Uber shares are 4.4% higher in today’s stock trading action at nearly $36 per share, after a judge ruled in favour of the company to overturn the ban imposed by Transport for London (TfL) that prevented the firm from operating in the city.

The ruling grants Uber an 18-month licence to operate in the city – one of its most important markets – and creates some positive positive news for the ride-hailing app, which continues to struggle to solidify its business model against pressures from taxi-driver associations and other industry players.

Judge Tan Ikram, who ruled on the case, said: “Despite their historical failings, I find (Uber), now, to be a fit and proper person to hold a London PHV (private hire vehicle) operator’s licence”.

The London licence means Uber will not lose access to its more than 3.5 million users in the capital and its 45,000 drivers registered with the app in the city will not lose their source of employement..

“This decision is a recognition of Uber’s commitment to safety and we will continue to work constructively with TfL”, said Jamie Heywood, regional manager for Northern and Eastern Europe for the company.

However, the decision has sparked significant backlash from the Licensed Taxi Drivers’ Association of London, as reflected in the commentary on the matter by its general secretary Steve McNamara.

In regard to the ruling, McNamarar said: “Uber has demonstrated time and time again that it simply can’t be trusted to put the safety of Londoners, its drivers and other road users above profit. Sadly, it seems that Uber is too big to regulate effectively, but too big to fail”.

How have Uber shares performed lately?

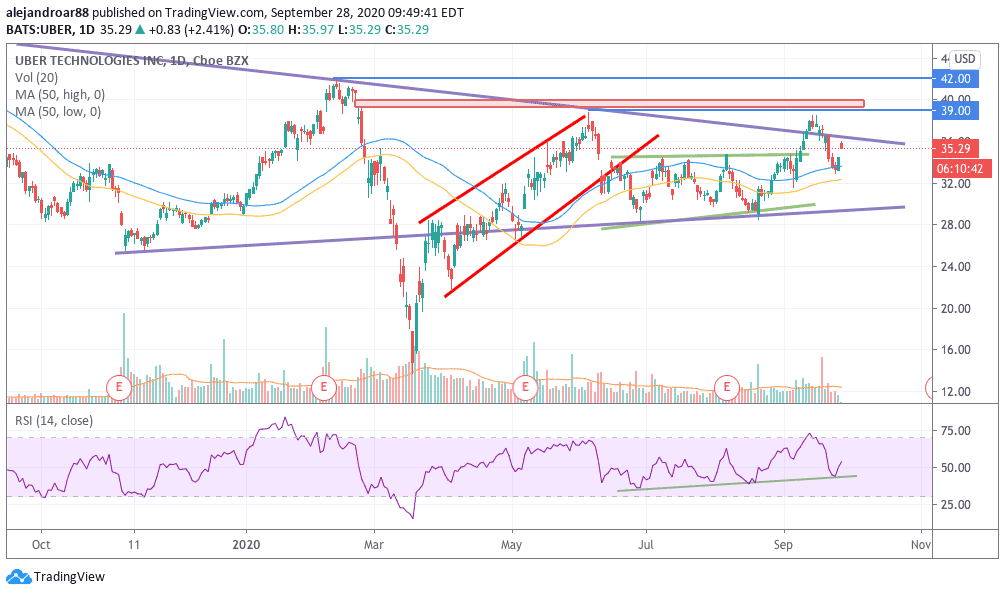

Uber shares took a major blow recently following the broad-market risk-off move, which strongly affected tech stocks. This downtrend resulted in a 17% drop to $33 per share, down from a previous failed resistance break at $38.5.

The stock is up 21% this year despite the headwind of the COVID-19 pandemic for the company’s ride-hailing business. In this regard, Uber Eats delivery unit has saved the day for the troubled firm, managing to bring in more revenues than rides during the first two quarters of the year as a result of stay-at-home policies.

What’s next for Uber shares?

Uber shares are still trading within a descending triangle formation dating back to its IPO, despite today’s uptick.

The latest price action on the shares of the firm headed by Dara Khosrowshahi failed to break above the $39 level, which would have caused the successful filling of an open price gap from the February pandemic sell-off.

This would be the second time the stock fails to move above that level, which points to the strength of that resistance. Traders should take this into account, especially if the stock manages to break above the triangle again – as that resistance would be the key level to watch right after that happens.

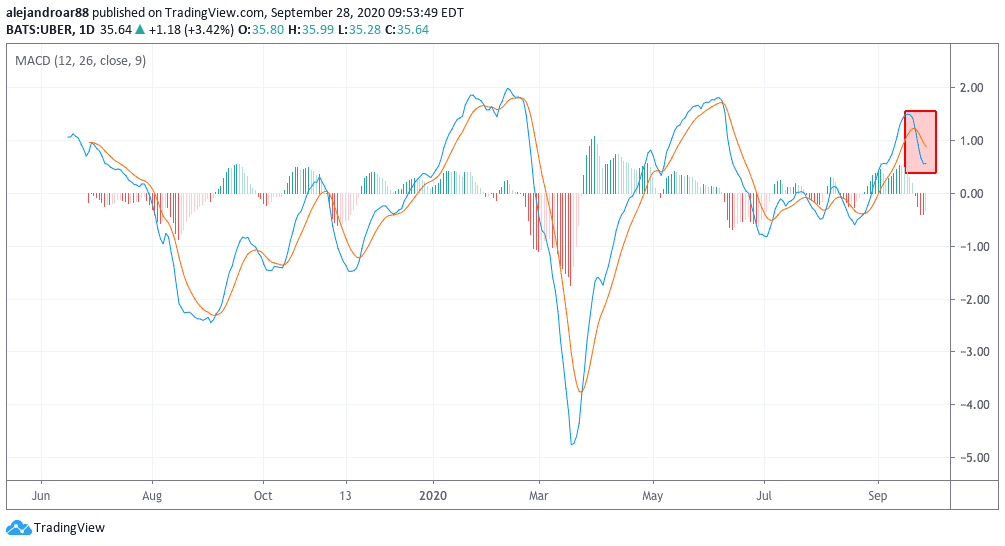

Another element to keep an eye on is the MACD oscillator, which despite today’s uptick is still not sending a buy signal as it remains below the signal line – although it continues to be on positive territory.

Traders should expect a cross above the signal line in the next couple of days to confirm the strength of the momentum and a new high in both the RSI and the MACD should come as a result of a break of the $39 barrier.

Question & Answers (0)