How to Buy TUI Shares UK – With 0% Commission

The travel industry has had one of its worst years on record. Thanks to the coronavirus pandemic, international travel came to a halt, airlines grounded their fleets, and hotels closed their doors to visitors.

Few companies were hit harder than TUI AG, the largest leisure travel and tourism company in the world. This German firm saw its revenue dip by as much as 97% at the height of the lockdowns.

With travel expected to pick up in 2021, however, TUI stands to get back to business. So, is now the right time to buy TUI shares in the UK? In this guide, we’ll explain how to buy TUI shares in the UK and take a closer look at whether this travel company is a strong investment.

-

-

Step 1: Find a UK Stock Broker That Offers TUI Shares

TUI trades on the London Stock Exchange and is a member of the FTSE 250 index. So, the majority of UK brokers offer stock trading for this travel company.

However, there’s more to choosing a stock broker than just what shares are offered. When picking a broker, it’s important to look at factors like cost, customer service, and regulation. You’ll also want to consider the broker’s trading platform, since this is what you’ll use for the bulk of your stock research and analysis.

Step 2: Research TUI Shares

Before you buy TUI shares, it’s important to do your research. Given the state of the travel industry, TUI should be considered a high risk investment. Let’s take a closer look at this company’s history and its path for recovery in the wake of the COVID-19 pandemic.

TUI Share Price History & Market Capitalisation

TUI AG, also known as TUI Group, is a German-English multinational tourism company. The company has its roots in Preussag AG, a German mining company that was formed in 1923 and which renamed itself TUI in 2002.

Throughout the early 2000s, TUI transitioned from a mixed focus on tourism and international shipping to focusing solely on tourism. In 2014, TUI began trading on the London and Frankfurt Stock Exchanges at a share price of £10.96.

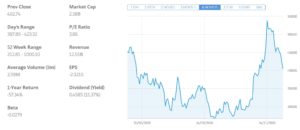

TUI’s share price remained relatively consistent through most of 2017, despite the growth in international travel during this period. The share price ultimately rose to a high of £18.92 in May 2018, but then tumbled to just £7.30 by early 2019 as rival tourism company Thomas Cook collapsed. After Thomas Cook shares ceased trading, TUI’s share price recovered to £10.75.

Shortly after, the COVID-19 pandemic hit TUI shares extremely hard. TUI stock fell to as low as £2.18 and was hovering around £3 for much of the summer. The stock price spiked to £5.46 on news of the Pfizer and Moderna vaccines, but has since fallen back to £4.03 per share.

At the current share price, TUI has a market cap of £2.38 billion and price to earnings (P/E) ratio of 5.57. The company reported an earnings per share of £-2.33 for the second quarter (ending in June) on a loss of nearly £1.4 billion. TUI aggressively cut costs over the summer, but still reported a net loss of £-2.26 per share in the third quarter on £1.3 billion in losses.

TUI Shares Dividend Information

TUI was once considered a very strong dividend stock for UK investors. In 2019, the company paid out a yield of 4.9%, and most analysts were expecting that to rise to 6% in 2020.

However, like many of its peers, TUI canceled dividend payments in March and has not made any plans to resume payouts to investors. The company has taken on a significant amount of new debt to survive the pandemic, so it is unlikely that a new dividend will be declared until 2023 at the earliest.

Should I Buy TUI?

TUI airline stocks look extremely cheap right now. The company is trading at a P/E ratio of just 5.57, which is a number that looks ripe for value investing.

Still, we recommend caution around TUI shares. There are some promising signs for this company, but also some red flags that investors need to be aware of.

Travel Recovery

The most important thing that TUI has going for it is the expected recovery in UK and European travel in 2021. The company announced over the summer that summer 2021 bookings are up by 145%, as customers not only rebook travel from 2020 but also book new holidays post-pandemic. Given how effective the COVID-19 vaccines have proven, it’s likely that TUI may see an even bigger bump next year than anticipated.

Importantly, TUI hasn’t mortgaged its future during the pandemic. The company took on debt as opposed to selling off assets, so it still has all of its plane fleets, high street office locations, and tourism infrastructure. That, combined with the widespread recognition of the company’s brands and the elimination of Thomas Cook as a rival firm, should help TUI capture the bulk of new travel business arriving in the next year.

Debt

While there is at this point little question around whether TUI will survive the pandemic, the company will be dealing with the effects of this year’s travel shutdowns for a long time to come. TUI took on nearly £4 billion in new debt this year to get through the crisis, on top of the more than £2.4 billion that the company already had. The company reported a debt-to-capital ratio of 97% with its third-quarter earnings.

That amount of debt is in many ways crushing. It limits TUI’s ability to raise new capital either through lenders or bonds. It also restricts the company’s ability to make adjustments to new travel behavior in the wake of the pandemic. That could end up hurting TUI’s long-term growth and make room for more nimble competitors.

More immediately concerning to shareholders, TUI has raised the prospect of a secondary stock offering to raise capital and pay down debt. A secondary offering would instantly dilute the value of existing shares, which is bad news for anyone holding TUI stock at the time.

TUI Shares Buy or Sell?

TUI shares look extremely cheap at the moment, which makes them quite tempting for investors. However, the company’s enormous debt burden and the prospect of a secondary stock offering make this company a risky investment.

If travel rebounds more quickly than expected and TUI avoids a secondary offering, anyone who buys shares now will be generously rewarded. On the other hand, if TUI does dilute its shares with a secondary stock offering, it could take years to see a profit from this travel company.

Overall, we think TUI shares are a good buy for risk-tolerant investors with long time horizons. If you can buy up shares at the current low price and hold them for at least several years, we think TUI offers a lot of promise. If you’re more interested in a short-term play around the pandemic recovery, look elsewhere in the travel industry (such as to airlines like Easyjet).

The Verdict

Leisure travel giant TUI was hit harder than most other companies by the COVID-19 pandemic. The company went from being highly profitable to losing money almost overnight. While TUI will make it through the crisis, surviving meant taking on an enormous debt load that could hurt the company for years to come.

Still, the recovery in travel presents an opportunity for investors. TUI shares are still trading at a significant discount compared to the start of the year, and the company stands to benefit from a quick recovery in travel and tourism next year.

FAQs

What exchange does TUI trade on?

TUI trades on both the London and Frankfurt Stock Exchanges. It is a member of the FTSE 250 index.

Who is TUI’s current chief executive officer?

The current CEO of TUI is Friedrich Joussen, who has been at the company’s helm since 2013.

Can I buy TUI shares with an ISA or SIPP?

Yes, you can buy TUI shares with an ISA or SIPP. Since this company is part of the FTSE 250, most UK brokers offer TUI shares for trading and investing.

What travel brands does TUI own?

TUI owns a number of travel brands including First Choice, Marella Cruises, Crystal Ski Holidays, TUI Sensatori, TUI Airways, and SplashWorld Resorts.

How much revenue does TUI generate?

TUI made £18.9 billion in revenue in 2019, but is expected to generate just £7.9 billion in 2020.

Michael Graw

Michael Graw is a freelance journalist based in Bellingham, Washington. He covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech. In addition to covering financial markets, Michael’s work focuses on science, the environment, and global change. He holds a Ph.D. in Oceanography from Oregon State University and worked with environmental non-profits across the US to bridge the gap between scientific research and coastal communities. Michael’s science journalism has been featured in high-profile online publications such as Salon and Pacific Standardas well as numerous print magazines over the course of his six-year career as a writer. He has also won accolades as a photographer and videographer for his work covering communities on both coasts of the US. Other publications Michael has written for include TechRadar, Tom’s Guide, StockApps, and LearnBonds.View all posts by Michael GrawWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

TUI trades on the London Stock Exchange and is a member of the FTSE 250 index. So, the majority of UK brokers offer

TUI trades on the London Stock Exchange and is a member of the FTSE 250 index. So, the majority of UK brokers offer

The most important thing that TUI has going for it is the expected recovery in UK and European travel in 2021. The company announced over the summer that summer 2021 bookings are up by 145%, as customers not only rebook travel from 2020 but also book new holidays post-pandemic. Given how effective the COVID-19 vaccines have proven, it’s likely that TUI may see an even bigger bump next year than anticipated.

The most important thing that TUI has going for it is the expected recovery in UK and European travel in 2021. The company announced over the summer that summer 2021 bookings are up by 145%, as customers not only rebook travel from 2020 but also book new holidays post-pandemic. Given how effective the COVID-19 vaccines have proven, it’s likely that TUI may see an even bigger bump next year than anticipated.