Best Forex Courses UK 2021

Trading forex and making consistent gains is not easy. In fact, very few online traders are able to achieve this feat on a long-term basis. With that being said, the most seasoned traders will each have one thing in common – knowledge. In this guide, we explore some of the popular forex courses in the UK.

-

-

What is a Forex Trading Course?

Put simply, UK forex courses are training programs that seek to teach you everything you need to know to become a successful trader. There are many courses available in this respect – both online and offline.

Put simply, UK forex courses are training programs that seek to teach you everything you need to know to become a successful trader. There are many courses available in this respect – both online and offline.At one end of the spectrum, you have forex courses that strive to ease you into the arena on a slow and steady basis. This will likely cover the fundamentals surrounding currency pairs, pips, leverage, spreads, and market orders. At the other end of the spectrum, there are also forex courses that look to take things to the next level.

For example, you might learn how to read and analyze charts, and how to utilize technical indicators like the RSI, MACD, and Fibonacci Retracement. Advanced UK forex courses will also look to teach you how to deploy trading strategies. All in all, there are online forex trading courses to suit all experience levels.

In terms of recognized qualifications, this isn’t something that really exists in the forex space. Even if it did, it isn’t something that is necessarily going to add value if you are looking to trade from the comfort of your home.

The Popular UK Forex Courses in 2021

As noted above, the internet is jam-packed with forex courses – some free and some paid. Each course will take its own approach to financial education, which again, makes it somewhat challenging to know which one to pick.

To help you along the way, below you will find a review of the popular UK forex courses in 2021.

1. ForexSchoolOnline.com

ForexSchoolOnline.com offers a wealth of courses to suit all experience levels. If you’re just starting out and you have little to no knowledge of how currency trading works, ForexSchoolOnline.com offers an in-depth newbie program.

To help ease you into the currency arena, the course initially starts by discussing the basics of how the forex markets work. This will cover key metrics such as trading orders, spreads, and opening and closing positions. Then, the course will explain the importance of understanding trading fees, commissions, and overnight financing.

Once the basics are out of the way, the course moves on to market analysis, money management, and calculating a risk vs reward ratio. Crucially, the course increases in difficulty gradually, subsequently ensuring that you do not feel overwhelmed with the information being presented. Notably, the newbie ForexSchoolOnline.com course is completely free. Outside of the introductory course, the platform offers a range of other training material.

This includes a guide on price action trading, as well as getting the most out of MetaTrader 4. Regarding the latter, this is one of the most utilized third-party trading platforms in the forex arena, so the course is well worth looking into. Additionally, ForexSchoolOnline.com now has its very own Telegram group. Within it, you will find regularly posted forex signals, and the ability to share ideas and insights with your fellow graduates.

2. Learn 2 Trade

If you’re a complete beginner and want to learn everything there is to know about forex, Learn 2 Trade offers a plethora of free guides that cover all-things forex. For example, you’ll come across dedicated pages on leverage, automated robots, spreads, trading strategies, and more.

Each and every guide is written by experts from within the industry – and explained in a simple and easy-to-understand manner. If you want to take things to the next level, Learn 2 Trade also offers a comprehensive online forex course. The course consists of 11 chapters, and it can be completed via your desktop device or mobile phone.

Some of the things that you will learn include basic forex terms, timing the market, performing fundamental analysis, reading charts, and technical indicators. Each chapter also provides you with relevant tips, examples, and case studies to help you grasp the information with ease. The Learn 2 Trade forex course also includes tests and quizzes, which you will be required to complete before moving on to the next stage.

In terms of pricing, Learn 2 Trade charges £99 for its in-depth forex course. It is also worth noting that Learn 2 Trade offers a fully-fledged forex signal service – both free and paid-for.

3. Forex Trading A-Z (UDEMY)

If you’re the type of student that prefers interactive learning materials, you might want to check out the The Forex Trading A-Z course on UDEMY is a third-party course presented in video format.

This means that you can sit back and learn the ins and outs of forex in a seamless manner. You also have the opportunity to take the course at your own pace, as everything is pre-recorded.

At the time of writing, the course has enrolled over 66,000 students, with an overall rating of 4.6/5. In terms of what the course consists of, you will be walked through heaps of topics. This starts with an overview of how the forex markets work, and what you need to factor in before choosing a forex broker.

You will then be exposed to key terms such as leverage, pips, short-selling, and base/quote currencies. Moving forward, the course will then teach you the ins and outs of fundamental and technical analysis, and how to calculate the risks associated with a trade. To conclude, you will then be shown how to install and use MetaTrader 4.

4. Bizintra

The forex trading course offered by Bizintra is going to set you back $130 per month. But, it provides a number of features and learning sources. First and foremost, the course is run by Nick Lesson and Jason Sen – two seasoned traders with decades worth of experience in the forex scene.

The selling point of the Bizintra course is that you will be accustomed to ongoing live demonstrations. That is to say, rather than just teach you what you need to know, the team at Bizintra will practice what they preach. For example, let’s suppose that the course is explaining how to deploy a scalping strategy on GBP/USD.

Not only will they demonstrate this with their own trading funds, but the information will be super-relevant to current market conditions. After all, the forex space moves at a rapid pace. As such, you will get to learn the ins and outs of trading strategies that are relevant to the here and now.

On top of live demonstrations, your $130 per month will also get you heaps of on-demand videos, individual courses, and up-to-date brokerage review.

5. Six Figure Capital

Six Figure Capital, in a nutshell, consists of a 14-day forex crash course that strives to teach you everything you need to know to get your trading career off on the right foot.

Although this is much shorter than the other courses on our list, it is important to note that the program comes jam-packed with valuable material. To get the ball rolling, the first few days will consist of the basics – including currency pairs, trading hours, and market terminology.

The course then attempts to help you identify the type of trading personality that you possess. After that, the course moves swiftly into second gear – covering topics such as Japanese Candlesticks, identifying patterns, and looking out for bullish and bearish traps. Towards the end of the course, you will learn a selection of profitable trading strategies.

In terms of pricing, this is the most expensive course on our list. It will set you back a whopping £800 – which is a one-time fee. On top of the 14-day crash course itself, this also includes access to a private Slack community, bonus eBooks and spreadsheets, and ongoing support. If an upfront payment of £800 is too much, then Six Figure Capital also offers a payment plan of £97 per month.

Features of a Forex Course

As we previously noted, there are many forex courses active in the space. In fact, a quick Google search will yield thousands of results. This can make it difficult to know which is the suitable forex course for you.

As such, here are a few features to look at while picking a suitable forex course for you.

Online vs Offline

You should identify how you would like to receive the material. That is to say, are you looking to take a forex course from the comfort of your home.

Or, are you also looking for access to the course via your mobile phone. Alternatively, some of you might be seeking a UK forex trading course that is taken in class.

This will require you to visit a physical location each and every day/week until the course is complete. Take note, taking an offline class will cost you significantly more in comparison to an online program – so do bear this in mind.

Experience Level

You then need to think about the type of trader that the forex course has been designed for. If you are a complete newbie, then it goes without saying that you will need to opt for a beginner’s course. This will ease you into the world of forex slowly, and begin by starting with the basics.

If you are an advanced trader, then you will need to look for a niche course that targets a specific topic. For example, you might be looking to learn about a specific technical indicator – like the RSI or MACD. Alternatively, you might be after a course in Japanese Candlesticks or utilizing forex robots.

Course Materials

We all learn in different ways, so it’s crucial that you explore how the course material is delivered. For example, some courses will rely exclusively on written guides and explainers that are backed by graphs, charts, and other visual materials. While this is fine for must of us, some of you might be looking for something a bit more interactive.

Additionally, you should look to see what supplementary content is offered by the course provider. For example, we prefer courses that offer quizzes and tests. That way, you can be sure you understand the material before progressing to the next stage of the course.

Time Commitment

While some forex courses are somewhat thin on the ground, others are going to be highly comprehensive. As such, you need to explore how much time you are going to be required to commit. If your chosen course offers on-demand content – then this isn’t going to be as much as an issue – as you can effectively learn at your own pace.

Public Reviews

The reality is that many UK forex trading courses available in the online space are not going to be worth your time. This is usually because the content is too broad or worse – completely outdated. As such, if the course you are interested in comes at a cost, you need to explore what previous and current students make of it.

The internet is your best friend in this regard, as you should be able to find public reviews of the course. Make sure you assess the credibility of the review before making a decision.

Forex Trading Course London

If you’re based in London and looking for an in-class forex course, there are several providers active in the space. One of the most popular in this respect is that of Alpha Trading Floor. Although the provider offers a one-day crash course,it also provides a 12-week forex training mentorship program.

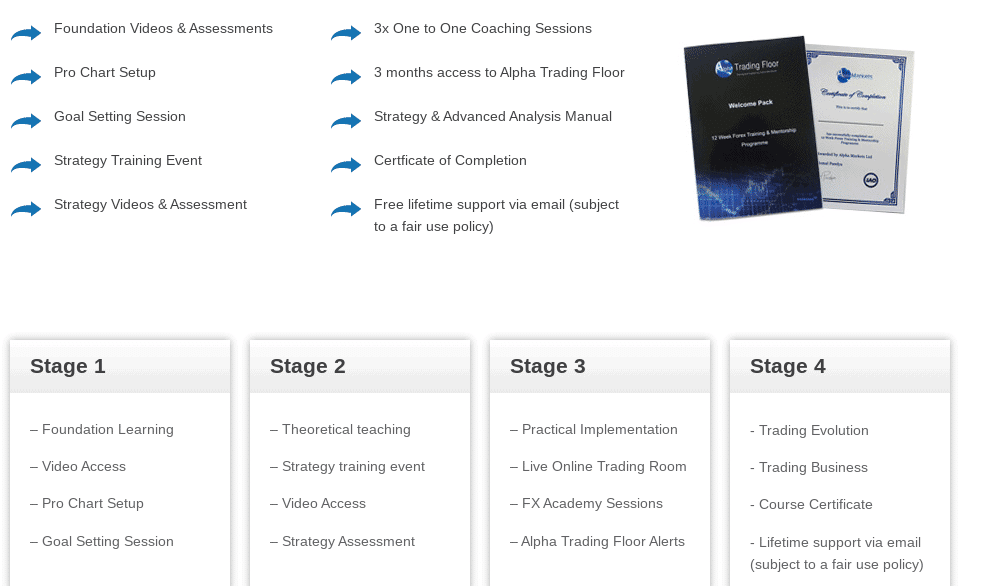

This particular forex training course is facilitated in London across four specific stages. You will start with the foundations of forex, alongside goal setting. Stage 2 covers theoretical material and formulating a forex strategy. Stage 3 and 4 ups the pace by introducing you to live forex sessions, creating trend alerts, and more.

The course runs four times per year, and will set you back £2,995. If you don’t have the time to commit to a full-on 12-week program, then the London Academy of Trading offers evening and weekend classes.

Forex Management Courses

Forex management courses aren’t really a thing these days – as most traders will operate independently. That is to say, the vast majority of would-be currency traders will buy and sell currencies from the comfort of their own home.

After all, one of the biggest appeals of becoming a full-time currency trader is that you will be able to live an independent lifestyle free from the 9-5 drain. As a result, if you want to combine the fruits of forex and management, you will need to take this up through two individual programs.

Conclusion

In summary, there are thousands of forex trading courses active in the online space. You also have heaps of offline courses to look into – with options available across the length and breadth of the UK. The most important thing is that you assess what it is you are looking to learn.

After all, no-two forex courses are the same, so spend some time thinking about what your objectives are.

FAQs

How are forex courses delivered?

If you’re referring to an online forex trading course, then the material typically comes in the form of guides, videos, and quizzes.

Should I undertake an offline forex course?

This depends on you and your personal requirements. In truth, online forex courses are just as comprehensive than their offline counterparts. Crucially, not only are online forex courses more cost-effective, but you can typically undergo the program at your own pace. This isn’t something you can do when you sign up for an offline UK-based course.

How long do I need to complete a UK forex trading course?

There is no one-size-fits-all answer to this question, as no-two courses are the same. For example, while some course can take many months to complete, the Six Figure Capital crash course takes just 14 days.

What course should I take after learning the basics of forex?

Once you have a firm grasp of the basics, it is then worth ‘niching down’ into specific areas of the forex scene. This might include a specific trading strategy like scalping, or a technical indicator like the RSI.

How long will it take to become a forex pro?

This depends on you. If you are able to dedicate several hours per day in learning how the forex markets well – there is no doubt that you will be successful. After all, knowledge is key in the forex arena!

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Six Figure Capital, in a nutshell, consists of a 14-day forex crash course that strives to teach you everything you need to know to get your trading career off on the right foot.

Six Figure Capital, in a nutshell, consists of a 14-day forex crash course that strives to teach you everything you need to know to get your trading career off on the right foot. You should identify how you would like to receive the material. That is to say, are you looking to take a forex course from the comfort of your home.

You should identify how you would like to receive the material. That is to say, are you looking to take a forex course from the comfort of your home.