How to Buy Diageo Shares UK – with 0% Commission

Diageo plc is a huge UK-based company that specialises in alcoholic beverages. Some of its most recognised brands include Guinness, Johnie Walker, Baileys, Captain Morgan, and Smirnoff. If you want a piece of the action, you can buy Diageo shares with ease. After all, the firm is listed on the London Stock Exchange and forms part of the FTSE 100 index.

In this guide, we walk you through the process of how to buy Diageo shares online in the UK. We’ll also include an overview of the best UK brokers to buy Diageo shares from, how the coronavirus has affected Diageo, its past performance and what the future holds for the company in terms of its stock price.

-

-

Step 1: Find a UK Stock Broker to Buy Diageo Shares

Most online brokers based in the UK will allow you to buy Diageo shares – with the process rarely taking more than a few minutes when using a platform that accepts debit/credit cards.

You do, however, need to check what fees and charges you will be expected to pay to buy the shares – as this can vary quite wildly. Additionally, pay extra attention to minimum deposit amounts and whether or not the broker is licensed by the FCA.

If you want to buy Diageo shares in the fastest and most cost-effective manner right now – the two stock brokers listed below allow you to do this at the click of a button.

Step 2: Research Diageo Shares

Even if you hadn’t heard of Diageo plc (DGE) before reading this guide – you will have no doubt come across one of its brands. This is because the firm is behind some of the most recognisable alcoholic beverages globally.

Nevertheless, we strongly advise you to perform some enhanced research not only on Diageo as a company – but in terms of its share price history. After all, you will be risking your own money when you buy Diageo shares – so you need to ensure that the company represents a viable, long-term addition to your stock portfolio and that the volatility levels match your risk preference.

What is Diageo plc?

As noted above, Diageo (ticker DGE, ISIN: GB0002374006) is a UK-based multinational supplier of alcoholic beverages.

This includes:

- Tanqueray

- Gordon’s

- Captain Morgan

- Don Julio

- Smirnoff

- Johnnie Walker

- J&B

- Bell’s

- Baileys

- Guinness

The company was first launched in 1997 as a result of a merger between Grand Metropolitan and Guinness Brewery. Since then, the firm has acquired dozens of well-known alcoholic brands – such as those listed above. Globally, Diageo employs close to 28,000 people across more than 140 countries. The company is run by CEO Ivan Menezes – who has sat at the helm since 2013.

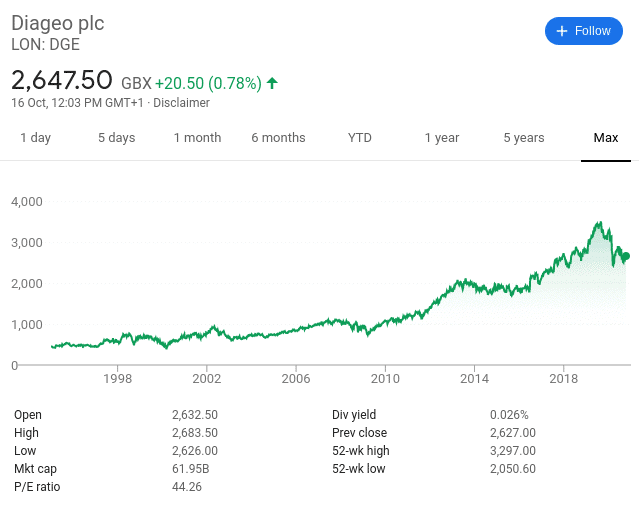

Diageo Share Price History

Over the course of time, Diageo shares have performed well – making investors slow and steady returns since its public listing over two decades ago. The shares are listed on the UK primary exchange – the London Stock Exchange (LSE). Owing to Diageo’s £62 billion market cap – it is also listed on the FTSE 100 index.

In terms of its recent share price action, Diageo was priced at 1,836p five years prior to writing this page. Fast forward to October 2020 and the same shares will cost you 2,654p. This represents gains of 44% over the 5 year period. In comparison to the wider FTSE 100 – Diageo has performed significantly better.

In fact, by investing in the FTSE 100 index 5 years ago, you would actually be looking at a loss of 7% as of October 2020. In more recent times, we should note that Diageo shares are actually down YTD. The stocks started 2020 at 3,183p and are currently priced at 2,654p.

This translates into 2020 losses of 7%. While not ideal, it is important to remember that the impact of the coronavirus not only put a ban on drinking establishments in most countries around the world during the lockdown, but supply chains were severely disrupted.

Diageo EPS and P/E Ratio

At the time of writing, Diageo has an EPS of 60.10, with an EPS growth of -16%. The p/e ratio for Diageo is 24.5.

Diageo Shares Dividend Information

Not only is Diageo a dividend payments company – but it has distributed a dividend yield every financial year since 1998. This is also the case this year – while a lot of its fellow FTSE 100 counterparts either cut or suspended their usual dividend yield payment. Its most recent payment was made earlier in October at a final dividend of 42.47p. In most cases, Diageo will pay dividends twice per year. The interim dividend is paid in April and the final dividend in October.

Should I Buy Diageo Shares?

On the one hand, Diageo shares have outperformed in the FTSE 100 by some distance over the past 5 years. Additionally, the firm is a strong and stable dividend payer. So, what’s not to love? Well, seasoned stock investors are more concerned about where the shares are headed in the future, so we now need to look at what factors you need to consider before you buy Diageo shares.

Buy Diageo Shares at a 2020 Discount

When we refer to ‘discounted shares’, we are talking about stocks that are potentially undervalued. That is to say, based on current prices, the shares could be lower than their intrinsic value. There is every reason to believe that this is the case with Diageo at the time of writing.

This is because at 2,654p – the shares are trading at a 19% discounted in comparison to its pre-pandemic, 52-week highs of 3,292p. This is huge in the case of Diageo – as the wider disruption of the global alcohol industry was of no fault of its own.

Full Year Results

Although Diageo’s full-year results were less than desired as per the pandemic, we must discuss them nonetheless. In terms of revenues, this saw a decline of 8.4% to £11.8 billion. Operating profit took an even bigger hit with a 14.4% decline. Diageo also initiated some major asset write-offs – amounting to £1.3 billion. On the announcement of its financial results, Diageo shares dropped over 6%.

Strong Brands

The most attractive aspect of Diageo from an investment perspective is that it is behind some of the most dominant alcohol brands globally. For example, the likes of Smirnoff, Johnnie Walker, Guinness, and Gordon’s are also market leaders in their respective fields. With this in mind, no is no reason to believe that revenues will not return to pre-pandemic levels in the very near future.

Diageo Shares Buy or Sell?

Diageo is no doubt a strong and stable FTSE 100 leader with a tremendous track record of paying dividends. It is behind some of the biggest and most recognised alcoholic brands globally, many of which dominate their respective field in terms of market share. While the company was hit particularly hard by the wider impact of COVID-19 – there is no reason to believe that its shares won’t eventually bounce back to pre-pandemic levels.

The Verdict?

Buying shares in Diageo is a process that can be completed by anyone with an internet connection. It’s simply a case of opening a stock broker account, making an instant deposit with your debit or credit card, and then deciding how many Diageo shares you want to purchase.

FAQs

Are Diageo shares a good buy?

Like many companies on the FTSE 100 - Diageo shares are down in 2020 as of October. However, the firm has a great portfolio of leading alcoholic brands meaning that most analysts foresee an eventual recovery. If you agree with this sentiment, you still have the chance to buy the shares at a discount.

What stock exchange are Diageo shares listed on?

Diageo is listed on the London Stock Exchange (LSE). It is also a constituent of the FTSE 100 index owing to its multi-billion pound market capitalisation.

What is the minimum number of Diageo shares you can buy?

Minimum investment amounts are set by your choice of online broker.

Does Diageo pay dividends?

Yes, Diageo has paid a dividend every year since it first started making distributions in the late 1990s.

How many brands does Diageo own?

At the time of writing, Diageo is behind over 200 alcoholic brands.

Can I invest in Diageo via an ISA or SIPP?

Yes, most ISA and SIPP providers in the UK will allow you to buy Diageo shares.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up