your capital is at risk.

Conclusion

In conclusion, gold offers many benefits over traditional assets like stocks and bonds. At the forefront of this is its store of value characteristics. There is a finite supply.

As we have discussed throughout this guide, there are many ways that you can invest in gold in the UK. This includes gold ETFs, buying shares in gold mining companies, and even trading gold CFDs. Nevertheless you need to do your own market research and due diligence before investing in any financial asset.

FAQs

How is the price of gold calculated?

Like most asset classes in the financial space, the value of gold is determined by global demand and supply. That is to say, as the demand for gold outweighs supply, its value should increase.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up