The US Federal Open Market Committee’s (FOMC) next meeting is scheduled for September 17-18 and while some market participants are calling for a 50-basis point rate cut, rating agency Fitch believes that the Fed would opt for 25 basis point rate cuts only.

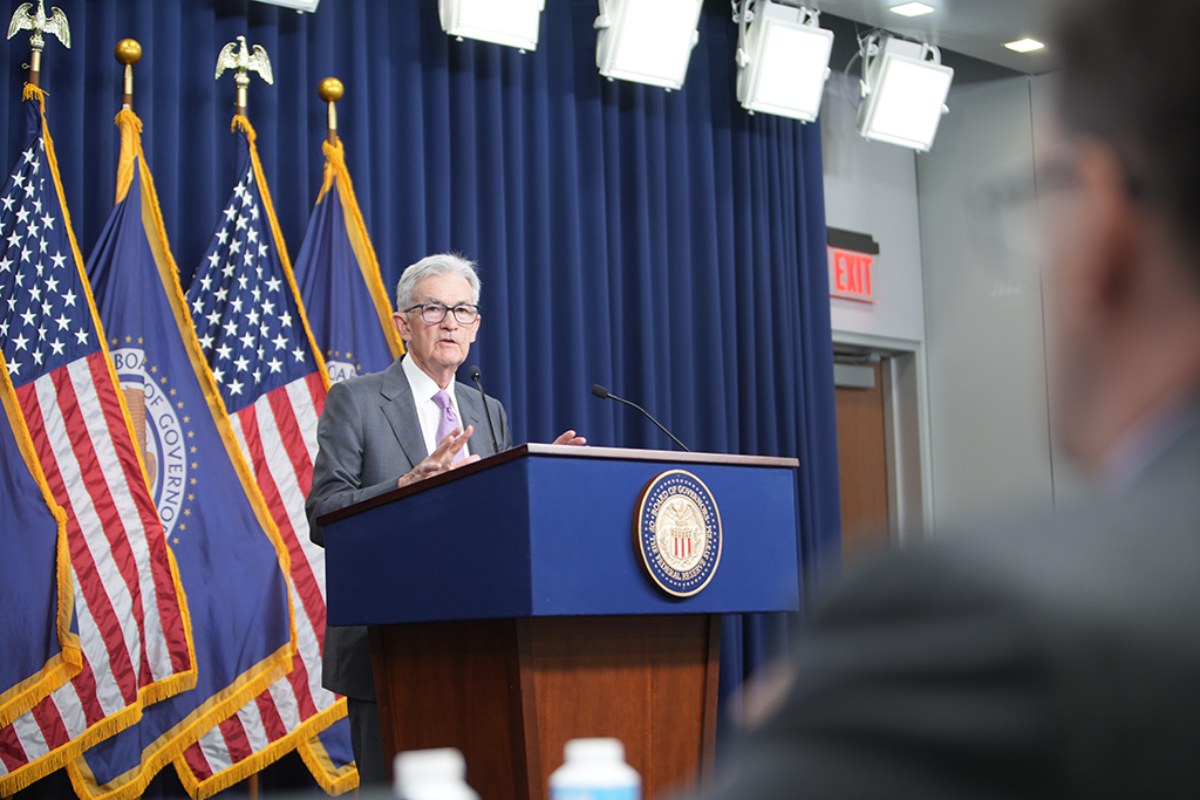

Optimism over a Fed rate cut has risen since the Jackson Hole symposium last month, where Fed chair Jerome Powell said, “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

Fitch expects Fed to cut rates by 25 basis points

Many economists are calling for a 50-basis point rate cut as multiple data points show a worsening slowdown in the US economy. Fitch however expects the Fed to cut rates by a cumulative 250 basis points over the next 25 months in equal tranches of 25 basis points.

“One reason we expect Fed easing to proceed at a relatively gentle pace is that there is still work to do on inflation,” said Fitch in its release.

It added, “The inflation challenges faced by the Fed over the past three and a half years are also likely to engender caution among FOMC members. It took far longer than anticipated to tame inflation and gaps have been revealed in central banks’ understanding of what drives inflation.”

Fed was on an aggressive rate hiking spree

Notably, the Fed has been on a rate-hiking spree since March 2022. It raised rates by 25 basis points in March 2022 and by 50 basis points in May. In the next four meetings, it raised rates by 75 basis points each before lowering the pace of hikes to 50 basis points in December.

The US central bank raised rates four times in 2023 by 25 basis points each. Currently, the Fed fund rates are 5.25%-5.50% which is the highest since 2001. It was the most aggressive rate tightening cycle in nearly four decades but Fitch expects the easing cycle to be a lot more conservative.

August core inflation inched up

To be sure, while the annualized CPI rose at an annualized pace of 2.5% in August, which was the lowest pace of increase since early 2021, it is still above the 2% that the Fed targets.

Also, core inflation that excludes food and energy prices rose by 0.3% month-on-month in August which was higher than the 0.2% increase in July. The increase in core CPI somewhat muddied the rate cut outlook and was yet another sign that the fight against inflation is still far from over.

Incidentally, in 2020, the Fed changed its approach and now targets an average inflation of 2%. The mandate gives it more leeway in deciding on monetary policy, unlike the previous framework where it strived to keep inflation below 2% at all times.

Also, Powell said that on more than one occasion the Fed won’t wait for inflation to fall below 2% before it starts cutting rates.

Fitch expects rate cuts in China also

Fitch believes that the Chinese central bank might also cut rates. “[Expected] Fed rate cuts and the recent weakening of the US dollar has opened up some room for the PBOC to cut rates further,” the rating agency said in its report.

It added, “Producer prices, export prices and house prices are all falling and bond yields have been declining. Core CPI inflation has fallen to just 0.3% and we have lowered our CPI forecasts.”

Notably, while the rest of the world was battling high inflation, the pace of the price rise was quite modest in China. In fact, deflation seems like a bigger worry for the world’s second-largest economy but the country’s central bank still unexpectedly cut rates in July to support its deteriorating economy.

Gold prices rise to record highs ahead of a Fed rate cut

While Fitch expects the Fed to cut rates by 25 basis points, according to the CME FedWatch Tool, the odds of a 50-basis point rate cut in September are now 47%. A day back the odds were a mere 28%.

Meanwhile, gold prices have surged to a record high in anticipation of a Fed rate cut. Notably, as a non-interest-bearing asset, gold tends to outperform in periods of low interest rates.

Alex Ebkarian, chief operating officer at Allegiance Gold sees more upside for gold as the Fed looks set to embark on its rate cut cycle.

Fed has to strike a balance

“We are headed towards a lower interest rate environment so gold is becoming a lot more attractive… I think we could potentially have a lot more frequent cuts as opposed to a bigger magnitude,” said Ebkarian in his note.

As for the Fed, it now has to address both inflation and growth. During his Senate testimony in July, Powell talked about the risks of cutting rates too late, hinting that with inflation now gradually falling towards its target, it is also worried about a slowing US economy.

In his prepared remarks for the Senate testimony earlier this month, Powell said, “Reducing policy restraint too late or too little could unduly weaken economic activity and employment.”

He added, “In light of the progress made both in lowering inflation and in cooling the labor market over the past two years, elevated inflation is not the only risk we face.”

The US central bank might need to do a balancing act now and try to address the economic slowdown without stoking inflation.

Question & Answers (0)