Churchill Capital IV (CCIV), the SPAC (special purpose acquisition company), that is taking Lucid Motors public, rose 7% yesterday and was up in US premarket price action today also. Is more upside on the cards for the shares?

There was a broader uptrend in Electric vehicle (EV) shares yesterday and Fisker, the EV startup that went public last year, also rose sharply. Tesla, NIO, and Lordstown shares were also higher.

EV shares

EV shares have gone through a boom-bust cycle in 2021. The year started on a positive note for EV shares and most of them including Tesla went on to hit new all-time highs. There was an almost unending appetite for EV shares among investors. Amid the euphoria over the green energy theme, CCIV announced a merger with Lucid Motors.

CCIV shares fell after the

CCIV shares rose as high as $65 on the merger rumours. However, the shares tumbled after the merger was finally announced. The merger with CCIV valued the combined entity at an equity value of $24 billion. While the deal’s terms were reasonable to both CCIV and Lucid Motors shareholders, the steep rise in CCIV shares on the merger rumours played the culprit. There was almost no way that the steep rise in CCIV shares, where it rose almost 550% from the IPO price, could have been justified.

CCIV shares have recovered

Meanwhile, CCIV shares plunged after the merger news. The shares fell below $20 and at one point of time, they looked set to breach the $15 price level at which the PIPE (private investment in public equity) was priced. While almost all the SPACs price the PIPE investment at the IPO price, CCIV priced it at $15 which was some succour for CCIV shareholders.

Meanwhile, there has been some uptrend in CCIV shares and they are up 27% so far in June. The uptrend is not limited to CCIV shares and there has been a rise in all EV shares. EV shares had tumbled amid the sell-off in growth names. Barring Tesla, all other pure-play EV companies are making losses. Amid the rise in US interest rates, loss-making growth companies fell out with investors. These companies have all their earnings skewed to the future which makes the future cash flows less attractive in current dollar terms amid the rise in long term interest rates.

EV shares are getting mainstreamed

Meanwhile, EV shares are getting mainstreamed. Tesla was added to the S&P 500 Index in 2020 and now the Russel 3000 is adding several companies in the EV ecosystem. These include Fisker and Lordstown Motors. It is also adding solid-state battery maker QuantumScape as well as charging infrastructure companies ChargePoint and Blinks Charging to the index.

The inclusion of green energy companies in major indices is a sign that they are no more a mere concept and are going mainstream. Meanwhile, the outlook for EV shares is generally positive as the pivot towards zero-emission is for real. The only topic worth debating is the pace of the change.

CCIV shares

Talking of CCIV, looking at the current share price, Lucid Motors is valued at a proforma market capitalization of $40 billion. While the valuation might look high, it is only about 6% of Tesla’s $630 billion market cap. Looking at the Lucid Air model, Lucid Motors looks like a worthy competitor to Tesla after it completes the merger with CCIV.

Lucid Motors expects to begin the deliveries later this year. The company’s Air model has received good reviews and looks like a strong competitor to Tesla’s luxury Model S sedan. Earlier this month, Tesla launched the Model S Plaid but the company went back on the Plaid+ model which would have had a higher range as is the case with Lucid Air.

Lucid Motors

Meanwhile, there is strong momentum in CCIV shares amid the broader uptrend in EV shares. The company expects the merger to be complete next month and might soon announce the voting day. The shares might see some upside in the near term amid the positive sentiments towards EV shares.

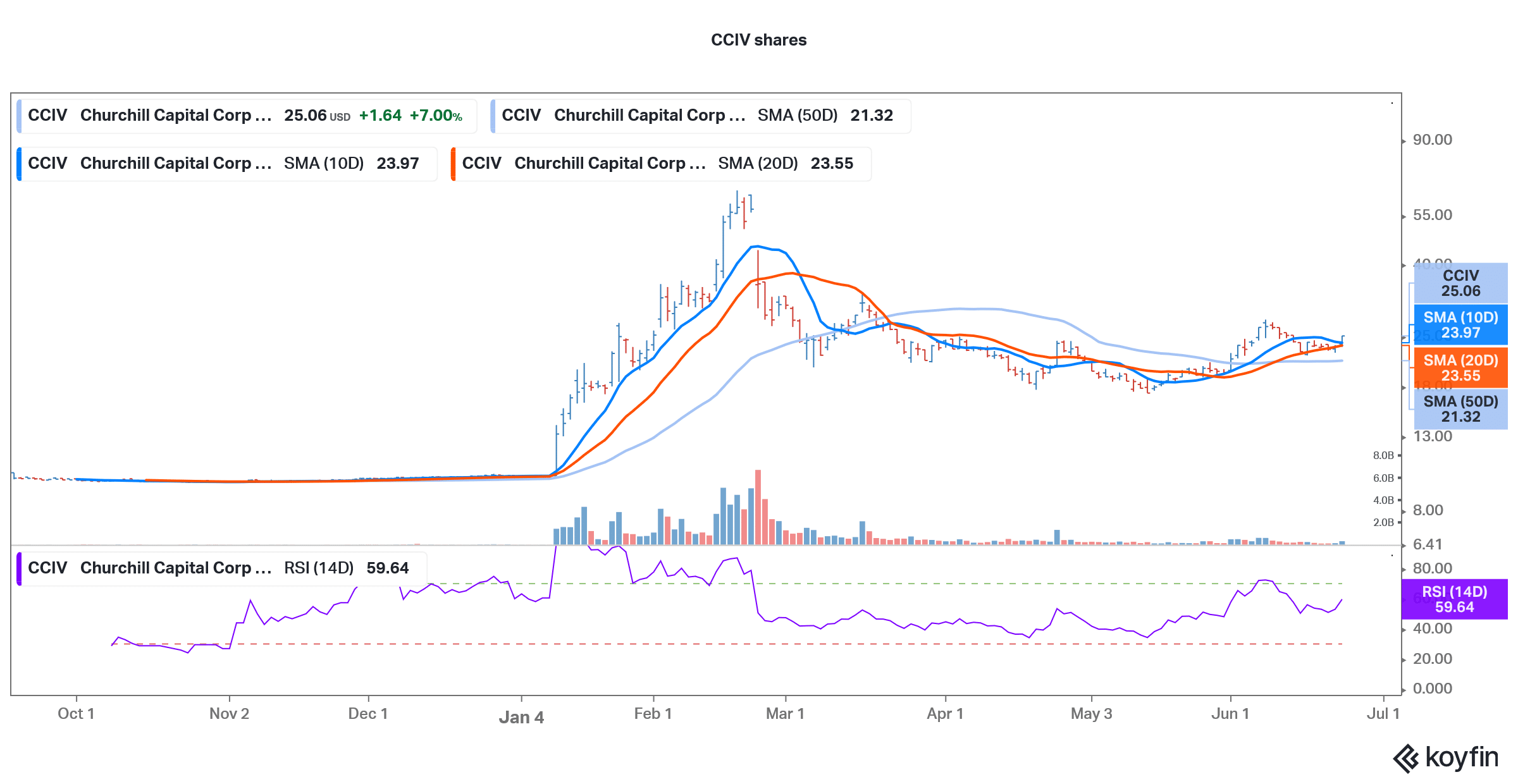

CCIV shares trade above their 10-day, 20-day, and 50-day SMA (simple moving average) which signals a short-term uptrend. The 14-day RSI (relative strength index) of 59.6 is, however, getting near overbought levels.

Strong momentum in CCIV shares

CCIV shares were trading 1.7% higher in US premarket price action today as the EV rally looks set to continue. However, from a fundamental perspective, a lot of EV shares have started to look overvalued especially considering the formidable competition from legacy automakers like Ford and General Motors, both of which have spiked in 2021 and are outperforming the pure-play EV companies. Most of EV shares are trading with year-to-date losses despite the recent rally.

Question & Answers (0)