How to Invest in Algorand UK – Beginner’s Guide

Are you looking for how to invest in Algorand, the self-sustaining blockchain-based network that supports a wide range of applications? Our guide on investing in Algorand will tell you all about the project, the strengths, reasons you should invest in ALGO, and the best platform to use for Algorand investment.

Key points on Algorand

- Algorand was developed by MIT Professor Silvio Micali in 2019. The blockchain aims to facilitate faster, cleaner, and cheaper DeFi transactions.

- At the moment of writing, Algorand has grown into the top 30 most valuable blockchain protocols with $8.7 billion in market cap.

- With strong underlying tokenomics, Algorand is expected to continue surging, further boosting early investors’ earnings.

How to Invest in Algorand – Quick Steps

Investing in Algorand is easy if you use a crypto broker. You can get started in as little as 10 minutes by following these quick-fire steps.

1. Open an account – Navigate the exchange page and click on ‘Join Now’ to register for a free account

2. Deposit – Fund your newly created account with as little as $50 (about 37 GBP) through a bank wire transfer, credit/debit card, or e-wallet solutions

3. Search for Algorand – Type ‘ALGO’ into the search bar to be redirected to the digital asset’s page

4. Invest – Click ‘Trade’ to open up the order log and insert how much Algorand you want to purchase. Then click on ‘Open Trade’ to complete your Algorand investment

What Is Algorand (ALGO)?

Algorand is a decentralised blockchain technology network featuring the ALGO token as its native currency. Algorand was created to combine aspects of major, well-established cryptocurrencies, such as decentralisation, transactions without a central authority, and easy-to-divide tokens–with increased speed and lower processing power requirements.

The Algorand team understands that mainstream adoption will be impossible without a scalable solution. This is apparent in prominent cryptocurrencies like Bitcoin and Ethereum, which have struggled largely due to their outdated model of validating transactions and are too slow for the rapidly growing decentralised economy.

On the other hand, scalability cannot come at the expense of decentralisation and security. All three are necessary for a successful blockchain platform. Algorand has worked hard to incorporate all three into its platform, resolving the Blockchain trilemma of speed, security and scalability.

The decentralised blockchain is out to “re-imagine” blockchain by tackling Bitcoin’s major flaws, including delayed transactions and expensive mining fees. Its purpose is to make transactions safe, quick, and auditable.

In addition, the Algorand platform uses a unique “pure proof-of-stake” consensus mechanism that, unlike other PoS systems, does not require a “bonding” time to issue tokens and decentralised applications (dApps).

This has greatly made the Ethereum competitor scalable, and investors are turning their attention to the PoS protocol. Algorand is also the first blockchain to guarantee transaction finality, thus eliminating the possibility of forking.

Why Invest in Algorand?

While many investors buy Ripple, Bitcoin and other popular cryptocurrencies, Algorand is one project that is gradually rising to the top of the charts. The concept has sparked a lot of curiosity in the crypto world.

The decentralised network is one of the most interesting projects currently under development. The development team is looking to revolutionise finance. These are some reasons we think you should invest in Algorand.

1. Interoperability on the Platform

Cryptocurrency networks have largely concentrated on creating distinct blockchain networks that offer unique benefits to users and investors.

Due to the emergence of rather “closed” cryptocurrency ecosystems, investors are now compelled to choose between one cryptocurrency or blockchain network and another. This has led to the idea of ‘siloed’ networks.

A paradigm change is taking place in the case of Algorand. The asset is well-known for being able to function with several blockchain networks. Developers on Algorand can use the blockchain’s Layer-1 network to generate digital assets or smart contracts.

Algorand has invented a method for launching multichain projects. Developers can easily create various apps that function on various blockchains using the Algorand modular framework. This characteristic, called interoperability, enables a degree of interconnectedness not found in most older blockchains.

External cooperation might be the way blockchain networks evolve in the future. Algorand looks to have an advantage over the competitors in this aspect.

2. Algorand Has Huge Growth Potential

Cryptocurrency investors have shown interest in ALGO since the asset recorded a good price momentum. Algorand has risen in the cryptocurrency rankings due to its development and expansion.

Algorand has quickly shot up the ranks of the global crypto charts despite not hitting a new all-time high (ATH). The protocol sits on the 23rd spot of the most valuable digital assets with over $8 billion in market cap.

With strong underlying tokenomics, Algorand is expected to continue surging, further boosting early investors’ earnings.

3. The Utility Is Provided via Smart Contracts and Use Cases

Smart contracts enable trustless and permissionless transactions, crucial in the fast-rising decentralised economy. With Algorand offering this service right off the bat, the Ethereum rival is expected to stake a place in the crypto market.

Smart contracts are expected to be the new form of settling financial transactions, and Algorand is amply suited to be a purveyor for the new crypto space.

4. More Sustainable Algorithm

The Ethereum rival’s blockchain is a permissionless Purely Proof-of-Stake (PPoS) algorithm. Unlike the Proof-of-Work algorithm (PoW), PPoS requires less computational power and is more sustainable.

Recall that earlier this year; Bitcoin mining operations drew the attention of environmentalists due to the high energy consumption and carbon emissions resulting from running computers responsible for mining the PoW-based cryptocurrency.

In comparison, the PoS algorithm is provably less energy-intensive making it ideal for those who want to invest in DeFi and minting cryptographically-unique tokens called non-fungible tokens (NFTs). Also, since Algo is purely a PoS token, investors can stake their assets and earn passive income.

5. ALGO Is Deflationary

Algorand is deflationary because the number of ALGO tokens available on the network is limited. The total supply of ALGO tokens is set at 10 billion, with 3 billion being distributed in the first five years, including 25 million that were auctioned at launch.

The limited supply of the decentralised token would lead to artificial scarcity, causing the supply crunch to drive up the digital asset price in the coming years.

Algorand Crypto Price

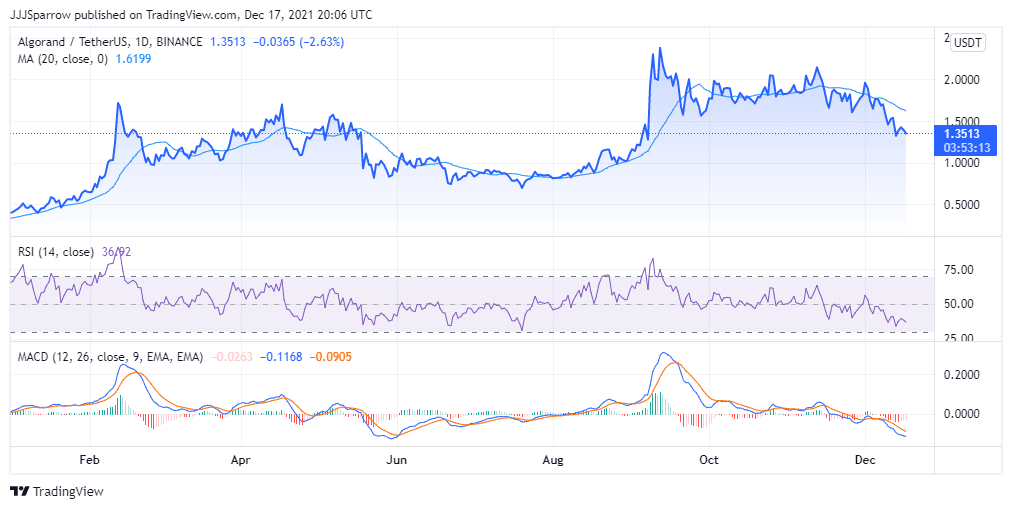

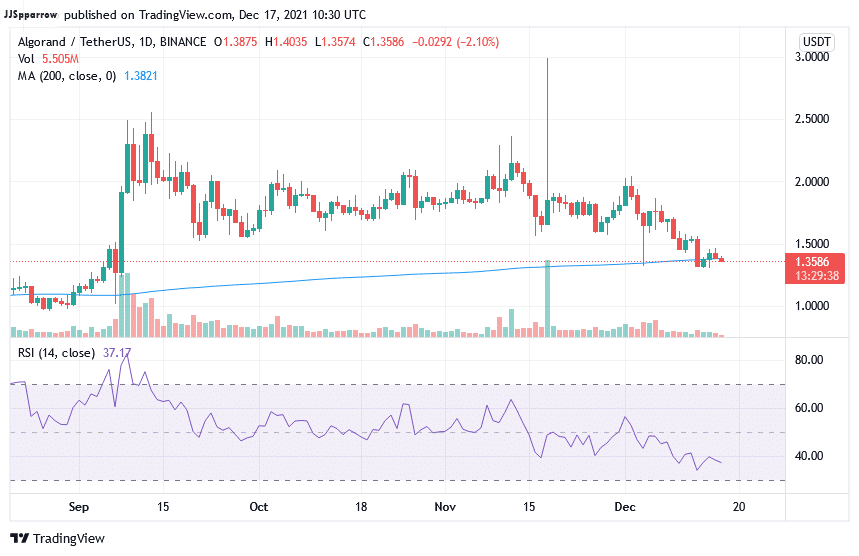

ALGO, at press time, is trading at $1.3586, down 3.99% in the last 24 hours. The coin is also trading in the red zone on weekly margins, losing 9.68% in the last seven days.

This year, the asset has posted an impressive performance, soaring to 305.16% year-to-date (YTD) while also gaining an impressive 284.84% in price in the last year.

The 24-hour trading volume of the Algorand crypto price is $177.2 million, down 23.77% in one day.

ALGO is currently trading below the 20-day moving average (MA) support price of $1.6542, showing that ALGO is on a bearish run.

The 200-day MA price of $1.2624 tells the same story.

However, ALGO is only a victim of a broader downturn in the crypto market that has seen the bears in charge for weeks now. The 14-day relative strength index (RSI) figure of 37.17 shows that the utility token is trading in the underbought region.

The moving average convergence divergence (MACD) indicates the orange trendline indicator soaring above the green, signalling a sell order.

Algorand’s strategic partnership and use causes will see the price of the digital asset rally in the days ahead. ALGO signed an agreement with Borderless Capital. The partnership saw the Algorand blockchain receive a $500 million funding intended to offer support for creating digital asset niche services like non-fungible tokens (NFTs), liquidity mining, lending, borrowing and yield farming.

Algorand Price Prediction

Algorand has been a revelation in the past year, and as the DeFi race picks up, the Ethereum rival is gaining major traction. Given this, forecasts on the asset have been bullish.

According to popular crypto prediction website Digitalcoin Price, Algorand price prediction is expected to surge to $2.07 by this year’s end. Next year points to even more bullish activities as Algorand is expected to close the year at $2.48 while making a seven-year rally to $5.93.

Fellow forecast website Wallet investor is even more bullish on the Ethereum killer.

According to Wallet Investor, Algorand price prediction is expected to hit $2.746 in the next year, while the digital asset may rally to as much as $7.814 in the next five years. These projections indicate that Algorand coin price prediction is likely to climb in future.

Staking Algorand

Staking cryptocurrencies involves committing your digital asset like ALGO to support the blockchain’s network and confirm transactions on the blockchain.

Staking is mostly available to cryptocurrencies that use the proof-of-stake (PoS) consensus mechanism to validate transactions.

PoS consensus mechanism is a more environmentally friendly process than proof-of-work (PoW), used by Bitcoin, which consumes much energy.

This is because validators are chosen based on the governance token they have in contrast to PoW models, which require miners to compete, leading to excess energy wastage.

Staking enables crypto assets owners to lock their coins within the blockchain protocol. The blockchain platform then chooses from all the participants who have pledged their assets to act as validators to confirm blocks of transactions.

Participants who pledge more coins stand a higher chance of being chosen as validators. In many cases, participants are rewarded with the same crypto asset they staked as rewards to that block’s validator.

However, your coins are still in your possession when you stake them. In the event of a price rally, staked coins tend to carry more value given the newly minted coins added to a user’s crypto funds. This makes staking an ideal way of generating passive income for many.

Staking of crypto assets is usually for a specific time frame ranging from a few days to one full year. You can decide to unstake your ALGO at any time if you want to trade them.

Benefits of Staking ALGO

Staking presents a great opportunity for users to generate passive income. It is especially true because, on some blockchains, you can earn as high as 10-20% return on investment (ROI) per year based on your locked up cryptocurrencies.

Other benefits of staking crypto include the following:

- It is an easy way of earning interest on your cryptocurrency holdings.

- You do not need to invest in any equipment to mint new coins, unlike crypto mining that is capital intensive.

- By staking your Algorand coin, you are helping to maintain the security and efficiency of the blockchain.

- Staking is extremely simple, which should make it appealing to new investors.

- Staking cryptocurrencies is a much more environmentally friendly process than crypto mining.

Bybit – Top Platform for Investing in Algorand

Bybit is a crypto derivative platform. The crypto exchange was founded by Ben Zhou in March 2018 and has grown in leaps and bounds since then. Bybit is now home to over 3 million users globally.

The trading platform has its headquarters in Singapore. Although the crypto platform is not regulated, many users trust the Bitcoin exchange and rate its services highly. ByBit also offers staking services for users keen on staking their PoS tokens for added gains.

Many cryptocurrencies are available on the Bybit platform, with Bitcoin (BTC) and Ethereum (ETH) the most popular of the lot. In total, the platform offers access to about 111 different cryptocurrencies pairs.

Trading on the Bybit platform usually involves two entities; the maker on the one hand and the taker on the other hand.

The maker places the order to initiate a trade while the taker places a trade that matches the maker’s. Makers pay a negative 0.025% as transaction fees called rebates, while the takers pay 0.075% as transaction fees for every order. This applies to derivatives trading and Tether’s USDT contracts.

In the case of spot trading, makers pay zero fees while takers pay a transaction fee of 0.10%. ByBit charges varying withdrawal fees depending on the cryptocurrency in question.

On Bybit, payment methods include crypto transfers, electronic transfers, Visa/Mastercard debit/credit cards, and cash deposits. When making cash deposits, investors have up to 59 different fiat currencies to choose from. However, fiat currencies can only be used to buy BTC, ETH and USDT on the platform.

- Lots of educational resources

- Advanced trading tools

- Multiple payment solutions

- User-friendly

- Not regulated

- Derivative trading is very risky

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

Best Broker to Invest in Algorand

Investing in Algorand is considered a smart move by many indications. The utility token has shown great potential in the past. In addition, innovations surrounding the token portends great things for the future of the digital asset.

Investing in Algorand is made easy on crypto brokerage platforms.