The International Monetary Fund (IMF) has issued a recent, strong warning regarding the United States’ mounting public debt, projecting that the debt-to-GDP ratio will surpass 140% by the end of the decade.

This concern is part of a broader warning about global fiscal imbalances, outlined in their recent reports, including the Global Financial Stability Report and the Fiscal Monitor, released during the IMF’s annual meetings.

Key aspects of the IMF’s warning on US debt

- Soaring debt levels: The IMF projects that the US public debt will climb past the peak reached after World War Two and exceed 140% of GDP by 2029. This is driven by large and persistent fiscal deficits.

- Fiscal imbalances: Expanding fiscal deficits in major economies, particularly the US, are pressuring sovereign bond markets. The IMF warned that an abrupt yield increase, triggered by debt sustainability concerns, could strain bank balance sheets and pressure open-ended funds.

- Need for deficit reduction: IMF officials plan to urge US authorities to take sustained action to stabilize debt by shrinking the budget deficit. They stress that cutting the US deficit would not only rebalance the US economy but also free up resources globally, potentially lowering international interest rates and making financing conditions more favorable worldwide.

- High interest payments: The crisis is compounded by rising interest rates, which means the annual interest payments on the US national debt are now topping $1 trillion, exceeding the Pentagon’s budget.

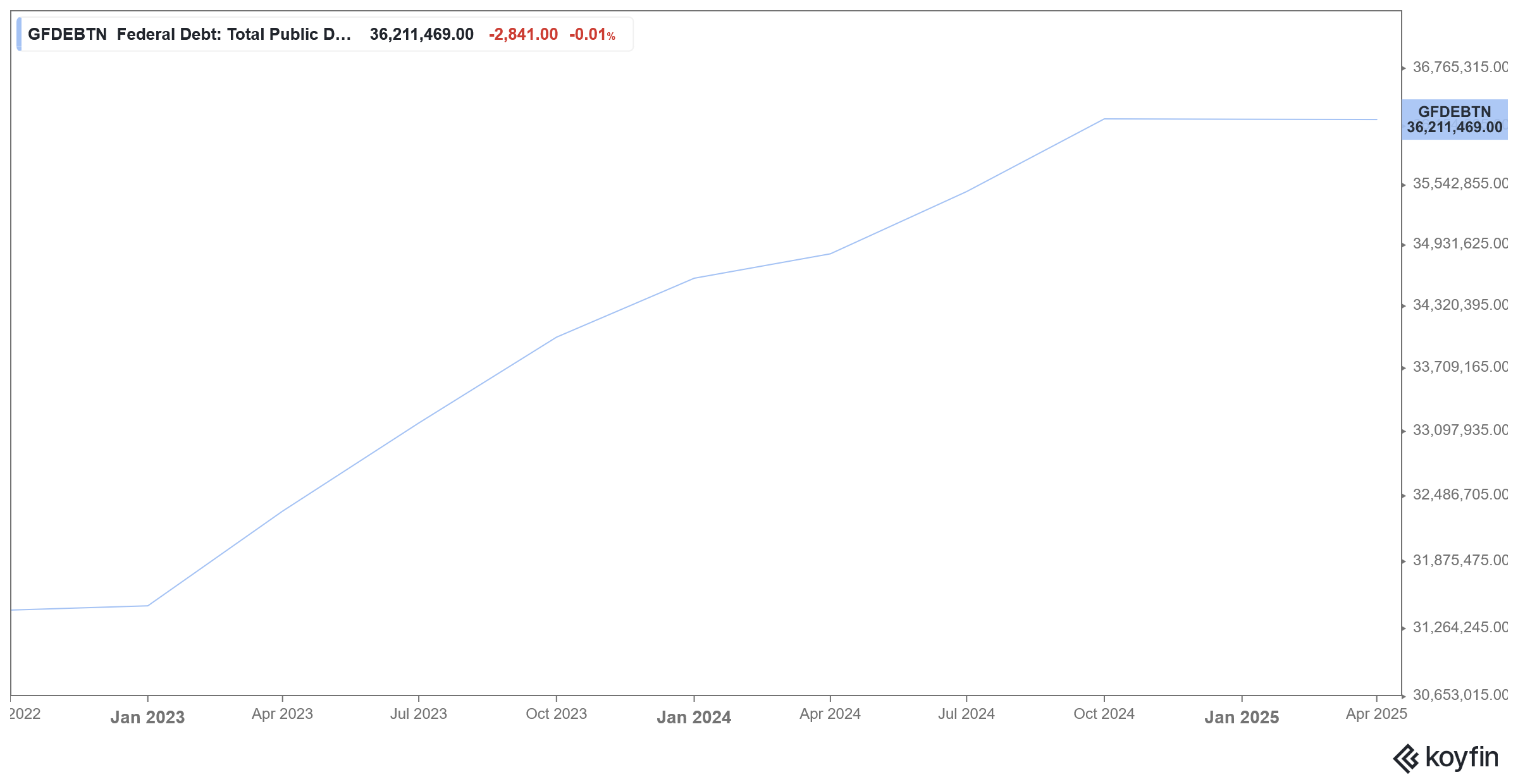

US debt has risen significantly since 2020

Notably, the US budget deficit hit a record high of $3.13 trillion in the fiscal year 2021. The surge was understandable as the economy needed support during the pandemic. The deficit came down to $2.77 trillion in the fiscal year 2022. It fell further to $1.38 trillion in the next fiscal year, and while it was much below the previous year, it was significantly higher than in pre-pandemic times, when the deficit was contained below $1 trillion. However, in the fiscal year 2024, the budget deficit increased to $1.8 trillion.

Several leading economists and fund managers have been warning about the soaring fiscal deficit and ballooning US national debt. At Berkshire Hathaway’s annual meeting earlier this year, chairman Warren Buffett warned that US debt has reached unsustainable levels.

Many fear that the fiscal path that the world’s biggest economy has been pursuing since the COVID-19 pandemic is unsustainable, and the country needs to bring down its burgeoning fiscal deficit that has surpassed its national GDP.

The US has lost its only top credit rating

The high budget deficits and soaring debt pile have prompted credit rating agencies to cut the US sovereign credit rating. The US lost its last top credit rating in May after Moody’s cut the country’s sovereign credit rating one notch to Aa1 from Aaa. The rating agency joined its peers in slashing the US credit rating amid concerns over unsustainable US fiscal debt and the rising cost of financing the deficit.

Warren Buffett has been cautioning about unsustainable debt

At Berkshire Hathaway’s annual meeting earlier this year, chairman Warren Buffett warned that US debt has reached unsustainable levels.

“We are operating at a fiscal deficit now that is unsustainable over a very long period of time. We don’t know whether that means two years or 20 years, because there’s never been a country like the United States, but this is something that can’t go on forever,” said Buffett at the meeting, where, among others, he announced his retirement from the conglomerate.

He added, “And it has the aspect to it that it gets uncontrollable to a certain point that essentially you just give up on it. Paul Volcker kept that from happening in the United States, but we came close. We’ve come close multiple times, and we still have very substantial inflation in the United States, but it has never been runaway yet. And that’s not something we want to try and experiment with because it feeds on itself.”

The US is on an unsustainable fiscal path

Fed chair Jerome Powell has also cautioned about the rising deficits and unsustainable fiscal position multiple times. Powell believes that politicians were taking the wrong approach by targeting discretionary spending, which he said not only contributes a small percentage of total spending but also its share in total spending has been gradually falling.

“The largest and fastest-growing portions are Medicare, Medicaid, Social Security, and now interest payments, so this is indeed where efforts need to be focused, and these issues can only be resolved on a bipartisan basis; neither side can find a solution without the involvement of both, so this is crucial,” said Powell while speaking at the Economic Club of Chicago earlier this year.

BlackRock CEO Larry Fink is among the list of prominent people who have cautioned on the high US budget deficit and the alarming rise in the country’s national debt.

JPMorgan cautions on rising federal debt

The most recent warning on soaring US debt pile comes from David Kelly, the Chief Global Strategist at J.P. Morgan Asset Management, who, in a client note discussing the growing US federal debt, said “America is ‘going broke slowly.”

“The question I am asked most frequently by investors and financial advisors is when is the federal debt going to blow up in all of our faces. My usual answer is that, while we are going broke, we are going broke slowly.” Said Kelly in his note.

He added, “Global bond markets are very well aware of the trajectory of U.S. debt. The fact that even today, the U.S. government can borrow money for 30 years at a yield of just 4.6% speaks to a conviction that there remains room for the government to borrow more.”

Kelly, however, cautioned, “That being said, there is a danger that political choices lead to a faster deterioration in the federal finances, leading to a backup in long-term interest rates and a lower dollar.”

Question & Answers (0)