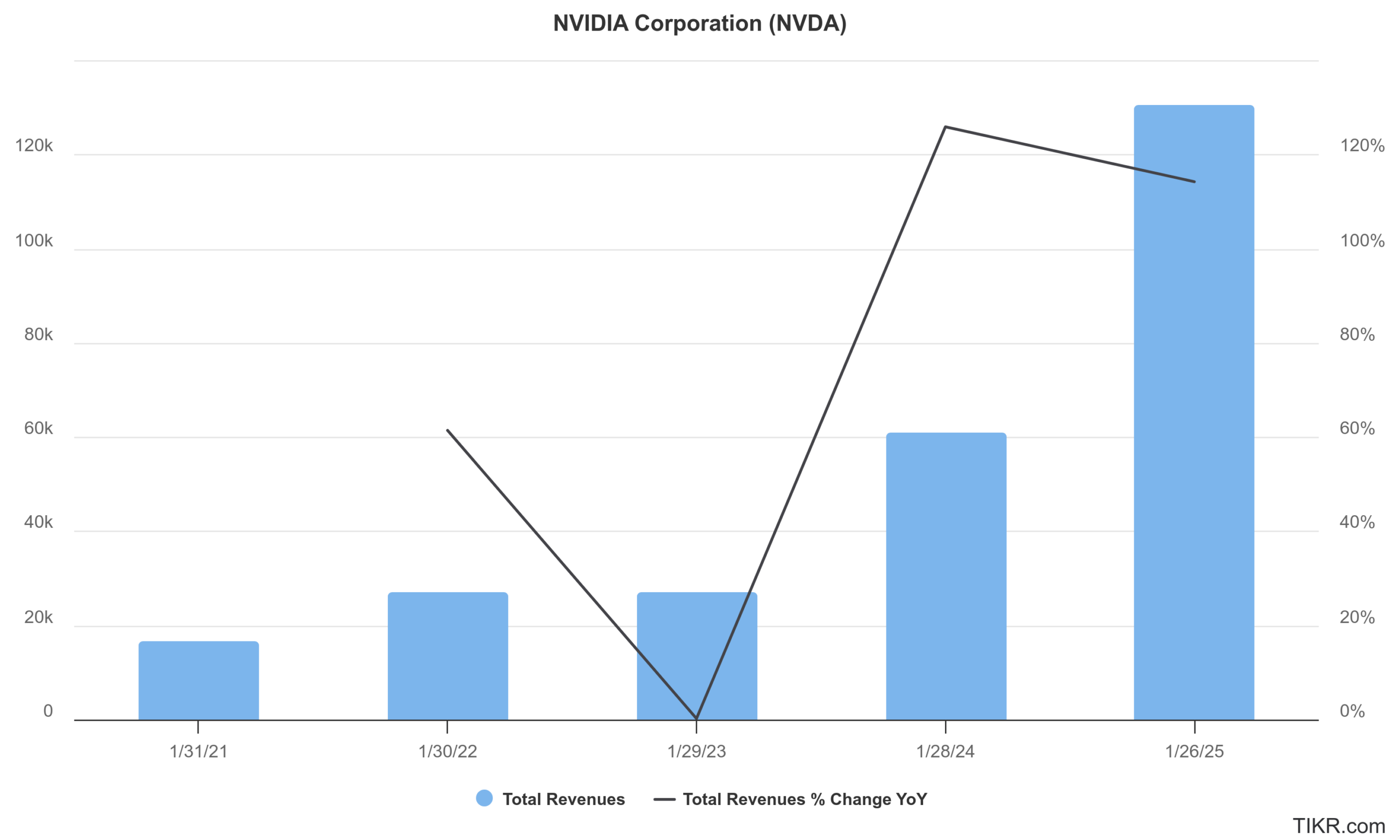

Nvidia (NYSE: NVDA) reported its fiscal Q4 2025 earnings yesterday after the markets closed and the shares are trading higher in US premarket price action today. Here we’ll look at Nvidia’s performance in the quarter and how analysts reacted to the report.

Nvidia reported revenues of $39.33 billion in the quarter, up 78% YoY and ahead of its guidance. The number also easily surpassed the $38.05 billion that analysts were expecting. The Jensen Huang-led company posted an adjusted EPS of $0.89 which was higher than the $0.84 that analysts were modelling.

Nvidia’s Data Center revenues skyrocket

Revenues of Nvidia’s Data Center segment that sells artificial intelligence (AI) chips rose 93% YoY in fiscal Q4. In the full year, the segment’s revenues rose 142% to $115.2 billion. The Data Center segment is now by far the biggest segment for Nvidia and dwarfs the revenues of all other segments, including Gaming which was once the company’s largest segment.

During the quarter, Nvidia began shipping its Blackwell chips, which is the company’s most recent AI chip. It generated revenues of $11 billion from Blackwell during the quarter and said that it was the fastest ramp-up in the company’s history.

During the earnings call, Nvidia CFO Collete Kress said, “Blackwell production is in full-year across multiple configurations, and we are increasing supply quickly expanding customer adoption.”

Blackwell sales fared better than expected

However, as the company had previously warned, the pivot to Blackwell chips took a toll on its gross profit margins which fell to 73.5% in the quarter as compared to 75% in the corresponding quarter last year.

Wall Street analysts were generally impressed with the ramp-up of Blackwell whose revenues came in ahead of consensus estimates. Bernstein, which kept its overweight rating on Nvidia while raising the target price by $10 to $185, wrote in its note, “There was tremendous angst going into these results around what NVIDIA management might say regarding outlook given a substantial amount of supply chain noise and worries over the company’s ability to ramp Blackwell.”

Analyst Stacy Rasgon added, “However, we might actually characterize the print as relatively quiet, and it seems like they are through the worst of the ramp issues, with all Blackwell configurations now in full production across the board.”

How did Nvidia’s different business segments fare in Q4?

Looking at Nvidia’s other business segments, the company’s Gaming and AI PC segment reported revenues of $2.5 billion – down 11% YoY. In the full fiscal year though, the segment’s revenues rose 9% to $11.4 billion.

Nvidia’s Professional Visualization segment’s fiscal Q4 revenues rose 10% YoY to $511 million. The company’s Automotive and Robotics segment among others supplies chips for autonomous driving, reported revenues of $570 million in Q4 with sales more than doubling in the quarter.

NVDA provided better-than-expected guidance

Nvidia guided for revenues of $43 billion in the current quarter at the midpoint which was ahead of the $41.8 billion that analysts were expecting. The company forecast revenues of its automotive vertical at $5 billion this fiscal year which would imply revenues rising over threefold from the previous year.

Meanwhile, the company warned of growing competition in China where US export controls don’t allow it to sell its top-of-the-line AI chips. During the earnings call, Nvidia said, “as a percentage of total Data Center revenue, data center sales in China remained well below levels seen on the onset of export controls. Absent any change in regulations, we believe that China shipments will remain roughly at the current percentage. The market in China for data center solutions remains very competitive.”

The company is particularly seeing competitive pressure from Chinese tech giant Huawei which not only survived US sanctions but is now threatening Apple’s dominance in the Chinese market with its handsets.

How did analysts react to Nvidia’s Q4 earnings?

Nvidia’s earnings were generally received well by analysts and most raised their target prices following the report. JPMorgan kept its overweight rating on Nvidia saying “Demand for Blackwell is very strong and will continue to outstrip supply for several quarters. We believe the team did a good job on addressing AI model innovations like DeepSeek and they continue to believe that there are multiple phases/ and innovations in models that will drive overall compute complexity higher and sustain the demand for more and higher performance compute infrastructure.”

Analyst Harlan Sur added, “Bottom line, the team continues to maintain a 1- 2 step lead ahead of competitors with its silicon/ hardware/software platforms, and a strong ecosystem and the team is further distancing itself with its aggressive cadence of new product launches and more product segmentation over time.”

Concerns over NVDA’s valuations

While there are concerns over Nvidia’s valuations, Citi analyst Atif Malik allayed such fears saying, “For long-term investors willing to look through these concerns, valuation looks attractive at 23x CY26 EPS and stock offers an attractive entry point.”

Bank of America, which raised Nvidia’s target price by $10 to $200 also looks comfortable with the share’s valuations. “We understand the desire to diversify portfolios away from AI/cloud, but we believe this underappreciates the solid pace of AI investments and NVDA’s compelling valuation. Visibility in non-AI markets remains muted, and many of those stocks trade at higher valuation than NVDA which does not seem reasonable to us,” said the brokerage in its note.

Meanwhile, Nvidia shares are trading around 2% higher in early US price action as investors digest the chip-designing giant’s quarterly report amid signs of a weakening US economy after a sharp rise in weekly jobless claims

Question & Answers (0)