European markets are cautiously lower ahead of Wall Street’s opening after yesterday’s sharp drop kept traders on edge, while virus fears and the state of the economy weighed on sentiment.

The French CAC 40 stock index is leading today’s losing board as it is retreating 0.76% at 4,779, followed by the Italian FTSE MIB, and the German DAX index, both of which are losing 0.4% and 0.3% respectively.

The FTSE 100, on the other hand, remains muted ahead of Wall Street’s opening bell, trading only 0.07% lower than yesterday’s closing price.

A strong resurgence of the virus in the past few days all across Europe has contributed to the recent market volatility, with the number of daily cases reaching record levels again in multiple countries including the UK, France, Italy, Germany, and Spain.

The Spanish nation has been one of the first to reintroduce strict lockdown measures, including a nationwide curfew from 11 pm to 6 am, while the federal government has also given states the power to restrict inbound and outbound traffic.

Given the severity of this second wave of the virus in the continent, with cases almost doubling the peak seen during the first wave in March and April, it is highly likely that other countries will follow through with this decision of reintroducing strong restrictions, which would slow down the pace of the economic recovery in the region.

Moreover, the United States’ virus situation seems out of control once again, with a potential third wave of the virus unfolding during the fall – as experts repeatedly warned – since cold temperatures prompt people to stay indoors – a situation that facilitates the spread of the virus.

Although the US government has reaffirmed its commitment of not to reintroduce strict lockdowns or business shutdowns, people may prefer to stay at home voluntarily due to the increased risk of falling ill, which would once again put pressure on an economy that relies significantly on consumption to thrive.

Retail sales in the UK signal a bleak outlook for the economy

The likelihood of a double-dip recession in the UK – and across Europe for that matter – remains high, as retail sales – as reported by the CBI – slumped 23% during October while they are also expected to decline at least 26% during November.

Department stores and non-food retailers were among the most battered sectors during the month, as foot traffic levels remain below their pre-pandemic readings.

Meanwhile, orders placed by retailers fell for the 18th consecutive month, according to the report, as firms keep liquidating their inventories to a level they deem fit for the demand they are seeing.

Ben Jones, Principal Economist for the CBI, said: “The fall in retail sales in October is a warning sign of a further loss of momentum in the economy as coronavirus cases pick up and restrictions are tightened across many parts of the country”.

He added: “With footfall still down by one third, many retailers face a difficult run-up to the all-important Christmas period”.

Internet sales remain the bright spot in the CBI’s report as shoppers have flocked to online channels to fulfill their needs while shunning physical stores to keep themselves safe from the virus.

What’s next for European markets?

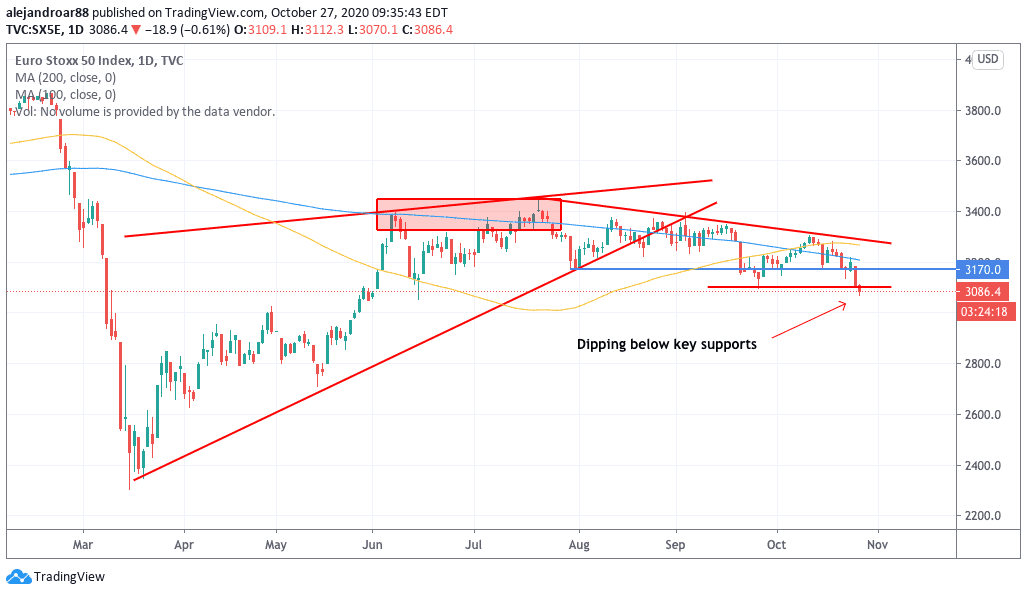

With prospects of more severe restrictions on the horizon, the path for European stock indexes is likely to remain bumpy, especially as efforts to decelerate the spread of the virus in different regions remain uncoordinated between nations.

That said, domestic stock indexes are likely to react in high correlation with the US market, although the reality of their respective nations may be slightly different than that of the North American country.

With that in mind, traders should keep an eye on how the US election plays out, as a contested result could lead to a severe spike in market volatility over the coming days.

Furthermore, the reintroduction of nationwide lockdowns and travel restrictions in other countries will definitely weigh on the short-term outlook of the largest European indexes, which means that investors must closely follow how virus cases evolve over the coming weeks as, considering the current numbers, another push higher could force countries to go in that direction since hospitalizations will likely put significant pressure on their health systems.

Question & Answers (0)