Alphabet (NYSE: GOOG) released its Q1 earnings on Thursday after the close of market hours. The shares surged over 10% yesterday and Alphabet joined the ranks of $2 trillion companies. Here are the key takeaways from the report and how analysts reacted to Alphabet’s Q1 earnings.

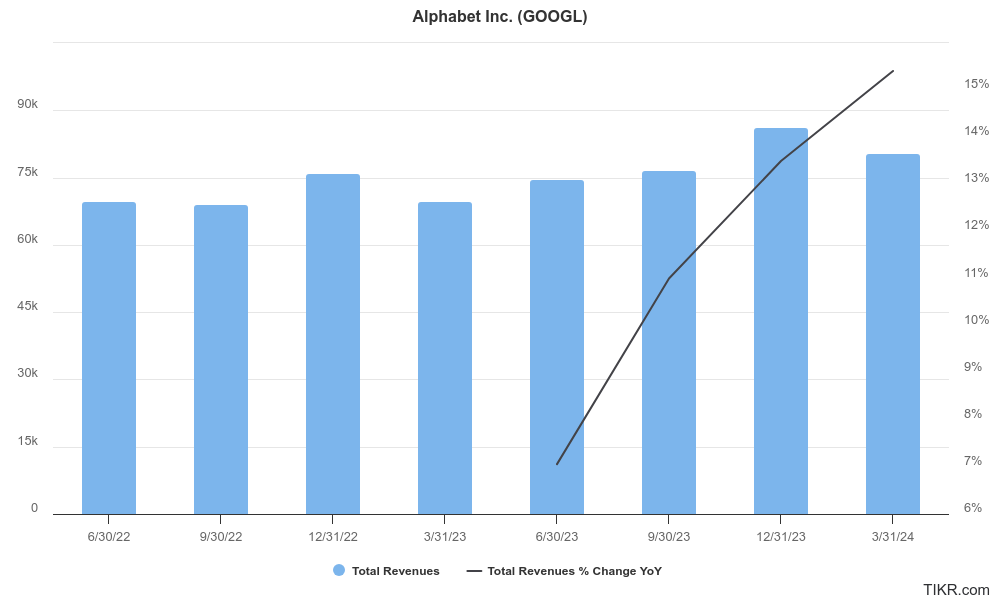

The Google parent reported revenues of $80.5 billion in Q1 which were 16% higher YoY in constant currency terms. The company’s net income surged to $23.6 billion, compared to $15.05 billion in the corresponding quarter last year. Both the metrics easily surpassed analysts’ estimates.

In her prepared remarks, the company’s CFO Ruth Porat said, “Our strong financial results for the first quarter reflect revenue strength across the company and ongoing efforts to durably reengineer our cost base.”

Key takeaways from Alphabet’s Q1 earnings

Notably, Alphabet has been on a cost-cutting spree for over a year. In 2022, its shareholder TCI Fund Management wrote an open letter to the company calling upon the company to reduce costs (including headcount), cut losses in its Other Bets business, increase share repurchases, and set a target for pre-tax margins.

Over the last year, Alphabet has relentlessly worked on cutting costs and has narrowed the losses in its Other Bets segment. Also, its cloud business’ profits have increased significantly and the operating income more than quadrupled in Q1.

During the Q1 earnings call, it announced a massive $70 billion buyback and initiated a dividend. Commenting on the dividend, Porat said, “We view the introduction of the dividend as further strengthening our overall capital return program.”

The company has also scaled up its capex and spent $12 billion in Q1. While Alphabet did not provide any quantitative guidance for the rest of the year it said the quarterly number this year would be similar or higher than that. Most of these investments are going into technical infrastructure and the investment in office infrastructure is expected to be less than 10%.

How analysts reacted to Alphabet’s Q1 earnings

After the earnings release, Barclays analyst Ross Sandler increased Alphabet’s target price by $27 to $200. In his client note, Sandler said, “Google is in the sweet spot of accelerating growth, expanding margins while shipping product faster, and returning capital — basically proving the naysayers wrong.”

While several observers had practically written off Alphabet in the AI race, the company has proved its mettle over the last month and has launched several new initiatives.

JPMorgan analyst Doug Anmuth also turned “incrementally positive” on GOOG and raised his target price by $35 to $200. In his note, Anmuth said, “The company is starting to bring AI responses into the main Search results page, & it is seeing an increase in Search engagement & satisfaction among AI users.”

He added, “Management also expressed confidence that the shift to Generative AI in Search will expand the Search market opportunity, just as GOOGL saw with the shift to mobile & voice.”

Bank of America sees challenges ahead

Bank of America maintained its $200 target price and said it sees challenges ahead for the company.

In his note, Bank of America’s Justin Post said, “The quarter beat expectations across all major business lines, supporting a narrative change: Google is a beneficiary of AI. Search is still not without disruption risk, but we remain constructive on Google infrastructure, data and distribution advantages.”

He was constructive about the divided initiation though and said, “We think a dividend will support a higher long-term multiple, but expect some deceleration in sector growth in 2Q on a tougher q/q calendar.”

Meanwhile, the rise in Alphabet shares is a welcome break for investors as the shares crashed following the Q4 release after the company missed earnings estimates. With GOOG signaling that it is pretty much in the AI race while managing costs efficiently, Wall Street analysts also warmed upto the shares even as some see a more challenging path ahead.

Question & Answers (0)