Chinese electric vehicle (EV) companies have reported their deliveries for May. Here are the key takeaways from their reports.

Xpeng Motors reported steady growth in EV deliveries

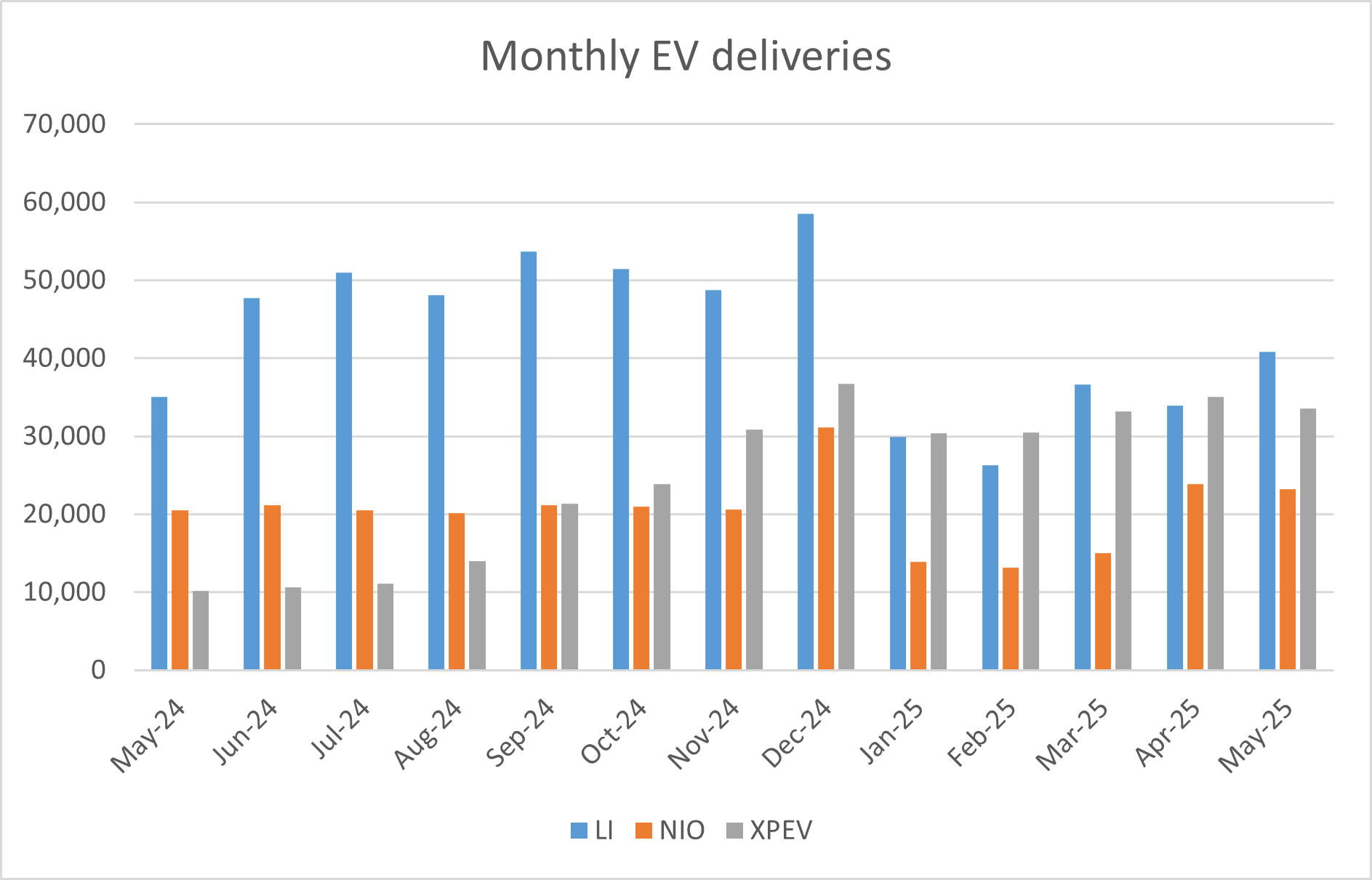

Xpeng Motors delivered 33,525 EVs in May, which was 230% higher YoY, even as the number was lower than in April. The company’s deliveries have topped 30,000 for seven consecutive months, thanks to strong demand for its Mona MO3, whose cumulative deliveries topped 100,000 in April. Moreover, its P7+ achieved the production milestone of 50,000 in five months of its launch.

It delivered 162,578 vehicles in the first five months of 2025, which is 293% higher than the corresponding period last year. While the rise is admittedly coming from a lower base, as the company’s deliveries were quite subdued in the first half of 2024, the numbers are nonetheless quite reassuring.

Xpeng Motors’ cumulative EV deliveries were 752,977 at the end of May. During their Q1 2025 earnings call last month, Xpeng Motors said that it expects to deliver between 102,000 and 108,000 vehicles in the second quarter. The company delivered 63,570 vehicles in the first two months of the quarter, so the midpoint of its guidance implies deliveries of 36,430 in June.

Xpeng Motors is set to launch new EV models

Late last month, Xpeng Motors launched the Mona M03 Max model, which it says “lowers the entry barrier for urban AI smart driving to the 150,000 RMB range for the first time, making advanced vehicle technology more accessible to younger users.” It added, “The MONA M03 Max is also the first XPENG model equipped with the AI Tianji XOS 5.7.0, offering over 300 new features.”

Over the next few quarters, Xpeng Motors will launch several new EVs to expand its portfolio. The company is also looking to launch extended-range electric vehicles (EREVs), which are quite popular as they come with a generator that can extend the battery’s range.

Li Auto reported a monthly rise in deliveries

Li Auto delivered 40,856 vehicles in May, which is 16.7% higher than the corresponding month last year. Its cumulative deliveries reached 1,301,531 at the end of May, which is the highest among emerging NEV companies in China.

Zeekr delivered 46,538 vehicles in May. Of these, the Zeekr brand accounted for 18,908 vehicles while the Lynk & Co brand delivered 27,630 vehicles.

NIO reported a sequential fall in May deliveries

NIO reported EV deliveries of 23,231 in May, which was 13.1% higher YoY but below the 23,900 cars it delivered in April. In the first five months of 2025, its EV deliveries rose 34.7% to 89,225, while its cumulative deliveries rose to 760,789.

Looking at the breakup, the company delivered 13,270 vehicles of its eponymous premium brand NIO, while 6,261 vehicles from its family-oriented smart electric vehicle brand ONVO. The remaining deliveries were for the new small vehicle brand Firefly, whose deliveries commenced in late April. The company expects to launch the Firefly model in global markets in the “near future.”

BYD’s EV deliveries surpassed hybrids in May

BYD delivered 382,476 vehicles last month, which is 15.27% higher than the corresponding month last year. 0.63% rise month-on-month, reinforcing BYD’s position as a leading player in the global new energy vehicle (NEV) market.

Looking at BYD’s May sales mix, Battery Electric Vehicles (BEVs) accounted for 204,369 units, while Plug-in Hybrid Electric Vehicles (PHEVs) contributed 172,561 units. It is the second consecutive month when BYD sold more BEVs than PHEVs. Prior to that, the company’s hybrid sales were ahead of BEV sales for many months.

BYD sold more EVs than Tesla in Q1 and looks set to grab the title of the world’s biggest EV seller in 2025. Notably, BYD’s 2024 revenues were ahead of Tesla as it reached the milestone of hitting $100 billion in revenues.

BYD’s global sales soar

Perhaps the most striking highlight from the May report is BYD’s accelerating success in international markets. The company’s sales in global markets reached 89,047 units in May, marking the sixth consecutive month of record deliveries.

This sustained upward trend in international deliveries underscores BYD’s aggressive global expansion strategy. Last month, BYD sold more BEVs than Tesla in Europe. While the Elon Musk-run company has been in Europe for quite some time now and also has one of its Gigafactories in Berlin, BYD entered the region only in late 2022. Moreover, BYD cars face tariffs in the EU, while the EVs built by Tesla at its Germany Gigafactory are exempt from these tariffs.

BYD is targeting annual deliveries of 5.5 million

BYD has sold 1.76 million vehicles in the first five months of this year and is targeting annual deliveries of 5.5 million units this year. In an apparent bid to spur sales, last month BYD announced that it is cutting prices on 22 of its models until the end of this quarter. The price cuts are quite aggressive, and the company slashed the price of its Seagull EV hatchback by 20%. The model, which is the cheapest from BYD, would now cost just about 55,800 yuan (around $7,780). The biggest cut was for the Seal dual-motor hybrid sedan, whose price has been slashed by 34%.

China EV price war

BYD’s price cuts are yet another salvo in the price war in the Chinese EV market. Notably, there has been a brutal price war in the Chinese EV industry since Q4 of 2022, when Tesla started to cut car prices to spur sales.

Citi analysts expect that the price cuts caused an increase in footfall by between 30%-40% at BYD’s dealerships this weekend, compared to the previous one. The brokerage, meanwhile, expects other Chinese automakers to also announce price cuts and said, “We anticipate peers to follow BYD’s price cut.” Notably, while China is home to around 4 dozen EV companies, only a few are posting a profit, and the price war would only aggravate the situation.

Chinese EV companies offer models at very competitive prices, which has helped them grab market share in markets outside China. Tesla CEO Elon Musk has been all praise for Chinese EV companies and the country’s EV ecosystem. During Tesla’s Q4 2023 earnings call last year, he said, “Frankly, I think, if there are not trade barriers established, they will pretty much demolish most other companies in the world.”

He added, “The Chinese car companies are the most competitive car companies in the world. So, I think they will have significant success outside of China depending on what kind of tariffs or trade barriers are established.”

Question & Answers (0)