How to Buy British American Tobacco Shares UK – With No Commission

With increasing net profits even though cigarette sales are plummeting, British American Tobacco has ensured their business model is robust in the face of lowered demand. However, with innovative vaping products gathering traction, this company could be in line for a bullish push after sideways movement over the past year. In this guide, we’ll discuss How to Buy British American Tobacco Shares UK.

We explore the company’s business model and financials and showing you how to buy shares without paying a penny in commissions.

Step 1: Choose a Stock Broker

Deciding which broker to use is a crucial step when you buy British American Tobacco shares in the UK. There are many brokers available to choose from, all with various features and fee structures on offer.

To help you make your decision, this section will present two of our recommended stock brokers when buying British American Tobacco shares.

Research British American Tobacco Shares

When considering the best investments available to you, it’s essential to gain a comprehensive overview of what you’re investing in and the outlook for the asset in the future. In the case of British American Tobacco, areas such as the company’s share price and dividend yield are both things to look at before investing.

To streamline this process, the sections below cover everything you need to know when you buy British American Tobacco shares in the UK, helping you make an informed investment decision.

What is British American Tobacco?

British American Tobacco PLC (BAT) manufactures and sells cigarettes and tobacco worldwide and is based in London, England. The company has been around for nearly 120 years and is currently the largest tobacco company by sales revenue, according to Statista.

British American Tobacco has a primary listing on the London Stock Exchange (LSE) and is one of the companies that make up the FTSE 100 index. In addition, the company is also listed on the Johannesburg Stock Exchange and the New York Stock Exchange. At the time of writing, British American Tobacco has a market capitalisation of £62.25 billion – making them the 7th largest company in the UK by market cap.

The company was initially launched back in 1902 when the Imperial Tobacco Company and the American Tobacco Company merged operations. Over the following decades, British American Tobacco began solidifying itself worldwide through the ownership of well-known brands such as Pall Mall and Lucky Strike. In the 1980s, Imperial Tobacco completed divested from the company and is now one of British American Tobacco’s most significant competitors.

From the early 2000s to the present day, British American Tobacco has conducted large-scale acquisitions across the world to solidify its market position. Companies have been acquired in countries such as Italy, Serbia, Turkey, and Indonesia. British American Tobacco even purchased a stake in a cannabis producer based in Canada recently in a bid to diversify their product range.

However, British American Tobacco’s main product, and the one they are best known for, is cigarettes. The company offers a considerable number of popular brands – along with the previously mentioned Pall Mall and Lucky Strike, British American Tobacco also offer Dunhill, Kent, Royals, Rothmans International, Winfield, and more.

Although the health risks of smoking are widely known, British American Tobacco’s cigarettes continue to be incredibly popular. In fact, they even have sections dedicated to the health risks on their website and actively state that they do not encourage people to smoke. Although this may seem counterintuitive, this transparent approach has certainly aided British American Tobacco’s reputation and sustainability.

Aside from cigarettes, the company has also innovated to combat the decline in tobacco consumption in recent years. Notably, they have released a line of ‘reduced risk’ products that are non-combustible and healthier than smoking cigarettes. These products include vapes, tobacco heating products, nicotine pouches, and snus. British American Tobacco aims to grow annual revenue from new categories such as these to £5 billion by 2025.

British American Tobacco Share Price

Before you buy shares in British American Tobacco, it’s essential to look at the company’s past performance and get an idea of market sentiment. At the time of writing, one share of British American Tobacco has a valuation of 2719 GBX (pence). This is pretty much at the same level that the British American Tobacco share price began the year at and represents a 16.42% decrease from this time last year.

Overall, the British American Tobacco share price has been trading sideways since around September 2020, with peaks in price being closely followed by troughs. Looking at the price chart, it’s clear to see that the market doesn’t have a bullish or a bearish view of the company at present and is waiting on the next driver of price. To provide context to the current price, the British American Tobacco share price all-time high occurred in June 2017 when shares reached 5645p.

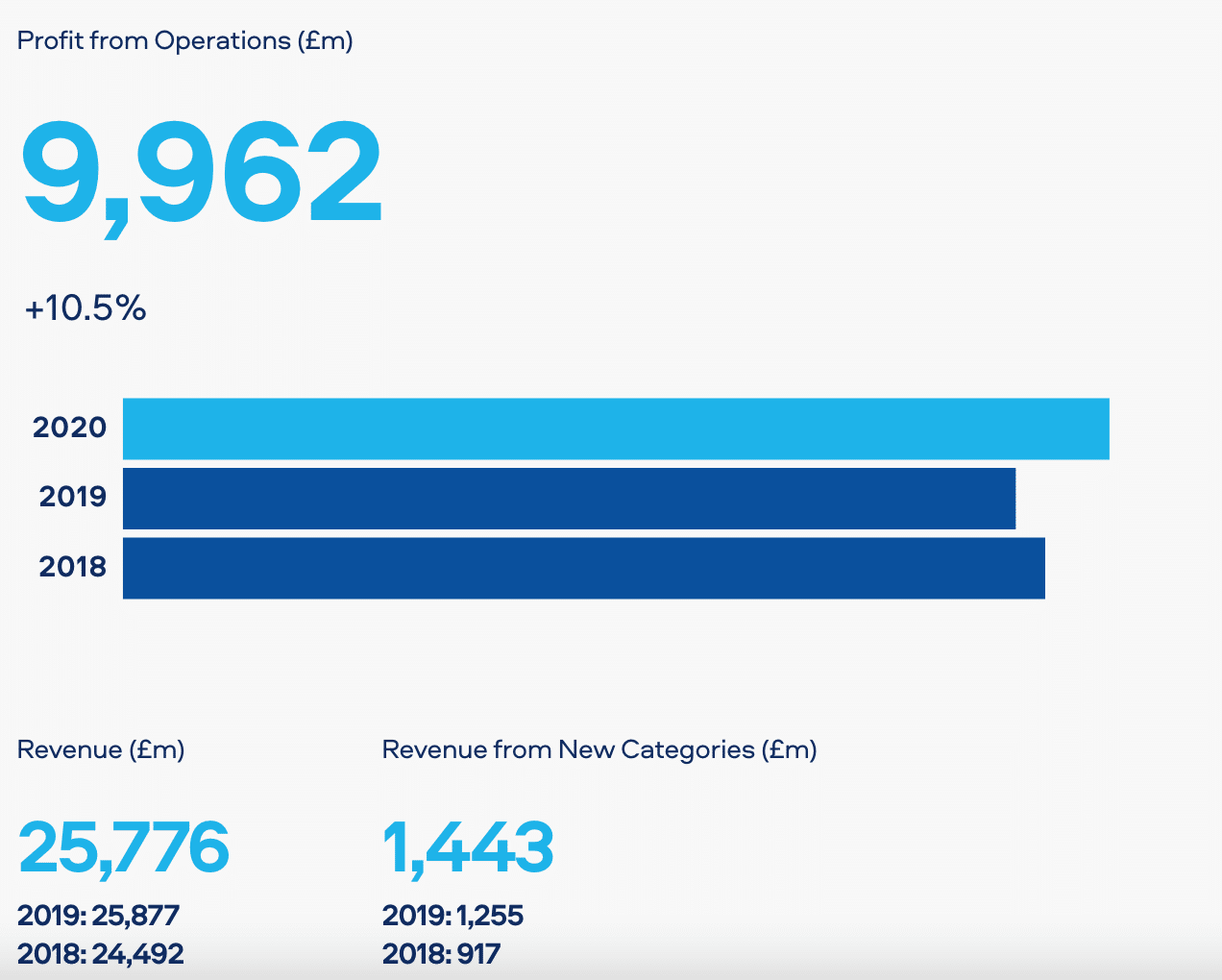

Moving on to the company’s finances, British American Tobacco actually performed pretty well throughout 2020, generating £25.78 billion in revenue – slightly higher than 2019. This showcases how demand for British American Tobacco’s products will be substantial regardless of the volatility in the economy, as smokers will always require cigarettes. Notably, profits rose to £6.56 billion – representing an increase of around 12% from the previous year.

It’s also a good idea to look at some other metrics when equity trading. Two metrics that are good to use are the company’s price to earnings ratio (P/E) and earnings per share (EPS). These metrics give an idea of how valuable a company’s shares are and how profitable the company is. Looking at EPS first, this is determined by dividing the company’s profit figure by the number of shares outstanding. In British American Tobacco’s case, their EPS stands at £3.28.

This means that for every share outstanding, British American Tobacco generates £3.28 in profit. This figure represents EPS growth of 2% from the previous year, highlighting how profits have risen for the company. In terms of the P/E ratio, this metric is calculated by dividing the share price by the EPS estimate. At the time of writing, British American Tobacco’s P/E ratio stands at 10.86, according to YCharts.

This ratio has remained around the same level for the past two years, showcasing consistency in the British American Tobacco share price and operations. Notably, the company’s P/E ratio is significantly higher than its main competitor, Imperial Brands PLC.

British American Tobacco Shares Dividends

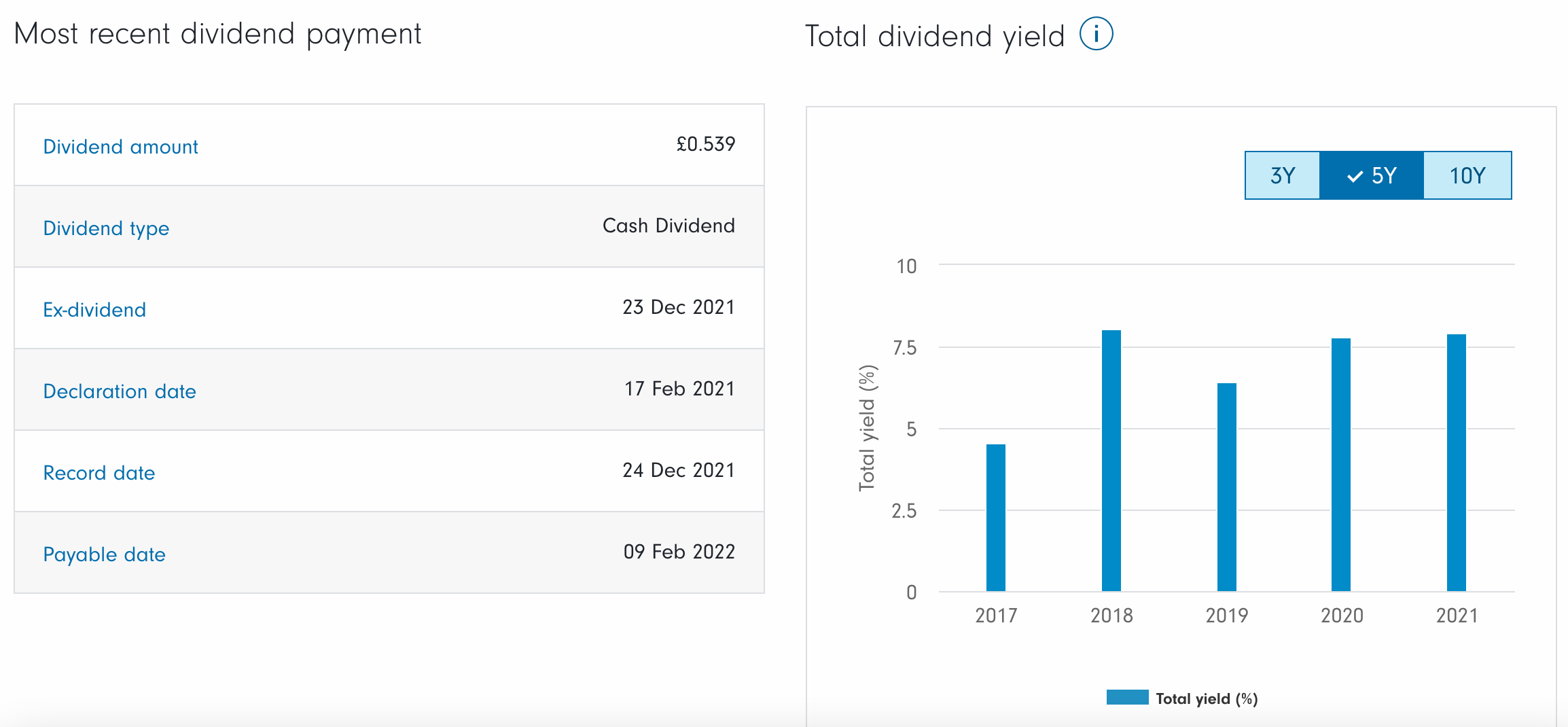

One of the main reasons to buy British American Tobacco shares in the UK is the company’s attractive dividend yield. If you are investing for income, you can’t go wrong with an investment in British American Tobacco. The company currently offers a dividend yield of 7.7%, which is very high relative to other shares.

British American Tobacco pays its dividends quarterly, with payments occurring in February, May, August, and November. The most recent payout took place on the 12th of May when investors received an impressive 53.9p per share. The following payment is set for August – so if you buy British American Tobacco shares in the UK before the ex-dividend date of the 8th of July, you will be entitled to a dividend payment.

It’s worth noting that even though the company’s dividends are already very high, there’s scope for them to increase even further. Dividends are paid from a company’s profits, and in the case of tobacco companies, they are very important as many people will not invest due to ethical concerns unless they receive a solid income stream. With British American Tobacco’s profits rising last year, keep an eye out for yield increases as we go forward.

Are British American Tobacco Shares a Good Buy?

Considering the points raised above, can British American Tobacco be considered one of the best shares to buy? We believe so – although the British American tobacco share price has traded sideways for quite some time, the company certainly has the potential to generate positive returns for investors.

Solid Financials and Innovative Products

As noted earlier, British American Tobacco’s revenues were up very slightly for 2020, which is still impressive given that consumer spending decreased due to people being in lockdown. The nature of the company’s products means that they will always be in demand; people who smoke will always need cigarettes. The great thing for British American Tobacco is that the brands they offer are well-known and trusted. Also, the local brands offered in countries around the world ensure customer loyalty remains high, even in the face of stiff competition.

Aside from cigarettes, the company are focusing heavily on new, non-combustible products such as vapes. According to British American Tobacco’s annual report, they serviced 13.5 million non-combustible consumers in 2020 alone and aim to increase this to 30 million consumers annually by 2030. Furthermore, with the recent investment into a cannabis producer in Canada, the company is setting itself up well for potential marijuana legalisation in the UK in future. If these products continue growing at this rate, it could mean good things for the firm’s bottom line.

Impressive Dividends

If you buy British American Tobacco shares in the UK, you’ll also get access to one of the best dividend stocks in the market. As noted earlier, the company’s yield of 7.7% is incredibly high and represents an excellent opportunity to generate a passive income stream. Furthermore, with quarterly payments, you’ll always get a periodic cash flow throughout the year.

Attractive Current Price

Finally, the British American Tobacco share price is currently at a level that may represent an attractive buy opportunity. Having been consolidating for quite some time, the share price seems to be looking for a driver which can provide a direction to head in. If profits continue to rise and product innovations hit the mark, then it’s not unlikely that we could see bullish momentum over the next 6-12 months.

Overall though, British American Tobacco is a company that has been around for over a century and know how to maintain and improve their market position. Although their products aren’t the most ethically appealing, the company does not shy away from this and actively promotes its healthier product line. If British American Tobacco can reach the revenue target they state on their website and maintain current margins, it could provide the impetus needed to grow the share price.

British American Tobacco Shares Buy or Sell?

In summary, is it a good idea to buy British American Tobacco shares in the UK? In our opinion, adding these shares to your portfolio could provide growth over the longer term. The products offered by the company are evergreen, meaning that they’ll always be in demand. This was showcased by the consistency in annual revenue throughout the Coronavirus pandemic.

Even though cigarettes form the basis of their product line, British American Tobacco is ensuring they don’t get left behind by offering new, healthier product options. Vapes and nicotine pouches are just some of the products that the company is now providing to appeal to consumers who are transitioning off of cigarettes or who are looking for a healthier alternative.

British American Tobacco has even purchased a stake in a Canadian cannabis producer. Although marijuana is not currently legal in the UK, if legalisation were ever to occur, a transition into this market would be huge for the company. The fact that the firm is already taking steps in this direction is a clever play for the future.

Overall, British American Tobacco is an attractive investment opportunity if you are someone who is looking for a solid dividend payout whilst still getting the possibility of capital growth. If the company’s product innovations can continue growing at the rate they are, and profits keep rising, then it’s sure to mean good news for the firm’s share price going forward.

Buy British American Tobacco Shares UK With 0% Commission

Throughout this guide, we’ve explored British American Tobacco in great depth, providing you with all of the information you need to make an informed investment decision. Even though tobacco sales are falling, the company’s strong margins and product innovations look set to keep British American Tobacco in a strong position in the future. So, if you’re looking for a company with a solid track record and impressive dividend yields, British American Tobacco might be worth a look.

FAQs

How much does it cost to buy British American Tobacco shares?

At the time of writing, one share of British American Tobacco is valued at 2719p. In addition to the share price, some brokers will also charge a commission, which is expressed as a percentage of your position size.

Does British American Tobacco pay dividends?

Yes – they pay a very high dividend yield of 7.76% annually. Dividend payments for British American Tobacco are made every quarter.

What is the minimum number of British American Tobacco shares that I can buy?

Many traditional stockbrokers will require you to buy at least one share when investing in British American Tobacco.

Is British American Tobacco a good buy?

The company has pivoted well to deal with the slowing demand for tobacco and has innovated through its non-combustible product line. This factor, combined with solid financials, means that British American Tobacco is certainly worth considering as an addition to your portfolio.

Where is the best place to buy British American Tobacco shares in the UK?

We recommend using traditional brokers to buy British American Tobacco shares as they are FCA-regulated, which means your capital and personal details are provided with the highest levels of protection.