Best CFD Brokers List UK in 2023

- CFD trading involves speculating on the price movements of an underlying asset such as shares, indices, ETFs, and more.

- Contracts for difference (CFDs) are a type of financial derivative that allows you to go long or short based on your forecasts of the markets.

- With this type of trading, you do not take ownership of the underlying asset. You’re only gaining exposure to the price movements.

- CFDs are leveraged instruments, meaning you get full market exposure for a small initial margin. Simply put, you’ll only be required to supply a portion of the cost of the position as margin, to gain full exposure to the trade.

In this guide, we provide information on what are widely regarded as some of the best FCA-regulated CFD brokers for trading stock CFDs.

UK Regulated CFD Brokers in the UK

- XTB – Stock-exchange listed Zero Commission Stock & CFD Broker

- AvaTrade – Online Trading Platform With Tight Spreads

- Fineco Bank – Regulated CFD Broker with Low Non-Trading Fees

- Trade Nation – CFD Broker with Fixed Spreads Regulated in The UK

- Plus500 – Low-Cost CFD Broker with Tight Spreads

What are Contracts-for-Differences (CFDs)?

Before going any further, it is important to quickly ascertain what we mean by ‘CFDs’ – not least because customers will be trading more sophisticated financial products. In its most basic form, CFDs – or contracts-for-differences, track the real-world price of an asset.

Not only does this include stocks and shares, but virtually every investment class imaginable. Whether that’s gold, oil, natural gas, bonds, indices, or cryptocurrencies – if a market exists, as will a CFD instrument.

CFDs can track the second-by-second price movement of a stock offers a plethora of benefits for an everyday trader. For example, the best CFD brokers permit commission-free trading, as well as highly competitive spreads.

Furthermore, stock CFDs can be traded with leverage, and allow customers to short-sell the respective company. This means that customers can speculate on the value of the shares going down – which would otherwise not be possible when using traditional stock brokers.

Choosing the right CFD broker for your trading needs is fundamental. For example, are you looking to trade stocks from a particular exchange or market, or are you more concerned with low commissions and tight spreads? Similarly, you might be looking to deposit and withdraw funds with a specific payment method, or you might want access to an advanced trading platform like MetaTrader4.

Below we have listed the best CFD brokers currently serving UK CFD traders.

1. XTB – Stock-exchange Listed Zero Commission Stock & CFD Broker

XTB is one of the largest CFD brokers in the world, offering a variety of financial instruments to trade. The platform can also be used to trade forex, commodities, stocks, real shares, ETFs and indices. Furthermore, the broker is listed on the stock exchange and is regulated by the Financial Conduct Authority- meaning that trading with this platform is very secure.

XTB Broker regularly updates its interface to be one of the best on the market. The platform provides a number of tools to help with research and analysis, as well as helpful educational resources for those who want to learn more about trading.

One of the best features of this platform is that users can trade CFDs, real shares and ETFs with zero commissions. This makes it ideal for traders who want to keep costs low and maximize their profits. XTB offers a leverage of 5:1 and it is possible to trade with just a 20% deposit.

As well as market-leading tools, XTB makes trading simple by providing users with an advanced stock-scanner that is built into the platform. Traders can use XTB to take both long and short trading positions.

XTB has over 20 years of experience and has been given numerous awards for its platform. If you’re looking for a CFD trading platform that you can trust, XTB is definitely worth considering.

75% of retail CFD accounts lose money.

2. AvaTrade – Tight Spreads from 1 Pip

In addition to this super-competitive spread structure, AvaTrade allows you to buy and sell CFD instruments on a commission-free basis. In terms of tradable markets, AvaTrade offers thousands of financial assets. On top of forex, this includes bonds, stocks, indices, commodities, cryptocurrencies, options, and futures. As such, whatever market you’re looking for, chances are you’ll find it at AvaTrade.

Avatrade offers several trading platforms. For example, you can use the AvaTrade platform via your web browser or through an Android/iOS mobile app. Furthermore, the platform also supports MT4 and MT5, which is great for advanced chart analysis and deploying automated robots, making it one of the few MT5 brokers UK if you wanted to explore this option.

We should also note that AvaTrade offers a spread betting facility. If you’re in the UK, this means that all profits are free of capital gains tax.

If you like the sound of AvaTrade but you want to test the platform out first, the CFD broker offers a demo account facility. Minimum deposits at the platform stand at $100 – which you can via a debit/credit card or bank transfer. Finally, AvaTrade is heavily regulated and it holds licenses in several countries.

71% of retail investor accounts lose money when trading CFDs with this provider.

3. Fineco Bank

Fineco Bank offers competitive fees to buy and sell shares – just £2.95 per trade.

Other fees include paying an annual fee of 0.25% on all stock investments. However, this is not a big deal as Fineco Bank remains at the top of the low-cost share platforms available in the market. Plus, the Italian financial institution offers you access to international markets, as well as automated portfolios.

As a UK investor, you should feel safe with the platform, as it’s heavily regulated by one of the most stricter financial watchdogs in the world: the Financial Conduct Authority (FCA). Yes, your funds are protected by the FSCS as well. You can get started by making a small investment of £100, allowing you to access a wide range of research tools, and a friendly-user platform to handle your account in an easier manner.

Fineco Bank fees:

| Commission | £2.95 per UK stock trade (0.25% annual fee) |

| Deposit Fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | Free |

64.84% of retail investor accounts lose money due to CFD trading with this provider.

4. Trade Nation – CFD Broker with Fixed Spreads Regulated in The UK

Trade Nation is a reputable broker in the UK, regulated by the FCA, offering a wide range of trading services, including CFD trading, spread betting, and forex trading. One of the things that makes Trade Nation stand out is its commitment to providing low-cost fixed spreads, starting at just 0.6 pips for CFDs. This means traders don’t have to worry about unexpected fees, creating a transparent and cost-effective trading environment.

What’s more, Trade Nation goes the extra mile to support its users in making informed decisions. They offer an impressive selection of research materials and technical analysis tools, suitable for traders of all experience levels. Whether you’re a seasoned pro or just starting, you’ll find helpful resources like indicators, real-time market insights, and educational articles to improve your trading experience and decision-making skills.

For added convenience, Trade Nation also offers signals through its platform. It’s worth noting that the signals provider is one of the few regulated signal platforms in the UK. These market signals can be a valuable guide for traders, but it’s essential to remember that conducting your own market research and analysis is equally important. Relying solely on signals may not give you a comprehensive understanding of the market dynamics.

Trade Nation offers two charting tools that can be used to conduct analysis and make informed trading decisions. These include MT4 and TN Trader. Both tools provide a range of indicators that are useful to traders of all levels. The tools are also both available to use on mobile.

75% of retail investor accounts lose money when trading CFDs with this provider.

5. Plus500 – Commission-Free CFD Provider

This covers heaps of UK and international exchanges – which is great if you are looking to gain exposure to less liquid markets. For example, while the bread and butter of the UK and US are covered, Plus500 also lists stock CFDs from Finland, South Africa, and Canada.

The CFD provider does not charge any trading commissions – meaning your fees will come in the form of overnight financing (if holding positions beyond the close of trading hours) and of course – the spread. The trading platform itself is unique to Plus500, and there is no requirement to download any software. Instead, you can trade via the main desktop website or the Plus500 mobile application.

You can deposit and withdraw funds with a UK debit/credit card, bank account, or Paypal – and all payment methods are fee-free. Minimum deposits start at £100 – although you can place buy and sell orders for much less than this.

Leverage is available on all of the CFD products hosted by the platform – with stocks capped at 1:5 if you’re a retail client. Plus500UK Ltd is authorized & regulated by the FCA (#509909).

Compare CFD Brokers

| CFD Brokers | Available CFD Assets | Pricing Structure | Fee for trading GBP/USD CFD | Fee for trading AMZN CFD – Buy AMZN Shares |

| XTB | Stock CFDs, shares, forex, indices, commodities, ETF CFds | 0% commission on stock CFDs and shares. Market spreads. | 0,1 pips | Commissions free stock CFDs including AMZN. Minimum trade amount is 10 EUR. |

| AvaTrade | Forex CFDs, stock index CFDs, stock CFDs, ETF CFDs, Commodity CFDs, Bond CFDs, Cryptos | 0% commission. Market spreads | 1.6 pips | Typical spread: 0.13% |

| Fineco Bank | Stock index CFDs, Stock CFDs, ETF CFDs, Commodity CFDs, Bond CFDs, Forex CFDs | Commission and spreads | As low as 1.0 pip | Fixed commission of $3.95 per trade for UK clients |

| Plus500 | Forex CFDs, Stock index CFDs, stock CFDs, ETF CFDs, Commodity CFDs, crypto CFDs | Commission-free CFD trading. Most trading fees are built into the spreads. | Spread: 0.00013 or 0.01% | Spread: 23.94 pips or 0.75% |

How does CFD trading work?

Contracts for difference (CFDs) are a popular form of derivative trading. CFD trading allows you to speculate on the fluctuating prices of volatile financial markets, such as forex, commodities, indices, shares and more.

When it comes to CFD trading, you don’t purchase or sell the underlying security (such as a commodity, actual share, or forex pair). Rather, you trade several units for a specific financial asset, depending on whether you believe the market price will rise or fall.

Most CFD brokers offer CFDs on a variety of global financial markets, including FX pairs, stocks, commodities, cryptos, and treasuries.

An example of one of the most popular stock indices is the S&P 500, which tracks the performance of the 500 large-cap companies that make up the US markets (NASDAQ and NYSE).

What does this mean?

For every point the price of the underlying asset moves in your favor, you receive multiples of the number of CFD units you opened long or short positions on. Therefore, for every point that price moves against your speculation, you’ll incur losses.

What assets can you trade as CFDs?

When you open a live CFD trading account you’ll have access to a range of financial markets to trade CFDs on. Since this depends on your preferred CFD brokers you’ll need to research and check that the CFD assets you want to trade are supported.

With a live trading account, you’ll have unfettered access to Forex CFDs, stock Index CFDs, Stock CFDs, ETF CFDs, Commodity CFDs, Crypto CFDs. When you trade CFDs, you can take a position on heaps of instruments. The typical spreads start from just 1 pip on the major currency pairs EUR/USD and USD/JPY.

Additionally, you can trade commodities like Copper from just 2 pips, the SPX500 from 0.75 points, stock and ETF CFDs from 0.09%, and cryptocurrency CFDs from just 0.75%.

Benefits of Trading CFDs

Trading CFDs means you’re willing to exchange the difference in the price of a security from when you open the position to the moment it is closed.

Boost your purchasing power with leverage

Since you only have to deposit a percentage of the trade’s total value to open a position, CFDs allow you to stretch the purchasing power of your investment funds. This initial deposit is commonly referred to as margin. Leverage is a double-edged sword in that it reduces the cost of opening a position, but it can also maximize any potential losses.

Why? This is due to CFD profits and losses being calculated on the overall size of your trade, not just the margin that you deposited.

The amount of margin you’ll have to deposit depends on the size of the trade and the margin factor for your preferred financial market.

Example: Using leverage to trade CFDs

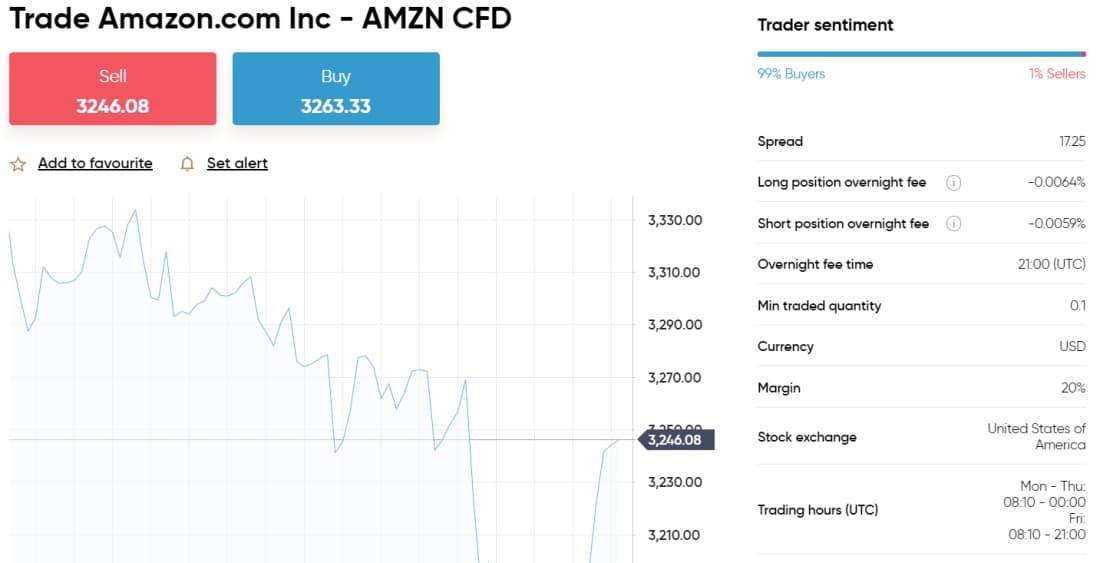

Let’s say you want to trade CFD shares on AMZN, which has a margin factor of 20%. This would mean that a position worth £2,000 would only need an initial margin of £400.

CFD trading gives you the ability to go long or short

When you buy and sell CFDs you’ll come across the buy and sell prices. You’ll trade at the buy price if you forecast a rise in the market price of the underlying asset. This is otherwise referred to as going long. On the other hand, you’ll trade at the sell price if you believe the market price is going to drop – this is called going short.

If your speculation proves to be accurate, you’ll make positive returns based on the total value of your position. But, if the markets move against your prediction, the loss will be calculated on the overall value of the position. In other words, potential losses could surpass your initial margin, so always invest money you can afford to lose.

Access to a wide range of markets makes portfolio diversification easier

With XTB, you can trade share CFDs on 17 international exchanges including the LSE, NASDAQ, NYSE, Hong Kong Stock Exchange (HKG) just to name a few. Not to mention the other financial markets you can trade via CFDs such as forex, commodities, and indices.

Moreover, as CFDs are leveraged derivatives you won’t take ownership of the underlying asset.

CFD trading can be used to hedge your investment portfolio

Many expert investors use CFDs to hedge risks in their investment portfolios. In other words, hedging means you tactically open new CFD trades to safeguard any active trades from market volatility and to offset any possible losses.

For instance, let’s imagine that you own Facebook shares but the market price has started to drop after the recent social media outages. While selling your FB shares is something you’re not willing to do, you’ll also want to mitigate the risk of the share price dropping to a level that’ll translate into a huge loss.

Therefore, you open a short CFD position on Facebook (sell as opposed to buy) with the same trade value as your actual share investment. This way if the FB share price plummets, the profits on your short share CFD position will offset a percentage of the losses on your stock investment.

Limitations of Trading CFDs

CFDs are highly leveraged instruments, meaning if positions head south you’ll be liable for the amount of borrowed leverage. Furthermore, highly volatile market conditions can make avoiding losses a challenge. The trick is to place Stop-Loss orders to help you minimize the risks involved with CFD trading.

Leverage: a blessing or a curse?

The number one high risk of trading CFDs is high leverage. But what about leverage stretching your buying power? CFD brokers calculate profits and losses based on the total value of the CFD position. This means that if the market price of the underlying asset starts to move against your prediction you’ll be facing losses based on the entire position, not just the initial deposit you put down as margin.

Overtrading CFDs

Since CFD trading gives traders cheaper exposure to the markets, it’s easy to start overtrading. Overtrading is where your investment portfolio is overexposed to the underlying market. As such, the remaining capital is not enough to cover potential losses. Therefore, it’s important to only invest money you can afford to lose.

Overnight Financing Fees

With CFDs being highly leveraged, speculative financial instruments, it’s better suited to short-term investors when it comes to non-trading costs. Overnight financing fees come into play when you keep a leveraged position open after the market closes. All in all, it might be a smart move to consider alternative long-term investments such as bonds and ETFs, as well as ISA accounts.

How to Find the Best CFD Brokers UK?

Irrespective of which UK CFD broker you go with, the end-to-end investment process works largely the same. In other words, you will always be required to open an account, upload some ID, deposit funds, and then place buy and sell orders on a DIY basis. With that in mind, your focus needs to be on key metrics like fees, commissions, payment methods, safety, and customer support.

Below we discuss these key factors in more detail to ensure you pick a CFD broker that is closely aligned with your needs.

FCA Regulation

You will be depositing and trading real-world funds – so it’s crucial that your money is safeguarded. This is why you should only consider a UK CFD broker if it is authorized and regulated by the Financial Conduct Authority (FCA).

In most cases (but always check first), this should also mean that your investments are protected by the Financial Services Conduct Authority (FSCS). For those unaware, this means that were the CFD broker to go bust, your funds would be protected up to the first £85,000.

This won’t, however, protect you from losses you have encountered from an unsuccessful trade. FCA regulation also ensures that the CFD broker keeps client funds in segregated bank accounts.

Deposits, Withdrawals, and Payments

You should also visit the CFD broker’s website to assess what payment methods it supports. This is crucial. as you will be depositing and withdrawing real-world pounds and pence.

Although the specific payment methods available to you will vary from provider-to-provider, this might include:

- Debit Cards

- Credit Cards

- Bank Account Transfer

- PayPal

- Skrill

- Neteller

Once you have assessed which payment method you wish to use, check to see whether or not any transaction fees apply. You should also explore how long the UK CFD broker typically takes to process withdrawals, and whether a minimum cash out threshold applies.

Fees, Commissions, and Spreads

You will need to pay a fee to trade CFDs online, so this should also form part of your in-depth research process.

In particular, look out for:

- Spread: The spread is the difference between the stock CFD’s ‘bid’ and ‘ask’ price. The best CFD brokers usually display this as a ‘buy’ and ‘sell’ price, respectively. Either way, you’ll want to ensure that your chosen platform offers competitive spreads, not least because this will contribute to your end-to-end trading costs. If you can get your stock CFD spreads below 1 pip, you’re doing well.

- Trading Commissions: Some, but not all, CFD brokers will charge you a trading commission. For example, IG charges 0.10% when trading UK stock CFDs – at a minimum of £10. In other cases, XTB and Plus500 charge no commissions at all.

- Overnight Finance: If you plan to trade stock CFDs with leverage, you might need to pay an overnight financing fee. As the name suggests, this will be the case if you keep the CFD position open overnight. CFD brokers base this on an annualized interest rate, which is broken down on a day-by-day basis. In most cases, you can view the specific charge before placing your trade.

Tradable Markets

The best CFD brokers will give you unfettered access to heaps of stock exchanges. While some of you might be happy to concentrate on UK companies, others like to take a more diversified approach. As such, look to see what markets the CFD broker offers. The likes of XTB, Plus500, and IG cover exchanges from the US, Canada, Germany, France, South Africa, Saudi Arabia, Finland, and more!

Features and Tools

On top of the fundamentals – we would also suggest exploring what trading features and tools the CFD broker offers.

This might include:

Technical Indicators:

If you want to make a success of your stock CFD trading endeavours, you’ll need to learn the ins and outs of how technical indicators work. This will ensure you have the capacity to read and interpret pricing trends. The best CFD brokers typically provide dozens of technical indicators – but be sure to check nonetheless.

Mobile Trading:

CFD trading is typically carried out on a short-term basis. That is to say, seasoned investors often keep a position open for a number of minutes or hours – so they need to be ‘at the ready’ when a new trend comes to fruition. As such, the best CFD brokers will offer a free stock trading app.

Educational Resources:

If you have little to no experience in trading CFDs, it’s best to stick with a broker that offers educational resources. This could be anything from a selection of how-to guides, video explainers, and even live webinars.

Leverage:

If you have a slightly higher tolerance for risk, the best CFD brokers will usually offer leverage of up to 1:30. This is typically 1:5 when trading share CFDs.

Negative Balance Protection:

Although now the norm with CFD brokers, it’s best to make sure that the provider has Negative Balance Protection in place. This means that an unsuccessful leveraged trade will not push your account balance into negative territory. Instead, when your CFD account balance hits zero your position closes automatically.

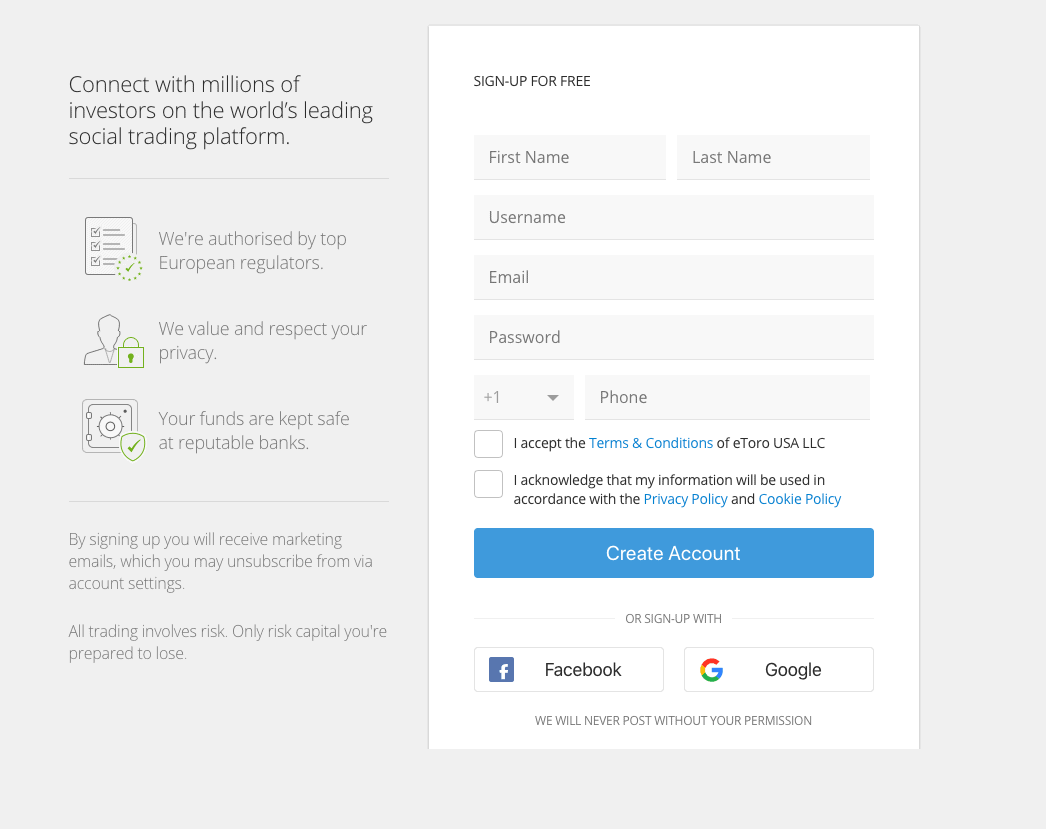

How to Open an Account with a UK CFD Broker

Based in the UK and looking to start trading CFDs today? If so, below you will find a quick step-by-step walkthrough.

Step 1: Open Account and Upload ID

When you open an account, as is the case with all FCA-regulated CFD brokers, you will need to provide some personal information.

- Full Name

- Home Address

- Date of Birth

- National Insurance Number

- Email Address

- Mobile Number

You will also need to upload some ID – as per UK anti-money laundering laws. This includes a passport or driver’s license and a recently issued utility bill or bank account statement.

Step 2: Deposit Funds

To deposit funds, you can choose from a debit/credit card, e-wallet, or bank account.

Step 3: Place a CFD Trade

Now that your account has been verified and funded, you can start trading CFDs straight away.

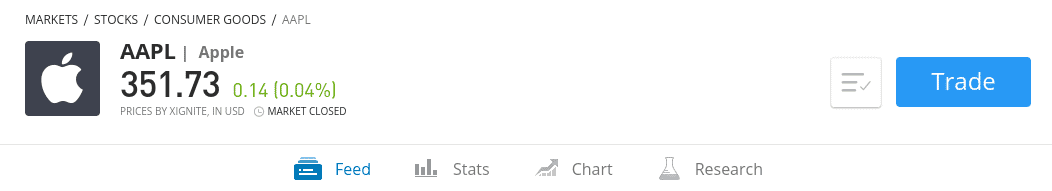

- Click on the ‘Trade Markets’ button

- Select your preferred CFD asset class (for example, stocks)

- Click on the asset you wish to trade

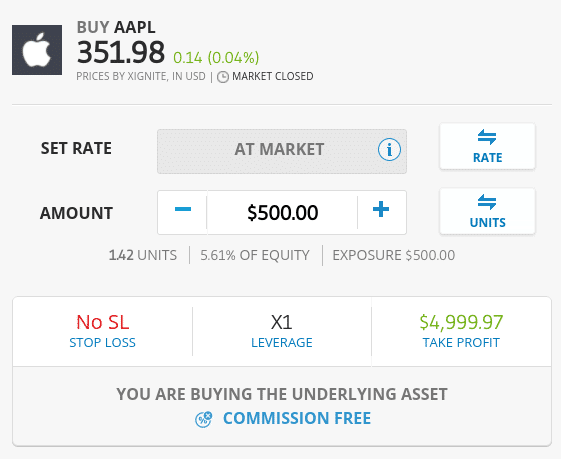

Next, you’ll need to set up an order. In our example, we are looking to trade Apple CFD stocks.

- Choose from a buy or sell order

- Enter your stake

- Choose from a market or limit order

- Determine if you want to apply leverage and at what ratio

- Enter your stop-loss price

- Enter your take-profit price

- Confirm the trade

Once you execute your CFD trade, it will remain active until you close the position manually – or either your take-profit or stop-loss order comes into action.

The Verdict

Finding the best CFD broker for your individual trading needs is imperative. Not only do you need to ensure that your research covers the regulatory standing and reputation of the broker, but other metrics like tradable assets, fees, commissions, spreads, and payments.