Best MSCI World Index ETF UK To Watch

The MSCI World Index is a global stock index that includes shares from 23 countries, including the US, UK, and Japan. You have the option to invest in the MSCI World Index in the UK through ETFs.

In this guide, we’ll review some Popular MSCI World Index ETF UK for 2021.

-

-

MSCI World Index ETF UK 2021 List

Here are 5 popular MSCI World Index ETFs in the UK for 2021, read on for a more in-depth analysis of each:

- iShares Core MSCI World UCITS ETF

- Lyxor Core MSCI World UCITS ETF

- HSBC MSCI World UCITS ETF

- Amundi Index MSCI World UCITS ETF

- Xtrackers MSCI World UCITS ETF

MSCI World Index ETFs UK Reviewed

MSCI World Index ETFs (exchange-traded funds) can look very similar, but there are important differences between individual funds. So, let’s take a closer look at 5 popular MSCI World Index ETFs in the UK.

1. iShares Core MSCI World UCITS ETF

The iShares Core MSCI World UCITS ETF is the single largest MSCI World Index fund in the world. It has a whopping $35.8 billion USD in assets under management.

That means you’ll have no trouble with liquidity when you want to purchase or sell shares of this fund. But it can also mean that the fund itself is less nimble, since it has to move huge blocks of shares everytime it wants to change its position in a company.

The iShares MSCI World UCITS ETF gained 51.28% over the past 3 years.

This fund uses an optimized sampling method, which means that it holds a selection of the full 1,586 stocks to track the MSCI World Index performance. This ETF UK is an accumulating fund, so all dividends are reinvested in the fund rather than paid out to investors. The iShares Core MSCI World UCITS ETF has an annual expense ratio of 0.20%.

2. Lyxor Core MSCI World UCITS ETF

The Lyxor Core MSCI World UCITS ETF provides investors with the lowest possible expense ratio. This fund charges just 0.12% per year in management fees.

One way the fund saves money is by using unfunded swaps to track the MSCI World Index performance. That means that this is a synthetic ETF, or one that only holds derivatives rather than the stocks that make up the underlying benchmark index.

The fund has around $1 billion in assets under management, so it’s relatively small for an MSCI World Index ETF. However, that makes it more nimble when changing positions and reduces overhead costs.

The fund is an accumulating fund, so all dividends are reinvested. The Lyxor Core MSCI World UCITS ETF gained 51.01% over the past 3 years.

3. HSBC MSCI World UCITS ETF

The HSBC MSCI World UCITS ETF is a distributing ETF, meaning that any dividends paid by the shares it holds are distributed to investors on a quarterly basis. The fund pays a dividend yield of around 1% per year.

The fund has performed extremely well over the past 3 years, returning 52.46% to investors after accounting for dividends. The fund has a reasonable 0.15% annual expense ratio, so that extra performance doesn’t come with a high price tag.

The HSBC MSCI World UCITS ETF currently has around $3 billion in assets under management. The fund trades on the London Stock Exchange rather than on a US exchange as well.

4. Amundi Index MSCI World UCITS ETF

The Amundi Index MSCI World UCITS ETF is a well-performing fund over the past month, posting a gain of 6.94% over the past 30 days. Over the past 3 years, the fund has had a total return of 50.54%.

This fund uses unfunded swaps instead of directly buying shares of the companies in the MSCI World Index. It has $1.7 billion in assets under management, making it a mid-sized fund.

One downside to the Amundi ETF is that it has a pricey 0.38% total expense ratio.

5. Xtrackers MSCI World UCITS ETF

The Xtrackers MSCI World UCITS ETF is a middle-of-the-road fund for investors who want a blend of performance, low fees, and fidelity to the MSCI World Index performance.

The fund uses an optimized sampling method, so it includes shares of most of the companies that are in the MSCI World Index. It also reinvests dividends, so its position in the indexed companies is consistently growing over time.

The Xtrackers ETF has $7.1 billion in assets under management, making it the second-largest MSCI World Index ETF behind the iShares fund. It has produced a gain of 51.25% over the past 3 years and has an annual expense ratio of 0.19%.

What is the MSCI World Index?

The MSCI World Index is a global equity index that tracks the performance of the world’s largest companies. It includes 1,586 large-cap stocks from 23 countries, including the United States, the United Kingdom, Japan, Canada, Australia, Germany, the Netherlands, Switzerland, Norway, France, and Spain. Altogether, the index represents around 85% of the total market capitalisation in each country.

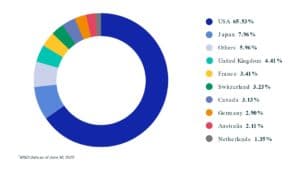

It’s important to note that the MSCI World Index is heavily weighted towards US stocks. In fact, over 66% of the index represents US companies. Japanese companies represent 7.5% of the index, and UK companies represent 4.4%.

The biggest holdings include the FAANG stocks (and Microsoft shares) as well as healthcare stocks like Johnson & Johnson. There are no small cap stocks or emerging markets stocks in the MSCI World Index.

Are MSCI World Index ETFs a Valuable Investment?

The main purpose of MSCI World Index ETFs is to invest in developed economies while attaining geographic diversification. By getting exposure to the UK and European stock markets, you are less dependent on volatility in the US stock market for your investment returns.

Still, US companies have a heavy allocation in the index. They make up more than two-thirds of the index’s weight, so the MSCI World Index performance is heavily dependent on the US stock market.

UK investors may want to look at S&P 500 ETFs, which includes the 500 largest US companies, and it has a strong performance over the past 3 years: the S&P 500 has returned 14.0% annually.

In addition, MSCI World Index ETFs tend to have higher expense ratios than S&P 500 ETFs. The cheapest MSCI World Index fund has an annual management fee of 0.12%, compared to 0.03% for the Vanguard S&P 500 ETF.

Another thing to look at is that MSCI World Index ETFs do not offer exposure to emerging market funds UK.

Make sure to properly research and analyse all options before investing or opening new trades.

MSCI World Index ETF UK Investment Platforms 2021

In order to invest in popular MSCI World Index ETFs, you’ll need a stock broker that offers ETF trading. In the sections below, we have reviewed two popular stock brokers that provide these facilities to investors in the UK.

1. Fineco Bank

Fineco Bank

offers tens of thousands of shares from the US, UK, and Europe, as well as more than 10,000 ETFs to choose from across these markets.

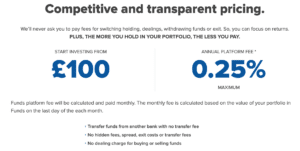

Importantly, Fineco Bank offers several ways to invest. You may open a share dealing account and pay £2.95 per UK ETF trade or $3.95 per US ETF trade. Alternatively, Fineco Bank offers stocks and shares ISAs. With an ISA, you’ll pay no trade commissions and instead be charged a 0.25% annual management fee based on the amount you have invested.

Fineco Bank allows you to manage your portfolio online or through a mobile stock app. The investment platform is simple navigate and allows you to track the growth of your portfolio in a straightforward manner. However, Fineco Bank doesn’t offer in-depth research into the ETFs it offers, so you’ll need to do your own research when choosing funds.

If you’re interested in trading ETFs, Fineco Bank offers the PowerDesk technical analysis suite. This includes customisable price charts with dozens of built-in technical indicators. It’s a popular tool for more advanced traders, although we’d like to see something in between that and the Fineco investment portal for long term investing in ETFs.

Fineco Bank is regulated by the Central Bank of Italy and is publicly traded on the Milan Stock Exchange. You may get in touch 5 days a week via phone or email if you need help with your account.

Invest /su_button]Sponsored Ad. Your capital is at risk.

How to Purchase MSCI World Index ETFs UK

If users are looking to invest in MSCI ETFs in the UK, you may want to look to choose a suitable broker that can provide you with low fees, multiple ETF and additional tools & features.

After choosing your suitable broker, here is how you can begin the investment process.

Step 1: Open Your Trading Account

Head over to the homepage of your chosen broker and begin the account set-up process. You will be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue.

Step 2: Verifiy Your Indentity

Most reputable brokers in the UK are regulated by the FCA – which is why users may be required to verify their accounts. To do this, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Step 3: Deposit funds

The next step is to deposit funds into your trading account. Most brokers may support 1 or more of the following payment methods:

- Credit card

- Debit card

- Bank transfer

- e-wallet

Choose your preferred payment option and deposit the funds into your account.

Step 4: Invest in MSCI ETFs

Once your account has been funded, proceed to search for any ETFs you wish to purchase on your platform’s search bar. Fill in the amount you want to credit into the trade, and confirm your transaction.

Conclusion

Investing in an MSCI World Index fund gives you exposure to stocks from the US, UK, Europe, Japan, and more. However, users must analyse and research possible investment options on their own to be 100% sure of all the investments.

Should you choose to begin investing in ETFs, you may want to do so with a suitable broker of your choice.

FAQs

What is the MSCI World Index?

The MSCI World Index is a stock index that tracks the largest companies in 23 developed countries. It includes 1,586 stocks in total across the US, UK, Europe, Canada, Japan, and Australia.

How do I purchase the MSCI World Index?

You can invest in the MSCI World Index through an ETF. There are many ETFs that invest in the same set of stocks and track the performance of the MSCI World Index.

What is an ETF expense ratio?

An ETF’s expense ratio is its annual management fee. This is usually charged as a percentage of the amount you have invested in the fund.

How much money do I need to invest in an MSCI World Index ETF?

The minimum amount of money you need to invest is the share price of the ETF you want to purchase. However, many brokers, allow you to invest in fractional shares of an MSCI World Index ETF with as little as £8.

Can I invest in an MSCI World Index ETF in an ISA?

Yes, users can invest in an MSCI World Index ETF in an ISA or SIPP. Your ISA or SIPP plan provider must offer trading on an MSCI World Index ETF.

How can I learn more about an MSCI World Index ETF?

One way to research an MSCI World Index ETF and make financial decisions is to read the fund prospectus. You can also speak with a financial advisor to get professional investment advice.

Michael Graw

Michael Graw is a freelance journalist based in Bellingham, Washington. He covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech. In addition to covering financial markets, Michael’s work focuses on science, the environment, and global change. He holds a Ph.D. in Oceanography from Oregon State University and worked with environmental non-profits across the US to bridge the gap between scientific research and coastal communities. Michael’s science journalism has been featured in high-profile online publications such as Salon and Pacific Standardas well as numerous print magazines over the course of his six-year career as a writer. He has also won accolades as a photographer and videographer for his work covering communities on both coasts of the US. Other publications Michael has written for include TechRadar, Tom’s Guide, StockApps, and LearnBonds.View all posts by Michael GrawWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up