Best Jupiter Funds UK to Watch

With more than 35 years in the industry, Jupiter Fund Management is one of the largest investment management firms in the UK. The firm focuses on providing investors with a variety of bond and equity mutual funds, encompassing all regions of the globe and a diverse set of investing strategies.

In this article, we’ll review some of the Popular Jupiter funds UK for 2021.

-

- 1. Jupiter European Fund

- 2. Jupiter Asian Income Fund

- 3. Jupiter Ecology Fund

- 4. Jupiter China Fund

- 5. Jupiter Corporate Bond Fund

- 6. Jupiter Distribution Growth Fund

- 7. Jupiter Global Sustainable Equities Fund

- 8. Jupiter European Special Situations Fund

- 9. Jupiter Emerging European Opportunities Fund

- 10. Jupiter Global Emerging Markets Fund

-

- 1. Jupiter European Fund

- 2. Jupiter Asian Income Fund

- 3. Jupiter Ecology Fund

- 4. Jupiter China Fund

- 5. Jupiter Corporate Bond Fund

- 6. Jupiter Distribution Growth Fund

- 7. Jupiter Global Sustainable Equities Fund

- 8. Jupiter European Special Situations Fund

- 9. Jupiter Emerging European Opportunities Fund

- 10. Jupiter Global Emerging Markets Fund

Popular Jupiter Funds UK List

In the list below, we have listed 10 popular Jupiter Funds which users can invest in the UK in 2021.

1. Jupiter European Fund

2. Jupiter Asian Fund

3. Jupiter Ecology Fund

4. Jupiter China Fund

5. Jupiter Corporate Bond Fund

6. Jupiter Distribution Growth Fund

7. Jupiter Global Sustainable Equities Fund

8. Jupiter European Special Situations Fund

9. Jupiter Emerging European Opportunities Fund

10. Jupiter Global Emerging Markets FundPopular Jupiter Funds Reviewed

With so many Jupiter funds to choose from, it can be hard to decide which mutual fund is right for you. Here, we’ll take an in-depth look at each fund’s investment portfolio, performance, costs, and more.

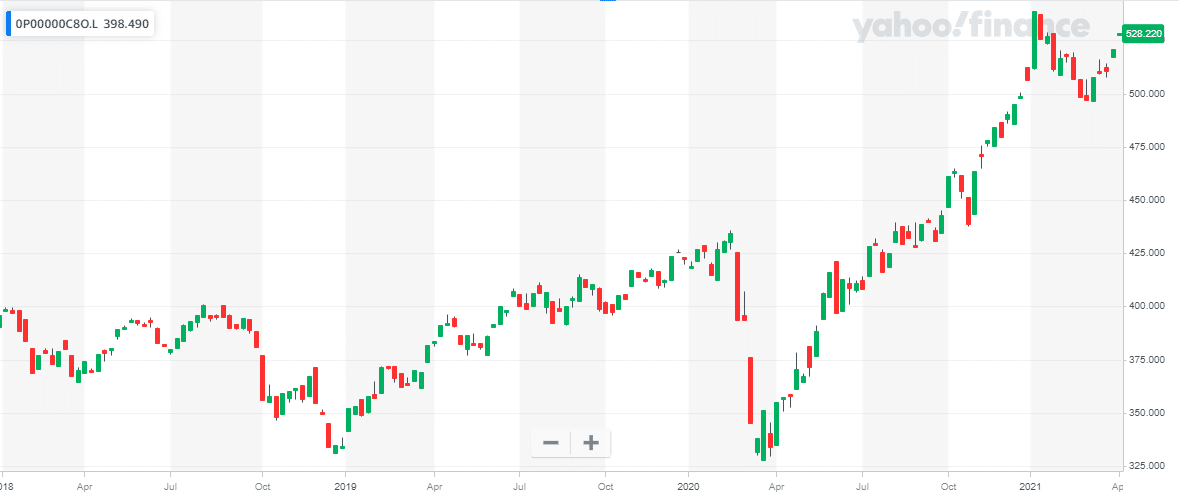

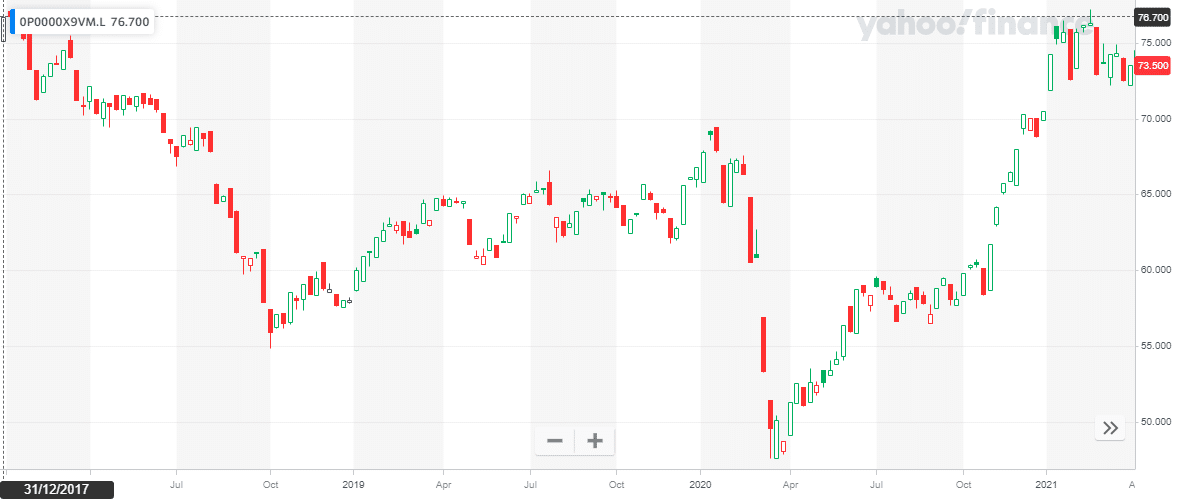

1. Jupiter European Fund

First up on our list of the popular Jupiter funds in the UK is the Jupiter European Fund. It’s one of the firm’s largest and popular investment funds, with £4.2 billion in assets under management. The fund’s objective is to provide a return that is higher than that of its benchmark FTSE World Europe ex UK Index.

Two-thirds of the fund’s portfolio are in the EU, while non-EU European countries and the UK are also represented. The fund is weighted heavily towards technology, financial services, healthcare, industrials, and communication services stocks.

Since 2017, the fund has been able to beat its benchmark in all but one year. It returned 27% last year and has a 1% annual expense ratio.

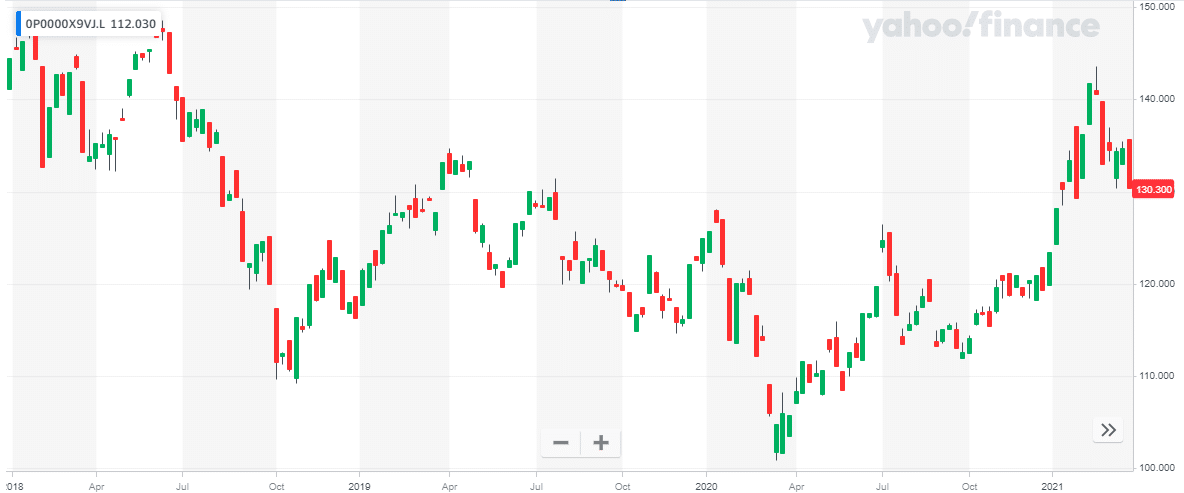

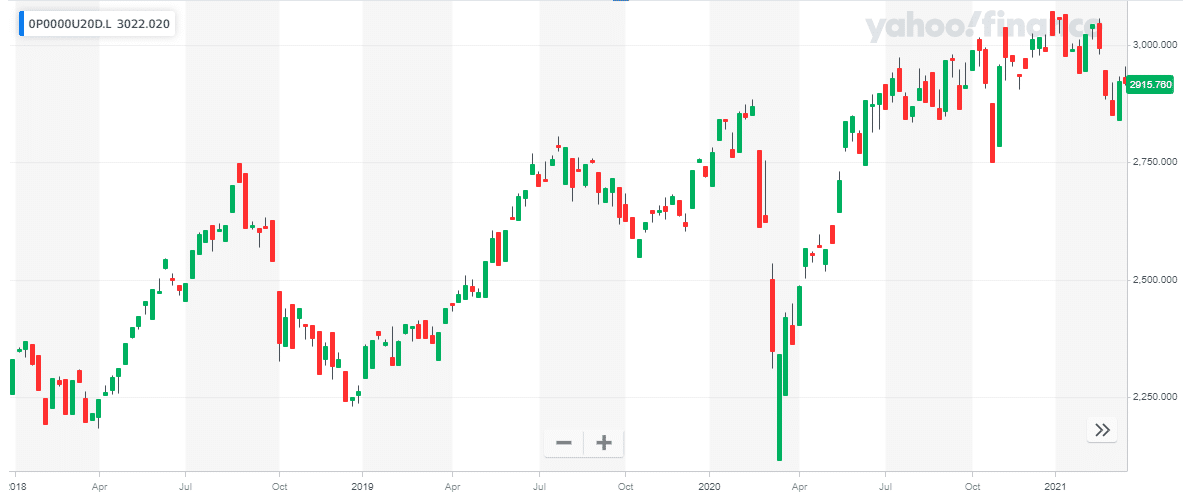

2. Jupiter Asian Income Fund

For investors looking for exposure to Asian markets, the Jupiter Asian Income Fund is a fund that may allow you to do so. This isn’t your average Asian stocks fund with names like Alibaba and other major China stocks. It focuses on producing dividends for investors, so it invests primarily in companies like Samsung, China Sands (a casino company), and Taiwan Semiconductor Manufacturing. Notably, the fund also includes some Australian and Japanese stocks – so it’s not entirely an emerging markets fund.

This focus has helped the Jupiter Asian Income Fund avoid fallout from the US-China trade wars to a greater degree than similar funds. It has a 5-year average annual return of 11.66% and pays out a 12-month yield of 2.88% through quarterly dividends.

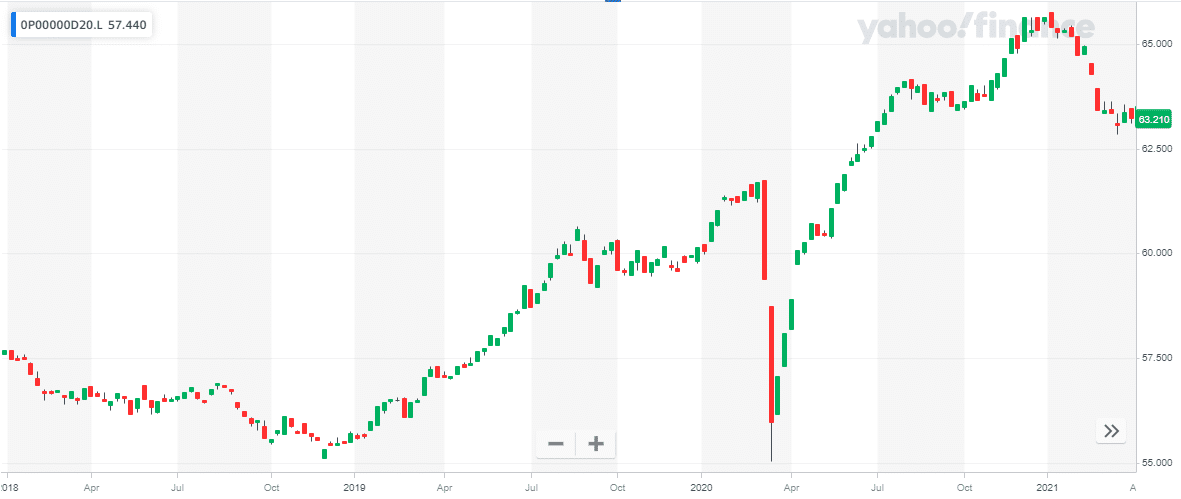

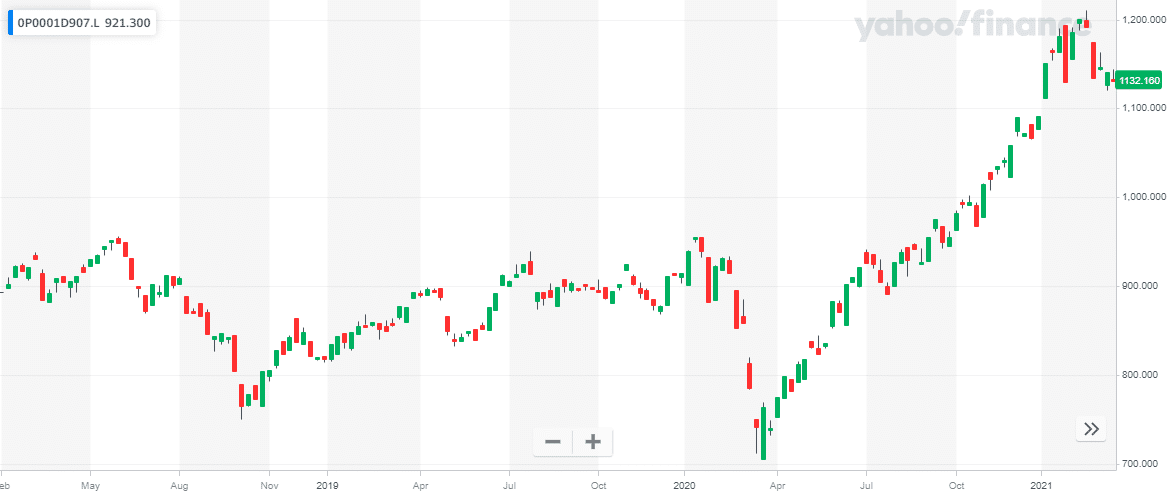

3. Jupiter Ecology Fund

The Jupiter Ecology Fund was the first authorized green unit trust to be launched in the UK. Investors’ interest in ESG investing is evidenced by the £662.7 million that has poured in since the fund’s inception.

The fund focuses on companies that provide solutions to environmental and social problems. The largest holdings include wind power companies like Vestas Wind Systems and water management companies like Itron Inc. Given the shift towards green energy and sustainability, the fund sees these as long-lasting investment opportunities. Investments are spread around the developed world, with 46% of the portfolio based in Europe, 38% in the US, and 10% in Japan.

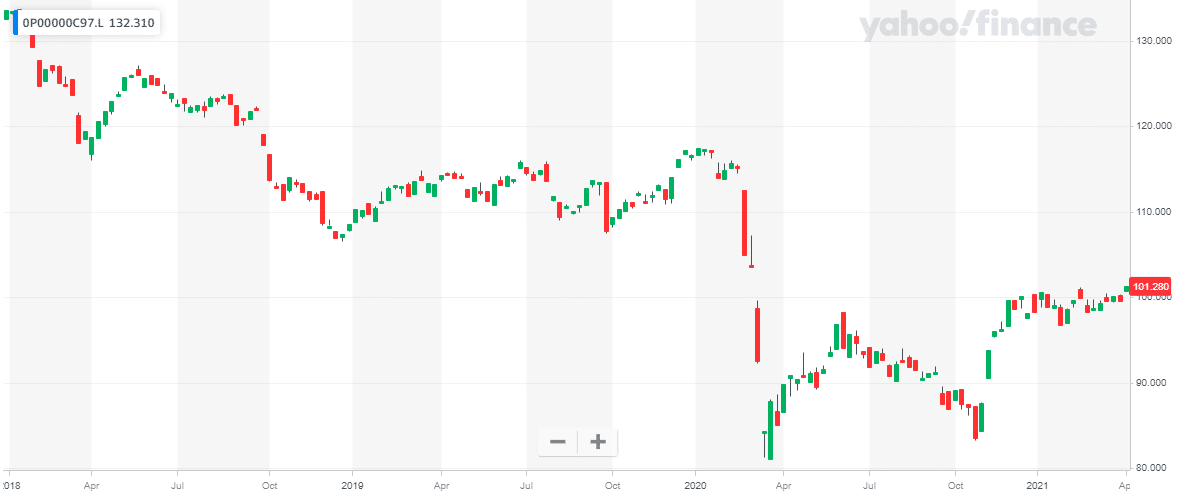

4. Jupiter China Fund

As the name suggests, this fund focuses on the Chinese stock market. It aims to provide investors with a return that is higher than that of the MSCI China Index. Since it invests in a single emerging market, investors should note that this fund carries more risk than other Jupiter funds.

The Jupiter China Fund portfolio is concentrated in technology companies. The largest 5 holdings are Baidu, JD.com, Tencent Holdings, NetEase, and Vipshop Holdings, and together they represent around one-third of the fund’s portfolio.

The fund has a 5-year annualized return of 7.8%, which is somewhat lower than the most popular China ETFs. It carries a 0.99% expense ratio.

5. Jupiter Corporate Bond Fund

The Jupiter Corporate Bond Fund is the go-to choice for investors who want to invest in bonds, which offer more stability than stocks. The fund invests primarily in BBB-rated corporate bonds, although it does have some bonds that are below investment grade. In addition, although it’s a corporate bond fund, 10% of the portfolio comes from government bonds. Most of the bonds are from the UK and Europe.

This fund has provided returns higher than the IA Sterling Corporate Bond benchmark in all but one year since 2015. It has a 5-year average annual return of 5.20% and has kept volatility to a minimum compared to the stock market. The fund has an expense ratio of 1.24%.

6. Jupiter Distribution Growth Fund

This £536.3 million fund uses a blend of equity and bond investments in order to deliver both fixed income and growth. The fund has 40 stock holdings, including UK dividend stocks like AstraZeneca, Diageo, and Unilever. No stock makes up more than 5% of the total portfolio. Around 20% of the portfolio comes from government and corporate bonds.

This fund produced an impressive 16.18% gain last year, but it has struggled to perform over the last 5 years. It has an annualized 5-year return of -1.58%, plus a surprisingly high expense ratio of 1.74%. We love the idea behind this fund, which is why it made our list, but it’s worth keeping an eye on its performance going forward if you invest.

7. Jupiter Global Sustainable Equities Fund

One of the more recent additions to the Jupiter family of funds, this impact investment fund launched in 2018. It invests at least 70% of assets in shares of companies that meet the fund’s environmental, social, and governance (ESG) requirements. Up to 30% of the assets may be invested in other assets, including shares of non-ESG companies, open-ended funds (including funds managed by Jupiter and its associates), and cash.

The annual fee for this fund is on the lower end at 0.71%. It posted a very impressive 19% gain in 2020 and a 29% gain in 2019. Nearly 60% of the portfolio is invested in US stocks, with a focus on the fast-growing tech and financial services industries.

8. Jupiter European Special Situations Fund

The Jupiter European Special Situations Fund targets long-term capital growth by investing in companies with good products, a quality management team, and a sustainable long-term growth business model. The popular European fund UK uses a fundamental-based, bottom-up investing approach. With close to 40 holdings, it aims to achieve superior diversification within European markets. No individual position has more than 5% weight within the portfolio.

This unique strategy has worked well for investors. The fund returned 29% last year and has a 5-year average return of 7.5%. The fund has a management fee of 1.74%.

9. Jupiter Emerging European Opportunities Fund

This fund focuses on Central and Eastern European equity markets in countries like Russia, the Baltic States, former USSR states, and Turkey.

Investors should note that this fund is a high risk investment option. Emerging markets in Eastern Europe have less liquid and more volatile markets than those in Western Europe. Also, the fund’s managers make aggressive bets on Russian stocks (the largest 5 holdings are Gazprom, Lukoil, Norilsk Nickel, Sberbank, and Novatek). In many ways, this fund resembles a Russia ETF.

This aggression has paid off recently. The fund gained 13.70% last year and 14% in the last 6 months alone.

10. Jupiter Global Emerging Markets Fund

Small but powerful might be one way to describe this fund. It only has £44.6 million in assets under management, but it’s produced a 5-year average annual return of 12.36% and a whopping 54% gain in the last year.

The fund relies heavily on technology, financial services, and consumer cyclical in emerging markets. The biggest holdings include companies like Taiwan Semiconductor Manufacturing, Chinese Tencent Holdings and Alibaba, Indian HDFC Bank, Korean Samsung, and Brazilian MercadoLibre. This mix also gives you quite promising diversification, both in geographical and sector terms.

The fund has a 1.74% expense ratio.

What are Jupiter Funds?

Jupiter Fund Management is one of the leading UK asset management firms. It has built a group of managed funds with total assets now reaching almost £59 billion. The firm recently acquired Merian Global Investors, which added £17 billion in assets under management.

Jupiter has a highly experienced management and investment team that combines fundamental investing with a bottom-up approach. It invests across fixed income, public equity, and hedging markets on a global scale. Jupiter Asset Management invests most heavily in the services sector, which alone makes up almost a third of its total asset allocations. The firm also invests in the financial, technology, health care, and other sectors.

Features of investing in Jupiter Funds

You don’t have to be professional and have the skillset yourself to profit from the market and generate returns over time. Investing in actively managed mutual funds or ETFs (exchange-traded funds) is easy and requires little work on your part. You just pay a small fee for the privilege of having experienced professional teams invest your money for you.

Jupiter Fund Management has a wide range of funds covering almost every combination of asset classes, geographical regions, and investing themes. The firm’s funds have comparatively low fees and risk-adjusted returns over the long term.

Before you decide to invest your hard-earned money in any mutual fund, you may want to look into factors like the prior performance of the fund, the fund’s composition, and the regions the fund invests in. Jupiter is upfront about its fund’s composition, fees, and management style. which is another plus for this company.

How to Invest in Jupiter Funds

Let’s take a closer look at how you can invest in Jupiter with a suitable broker of your choice.

Open Your Account

Head over to the homepage of your chosen broker and begin the sign-up process. You will be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue.

Verifiy Your Account

Most reputable brokers in the UK are regulated by the FCA – which is why users may be required to verify their accounts. To do this, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Deposit funds

The next step is to deposit funds into your trading account. Most brokers may support 1 or more of the following payment methods:

- Credit card

- Debit card

- Bank transfer

- e-wallet

Choose your preferred payment option and deposit the funds into your account.

Invest in Jupiter Funds

Once your account has been funded, proceed to search for your preferred Jupiter Funds on your platform’s search bar. Fill in the amount you want to credit into the trade, and confirm your transaction.

Conclusion

Jupiter Funds asset management firm covers basically all possible approaches to investing, there is a lot of diversification opportunities available.

However, users should conduct their own research and analysis before investing in any asset class. Only put in money after working on an investing strategy, or taking advice from your financial advisor.

FAQs

What sort of assets do a Jupiter funds invest in?

This asset management firm offers exposure to almost all asset classes as well as different geographical regions and investing themes. The only thing that is not found yet is the cryptocurrency-oriented fund.

How much money do I need to invest in a Jupiter fund?

This depends on who you invest with. If you invest directly with the fund provider, you usually need a larger minimum investment. However, depending on the brokers you choose, you have the option to invest for as little as $10.

What fees are associated with Jupiter funds?

Like other fund types, Jupiter Asset Management will charge an annual fee to investors called the ‘expense ratio’. This will be displayed as a percentage of your investment and can range from 0.1% to 1.74%. With some brokers, you may also have to pay a commission to open your position.

Ilija Rajakovic

Ilija Rajakovic

Ilija Rajakovic is a Serbian-based investor and writer. His main focus areas include finance, trading, and macroeconomy. Ilija holds a Master’s Degree in Investment Banking and is pursuing his Ph.D. with a focus on sustainable finance and development. He is actively managing personal investment portfolios and advising private clients. And has run a website which generated actionable stock market ideas and provided insights into global economic landscape in the past. His economic articles have been publshed in highly respected magazines like NIN and Magazin Biznis.View all posts by Ilija RajakovicWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up