Best High Leverage Broker UK to Research

The amount of leverage available to UK traders is usually capped at 1:30; however, if you’re a professional client or use an offshore platform, higher limits are available should you choose to access a high leverage broker.

In this guide, we review some high leverage brokers available to UK traders.

Key Takeaways on High leverage brokers in UK

- High leverage brokers are trading platforms that allow users to trade a range of assets with high amounts of leverage.

- There are caps on the amount of leverage that can be employed for certain assets, ranging from 30:1 for FX, to 5:1 for equities.

- To choose between the various high leverage brokers UK on offer, users often tend to focus on the pricing structure, asset selection, and payment methods.

High Leverage Brokers in UK 2022

In the section below, we provide a quick breakdown of the popular high leverage stock brokers in the UK.

- FinmaxFX

- Plus500

When looking for a high leverage brokerage, users review the assets and markets the broker supports, what fees and commissions it charges.

In the sections below, we review some UK-based brokerages that support high leverage trading.

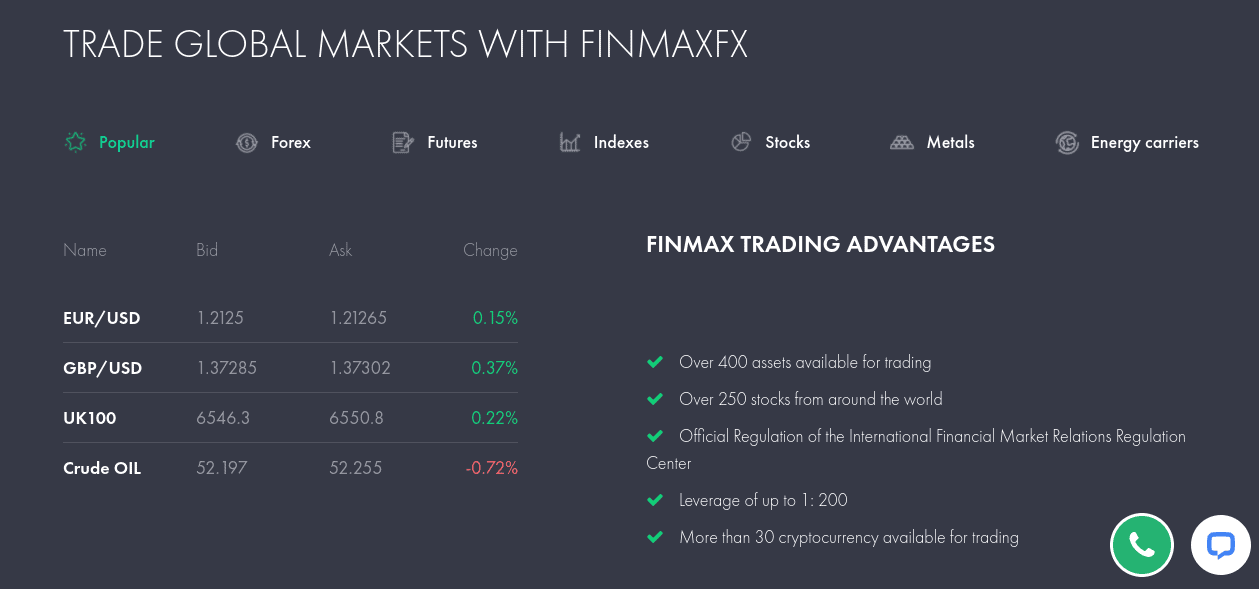

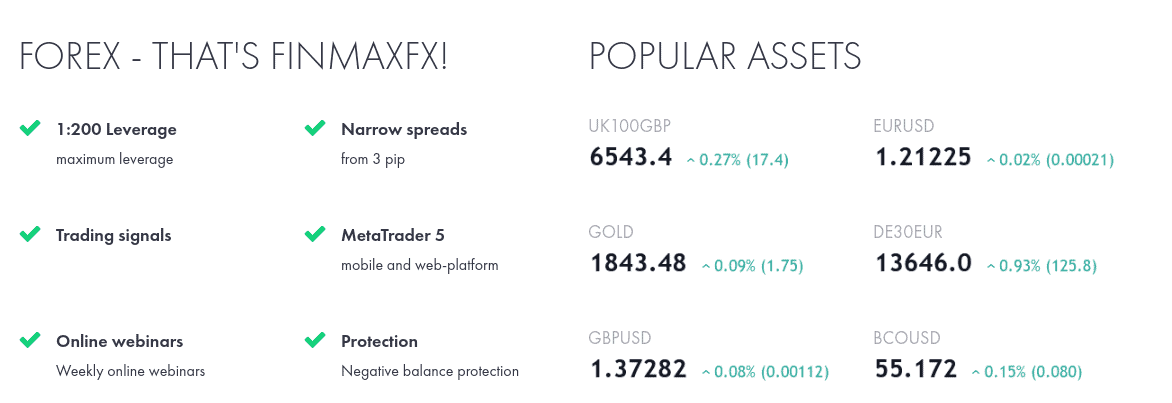

1. FinmaxFX

As we have discussed thus far – if you’re based in the UK and are a retail client, then you will be capped to a maximum leverage limit of 1:30. =

This means that a small account balance of £200 would allow you to enter a position worth £40,000. This is available on forex, indices, and gold trading markets, so you’ll get lower limits of other assets. With that said, FinmaxFX will still offer you up to 1:100 on non-gold commodities like oil and natural gas, as well as bonds.

If you’re looking to trade stock CFDs, then you will get leverage of up to 1:20. This is five times more than the 1:5 limit that you will get with FCA regulated platforms. When it comes to commissions, FinmaxFX builds all trading fees into the spread. The amount you pay will ultimately depend on your chosen account type and the asset you are trading.

If you’re looking to trade stock CFDs, then you will get leverage of up to 1:20. This is five times more than the 1:5 limit that you will get with FCA regulated platforms. When it comes to commissions, FinmaxFX builds all trading fees into the spread. The amount you pay will ultimately depend on your chosen account type and the asset you are trading.

But, to give you an idea – the Micro Account at FinmaxFX – which requires a minimum deposit of $250, offers spreads from 3 pips upwards. This is also the case with its Mini, Standard, and Premium Accounts. The only way to get your minimum spread down to 1 pip is to opt for the VIP Account, which requires a huge minimum deposit of $100,000.

In terms of payment methods, FinmaxFX supports debit/credit cards, bank transfers, and an assortment of e-wallets. The broker also supports Bitcoin payments, albeit, withdrawals are charged at a whopping 7%. As such, you may want to cash your trading funds with another payment method

Once you are set up with an account at FinmaxFX, you will be able to trade via the popular third-party platform MT5. If you haven’t previously used an MT5 broker UK, the platform offers heaps of advanced order types, technical indicators, chart drawing tools, and even the ability to install a trading robot. You can access MT5 via the FinmaxFX website, desktop software, or the mobile app.

Finally – and perhaps most importantly, FinmaxFX is authorized and regulated by the Vanuatu Securities and Exchange Commission. As a UK trader, this offers little in the way of investor protection. On the flip side, FinmaxFX does demand verification documents from all traders. So, at the very least, it takes its anti-money laundering responsibilities seriously.

2. Plus500

Another highest leverage broker in the UK is Plus500. Plus500 has been around since 2008 and is regulated by the FCA and ASIC. This trading platform has a high reputation due to its safety and is even listed on the London Stock Exchange. Due to this, investors are offered the highest levels of investor protection possible.

As Plus500 focuses on CFD trading, all of the platform’s fees are incorporated into the spread. This spread will vary from asset to asset, although ranges around 0.7% for ETFs and equities. In terms of leverage, Plus500 allows traders to use up to 1:20 leverage on stocks indices, 1:5 on individual stocks, and 1:30 on currencies.

The account opening process is very easy and requires a minimum deposit of $100 (£74). Users can fund their accounts with 16 different base currencies and are able to use credit/debit card, bank transfer, or e-wallet. Notably, deposits and withdrawals at Plus500 are completely free of charge. Finally, Plus500 really excels when it comes to its trading platform, featuring a clean and clear interface along with two-step login, price alerts, and a multitude of order types.

High Leverage Brokers Fees & Leverage Comparison

| Max Leverage (Retail) | Max Leverage (Professional) | Commission | Minimum Deposit | |

| Plus500 | 1:30 | 1:300 | 0% | $100 |

| FinmaxFX | 1:200 | 1:200 | From 3 pips | $250 |

High Leverage Explained

The online trading arena in the UK is very heavily regulated. In turn, the FCA has certain protections in place for retail clients with respect to leverage.

What is Leverage?

In its most basic form, leverage allows you to trade with more money than you have in your brokerage account. In effect, you are essentially borrowing the additional capital from your chosen trading platform.

Leverage can be viewed as a multiple (like x2, x3) or a ratio (like 1:2, 1:3), albeit, most brokers opt for the latter. For example, let’s suppose that you stake £100 on a forex trading position with leverage of 1:10. In turn, this means that you are trading with 10 times your stake. So, in this example, you’ve turned a £100 stake into £1,000.

Here’s a quick example of how this trade would work when using the popular high leverage brokers.

- You stake £100 on GBP/USD – opting for a buy order as you think the exchange rate will rise

- You apply leverage of 1:10

- A few hours later, your GBP/USD position is worth 4% more

- Happy with your profits, you close the trade with a sell order

- Without leverage, your 4% gains on a £100 stake would have made you just £4

- However, as you applied leverage of 1:10, this £4 profit is amplified to £40

UK Leverage Limits

As we have noted through this guide, the FCA is very strict where it comes to leverage limits available to retail clients – meaning there are no 1:500 leverage brokers UK for casual investors.

Overnight Financing on Leverage

Before embarking on a leveraged trading strategy on the most traded stocks (or any other asset), it is important to understand that there are certain fees involved. More specifically, you will need to pay an ‘overnight financing fee’ for each day that you keep your leveraged position open.

After all, you are trading with more money than you have in your account – meaning that you are borrowing the balance from the broker in question. In turn, the broker will want a financial return on the capital it lends out, which comes in the form of interest.

Difference Between Margin and Leverage

When searching for popular high-leverage brokers in the UK, you can be certain that you will come across the term ‘margin’. Both leverage and margin are often used interchangeably, but they do differ slightly.

In simple terms:

- Leverage refers to the amount that you wish to boost your stake by. For example, leverage of 1:5 will turn a £100 stake into £500.

- Margin, however, refers to the amount of capital you need to put up to obtain your desired leverage amount. In the example above, your margin is £100, as this is required to obtain £500 in trading capital at 1:5

Understanding how margin requirement is really important when using the popular high leverage forex brokers – as this will determine your ‘liquidation’ point.

Being liquidated by your high leverage broker means that the platform will close your trade automatically when it goes down by a certain amount.

Conclusion

If you are based in the UK and looking for high leverage traadng brokerages, you may want to review and analyse the various platforms that may provide these features. Most FCA brokers in the UK will allow users to obtain leverage up to 1:30, however the non-FCA brokers may provide more leverage.

It is important to note that trading with a non-FCA regulated broker may be riskier for traders. Make sure to conduct your own research and properly examine the amount of leverage you choose to trade with since there is a lot of risk involved in such investments.