Games (GAW) Workshop shares are plunging today in mid-day stock trading activity in London after the company released its half-year report covering the first six months of its 2021 fiscal year.

The company reported revenues of £188.2 million during the period, representing a 27% jump compared to the £148.4 million it generated during the same period a year ago, as online sales kept booming during the pandemic.

Meanwhile, operating profits landed at £92 million, up 55.4% compared to a year ago, while basic earnings per share went up 55% as well, ending the six-month period at 226.1p.

During the period, online sales became increasingly important for the group, as they accounted for 24.5% of the company’s revenues, up from a previous 16.5% contribution they made during the first six months of the previous fiscal year.

Meanwhile, online revenue nearly doubled during the six months ended on 29 November, moving from £46 million to £24.5 million, while retail sales declined 18.6% amid government lockdown measures – which resulted in the shutdown of non-essential establishments in multiple corners of the world.

Gross margins further advanced to 75% – up 6% compared to the prior 6 months – as higher sales volumes allowed for economies of scale. However, Games Workshop acknowledged that ‘out of stock’ items were running higher than the company expected.

This slightly pessimistic tone could have prompted investors to lock in some of the profits they have seen recently, with the stock advancing as much as 87% during 2020 amid higher demand for its products during lockdowns.

Meanwhile, the management team mentioned that the firm effectively closed eight stores, which leaves it with a total of only two net store openings during the period, while they also commented that 50 of their 529 active stores may not be able to break even amid the negative impact of government restrictions during the pandemic.

Games Workshop declared a half-year dividend of 80p per share for a 1.37% implied annual dividend yield.

Are there reasons to worry about today’s downtick in GAW shares?

Today’s downtick in Games Workshop shares is probably more a short-lived decline than a long-term shift in the firm’s latest positive performance, as the business continues to be as strong as it has ever been.

This view is reinforced by the fact that, using a simple run rate of the company’s last six months earnings, the price to earnings ratio currently stands at 23, which is an attractive multiple for a company that has seen its earnings multiplied by nearly 7 times from 2011 to 2020, while it could now see its net income nearly double by the end of the current fiscal year.

Technical analysis of Game Workshop shares

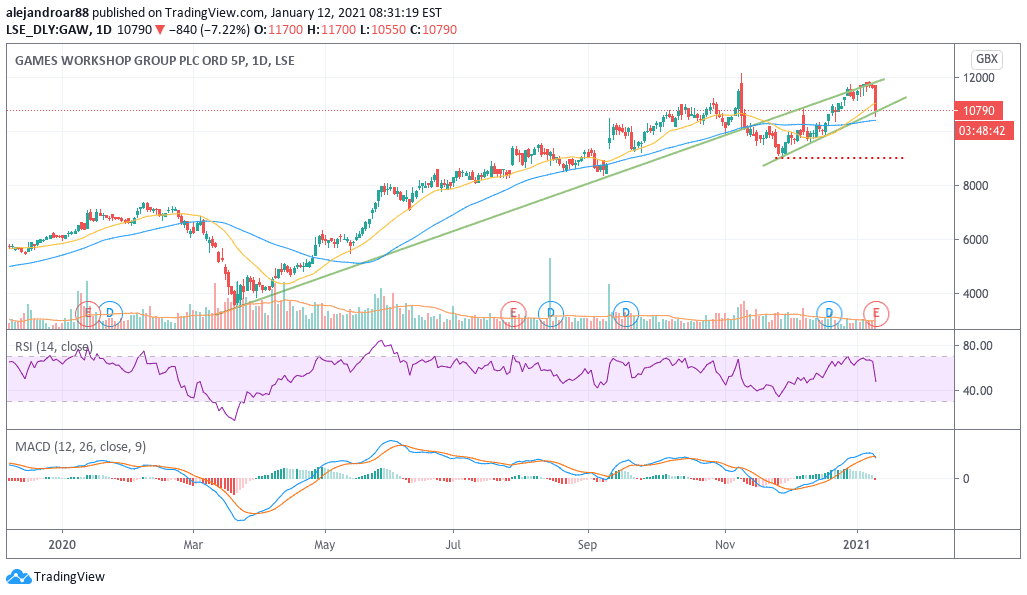

The chart above shows how GAW’s strong uptrend started back in March, after the share price bounced off a 3,590p post-pandemic low until hitting an all-time high of 12,000p per share in early November.

Once that peak was reached, the stock pulled back strongly, as investors saw the news of a feasible vaccine for the virus as a negative catalyst for GAW’s business.

Since then, the stock price has retested the lower trend line shown in the chart multiple times, with this threshold now apparently becoming resistance for the price action.

That said, a new uptrend seems to have emerged off the lows that followed the 9 November pullback, with the price posting a series of higher lows, although failing to jump back on the trend line.

Both the fundamental and technical elements seem to be reinforcing the view that today’s downtick is a short-lived one, as the price has bounced off the newly-established trend line during intraday action, although the MACD has just sent a sell signal amid the downtick.

If the stock were to break its trend line support, 9,000p seems like a plausible landing zone for it. At that point, traders should keep an eye on a potential bounce, which could end up forming a bullish double bottom in combination with the stock’s 24 November low.

Question & Answers (0)