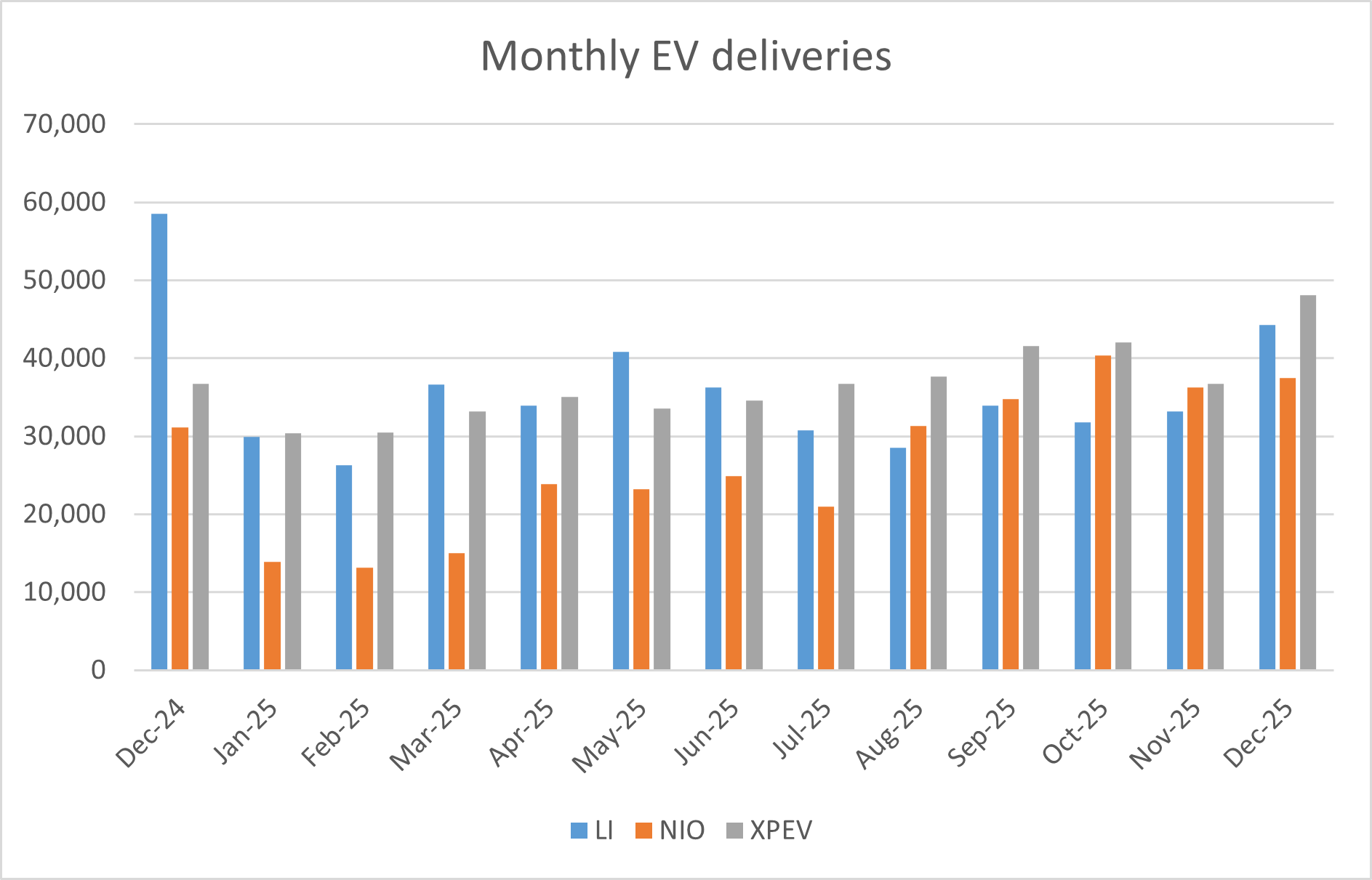

Chinese electric vehicle (EV) companies have released their December 2025 delivery numbers. Here are the key takeaways and the performance of some of the major players.

NIO delivered 48,135 EVs in December, which was 54.6% higher than the corresponding month last year. In Q4, it delivered 124,807 vehicles, representing a 71.7% year-over-year increase, while annual deliveries rose 46.9% to 326,028 units. The Chinese EV company is on the verge of reaching the milestone of cumulative deliveries of 1 million, with just a few thousand units remaining.

Xpeng Motors’ global EV sales soar

Xpeng Motors delivered 37,508 EVs in December, which was only 2% higher than the same month last year. The company missed the Q4 delivery target of 125,000-132,000 units and could only deliver 116,249 units in the final quarter of the year. Its annual deliveries rose 126% to 429,445 units, while the cumulative deliveries were 1,019,846 at the end of 2025.

Xpeng Motors is pivoting to physical AI

Meanwhile, apart from expanding its manufacturing footprint, Xpeng Motors is also doubling down on physical artificial intelligence (AI). The company held its AI day in November, where it announced several physical AI initiatives. Xpeng announced it will introduce three purpose-built Robotaxi models in 2026 and commence pilot operations in Chinese cities like Guangzhou. These vehicles represent a significant leap in its autonomous driving strategy and will utilize Xpeng’s full-stack, in-house developed AI system.

Each robotaxi will be equipped with four Turing AI chips (developed by Xpeng Motors), providing a massive combined computing power of up to 3,000 TOPS (Tera Operations Per Second), which the company claims is currently the highest standard for autonomous vehicles.

Xpeng has announced it will open its proprietary, partly autonomous driving system to other car manufacturers globally. This pivot transforms Xpeng from solely a car seller into a technology platform, positioning it as a leading supplier of artificial intelligence for the future of mobility.

Xpeng Motors has also pivoted to humanoids and aims to begin mass production by the end of 2026. Initial deployment will focus on commercial applications within its own operations, such as guiding customers, and industrial roles like facility inspection.

At the AI day, Xpeng Motors unveiled the latest generation of its humanoid robot, IRON, with a clear goal of large-scale commercialization. The robot boasts a highly articulated, human-like body with 82 degrees of freedom and hands featuring 22 degrees of freedom, allowing for natural, fluid movement.

It is powered by three Turing AI chips (delivering 2,250 TOPS) and the VLA 2.0 system, enabling real-time conversation, interaction, and complex physical tasks.

Xiaomi’s cumulative EV deliveries surpass 500,000 units

Looking at other EV companies, Xiaomi Auto capped off a historic first full year of production by shattering its own upwardly revised targets. After launching the YU7 SUV mid-year to compete with the Tesla Model Y, the company’s momentum became unstoppable. It delivered 50,000 units in December and 410,000 units in the full year. Notably, Xiaomi reached 500,000 cumulative deliveries in just 20 months, one of the fastest ramp-ups in automotive history.

However, Li Auto’s sales woes continued, and the company’s December deliveries fell 24.4% to 44,246 units. In the full year, its deliveries fell 18.8% to 406,343 units, and it trailed both NIO and Xpeng Motors.

Meanwhile, Li Auto surpassed 1.5 million cumulative deliveries in December, maintaining its status as the leader in the EREV (Extended Range) market.

BYD’s sales continue to fall

BYD sold 420,398 vehicles in December, which was 18% lower than the corresponding month last year. It was the fourth consecutive month when the Chinese NEV (new energy vehicle) giant reported a yearly decline in deliveries.

Notably, Q3 2025 marked BYD’s first quarterly revenue decline in over five years, which was accompanied by an almost 33% plunge in third-quarter profit. In a clear sign of the mounting challenges, BYD had previously slashed its 2025 sales target by about 16%, from 5.5 million to 4.6 million units. This is the first time in years the company has reined in its ambitions, but it eventually managed to hit that goal with just over 4.6 million deliveries.

The key takeaway from the 2025 data is BYD’s performance in the pure battery electric vehicle (BEV) segment, whose sales soared almost 28% YoY, which more than offset the massive fall in hybrid sales. With 2.26 million BEVs sold, BYD is expected to finish the year ahead of Tesla (whose final numbers are pending) as the world’s top seller of pure electric cars. This marks the first time BYD has held this title for a full calendar year.

Meanwhile, amid slowing demand at home, BYD has expanded to global markets, and deliveries rose to a record high of 133,172 units in December. In the full year, it sold over 1 million units globally, which accounted for around 23% of its total sales.

BYD is gaining market share in Europe

Europe has particularly been a strong market for BYD, where it has grown at Tesla’s cost. BYD has now moved from a marginal player to a significant competitor with a noticeable increase in its overall EU market penetration. Unlike Tesla, which relies heavily on the Model 3 and Model Y, BYD offers a more extensive lineup that includes pure electric and popular Plug-in Hybrid Electric Vehicles (PHEV). This diversity appeals to buyers in regions where charging infrastructure is still developing or where consumers prefer the flexibility of a hybrid.

Notably, while the Elon Musk-run company has been in Europe for quite some time now and also has one of its Gigafactories in Berlin, BYD entered the region only in late 2022. Moreover, BYD cars face tariffs in the EU, while the cars built by Tesla at its Germany Gigafactory are exempt from these tariffs.

Chinese EV companies are expanding in Europe

Other Chinese EV companies are also expanding in Europe, and Xpeng Motors has partnered with Magna Steyr for local production of its G6 and G9 electric SUVs in Austria. Local production would help Chinese EV companies avoid the tariffs they are otherwise subject to in the EU on vehicles imported from China.

Question & Answers (0)