Lucid Group share (NYSE: LCID) is trading sharply higher today after the company announced a partnership with autonomous tech company Nuro, Inc., and Uber Technologies (NYSE: UBER) to launch a next-generation premium global robotaxi program, exclusively for the Uber platform.

This strategic collaboration aims to deploy 20,000 or more Lucid vehicles, specifically the new Lucid Gravity SUV, equipped with Nuro’s Level 4 autonomous “Nuro Driver” system, over the next six years. The initiative is expected to first launch in a major US city in late 2026, marking a significant step towards widespread robotaxi adoption. In its release, Lucid said that the prototype of the first Lucid-Nuro robotaxi is currently operating on a closed circuit at Nuro’s Las Vegas proving grounds.

Uber partners with Lucid Group for autonomous cars

Under the terms of the agreement, Uber will invest $300 million into Lucid, with additional multi-hundred-million-dollar investments planned for Nuro. This capital injection will support Lucid’s efforts to integrate Nuro’s hardware seamlessly into the Lucid Gravity on its assembly line, while Nuro will provide its advanced AI-powered self-driving software.

“This investment from Uber further validates Lucid’s fully redundant zonal architecture and highly capable platform as ideal for autonomous vehicles, and our industry-leading range and spacious well-appointed interiors, as ideal for ridesharing,” said Marc Winterhoff, Interim CEO at Lucid.

He added, “This is the start of our path to extend our innovation and technology leadership into this multi-trillion-dollar market.”

Notably, this collaboration marks a significant shift in Uber’s autonomous strategy, moving away from in-house development towards strategic partnerships with specialized technology providers. It also represents a crucial diversification for Lucid, expanding its reach into the burgeoning autonomous ride-hailing market beyond its traditional consumer vehicle sales.

Tesla launched its robotaxi service last month

Meanwhile, the partnership comes a few weeks after Tesla launched its robotaxi service in Austin, which it intends to soon expand to other US cities. The initial phase of the service utilizes a small fleet of Tesla Model Y vehicles, equipped with a specialized version of Tesla’s Full Self-Driving (FSD) software. For now, the service is invite-only, primarily extended to a select group of Tesla investors and enthusiasts. Rides are confined to a geofenced area in South Austin and operate from 6 AM to midnight.

Crucially, despite the “driverless” label, a human “safety monitor” from Tesla remains present in the front passenger seat of each vehicle during this pilot phase. While they do not actively drive the car, their role is to observe the system’s performance and intervene if necessary, reflecting a cautious approach to regulatory compliance and public safety.

Tesla CEO Elon Musk believes that Tesla’s autonomous driving business is the key driver of its current profitability. However, the FSD is far from being fully autonomous, as the name suggests. As for the robotaxi service, Musk previously mocked Alphabet-backed Waymo for the high cost of its cars and predicted that Tesla would have a lion’s share of that market.

Lucid Motors announced a reverse stock split

Meanwhile, along with announcing the partnership with Uber for autonomous cars, Lucid Motors also announced a 10-for-1 reverse stock split. The proposal comes as Lucid aims to make its shares more attractive to a broader range of investors and other market participants. A reverse stock split reduces the number of outstanding shares while proportionally increasing the share price. In Lucid’s proposed 1:10 split, every ten existing shares would be consolidated into one new share.

A reverse stock split would help Lucid escape from the penny stock category that it currently lies in, with its share price below the threshold of $5.

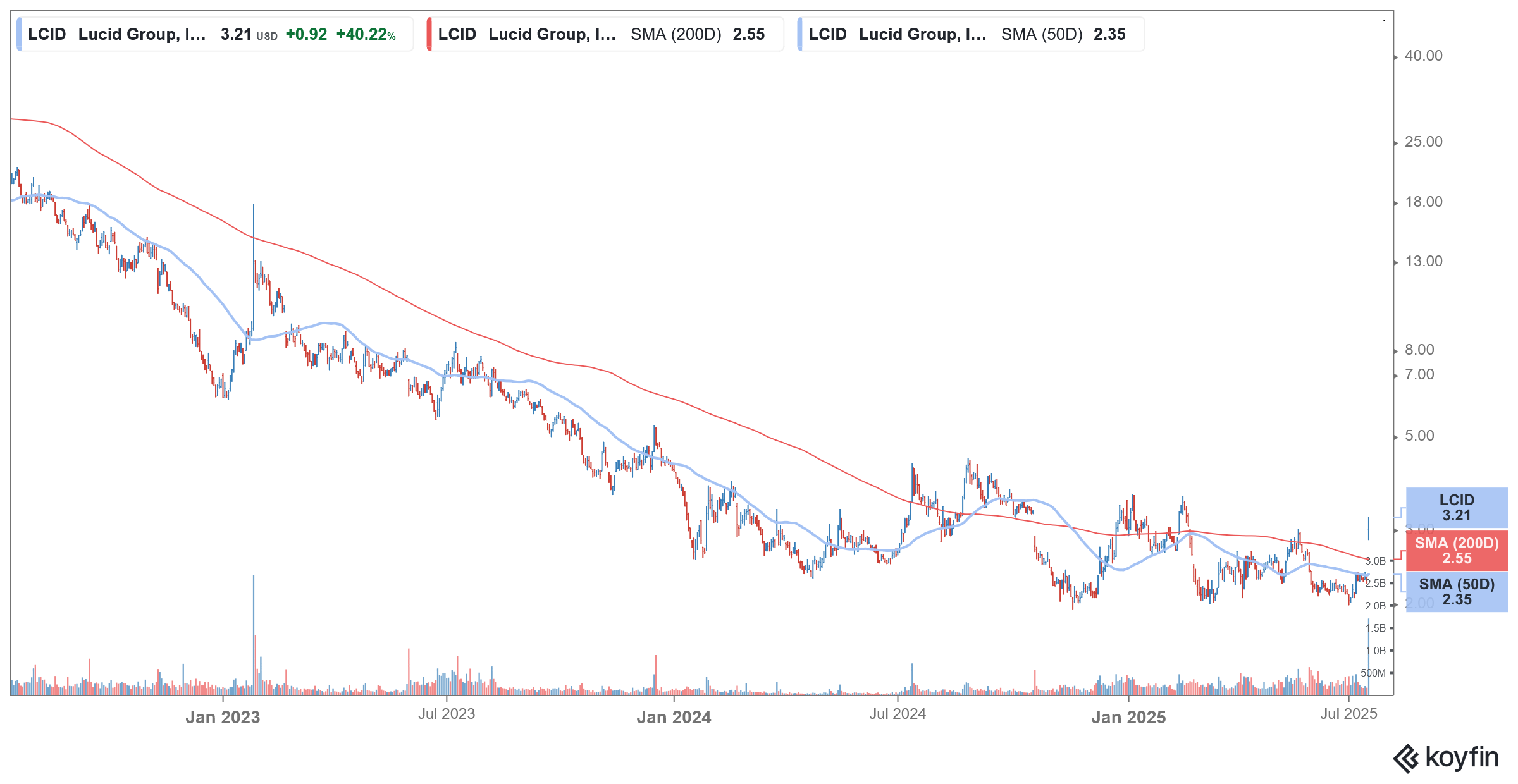

Lucid Motors trades at a fraction of its 2021 highs

Lucid Motors was the biggest special purpose acquisition company (SPAC) merger when it went public in 2021. It was among the most hyped SPAC mergers as it was touted as the “next Tesla.” Lucid Motors’ market cap reached almost $100 billion that year amid the euphoria towards EV shares.

However, that bubble has since burst, and many of the high-flying EV startups of that time have gone bankrupt. While Lucid remains in business, in part due to the backing from a cash-rich Saudi sovereign wealth fund, which has poured billions more into the company since it went public, the shares trade at a fraction of their all-time highs.

The partnership with Uber is a welcome break for Lucid and also a testimony to the prowess of its vehicles, which have received rave reviews. Notably, in 2023, Lucid partnered with Aston Martin to supply its cutting-edge electric vehicle powertrain and battery systems to power Aston Martin’s electrification strategy.

EV price war

Meanwhile, the EV industry is battling a slowdown in sales, which has led to a price war with companies cutting prices to boost shipments. The price cuts have dented the margins and made things even problematic for startup EV companies like Lucid Motors.

The price cuts have not helped lift shipments much, and even Tesla reported a yearly fall in deliveries last year. Things have only worsened for Tesla this year, with deliveries down in the double digits in the first half of the year.

Lucid’s performance has been somewhat better, even as it is coming from a much lower base. It delivered 3,309 vehicles in Q2, a YoY rise of 38%. Moreover, the company’s deliveries have increased sequentially for seven straight quarters.

The company has set a target of producing 20,000 vehicles this year, which is twice what it produced last year. A key component of this guidance is the successful ramp-up of the Lucid Gravity SUV. Deliveries of the Gravity began in April 2025, and its production volume is crucial for Lucid to hit its full-year target. Gravity is expected to broaden Lucid’s market appeal beyond the Air sedan.

Question & Answers (0)