Alibaba shares (NYSE: BABA) have rallied smartly this week amid renewed optimism towards Chinese companies. BABA is also among the prominent artificial intelligence (AI) companies in China and is investing billions of dollars to expand its AI capabilities.

Why have Alibaba shares rallied this week?

Several factors have aided Alibaba’s rally this week. Nvidia announced that it has received assurances from the U.S. government that it will be granted licenses to resume sales of its H20 AI chips to China. This marks a significant reversal of earlier restrictions that had halted these exports.

Alibaba, like ByteDance and Tencent, has been a major buyer of Nvidia’s AI chips. The H20, while a less powerful version than Nvidia’s top-tier chips, was specifically designed to comply with U.S. export controls and is vital for AI inference tasks and developing advanced AI models in China.

Alibaba is heavily invested in AI, from its cloud computing offerings (Alibaba Cloud) to various AI applications and large language models (like Qwen). Having access to Nvidia’s H20 chips will enable Alibaba to continue training and deploying more sophisticated AI models, maintaining its competitive edge in the rapidly evolving AI landscape.

Apple has selected Alibaba as its AI partner in China, and the partnership will help the Cupertino-based company bring its “Apple Intelligence” features to the country. Resumption of Nvidia’s H20 exports to the US will provide supply certainty to Chinese tech companies as they ramp up their AI business.

Alibaba halted the IPO of its cloud segment due to chip export controls

Notably, Alibaba halted the planned IPO of its cloud segment (which also houses its AI business) in 2023 after the Biden administration imposed restrictions on chip exports to China.

Exports of advanced AI chips to China have been a sensitive issue amid fears over dual military use. Moreover, experts believe that the restrictions are a ploy to delay China’s progress in AI.

Nvidia CEO Jensen Huang, meanwhile, believes that US chip export restrictions have not had the desired effect and are only spurring innovation in China. Notably, Chinese tech giant Huawei has also developed AI chips, and while these are still years behind Nvidia, the company is fast catching up.

Nvidia is all praise for Chinese AI models

During this week’s visit to China, Huang was all praise for China’s AI ecosystem. “Models like DeepSeek, Alibaba, Tencent, MiniMax, and Baidu Ernie bot are world-class, developed here and shared openly [and] have spurred AI developments worldwide,” said the Nvidia CEO.

He also praised China’s open-source model and added, “China’s open-source AI is a catalyst for global progress, giving every country and industry a chance to join the AI revolution.”

China’s Q2 GDP growth was better than expected

China’s GDP expanded at an annualized pace of 5.2% in Q2, which was ahead of estimates. The world’s second biggest economy has grown by 5.3% in the first half of 2025, with the run rate running higher than the 5% annual growth target that it set out earlier this year.

A significant factor contributing to the better-than-expected GDP performance was robust export growth. In June, exports rose by 5.8% year-on-year, an acceleration from May’s 4.8% increase. This surge was partly attributed to a temporary reprieve from steep US tariffs on Chinese goods, which prompted a rush of orders. Chinese companies have also strategically diversified by stepping up exports through offshore manufacturing and trade with other countries, mitigating some of the impact of ongoing trade tensions with the US.

However, despite the Chinese government’s efforts to boost consumption, domestic demand remains a significant concern. Retail sales growth in June slowed to 4.8%, missing expectations. A 0.1% drop in consumer prices in the first half of 2025 signals lingering deflationary pressures. Analysts point to a decline in consumer confidence, rising household debt (now over 60% of GDP), and job insecurity as factors suppressing spending. While government subsidies for home appliances and cars spurred a brief jump in May retail sales, the impact appears to be moderating.

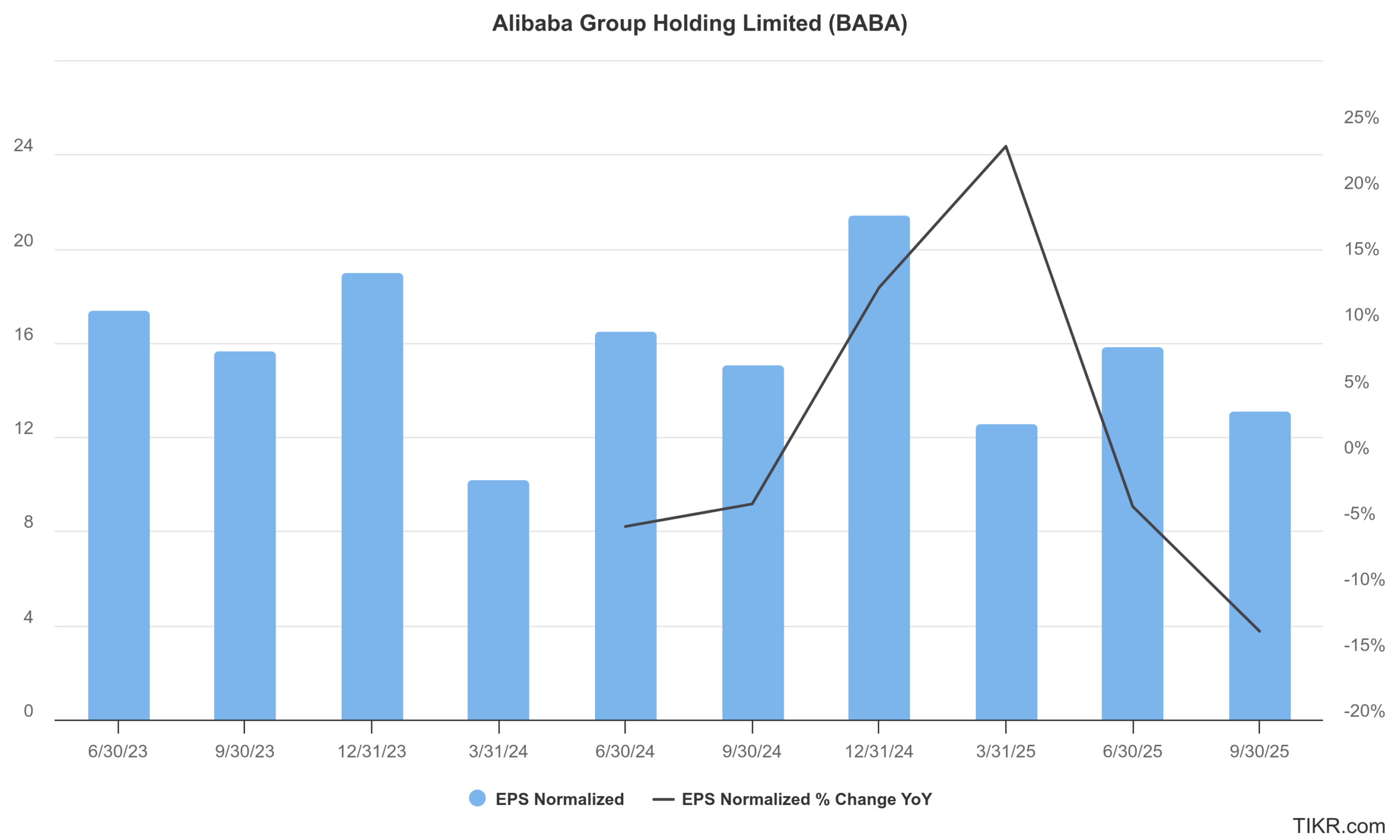

Alibaba missed earnings estimates in fiscal Q4 2025

Meanwhile, Alibaba had missed estimates for the March quarter as both revenues and profits trailed analysts’ estimates. The cloud segment was a silver lining with revenues rising 18% YoY. The acceleration was largely driven by the surging demand for AI-related products and public cloud services. Notably, AI-related product revenue achieved triple-digit growth for the seventh consecutive quarter, showcasing Alibaba’s strong position in the AI infrastructure space. The company emphasized its strategic investment in AI infrastructure, viewing it as a new engine for long-term growth.

While facing ongoing domestic consumption challenges and intense competition in various sectors, Alibaba’s latest earnings report suggests a stabilization and targeted growth strategy. The company’s significant investments in AI and its expanding international commerce footprint are poised to be key drivers for future growth, as it continues to streamline operations and focus on its core strengths. Investors will be closely watching for further developments in its AI initiatives and the performance of its international businesses.

Optimism towards Chinese companies

There is a renewed optimism towards Chinese shares, which happen to trade at quite depressed valuations compared to their global, especially US peers. The valuations of the country’s tech companies took a beating following the tech crackdown in 2021, but things have since stabilized with China signaling support for its tech companies amid the trade tensions with the US.

Earlier this year, Chinese President Xi Jinping met domestic entrepreneurs. Among those in attendance was Alibaba co-founder Alibaba who had become the face of the tech crackdown.

While Alibaba now back in the “good books” of Chinese leadership, the shares have also reacted positively and are up over 41% for the year.

Question & Answers (0)