Futures Trading UK Guide 2022

Futures allow you to access trading markets that would otherwise be difficult to reach as a retail client. This includes hard metals like gold and silver, natural gas, oil, and wheat. You can also trade futures contracts on stocks, indices, and forex.

One of the main attractions of futures trading in the UK is that you have the option of going long or short on your chosen market. Additionally, you can also apply leverage of up to 1:30 when trading futures online.

But, futures trading is a lot more complex than simply buying or selling an asset, which is why we would have created this guide on futures trading in the UK. Here, we explain the ins and outs of how futures work, what risks and profit-making opportunities you need to understand, and how you can get started with a trading account today.

-

-

What is Futures Trading?

Futures contracts are hugely popular with seasoned investors as they allow you to trade the future value of an asset without taking ownership upfront. The main premise is that you need to predict whether the value of an asset will increase or decrease on or before the futures contract expires.

Futures contracts are hugely popular with seasoned investors as they allow you to trade the future value of an asset without taking ownership upfront. The main premise is that you need to predict whether the value of an asset will increase or decrease on or before the futures contract expires.For example, you might come across a 3-month futures trading market on crude oil. If the price of the contract is $50 per barrel, you simply need to determine whether you think oil will be worth more or less than this figure in three months’ time. If you speculate correctly, you will make a profit.

With that said, there is no requirement to keep hold of your futures contract until it expires. On the contrary, you can typically offload the contract at any given time. This allows you to lock in your profits early, or mitigate your losses. In terms of tradable markets, futures can be accessed on virtually any asset class.

This includes everything from stocks, oil, natural gas, currencies, wheat, and gold. In the UK futures trading scene, most brokers allow you to buy and sell contracts with leverage. This stands at up to 1:30 on currencies, 1:20 on gold and major indices, and between 1:2 and 1:10 on other asset classes.

How Does Futures Trading Work in the UK?

There is much to learn before you begin trading futures in the UK, as this particular segment of the financial markets is somewhat sophisticated. That is to say, you need to have a firm grasp of what trading and risk management options you have at your disposal before taking the plunge.

Below you will find an explainer on the key terms that you need to know when trading futures in the UK.

All Futures Contracts Expire

When you invest in a traditional asset like stocks and shares, you can keep hold of your equities for as long as you wish. Whether that’s 10 weeks, 10 months, or 10 years – the underlying asset can remain in your stock portfolio indefinitely. However, this isn’t the case when trading futures.

On the contrary, futures contracts will always have an expiry date. In most cases, each contract lasts for a period of 3 months and will expire on the third Friday of the respective month. When the futures contracts do expire, they need to be settled. In simple terms, this means that the holder of the futures contract has a legal requirement to buy or sell the underlying asset.

For example:

- Let’s suppose that you are holding futures contracts on Ford Motors stocks

- The futures contract consists of 100 individual stocks, at a price of $6 each

- If you are still in possession of the futures contracts when they expire, you are legally required to purchase 100 Ford Motors stocks at $6 each

- This would result in a total outlay of $600

As we cover in more detail shortly, whether or not you made a profit would depend on the market value of Ford Motors at the time the contracts expired. In simple terms, if you went long of the futures trade and the value of Ford Motors stocks was more than $6 per share on the date of expiry, you would make a profit.

All Futures Contracts Have a Price

In the example above, we explained that you purchased a futures contract on Ford Motors at $6 per share. This means that you can buy the stocks at the aforementioned price when the contracts eventually expire.

However, this won’t mirror the current market value of the respective asset. That is to say, at the time you purchased the 3-month futures contract, Ford Shares might have been priced at $5.50.

In terms of the stock price of $6 that was attached to your futures contract, this is what the markets perceive Ford Motors’ share will be worth in three months time.

It is therefore your job to precise whether the shares will be worth more or less than the futures contract price, on the date of expiry. This concept remains constant across all asset classes in the UK futures trading scene.

Minimum Futures Contract

When you buy or sell a futures contract, you are committing to a basket of assets. In the case of stock trading, one futures contract typically consists of 100 individual stocks. In other asset classes, the figure might be higher or lower.

For example:

- In the WTI Crude Oil market, 1 futures contract will equate to 1,000 barrels of oil.

- At $40 per barrel, this would ordinarily require an outlay of $40,000.

However, the good news is that most traders utilize leverage when accessing the futures market. This means that they only need to outlay a small percentage of the total futures contract. However, in the UK futures trading arena, retail clients are capped at a maximum leverage ratio of 1:30.

With this in mind, unless you are looking to risk thousands of pounds to access your chosen marketplace, it is much more cost-effective to trade CFD futures. More on this later.

Long or Short

Once you have assessed the fundamentals of your chosen futures market, you then need to decide whether you want to go long or short. In Layman’s terms, this means that you need to determine whether you think the asset will increase or decrease in value, on or before the date in which the futures contracts expire.

For example:

- Let’s say that a 3-month futures contract on gold is priced at $1,800 per ounce

- If you think that the value of oil will surpass this price over the coming 3 months, you will be going ‘long’

- If you think the opposite, then you will be going ‘short’

Thus, you have the ability to profit from both rising and falling markets. In other words, if you think that an asset is likely to go down in value, futures allow you to capitalize on this prediction.

Strategies When Trading Futures Contracts

So now that you have an understanding of how futures trading in the UK works, we now need to explain how seasoned investors make money.

Below you will find a couple of examples of how a futures trade would result in a profit.

Example 1: Going Long on Disney Stocks

As we explained earlier, going long on a futures trade means that you think the value of the underlying asset will increase on or before the contracts expire.

- The current price of Disney stocks is $130

- You purchase 1 futures contract on Disney stocks – which consists of 100 individual shares

- The futures have a 3-month expiry date and a contract price of $140

- A few weeks before the contracts expire, Disney stocks are priced at $150 on the NYSE

- This is $10 higher than your contract price of $140 per stock

- As such, you decide to lock in your profits by selling the futures contracts at your chosen broker

- As your futures contract consists of 100 Disney stocks, you made a total profit of $1,000 ($10 x 100)

As illustrated in the example above, most traders will offload a futures contract before the expiry date. Not only does this allow you to lock in your profits, but also limits your potential losses.

Example 2: Going Short on Crude Oil Futures Trading

Now let’s look at an example of a short futures position, which means that you think the value of the asset will go down.

- The current price of oil is $30 per barrel

- You purchase 1 futures contract on oil – which consists of 1,000 individual barrels

- The futures have a 3-month expiry date and a contract price of $27

A few weeks into the trade, OPEC announces that intends of increasing production levels – subsequently resulting in an overly of oil

- As such, the value of oil starts to tank in the open marketplace

- A few days before the contracts expire, oil is priced at just $20 per barrel

- This is $7 per barrel lower than the contract price of $27

- As such, you cash in your gains by offloading the futures

- Your futures contract consists of 1,000 barrels of oil, so you made a total profit of $7,000 ($7 x 1,000)

The above example illustrates how the UK futures trading scene gives you the opportunity to profit from falling markets.

Futures Trading UK: Supported Asset Classes

Futures trading allows you to access lots of financial markets.

This includes:

Stock Futures

Stock futures offer investors another way to trade equities. This is because you can go both long and short on your chosen market, as well as benefit from leverage facilities.

In most cases, financial institutions will only offer future markets on major stocks. In the UK, this would consist of leading FTSE 100 players like BP, Unilever, and Diageo.

If you’re interested in trading futures on US stocks, you’ll have access to a much broader number of markets. In the tech space, for example, this would include markets on Facebook, IBM, Amazon, and Apple.

Commodity Futures

Commodities are often the go-to marketplace for futures traders. This is because assets like gold and oil would otherwise be difficult to trade in the traditional sense.

That is to say, you would need to go through the burden of purchasing and physically storing the asset, which wouldn’t be viable. Instead, traders simply need to purchase or sell a futures contract without needing to take ownership of the asset.

Popular commodity trading markets available in the futures arena include:

- Gold

- Silver

- Platinum

- Brent Crude Oil

- WTI Crude Oil

- Natural Gas

- Wheat

- Sugar

- Soybeans

As long as the contract holder offloads the futures before the expiry date, there is no obligation to take delivery of the respective commodity.

Forex Futures

Futures are ideal for currency traders that wish to speculate on a longer-term basis. This is because conventional forex trading markets are based on leveraged financial products. That is to say, as forex is typically traded in lot sizes of £/$ 100,000 – investors will make full use of leverage facilities.

If this didn’t, they would need to put up an obscene amount of money just to access their desired currency pair. Although trading forex with leverage is beneficial for bankroll management, the main flaw is that you will need to pay an overnight financing fee for each day that you keep the position open.

This is like an interest fee that you pay to the broker for trading with more money than you have in your account. Crucially, this is where forex futures come into play. As each contract will usually have an expiry date of 3 months, this allows you to keep your position open for much longer without being hammered by overnight financing fees.

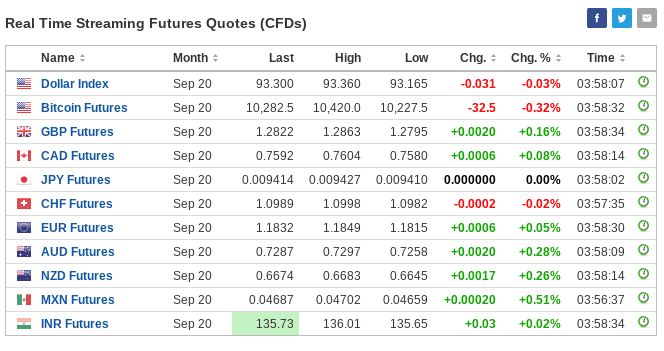

Crypto Futures

The CME Group – which is home to one of the world’s largest global derivatives marketplaces, allows institutional investors to get involved in Bitcoin futures trading. There is, however, a significant minimum requirement in terms of the contract value.

This stands at 5 Bitcoin per contract, so at current prices of just above $10,000/BTC – you would need to outlay at least $50,000. Of course, leverage is available, but the CME Group specifically is an exchange for larger-scale investors. With that in mind, one popular method is to trade cryptocurrency futures in the form of CFDs.

The CFD instrument will simply track the value of Bitcoin like-for-like, meaning that you can access the market without taking ownership of the underlying contract. In turn, this means that you can avoid the need to stake tens of thousands of pounds.

Why do Investors Trade Futures in the UK?

If you’re still unsure as to whether or not futures trading is right for you, below we have outlined some reasons why investors may trade futures in the UK:

Suitable for Longer-Term Trades

As we briefly noted earlier, futures are a popular alternative to leveraged CFD trading instruments. This is because you can keep your position open – usually for up to 3 months, without needing to worry about overnight financing costs. You do, however, need to factor in the fees of trading futures with leverage – as this is something that cannot be avoided.

Profit From Both Rising and Falling Markets

If you buy shares in the traditional sense, the only way (excluding dividends) that you can make money is if the stock price of the respective company goes up.

This leaves you in a somewhat restrictive position if you believe the shares will go down in value. But, with futures trading, you can profit from both rising and falling markets. This gives you much more flexibility in capitalizing on your market research.

Leverage Facilities

Most UK futures trading platforms give you access to leverage. Not only does this mean that you can trade with more money than you have in your account, but your potential profits (and losses) will be amplified.

In terms of limits, UK platforms are required to comply with the regulations set out by ESMA. This means that the amount of leverage that you can apply will depend on the specific asset class that the futures are linked to.

- 1:30: Major forex pairs

- 1:20: Minor forex pairs, gold, and major indices

- 1:10: Non-gold commodities, minor and exotic forex pairs

- 1:5: Stock CFDs

- 1:2 Cryptocurrencies

In simple terms, let’s suppose that you have £500 in your brokerage account and you trade futures with leverage of 1:10. This means that you are effectively trading with £5,000. In other words, your profits and losses will be amplified by a factor of 10.

Access Difficult to Reach Markets

In the day before financial derivatives, trading the future value on assets like oil, wheat, and gold would have been virtually impossible – especially for retail clients. But, the evolution of the UK futures trading scene means that you can now do this at the click of a button. As such, you can trade everything from soybeans, sugar, platinum, including the most popular Platinum ETFs UK and natural gas without ever needing to own or store the underlying asset.

What are the Risks of Futures Trading UK?

As is the case with all financial instruments, futures trading does present a number of risks that need to be considered.

This includes:

- You can lose money: Much like any other investment scene, you can lose money when trading futures. After all, you need to correctly predict which way the markets are likely to move in order to make money. If you don’t, you will make a loss.

- Risks of leverage: While leverage is great for being able to trade with more money than you have in your account, it is also fraught with risk. Put simply, if your futures position goes down in value by more than your margin balance, you will be liquidated.

- Complex: Futures contracts can be complex to trade. You will need to have a firm understanding of contract durations, strike prices, minimum lot sizes, and more.

- Settlement: When you purchase a futures contract, you are legally required to buy or sell the asset at an agreed date in the future. While most futures traders will offload their contracts before they expire, there is no guarantee that you will be able to do this.

Taking the above risks into account, you need to ensure that you have a firm understanding of how futures trading in the UK works before you part with your money.

Futures Trading Strategies

As futures contracts allow you to place sophisticated trades, there are heaps of potential strategies that you might want to consider.

This includes:

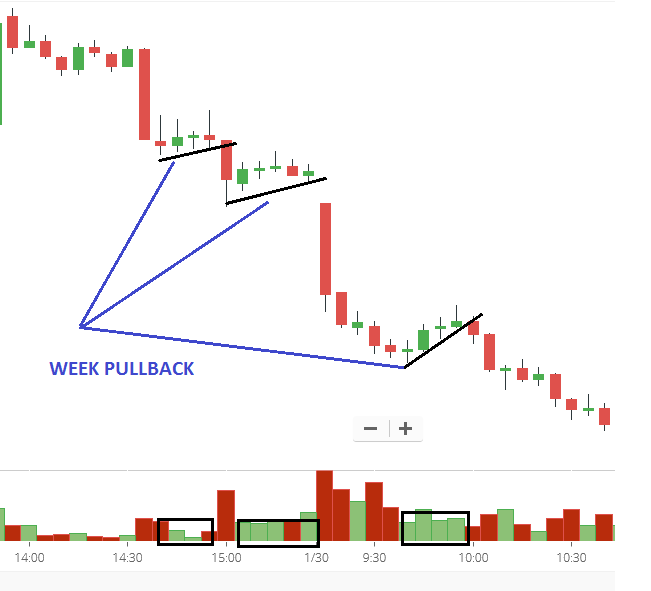

Market Corrections

When an asset goes on a prolonged trend, every now and then it will go through a market correction. This happens when investors exit their position to lock in their profits. For example, let’s suppose that Apple stocks have increased by 7% over the course of 7 days.

As some investors will look to cash out their gains, this might result in Apple stocks retracing by 2%. However, this isn’t to say that the upward trend is over.

On the contrary, this is just a short-term market correct. If this is the case, a seasoned investor might look to purchase long futures contracts on Apple stocks. In doing so, they are effectively entering the market at a 2% discount. If and when the upward trend resumes, they should be able to offload their contracts at a profit.

Hedging

Hedging refers to the process of mitigating the risks of an open position. For example, let;’s suppose that you have £20,000 invested in an ETF that tracks the FTSE 100. With the uncertainties of Brexit looming, you want to protect your investment. At the same time, you don’t want to cash out your ETF.

One method could be to short-sell some FTSE 100 futures. In doing so, you would buy yourself 3 months to make a decision on whether or not you should keep your ETF position open, or sell it. In theory, you’ll break even regardless of what happens to the value of the FTSE 100 while the futures contract is still open, as both potentialities are covered.

Trade on the Fundamentals

Fundamental analysis is the process of making trading decisions on the back of news developments. For example, let’s suppose that Amazon announces in its earnings report that it has smashed through market expectations on the revenues and operating profit. In turn, the value of Amazon shares would likely go on a short-term upward swing.

By purchasing long futures contracts on the announcement, you would have the chance to get in on the action at the start of the expected stock price bounce. Ultimately, in keeping up to date on financial news, you have a solid chance of predicting which way the respective futures market is likely to go.

What is Algorithmic Futures Trading?

Futures trading can be challenging if you’re a newbie investor. With that in mind, it might be worth considering the merits of an algorithmic futures trading strategy. In simple terms, you will be relying on an algorithm that has been built to trade futures on your behalf.

The software will scan the financial markets around the clock – constantly looking for trends that might influence the value of the asset in question. If and when a profit-making opportunity arises, the algorithm will enter a long or short position.

It is important to remember that the software does not have the capacity to evaluate fundamental news. On the contrary, it is focused entirely on the technicals. If you are interested in an algorithmic futures trading strategy, you will need to do some research on your chosen provider.

This includes historical trading results and what risk management tools the software is tasked with following. Upon purchasing and downloading the software, you will then need to install it into a third-party trading platform like MT4.

Popular Futures Trading Platforms in the UK

If you want to trade futures in the UK, you will need to find an online broker that meets your needs. In comparison to stocks, bonds, and other traditional assets – there are very few platforms that allow retail clients to trade futures.

Nevertheless, we have listed a selection of some popular futures trading platforms that serve UK investors.

1. AvaTrade

AvaTrade is an online futures trading platform that is regulated in multiple jurisdictions. It specializes in CFD instruments – with thousands of tradable markets available at the click of a button. This includes stocks, commodities, forex, and cryptocurrencies.

In terms of its futures trading offering, AvaTrade offers several asset classes. This includes indices like the FTSE 100 and Dow Jones, and hard metals such as gold. You can also trade futures contracts on government bonds, and agricultural products like corn, sugar, and wheat.

AvaTrade is a popular option with UK traders that are looking to access the futures arena without being hammered by fees. This is because the platform does charge any commissions. Instead, the fees are built into the spread. AvaTrade also supports MT4 and is one of the most popular MT5 brokers. It also offers social trading through the Zulutrade platform.

This gives you the option of deploying an algorithmic trading robot. If you like the sound of AvaTrade, you can create an account online or via your mobile phone. Minimum deposits start at £100, which you can fund instantly with a UK debit or credit card. Bank transfers are also offered, but this can take several days to process.

Futures Trading Fees 0% commission + spread Deposit Fees No Withdrawal Fees No Inactivity Fees $50 (£40) per quarter after 3 months of inactivity Monthly Account Fees No Sponsored ad. 79% of retail investors lose money trading CFDs at this site

2. IG

IG is a trusted UK brokerage firm that was first launched in the early 1970s. It holds licenses with multiple regulations, including the FCA. Its parent company is listed on the London Stock Exchange too.

In terms of its futures trading offering, IG allows you to access several marketplaces via CFDs. This means that you won’t own the underlying contract. After all, there is no legal requirement for you to buy or sell the underlying asset when the futures expiry.

Instead, you are merely trading the future value of the contracts. You can trade CFD futures on most asset classes as IG -all of which can be accessed with leverage. This sits in line with ESMA limits, meaning you’ll be capped at 1:30 on major currencies and less on other assets.

If you’re keen to explore other investment opportunities in addition to futures, IG offers 17,000+ CFD markets. You will also have access to over 10,000+ traditional shares, ETFs, and investment funds. You will need to meet a minimum deposit amount of £250 at the broker, which you can fund with a debit/credit card or bank transfer.

Futures Trading Fees £8 per trade (£3 for active accounts) Deposit Fees No (0.5% – 1% for credit cards) Withdrawal Fees No (£15 for international bank transfers) Inactivity Fees £12 per month after two years Monthly Account Fees No Sponsored ad. Your capital is at risk

How to Start Trading Futures in the UK

So now that you are armed with the required knowledge to trade futures, we are now going to walk you through the process of getting started with a brokerage account.

You are, of course, free to use any trading platform of your choosing.

Open a Futures Trading Account

Start off by opening an account with your chosen futures broker. You will also need to answer some questions pertaining to your identity and trading background.

Upload ID

You will be asked to provide a copy of your passport or driver’s license. This is to ensure that the broker is able to verify your identity.

Deposit Funds

Make your first deposit using one of the accepted payment methods. There may also be a minimum deposit threshold.

Browse Futures Markets

Once you have funded your account, you can browse the futures trading department.

Place a Futures Trade

Once you have selected a futures market to trade, you will need to select from a buy or sell position.

You will then be presented with an order box. This will ask you to enter a stake and your required leverage ratio. Once you confirm the order, the position will be matched at the next available market price.

Conclusion

Futures contracts can be difficult to master at first. After all, this particular trading scene is a lot more complex than simply buying and selling assets.

But, with the right knowledge of how things work, you have the option of placing much more sophisticated trades. This includes the ability to choose from long and short positions, and access your chosen market with leverage. Furthermore, you can exit your position at any given time before the futures contract expires.

If you’d like to trade futures, it’s important to partner with an FCA-regulated broker, so that you can trade as safely as possible.

FAQs

What is the difference between futures and options?

Both financial instruments allows you to trade the future value of an asset without taking direct ownership. However, it is the legal requirement to purchase or sell the underlying asset on expiry that sets the two apart. Crucially, while options give you the ‘right’ to buy or sell the asset, you will have an ‘obligation’ to do this when holding futures contracts on the date that they expire.

What are future CFDs?

Future CFDs allow you to trade futures without having a requirement to purchase or sell the underlying asset. Instead, the CFD is tasked with tracking the real-time value of the futures contract. This is why many UK traders opt for CFDs over traditional futures.

How much leverage can you get when trading futures in the UK?

UK retails can trade futures with leverage of up to 1:30 on major forex pairs, and less on other asset classes.

How long do futures contracts last?

In the traditional futures market, contracts typically have a duration of 3 months.

When do futures contracts expire?

Futures contracts will usually expire on the third Friday of the respective month.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up