How to Buy Curve UK – Beginner’s Guide

Curve crypto is a popular name in the fast-growing decentralised finance (DeFi) ecosystem. Famously known as Curve Finance, the digital asset has become a top decentralised exchange (DEX) platform by total value locked (TVL) with over $15 billion TVL, according to data from DeFi Pulse. If you want to buy Curve, this guide will show you how to purchase the asset from the best platforms.

Key points on Curve

- Curve Finance is a decentralised exchange (DEX) platform operating on the Ethereum blockchain that primarily focuses on stablecoin token swaps.

- CRV crypto has surged 1236.1% from its all-time low (ATL) of $0.33 after hitting an all-time high (ATH) of $54.01 on August 2020.

- Curve’s total value locked in dollars has been on an uptrend since May this year. So far, it has increased 168% within the last four months, with the protocol’s TVL currently at $19.08 billion.

- You can buy Curve quickly and easily on many exchanges.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Step 1: Choose a Cryptocurrency Broker

Investing and trading in the crypto space is simple if you have the right information. All you need is to identify a cryptocurrency broker or exchange that will help you tap into the booming space.

There are many exchanges and brokers now supporting cryptocurrencies, but we will explore one of the best in the business. Our top pick have been selected based on features like user-friendliness, fees, and regulation and efficiency.

The section below discusses the benefits of using our recommended platform.

Coinbase – Top Crypto Broker to Buy Curve Crypto

A popular choice for many crypto investors is the US-based Coinbase Global Exchange. Founded in 2012 by Brian Armstrong and co, Coinbase is a popular destination for several North American residents due to its user-friendly interface.

The platform is aimed at helping beginner investors make their first cryptocurrency purchase. Coinbase is registered with the Financial Crimes Enforcement Network (FinCEN) as a Money Services Business.

The publicly traded Bitcoin platform offers a Coinbase Pro variant of its exchange which features lower fees and more sophisticated technical trading tools. Coinbase Pro also serves as an initial listing hotspot for new tokens added to the exchange.

Coinbase runs a crypto custodial services arm called Coinbase Custody which helps legacy-based institutions store their digital assets in cold storage or offline sources.

Meanwhile, its Coinbase Prime serves as a more sophisticated trading zone for institutional investors looking to tap into the crypto market.

Coinbase is one of the world’s largest crypto exchanges and has since grown to attract more than 56 million users despite its somewhat high fees for its beginner platform. The exchange boasts of alternative currencies (altcoins) and popular digital assets.

Also, popular payment options like a bank account, debit card, PayPal, ApplePay, and wire transfer have made it easy for users to buy any crypto-asset on the platform.

- Reputable exchange with high liquidity

- Regulated by relevant US financial authorities

- Multiple platforms for individual user technical competence

- Multiple payment options

- Regular addition of new altcoins

- Low minimum deposit

- Zero credit card support

Your capital is at risk.

Step 2: Research Curve

Now that we have given you a brief overview of the best platform to buy Curve crypto, it is time to look into the asset itself.

What is Curve Finance?

Founded in 2020 by Michael Egorov, Curve Finance is a decentralised exchange (DEX) platform operating on the Ethereum blockchain. While popular DEX platforms are famous for facilitating token swaps only, Curve has quickly carved an entirely different niche for itself aside from token swaps. It primarily focuses on stablecoin swaps, thereby earning the name, ‘UniSwap of stablecoins.’

Like most DEX platforms, Curve Finance is an automated market maker (AMM) built to ensure efficient trading of cryptocurrencies of the same value while topping up these transactions with high-yielding annual interests for users.

It eliminates the use of an order book by deploying liquidity pools. Decentralised finance (DeFi) users have since turned to Curve due to its low slippage price, the economical cost for transacting on its network, and the protocol’s deep liquidity.

When it comes to liquidity pools, Curve has seven asset suppliers, three dedicated to stablecoins and the remaining four are wrapped tokens like Wrapped Bitcoin (WBTC), RenBTC, HBTC, and sBTC. Each pool comes with a high-interest yield, making Curve a viable investment opportunity for many.

Curve’s decision to focus on stablecoins has resulted in a thriving ecosystem for itself, despite running a small team. The platform links centralised stablecoin platforms like USDT and decentralised alternatives like DAI; this way, users can seamlessly move their assets from one stablecoin to another in the vast Ethereum ecosystem.

Like other decentralised projects, Curve operates a governance token called CRV crypto. Holders of CRV crypto can contribute to the future direction of the Curve Finance crypto. Meanwhile, the launch of the CRV crypto automatically converted the Curve protocol to a decentralised autonomous organisation (DAO).

Curve Key Features

The Curve team has spent a considerable amount of time thinking and building the DEX platform. If you want to utilise the AMM protocol, these are some of the key features you may likely come across:

- Simply User-centric

One thing that Curve Finance stands out for is its simple design language. The data is written in simple and clear terms, with each info grouped according to their base annual percentage yield (APY) and liquidity level. This makes it easy for anyone to quickly locate the asset pool they are looking for rather than looking for it manually.

- Minimal Slippage

One thing that Curve users appreciate about the protocol is its low margin for slippage. If you are confused, let us explain what slippage is.

The term describes the difference between an asset’s trade price and how much you pay for the asset itself. It reflects the difference in the price between the time you placed your order and when your order was executed.

To solve this problem, Curve uses a unique bonding curve which allows an assets’ price to be narrowed in the margin if one asset is purchased more than the other.

This feature allows arbitrage traders to buy up the under-purchased asset while rebalancing the liquidity pool’s ratio. Another thing is that Curve Finance mainly deals with stablecoins which are usually pegged to national currencies.

To reduce the volatility of digital assets, users can easily buy large quantities of fiat-backed currencies without experiencing too much slippage, like on centralised exchanges.

- Low Gas Fees

Another benefit that users stand to gain with Curve Finance is the low exchange rates for stablecoins. Transactions are completed in one trade instead of re-routing or going through different protocols, which ultimately racks significant gas fees. Curve’s simple, smart contract design cuts down on gas fees by fostering rapid transaction finality.

- High Digital Currency Support

Curve has been adding support for major national digital currencies in the crypto ecosystem. Offering users the opportunity to swap DAI easily, it also supports USDT, USDC, TUSD, BUSD, PAX, and sUSD.

In addition, it also enables the use of popular digital currency BTC as a wrapped token. Curve users can easily swap WBTC, sBTC, RenBTC, and HBTC for another asset.

Is Curve a Good Buy?

Yes, Curve is a good buy, given its low slippage and minimal fees. Curve crypto is seen as a suitable protocol to facilitate DeFi trades. Its preference for stablecoins gives it more legitimacy, making it easy for anyone to access the vast DeFi ecosystem.

DeFi has served as a great platform for many altcoins to gain the needed recognition, and one of the star performers so far has been Curve Finance.

Past performance is not an indication of future results

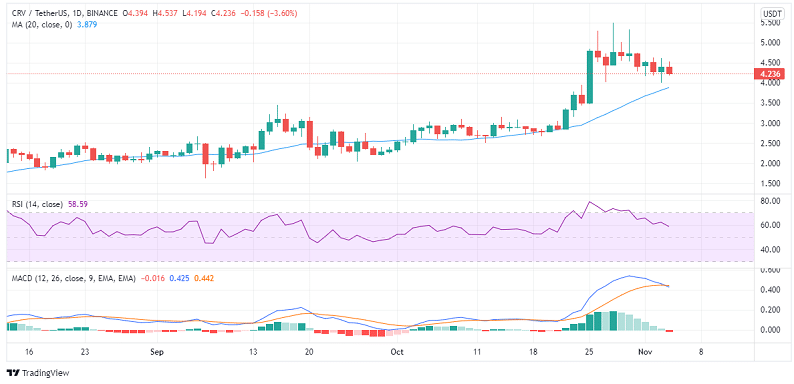

Another fact is that the overall performance of the stablecoin giant. CRV crypto has surged 1236.1% from its all-time low (ATL) of $0.33 after hitting an all-time high (ATH) of $54.01 on August 2020. However, a severe market upset saw it lose 91.8% of its gains in the bearish months as it currently trades at $4.236, per data from TradingView.

Despite this, the Curve coin is still a hot token due to some factors. One of them is that CRV staking has negatively impacted the number of tokens currently in circulation.

According to a tweet, 88.75% of CRV are locked on the protocol with an average vesting period of 3.68 years. This leaves about 347.8 million CRV tokens currently out of the market. This development is expected to help Curve crypto rise faster in value to reclaim its ATH.

Another major indication of Curve’s future success is the ongoing tussle between Yearn.Finance and Convex Finance to offer the best yields to attract CRV token holders to their platforms.

With both platforms top DeFi hubs, many people see this as good publicity for the stablecoin-focused protocol. Aside from this, well-known DeFi protocol Abracadabra.money is also stepping into the fray, snapping up available CRV deposits.

With all these platforms jostling for CRV crypto, there has been a supply squeeze as more investors look to cash in on the current high yields each protocol is promising.

An additional reason why Curve is a good buy is its sporadic TVL surge. Curve’s total value locked in dollars has been on an uptrend since May this year. So far, it has increased 168% within the last four months, with the protocol’s TVL currently at $19.08 billion, according to data from DeFi Llama.

The surge in TVL value has been due to the DEX platform’s recent expansion into several DeFi ecosystems aside from Ethereum. CRV token holders can now easily complete transactions in DeFi hubs like Polygon, xDAI, Harmony, Avalanche, and Fantom. With such strong performances, many investors believe that Curve crypto is one for future success.

Curve Price History

Curve has seen a mix of strong bullish and deep bearish price movements in the past year. Coming into the year at $0.6223 after a dramatic 2020, Curve spiked more than 200% to $3.55 on February 11 while latching onto the first crypto wave of the year.

Despite a brief dip in the weeks that followed, Curve kept a resilient bullish disposition and this paid dividends as it shot up to $4.04 in the April boom that saw Bitcoin hit an ATH of $65,000. Following this massive jump in its price, Curve followed the rhythm of the nascent industry, plummeting more than 50% and trading at the $1.5 average.

Meanwhile, the ERC-20 token has since returned to winning ways in this crypto boom of October, hitting a 52-week best of $4.761 as more investors look to buy Curve to access the booming DeFi ecosystem. With so much growth potential and a clear use case, this might be an ideal opportunity to buy Curve crypto.

Curve Price Prediction

There have been several projected growth margins for Curve price. According to the popular crypto price estimate website, Wallet Investor, Curve is expected to hit the $6.022 price by the close of 2021.

The expected closing price for its five-year growth margin is put at $12.737. The digital coin is more bullish, with a projected closing price for the year at $6.7 and a seven-year growth margin pegged at $19.32.

Meanwhile, since these are mere estimates, Curve may surpass these figures before the year closes and make a new ATH. However, a severe market downturn may see Curve falling short of these forecasts. Given that Curve has always bounced back from a dip like other crypto assets, it will likely continue rising through most of this bullish season.

Step 3: Choose Your Payment Method

Suppose you need a guide on what payment methods you should use to buy Curve; this section will show you how to select a convenient payment method.

Buy Curve with PayPal

Payment processing giant PayPal is gradually tapping into the crypto space, allowing some crypto activities on its platform. Even though you can buy Bitcoin with PayPal, smaller altcoins like Curve coin do not get this special treatment.

However, you can still use funds in your PayPal account to buy Curve through a crypto exchange or broker that supports this deposit method.

Buy Curve with Debit Card

There are numerous ways to buy Bitcoin with your debit card, but can you purchase Curve also? Yes, you can. Most crypto exchanges and brokers support this deposit method.

Meanwhile, credit cards are a bit different. For one, not all Bitcoin exchanges and brokers support this purchasing method, meaning you must research through a platform’s supported methods before signing up with them.

Another is the fees a credit card issuer may charge for using this method. Usually, credit card transactions are termed ‘cash advance’ and incur charges between 3 to 5%. Make sure you find out how much fees are involved before selecting this option. Coinbase charges 4% for debit card transactions.

Buy Curve with Bitcoin

If you own some Bitcoin, you can still use it to buy Curve. All you need to do is select it as a payment option while purchasing Curve coin from your chosen exchange.

Step 4: Buy Curve

If you want to buy Curve coin, chose your chosen broker or exhange and your payment method to fund your account. You can then go ahead and execute your trade.

Conclusion

Curve crypto has huge potential for future success. The ever-growing DeFi space is making investors turn to stablecoins, and Curve crypto will likely receive a surge in value shortly by this development.

Meanwhile, if you want to buy Curve crypto, we recommend working with reputable cryptocurrency brokers.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Frequently Asked Questions on Curve Crypto

What is Curve?

Is Curve Crypto a Good Investment?

Is Curve a Safe Investment?

Will Curve Go Up?

Where can I Buy Curve?

What is Curve crypto forecast?