Boeing shares remain unchanged during pre-market stock trading action on Wall Street after the management announced that it plans to cut almost 10% of the firm’s staff amid a prolonged slump in the aviation industry.

Investors seem to be digesting Boeing’s latest news, as the company released its financial results for the third quarter of 2020 this morning along with an internal memo where the CEO of the aircraft manufacturer highlighted the need to cut at least 16,000 jobs – almost 10% of Boeing’s global workforce – to prepare for a “long slump” in demand.

Boeing (BA) reported a 29% drop in revenues during the third quarter of the year, with sales landing at $14.14 billion, down from the $19.98 billion it brought in last year.

Commercial airplane deliveries during the quarter fell almost 55% to 28 aircraft as airlines continue to slash their capital expenditures to survive the downturn. Deliveries remain 67% down during the nine months ended on September 30.

The commercial aviation segment remains the most depressed for the company as sales slumped 56% during the quarter – a troubling situation for Boeing as this was its biggest revenue stream before the pandemic stroked.

Meanwhile, the Defense, Space & Security segment is holding firm, with sales retreating only 2% at $6.8 billion, while the firm’s Global Services – now the firm’s largest segment – saw a 20% drop in revenue during the quarter as well.

Boeing’s total backlog – orders that haven’t been yet fulfilled – is down 15% so far this year, with the firm still sitting on almost $400 billion worth of orders from customers – including $312 billion in commercial airplanes.

Boeing’s losses ended the quarter at $1.39 per share, which is almost half of what analysts were expecting for the three-month period. These milder losses were partially aided by $100 million in income from asset dispositions, along with a reduction in research and development expenses.

Debt remains a big concern for Boeing investors

Boeing’s massive debt burden continues to weigh on the firm’s outlook, with long-term debt jumping from $19.96 billion at the end of 2019 to as much as $57 billion as Boeing was forced to raise its liquidity position to cope with its cash burn.

Interest and debt expenses nearly tripled during the quarter compared to a year ago, landing at $643 million vs. $203 million the company paid last year.

Meanwhile, the company is sitting on almost 448 million of its own shares – which were acquired in prior years – a move that is now backfiring as the value of that investment has plunged amid the pandemic.

By the end of the third quarter, Boeing reported $4.8 billion in negative operating cash flow while its cash position stood at $27.1 billion, down from a previous $32.4 billion cash pile it had the last quarter.

Boeing’s liquidity position seems strong enough to withstand the turmoil, although the performance of the commercial aviation segment in the future remains uncertain given the long-lasting impact that the virus situation could have on airlines around the world.

On the other hand, a worrying thought about Boeing’s backlog is the possibility that a growing number of carriers file for bankruptcy if the virus situation endures and the demand for air travel continues to be as depressed as it is now, as companies could fight their way out of their contractual obligations as part of their restructuring efforts.

What’s next for Boeing shares?

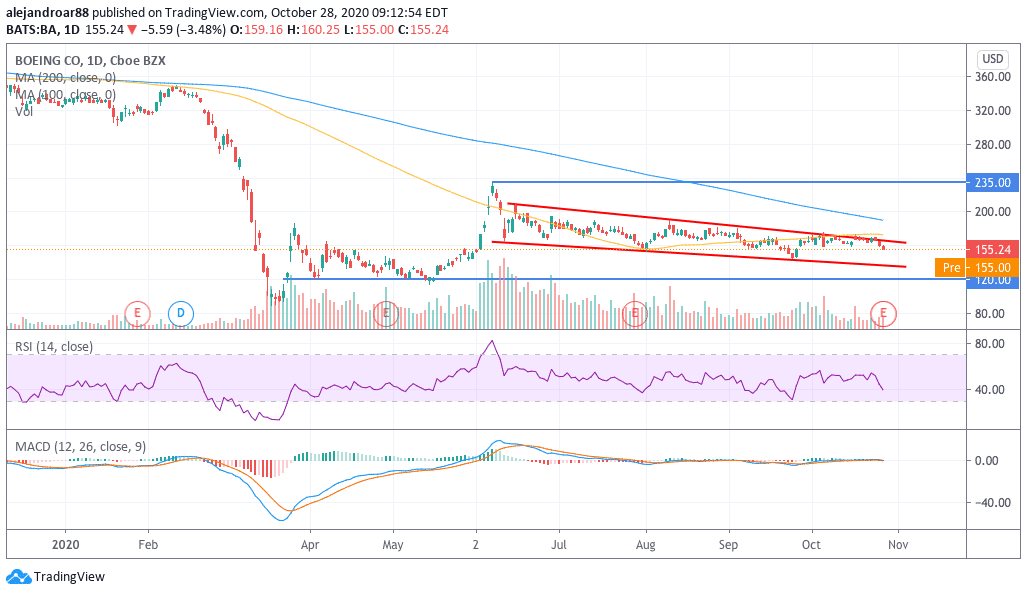

Boeing shares remain on a downtrend that emerged off a failed break above the $235 level in June as the pandemic keeps ravaging the commercial aviation industry around the world.

Shares of the Chicago-based firm remain unmoved this morning but, given the bleak outlook, it is highly unlikely that they will see bullish activity outside this price channel on short notice.

That said, investors should actually keep an eye on potentially bearish movements that lead to a break below the lower trend line shown in the chart. If that were to happen, support could be found at the $120 mark, in which case the stock will probably rebound after it makes a double bottom.

Question & Answers (0)