How to Buy Litecoin UK – Beginner’s Guide

If you’re looking to diversify your portfolio by investing in a selection of different cryptocurrencies, have you considered Litecoin? This digital coin has held its own as a top-10 cryptocurrency since it was launched in 2011. In this guide, we show you how to buy Litecoin in the UK online. We’ll also walk you through the steps of choosing a broker, understanding the potential risks and rewards, and completing your Litecoin investment in the safest way possible.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

-

- Unprecedented Returns Since Launching

- The Litecoin Blockchain is Better Than Bitcoin

- Litecoin has Formed Some Notable Partnerships

- You can Invest an Inconsequential Amount

- Your Litecoin Investment is Never Locked up

- How Much Does it Cost to Buy Litecoin?

- How to Buy Litecoin with Paypal

- How to Buy Litecoin with Bitcoin

-

- Unprecedented Returns Since Launching

- The Litecoin Blockchain is Better Than Bitcoin

- Litecoin has Formed Some Notable Partnerships

- You can Invest an Inconsequential Amount

- Your Litecoin Investment is Never Locked up

- How Much Does it Cost to Buy Litecoin?

- How to Buy Litecoin with Paypal

- How to Buy Litecoin with Bitcoin

What is Litecoin?

Litecoin is a digital currency that was first launched in 2011. This makes it one of the oldest cryptocurrencies in the space. Founded by Charlie Lee, Litecoin was created to improve on the ‘deficiencies’ of its older brother Bitcoin.

Litecoin is a digital currency that was first launched in 2011. This makes it one of the oldest cryptocurrencies in the space. Founded by Charlie Lee, Litecoin was created to improve on the ‘deficiencies’ of its older brother Bitcoin.Put simply, this meant creating a digital payments network that is faster and more scalable. In terms of the former, Litecoin is able to confirm a fund transfer in just 2.5 minutes, while Bitcoin takes 10 minutes.

Additionally, while Bitcoin can process just 7 transactions per second, Litecoin stands at 56. In terms of the fundamentals, the two cryptocurrencies are much the same. For example, both are backed by blockchain technology that is decentralized in nature. This means that no single person owns or controls Litecoin.

Furthermore, much like Bitcoin, Litecoin is traded on public exchanges. This means that it has a real-world value that goes up and down depending on demand and supply. As such, if you buy Litecoin in the UK, you are hoping that its value increases over time. This is no different from investing in a stock.

Should I Buy Litecoin?

Litecoin is just one cryptocurrency out of thousands. You won’t want to invest in all of these digital currencies, as most are worthless. Crucially, you need to perform some research to determine whether a Litecoin investment is viable in the long run. After all, you will be risking your own money.

To help clear the mist, let’s start by exploring some of the reasons why you might decide to buy Litecoin in the UK.

Unprecedented Returns Since Launching

When the Litecoin project was first launched in 2011, there was very little interest in cryptocurrencies. In fact, space was dominated by a minority of developers who in truth – would never have believed just how big digital currencies would eventually become.

As such, had you bought Litecoin in its early days, you would have paid less than $3 when it first hit a public exchange. Since then, the digital coin has experienced unprecedented returns. For example, in late 2018, Litecoin surpassed the $350-mark.

In comparison to its initial exchange listing price, this translates into returns of over 11,000%. In other words, had you invested just £500 into Litecoin just a decade ago, your money would have been over £55,000 when it peaked in 2018. However, we should note that Litecoin has since dropped in value.

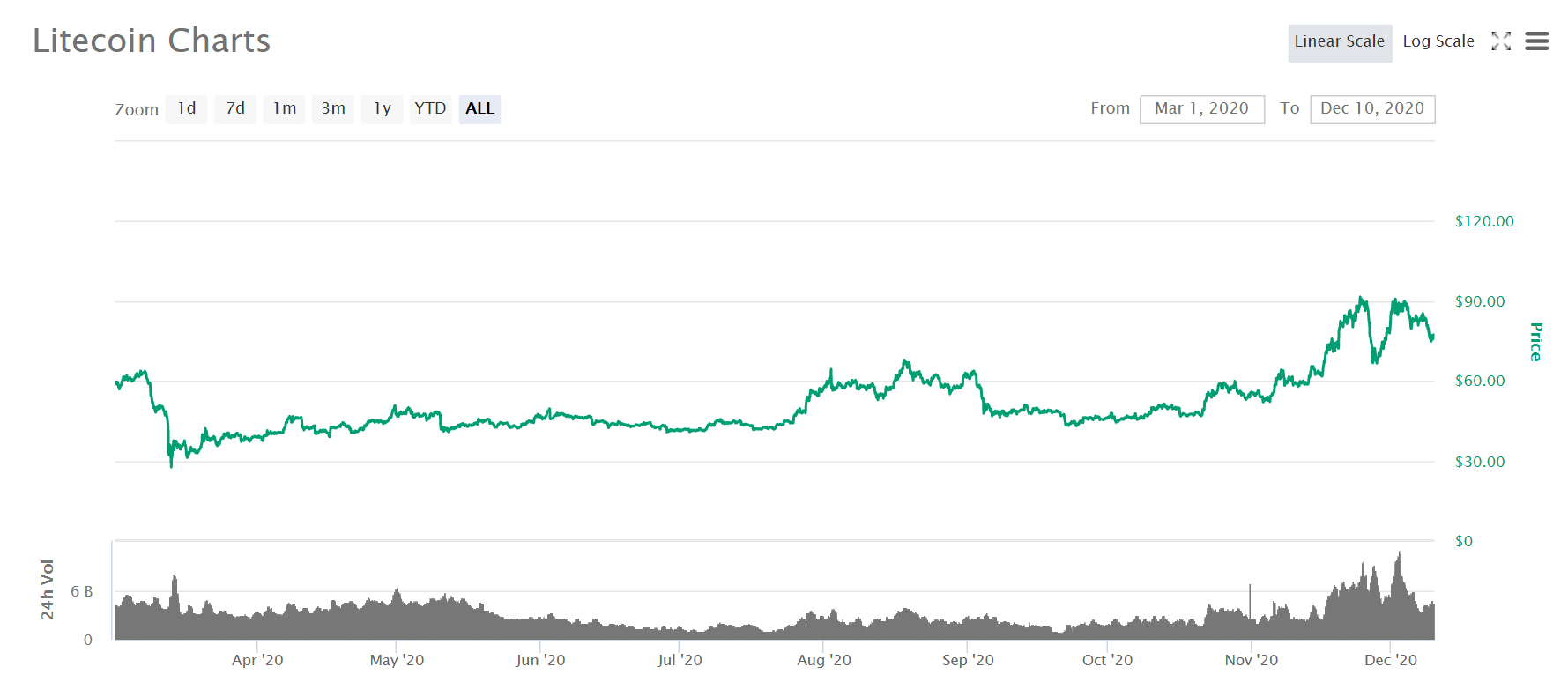

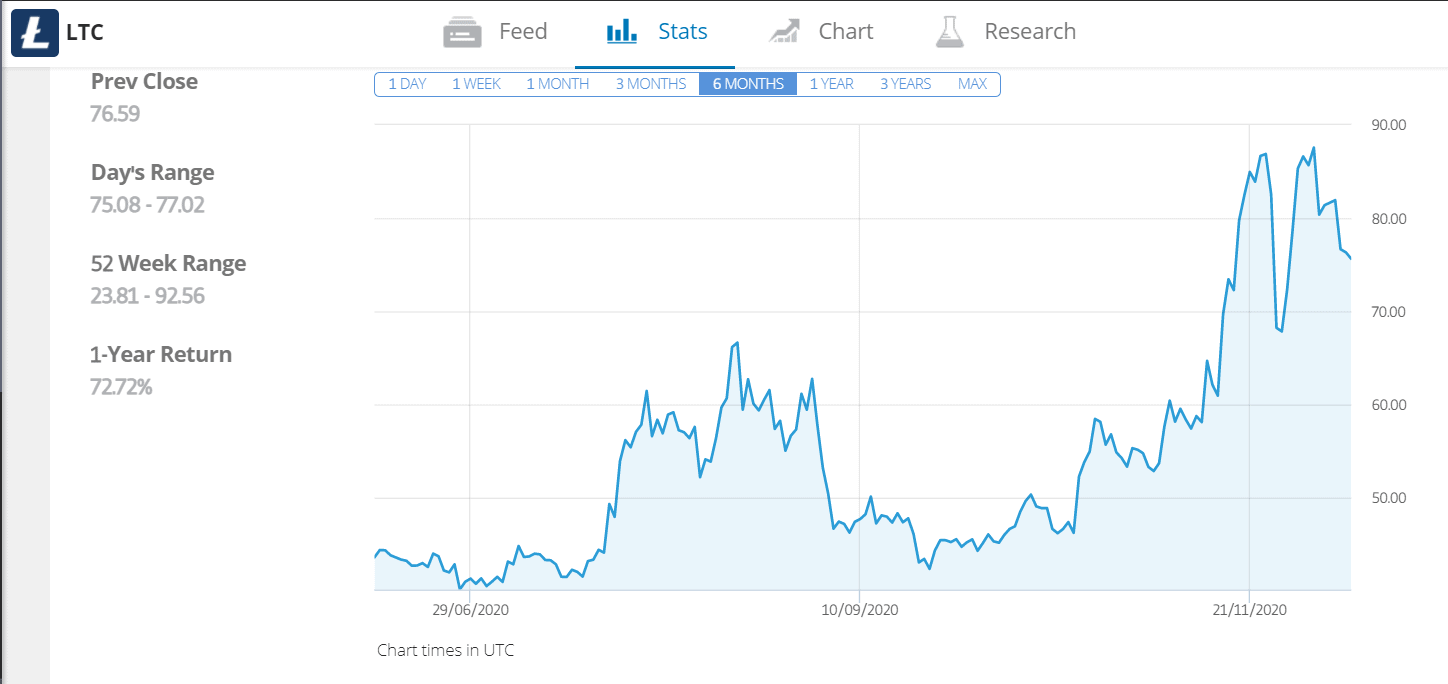

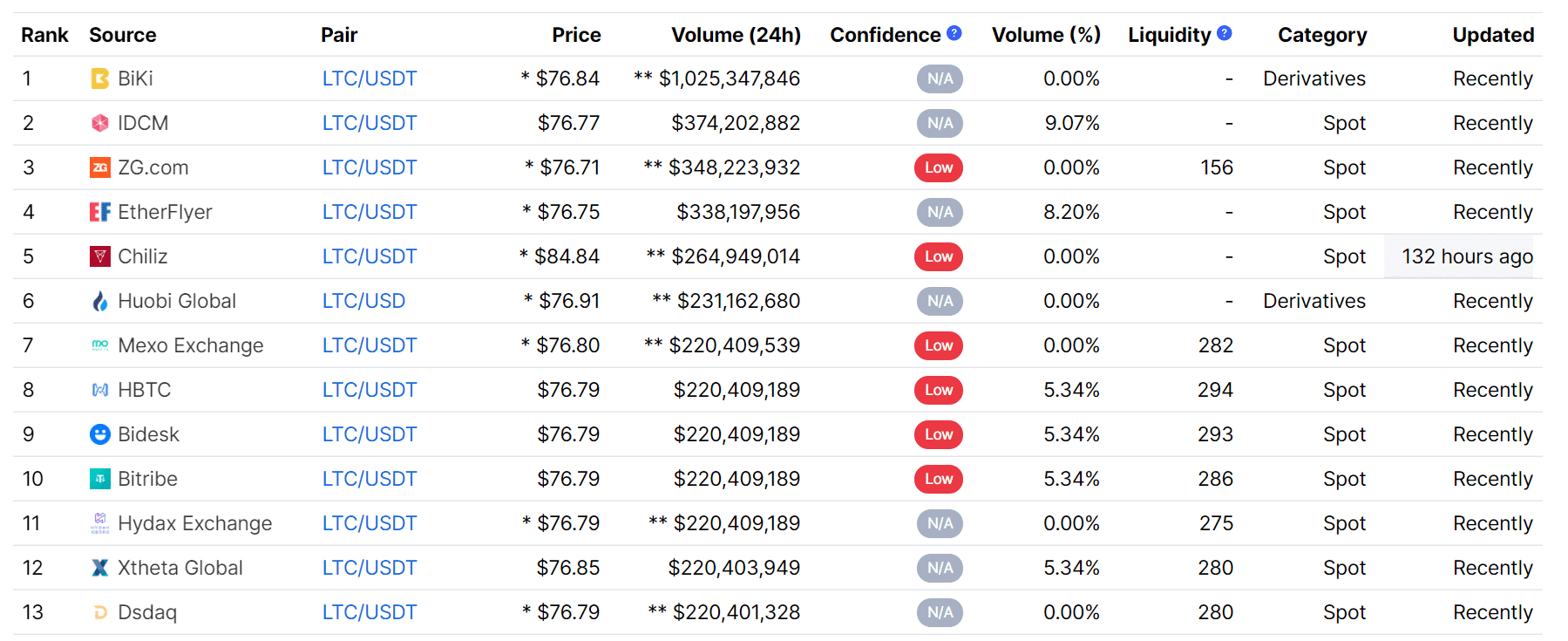

At the time of writing in late 2020, you’ll pay just $76. On the flip side, this does allow you to buy Litecoin in the UK at a more favorable price. Additionally, Litecoin was priced at just $32 in March 2020, meaning that it has increased in value by over 130% in just 9 months of trading.

The Litecoin Blockchain is Better Than Bitcoin

Make no mistake about it – Bitcoin is by far the largest and most popular cryptocurrency of choice. This is in terms of market valuation, trading volume, mass awareness, and more.

However, when it comes to the specifics, Litecoin actually possesses the better technology of the two making it the best cryptocurrency to invest in. This is for several reasons. Firstly, and as we briefly noted earlier, Litecoin transactions are four times faster than Bitcoin.

This means that you can send funds to somebody in just 2.5 minutes, as opposed to 10 minutes. Litecoin transactions are not only faster, but the underlying blockchain can handle eight times as much data.

In turn, the blockchain can process 56 transactions per second, while Bitcoin is still limited to just 7. As the network is, therefore, less congested, this results in cheaper Litecoin transactions.

Litecoin has Formed Some Notable Partnerships

Partnerships in the cryptocurrency scene are crucial. This is for several reasons.

For example, when a well-known organization shows interest in a digital coin like Litecoin, it gives the project credibility and legitimacy.

Additionally, depending on the type of partnership, this can increase real-world usage for the digital coin. This also increases mass awareness, which again, can result in demand for cryptocurrency rising.

In the case of Litecoin, the project has performed a wide range of partnerships. For example, in late 2018, Litecoin sponsored a major UFC event. Litecoin has since become the ‘official cryptocurrency’ of NFL team the Miami Dolphins.

Alongside other stakeholders, Litecoin has also since acquired a 30% stake in a small German bank. There are many other partnerships too – such as NordVPN, Glory Kickboxing, and Travala.

You can Invest an Inconsequential Amount

There is non denying that cryptocurrencies are highly speculative asset classes. That is to say, your average Joe Bloggs investor has no interest in what the underlying technology can do, nor what problems it is perceived to solve. On the contrary, the overarching objective is to make money.

However, cryptocurrencies operate in a volatile battleground. While there are thousands of digital coins in existence, most are virtually worthless. With this in mind, you’ll want to keep your stakes at a minimum. The good news is that you can easily buy Litecoin with a small amount of money.

In doing so, it’s a low-risk, high-reward approach, especially when you consider how much Litecoin is worth today compared with its initial listing price. By using an entry-level broker, you actually only need to invest a small amount per trade.

Your Litecoin Investment is Never Locked up

One of the most attractive aspects of buying Litecoin is that it is highly liquid. This means that you can enter and exit the market at the click of a button – so there’s no concern about being able to access your money when you need to. This is especially the case with Litecoin, as the cryptocurrency is a multi-billion pound asset class.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

As such, you will never struggle to find a buyer when it comes to cashing out. You can sell your Litecoin investment 24 hours per day, 7 days per week on almost any exchange. As soon as you do, the funds will be instantly available for withdrawal.

How Much Does it Cost to Buy Litecoin?

The price of Litecoin is determined by market forces. This is no different from stocks and shares. That is to say, as more and more people show interest in Litecoin, its price will naturally increase. But, if the market sentiment is on the decline, the price of Litecoin will follow suit.

At the time of writing in late 2020, 1 Litecoin will cost $76 – which is about £56. If you’re wondering why the price is quoted in US dollars – this is industry-standard in the cryptocurrency arena. In fact, this is the case with traditional commodities too – as the likes of gold, silver, oil, natural gas, and wheat are all quoted in US dollars.

This means that when you buy Litecoin in the UK, you will need to view your investment in a currency other than GBP. However, this shouldn’t deter you, as you still deposit funds with a UK debit/credit card or bank transfer. It’s just that as soon as you fund your account, the broker will convert your balance to dollars!

How to Buy Litecoin with Paypal

Very few Litecoin brokers and exchanges accept Paypal. This is because the e-wallet provider is a heavily regulated entity, meaning that it must perform checks on cryptocurrency platforms before it allows them to use its payment method.

For example, in the UK, brokers selling Litecoin in exchange for British pounds must be authorized and regulated by the FCA. As you can imagine, shady platforms don’t quite meet the requirements of the FCA, so they choose to remain unregulated.

How to Buy Litecoin with Bitcoin

In the vast majority of cases, people will buy Litecoin in the UK with an everyday payment method. Whether that’s a debit/credit card, e-wallet, or bank account transfer – the process is simple for newbies. However, if you are already in possession of a cryptocurrency like Bitcoin, there is no need to use a traditional payment method.

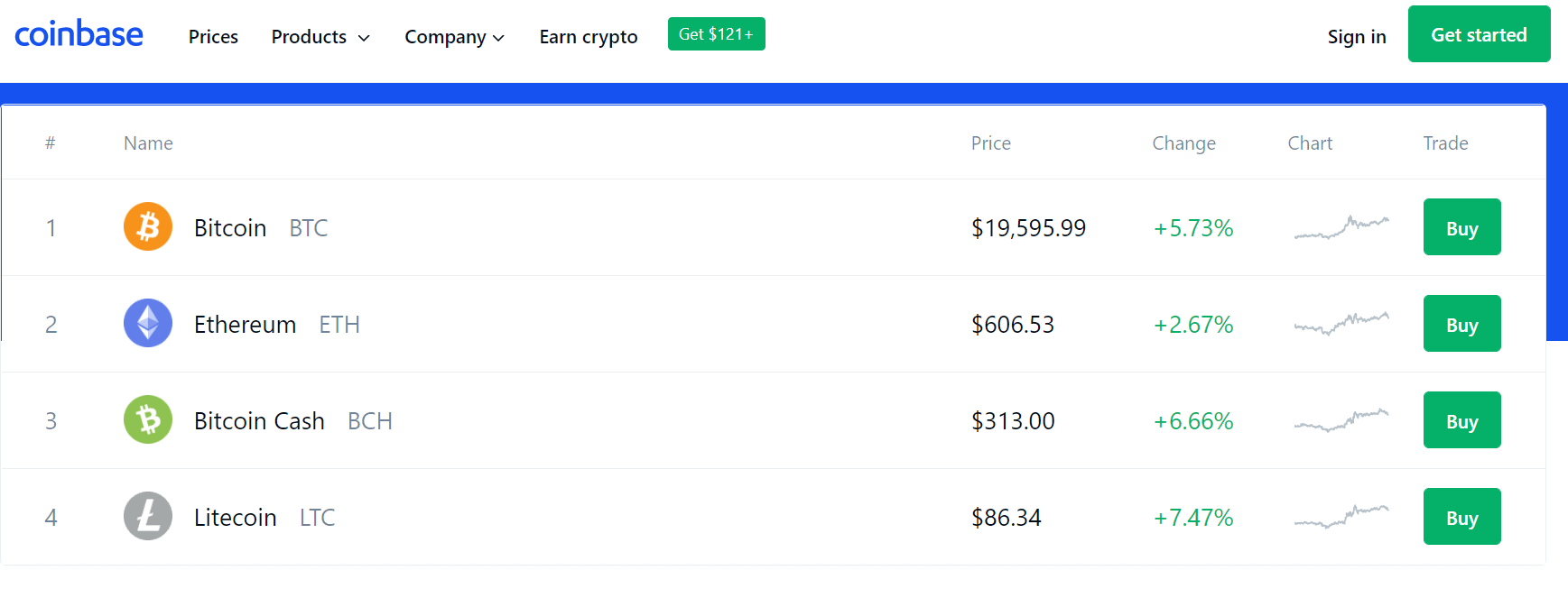

On the contrary, you can swap your Bitcoin for Litecoin with ease. The most effective way of doing this is to use a reputable cryptocurrency exchange. Two popular options in this respect are Coinbase and Binance. Both platforms allow you to deposit funds with Bitcoin.

Then, you simply need to head over to the LTC/BTC trading page. Here, you’ll be exchanging Litecoin for Bitcoin by paying a small commission. At Binance, this is just 0.1% – meaning a £1,000 exchange would cost you just £1 in fees! After you’ve made the exchange, you can then withdraw your newly acquired Litecoin to a private wallet.

Buying Litecoin Safely

Litecoin is a top-10 cryptocurrency with a current market capitalization of over $5 billion. As such, there are now hundreds of third-party cryptocurrency exchanges that give you access.

However, in all but a few cases – these exchanges all have one thing in common – they operate without a regulatory license. This means that you can never be 100% sure that you can buy Litecoin safely.

Instead, by using an unregulated exchange, there is every chance that you will get scammed. Even if the exchange does have good intentions, time and time again we hear about platforms getting hacked and users losing their funds.

- It is for this reason that you should only buy Litecoin with a regulated broker.

- In fact, this should be with the UK’s FCA.

- This means that you can buy Litecoin safely and never need to worry about being scammed.

After all, FCA brokers must keep client funds in a segregated bank account. When It comes to cryptocurrencies like Litecoin, the broker has an obligation to keep your investment safe. In addition to this, all FCA brokers selling Litecoin must perform KYC checks – meaning account holders need to upload a photo ID.

Risks of Buying Litecoin

On the one hand, those who bought Litecoin when the project was still in its infancy are looking at monumental returns. However, there is no guarantee that you will make money by buying this digital currency.

As such, make sure you consider the following risks before taking the plunge.

Litecoin is Super-Volatile

When you invest in a high-grade stock like AstraZeneca, Disney, or IBM – you know that the shares are going to move up and down in value. That’s just the nature of the investment game. However, when it comes to cryptocurrencies – these pricing movements are often parabolic.

In trading jargon, this means that the asset moves in an extremely sharp and volatile manner. For example, in the last 7 days alone, Litecoin has decreased by 12%. In the last 9 months, it has increased by 130%.

If you bought Litecoin in early 2018 at its peak, you would have encountered huge losses in the 12 months to follow. In fact, hitting 2018 lows of just $24, this works out at 93% less than its prior highs of $350. The key point here is that there is every chance that you will lose money when you buy Litecoin.

Once again, this is why it is crucial to keep control of your stakes and that you never invest more than you can afford to lose. The best way to counter this risk is to invest small amounts but on a regular basis.

Most Platforms Selling Litecoin are Unregulated

As we briefly mentioned earlier, the vast majority of exchanges supporting Litecoin purchases are unregulated. The problem is that as an inexperienced investor, you might not be aware that this is the case. Ultimately, if you end up depositing funds into an exchange that operates without a license, your capital is at risk.

This is why you should explore the platform’s regulatory standing before opening an account – and most definitely before you make a deposit. In most cases, if you scroll down to the bottom of the website in question, it will display which regulators it is authorized by. If, for example, you see an FCA license number, this is a good sign.

Real-World Usage of Litecoin is Questionable

When it really comes to it, you need to consider what Litecoin actually offers in terms of real-world usage. Sure, it is a decentralized payment network that supports fast, cheap, and secure transactions. But, it’s highly unlikely that we are ever going to see mainstream usage of Litecoin.

On the contrary, if cryptocurrencies do one day become a medium of exchange, it is likely that Bitcoin will dominate this role. Additionally, it should also be mentioned that while the Litecoin blockchain performs better than Bitcoin, there are far more advanced blockchains in the space.

For example, Ripple transactions are processed in less than a second, while Litecoin takes 2.5 minutes. And while Litecoin is capped to just 56 transactions per second, Ripple can handle 1,500. As such, even if Litecoin did become mainstream, it doesn’t currently possess the technology to handle usage on a large scale!

Selling Litecoin

Like all investments, there will always come a time when you decide to cash out. Hopefully, this will be because you have made a profit as opposed to you cutting your losses. In terms of how this works, the process can vary depending on how you initially made the purchase.

For example:

- If you decided to buy Litecoin in the UK with a broker, the coins would remain in your portfolio until you decide to cash out

- As soon as you click the ‘Sell’ button on the platform the trade will execute and the proceeds will be added to your cash balance

- Then, you simply need to withdraw the money back to the same payment methods that you used to deposit

As you can see, if you use an online broker selling Litecoin can be simple.

With that said, the process of selling Litecoin back to pounds and pence is slightly more cumbersome if you decide to withdraw and store the coins in a private cryptocurrency wallet.

The process would look like this:

- You are holding your Litecoin in a private wallet and decide that you want to cash out

- You transfer the Litecoin from your wallet to the wallet of your chosen cryptocurrency exchange

- You then swap Litecoin for a supported fiat currency – such as USD or GBP

- You then need to withdraw the funds to your bank account

As you can see, not only are there extra steps involved when selling Litecoin in this way but additional trading fees will apply, too.

Where to Buy Litecoin in the UK

As we have established, Litecoin is a multi-billion pound crypto asset that is available at hundreds of online platforms. However, most of these platforms should be avoided – as they operate without a regulatory license.

If you’re wondering how to buy Litecoin in the safest, fastest, and most cost-effective manner – consider completing the process with one of the two platforms listed below.

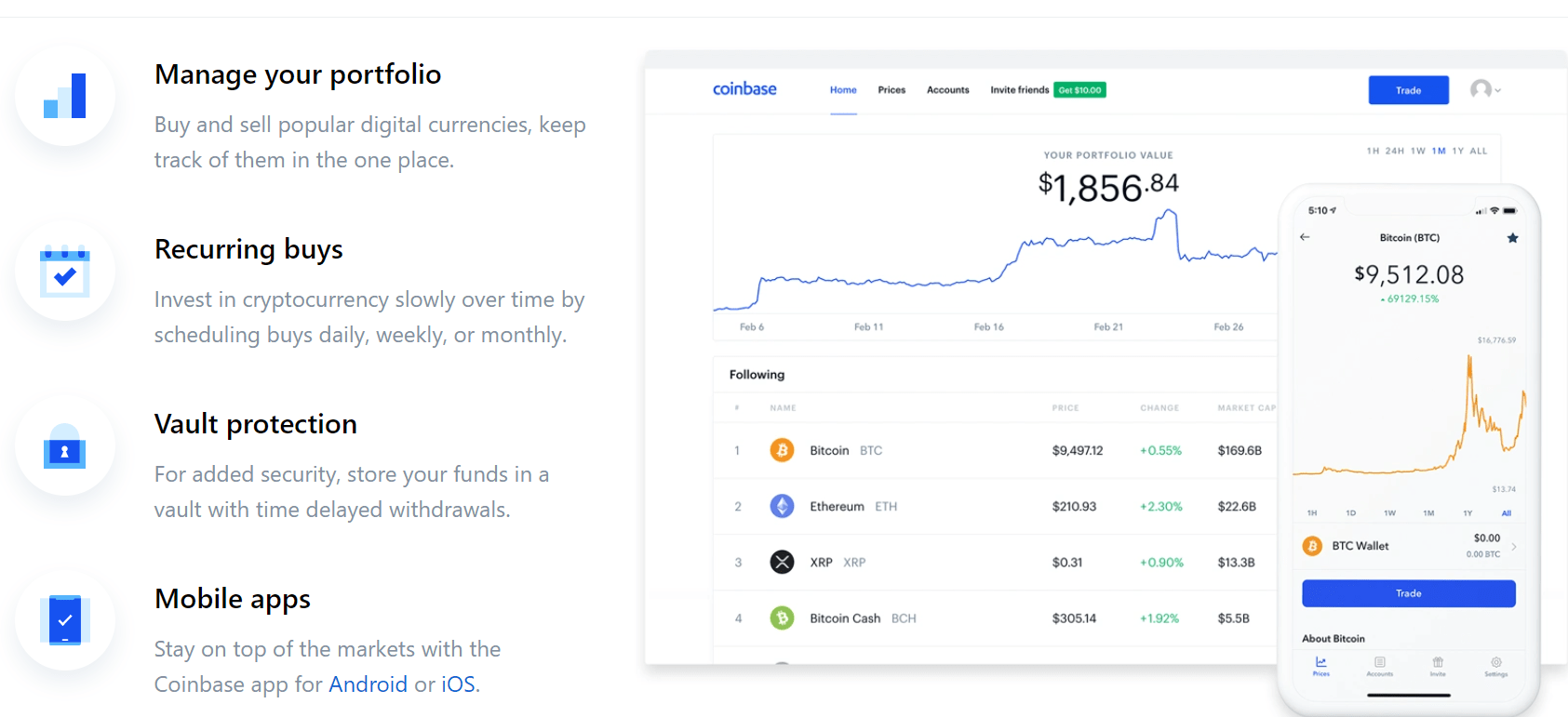

1. Coinbase – User-Friendly Litecoin Broker With Over 35 Million Customers

Coinbase is one of the most trusted cryptocurrency brokers globally and is one of the best crypto exchanges. Based in the US, it now has over 35 million customers from more than 100 different locations.

In particular, it has a very strong presence in the UK market. Not only does it supports UK debit cards and local bank transfers, but it is authorized and regulated by the FCA.

The broker also has institutional-grade security controls in place. This includes placing 98% of the client funds in ‘cold storage’, meaning the crypto assets are never connected to an online service. This reduces the risk of malpractice substantially.

On top of offering a safe, secure, and regulated way to buy Litecoin, Coinbase is also popular for its user-friendly interface. The platform is simple to use and requires no prior experience in investing. You can complete your Litecoin purchase online or via the Coinbase app.

With that being said, there is a slight negative with Coinbase, insofar that its fees are on the high side. For example, the platform has a standard commission rate of 1.49%. You will need to pay this when you buy Litecoin and again when you cash out.

If you are planning to use your UK debit card to buy Litecoin, then the fees are even higher. This is because you will pay an all-in fee of 3.99%. That’s £39.99 for every £1,000 invested. Ultimately, we do like Coinbase in terms of trust, security, and user-friendliness. But, it certainly isn’t the cheapest option in the market.

Pros

- Over 35 million customers and a great reputation

- Very user-friendly

- Deposit funds with a debit card or via bank transfer

- Ability to withdraw your coins out to a private wallet

- Handy mobile app

- Holds a license from the FCA

Cons

- 3.99% fee on debit card deposits

- 1.49% Litecoin trading fee

Your money is at risk.

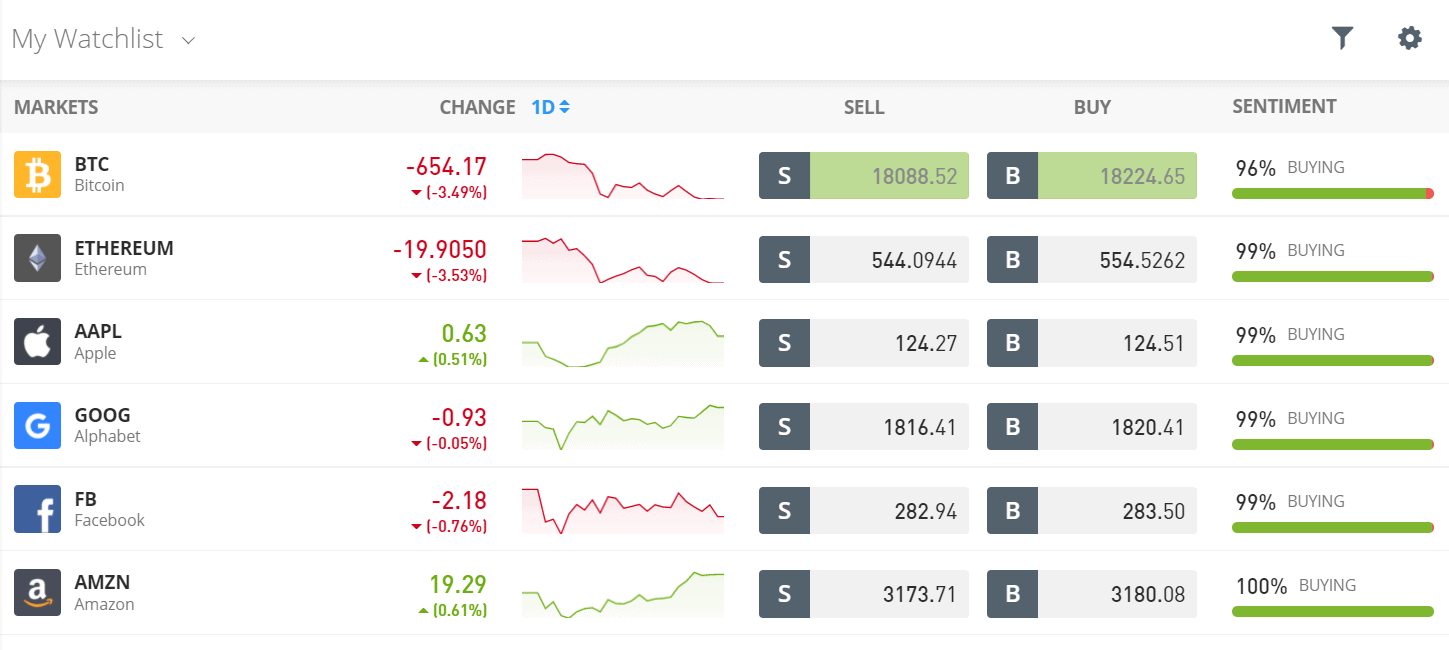

2. Binance – Popular Litecoin Exchange That Supports UK Debit/Credit Cards

Binance is the largest cryptocurrency exchange globally. Although it was only launched in 2017, it often processes over $15 billion in trading each and every day. These numbers of uncanny and largely unrivaled by any traditional brokerage site.

In terms of buying Litecoin, you can actually do this with a debit or credit card. After uploading your passport or driver’s license, the card purchase will be processed instantly. This makes Binance useful if you want to buy Litecoin right now. In terms of fees, Binance charges a variable rate of 2%.

Once again, at 2% this is slightly on the high side, but cheaper than Coinbase nonetheless. Additionally, Binance is currently running a promotion where it is halving the debit/credit card fee to just 1%. On the flip side, if you decide to use Binance to trade cryptocurrencies – this is where the platform stands out.

For example, you will pay a trading commission of just 0.1% per slide. This makes it highly conducive for low-cost trading even if you are only risking small amounts. Furthermore, Binance is home to hundreds of cryptocurrency pairs, so it’s a great platform for accessing less popular digital coins.

Pros

- Largest cryptocurrency exchange in terms of trading volume

- Hundreds of cryptocurrency pairs supported

- Trading commission of just 0.1%

- Supports UK debit/credit cards and bank transfers

- Great reputation in the cryptocurrency scene

- Ideal for advanced traders that seek sophisticated tools and features

Cons

- Not great for newbie investors

- A standard charge of 2% on debit/credit card deposits

Your money is at risk.

How to Buy Litecoin Today

If you’ve made it through our guide on How to Buy Litecoin UK up to this point, then you should now be able to make a purchase on a DIY basis.

Conclusion

If you’re based in the UK and you want to buy Litecoin, you have heaps of platforms to choose from. However – and as we have stressed throughout this guide, you need to spend a bit of time exploring the credibility of your chosen platform. This is because much of the cryptocurrency exchange arena operates without a brokerage license. This is why we strongly suggest considering an FCA-regulated platform.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

FAQs

Where to buy Litecoin UK?

You can buy Litecoin in just a few minutes with many brokers and exchanges. Simple register an account, deposit funds with a debit/credit card or e-wallet, and choose how much you wish to invest in Litecoin.

Is Litecoin better than Bitcoin?

This is a subjective question as it really depends on your own personal views. There is no denying that Bitcoin is the de-facto cryptocurrency of choice and is always likely to be. However, in terms of the underlying technology, Litecoin transactions are faster, cheaper, and more scalable.

What is the minimum Litecoin investment UK?

Minimum investments vary from broker to broker.

How do you buy Litecoin with Paypal?

Not many online brokers allow you to buy Litecoin with Paypal.

How do you sell Litecoin in the UK?

If you bought Litecoin at an online broker, you simply need to click on the ‘sell’ button from within your portfolio. The funds should be added to your brokerage account instantly, and then available for withdrawal.

Can you buy Litecoin anonymously?

If you want to buy Litecoin anonymously, you won’t be able to use a debit/credit card, e-wallet, bank transfer, or any fiat currency method for that matter. This is due to anti-money laundering laws that require all UK brokers to verify the identity of their customers.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Partnerships in the cryptocurrency scene are crucial. This is for several reasons.

Partnerships in the cryptocurrency scene are crucial. This is for several reasons.

Litecoin is a top-10 cryptocurrency with a current market capitalization of over $5 billion. As such, there are now hundreds of third-party cryptocurrency exchanges that give you access.

Litecoin is a top-10 cryptocurrency with a current market capitalization of over $5 billion. As such, there are now hundreds of third-party cryptocurrency exchanges that give you access.

Coinbase is one of the most trusted cryptocurrency brokers globally and is one of the

Coinbase is one of the most trusted cryptocurrency brokers globally and is one of the

Binance is the largest cryptocurrency exchange globally. Although it was only launched in 2017, it often processes over $15 billion in trading each and every day. These numbers of uncanny and largely unrivaled by any traditional brokerage site.

Binance is the largest cryptocurrency exchange globally. Although it was only launched in 2017, it often processes over $15 billion in trading each and every day. These numbers of uncanny and largely unrivaled by any traditional brokerage site.