2024 was a good year for China’s NEV (new energy vehicle) industry. In December, China’s NEV sales reached a new record high of almost 1.6 million units. Notably, the country’s NEV deliveries rose to record highs in the previous three months. China provided a trade-in subsidy to spur EV sales last year which helped the sector report stellar numbers in the final quarter of the year. The country has renewed the subsidy this year which came in as a relief to the sector.

China is the world’s largest EV market

Thanks to the stellar growth in deliveries, China’s NEV giant became the world’s fourth largest automaker after Toyota, Volkswagen, and Hyundai Group. Unlike these companies that get most of their revenues from sales of ICE (internal combustion engine) vehicles, BYD sells only NEVs that include both battery electric cars and hybrids.

NEV adoption rates in China have spiked and every second car sold in the world’s largest automotive market is either a hybrid or BEV. At the same time, EV adoption rates in the US have sagged and even Tesla’s deliveries fell in the country last year. It was the first time that Tesla – which still holds the title of the world’s largest EV seller – reported a YoY fall in deliveries.

Meanwhile, after a strong finish to 2024, 2025 has started on a somber note for China’s NEV industry with most players reporting a steep fall in deliveries. Here it is worth noting that China’s economic activity in the first two months is impacted by the Lunar New Year Holidays. While the Lunar New Year fell in February last year this year it falls in February. In this article, we’ll look at the key takeaways from Chinese EV companies’ January deliveries.

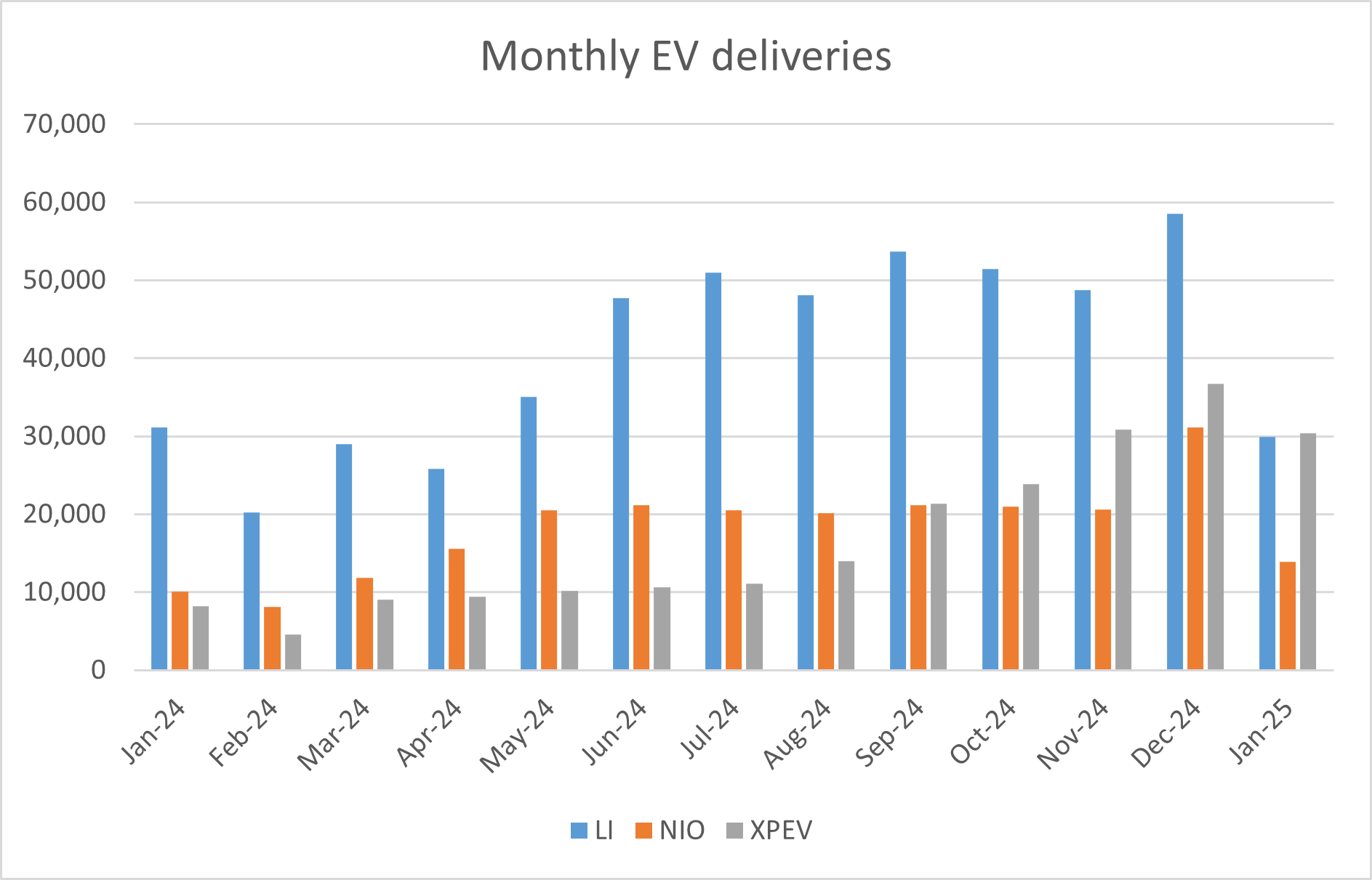

NIO reported a YoY rise in deliveries

NIO delivered 13,863 EVs in January which was 37.9% higher YoY. Of these, 7,951 vehicles were for the premium eponymous brand NIO while 5,912 vehicles were for the budget brand ONVO. The company’s cumulative deliveries reached 685,427 at the end of January. Meanwhile, while the company’s deliveries rose from a low base in January 2024 owing to the Lunar New Year holidays, they fell sharply from December when the Chinese EV company delivered a record 31,138 vehicles.

In the full year, NIO delivered 221,970 EVs – a YoY rise of 38.7%. Amid slowing sales, NIO has been looking to launch new models including budget EVs. NIO officially launched its flagship ET9 model last year and expects to commence its deliveries in March. In April, NIO expects to officially launch Firefly, its low-cost EV model.

Zeekr’s EV deliveries also fell in January

Zeekr delivered 11,942 vehicles last month as compared to 27,190 in December. The Geely-backed company went public last year only and joined the ranks of multiple other Chinese EV companies that trade on the US markets. At the end of January, Zeekr’s cumulative deliveries reached 430,698.

Li Auto’s deliveries fell sharply

Li Auto delivered a mere 29,927 vehicles in January and its cumulative deliveries reached 1,163,799 at the end of January. While fell startup Chinese EV companies struggled with deliveries over the last couple of years, Li Auto impressed markets with its performance.

Li Auto delivered a record 58,513 vehicles in December which was 16.2% higher as compared to the corresponding month in 2023. In the full year, the company delivered 500,508 vehicles which was a new milestone for the company.

That said, the company’s L6 model has gained traction and its cumulative deliveries topped 200,000 in January. In its release, it said, “Li Auto sustained its leadership as the sales champion of Chinese automotive brand in the passenger vehicle market priced at RMB200,000 and above, with Li L6 maintaining its position as the best-selling extended-range electric vehicle model in China for seven consecutive months.”

Xpeng Motors reported stellar growth in EV deliveries

For the last many months, Li Auto’s deliveries have been consistently higher than NIO and Xpeng Motors. There have been instances when Li Auto’s monthly deliveries came in higher than the cumulative deliveries of NIO and Xpeng Motors.

However, Xpeng Motors delivered 30,350 EVs in January which was higher than Li Auto. For context, it is the first time since September 2022 that Xpeng Motors delivered more vehicles than Li Auto.

Xpeng Motors’ Mona MO3 model has been a hit and its sales have been above 15,000 units for two consecutive months. Thanks to the stellar sales of the budget EV model, Xpeng Motors’ total deliveries have been above 30,000 for three consecutive months.

Xpeng Motors also has autonomous driving capabilities which are among the most advanced in China. In its release, Xpeng Motors said, “XNGP’s monthly active user penetration rate in urban driving reached 87% in January 2025. At the same time, XPENG rolled out its latest XOS version, AI Tianji 5.5.0, introducing “door-to-door” ADAS and other advanced smart driving features, such as the world’s first coach vehicle recognition with bypassing capability, to eligible customers across China.”

Xpeng has partnered with Volkswagen

In 2023, Volkswagen invested in Xpeng Motors and as part of the agreement, XPEV will build two EVs on its platform. The deal was a milestone for the Chinese EV ecosystem as it reflected the confidence of Volkswagen in a startup EV company. It was also a testimony to Xpeng Motor’s self-driving capabilities which the company intends to further build upon. The two companies are also said to be exploring international partnerships.

Question & Answers (0)