Investment Newsletters 2026 – Reviews

If you are still finding your feet in the investing world signing up to one or more investment newsletters can be one tool when it comes to learning the ropes.

If you’re more of an experienced trader, newsletters are an effective way of keeping up with volatile market conditions. It’s also a way to stay up to date with the latest economical and financial news, which as you know is extremely important in this industry.

So where does one start when there are just so many investment newsletters to choose from? If you are interested in improving your financial IQ, then read on.

-

-

Investment Newsletters for Beginners:

The Street

The Street newsletters provide the most recent and relevant information about the financial sector as well as the economy. They are written in a way that is considerate of both beginners and experts alike, so you won’t have trouble understanding the content.

The site’s newsletter subscribers receive a detailed weekly rundown of any big events in the market. Besides this, you can expect a warning of a potential market reversal, analysis of the latest opportunities and some tips for investment success.

This newsletter is going to help you to make informed choices based on where the market as a whole is heading. The Street is committed to helping you gain a deep understanding when it comes to the rudimentary analysis of selecting stocks for your portfolio.

The company also provides access to ‘Jim Cramer’s Action Alerts’. Whenever Cramer makes a suggestion of which shares to buy or sell – you will get an email alerting you.

Some traders find the information a little bit too broad and not as ‘to the point’ as some other newsletters. But bear in mind that once you have an idea of what kind of assets you are interested in, you can just concentrate on those.

Therefore the information which is relevant to your trading style will be helpful and insightful in the long run.

Nate’s Notes

Nate’s Notes is another insightful newsletter worth signing up for if you are an investment beginner. The content is suitable for both seasoned traders and newbies, with the focus being on guiding you when it comes to a long term investing approach and growing your stock market wealth.

This newsletter can be fully utilized to aid you in making more informed investing choices. Currently, a 1-year subscription costs $289, and you may cancel at any time you wish.

Finimize

Finimize is a daily publication brought straight to your email inbox. If you like a daily investment newsletter then you’re in luck. Not only this, but it is free of charge. The newsletter is educational and simple due to the everyday language it uses.

Many new traders comment on how helpful they find it, not only the newsletter but also the website.

If you are just starting out in investments, and want to feel more empowered and confident about handling your money and finances then Finimize could be one investing newsletter for you to start off with.

Stock Investment Newsletters:

Linde Equity Report

The Linde Equity Report is one of the most popular investment newsletters for people who like to trade stocks. When subscribing to this newsletter you can expect new stock recommendations every month.

Originally founded with the idea of offering advice to individual investors, this company favours quality over quantity when it comes to stock strategies. This means that when you receive your picks every month, you can be sure that it’s been a highly selective process.

The publication has been an award winning investing newsletter on more than one occasion over the decades, and the professionals behind it believe that selectivity is the key to its success. Its investment philosophy is heavily influenced by the likes of investing legends Peter Lynch and Warren Buffett.

The stocks highlighted in this resource can sometimes be aggressive, so it’s suited to investors who are tolerant of volatility. Many of its subscribers utilise the newsletter as more of an accompaniment to a cautious financial strategy. It’s a way to keep a balance you feel comfortable with.

Should you decide to invest in a featured equity you will be given monthly updates on that stock until it has been sold. The company will monitor every stock suggested on the market and they also publish its performance.

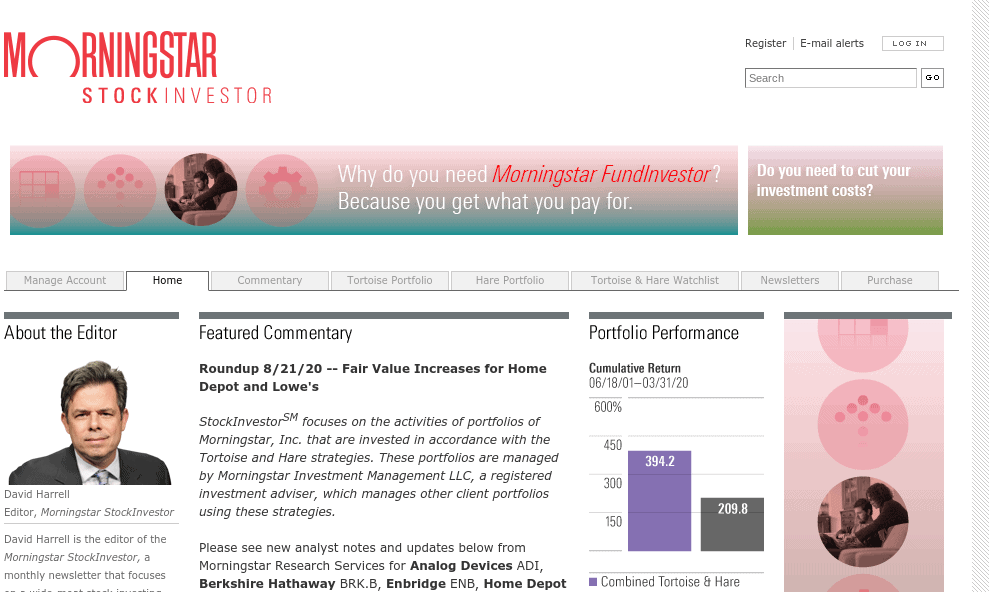

Morningstar

As regards to Morningstar, we are stretching the rules a little bit, as it’s not just an investment newsletter per se. Regardless of this, we think that as far as investment newsletters go this is an all-rounder. It’s been around for many years and the rating system by Morningstar is known throughout the investment sector.

By subscribing to this company you are certain to gain some insight into stocks, ETF’s, bonds, funds, and even financial planning. When it comes to research, this company is considered to be very perceptive.

If you are an investor who likes to use the fundamental/value approach to investing then Morningstar is popular with investors. There is a free basic account available, and also a free 14-day trial if you are considering a premium account but are not sure if it is for you.

For those of you who prefer to listen to your investment information, there’s also a podcast available.

Morningstar charges $29.99 per month for its premium membership investment newsletter. It is worth mentioning that if you are into chart reading as part of your strategy, then this newsletter is probably not for you. This is because the company is not going to be going into any technical chart evaluation.

Five on Friday

Now a brief mention for ‘Five on Friday’. Every week MyWallSt’s newsletter delivers to you five of the key reports from the financial market during that week. And as the publication name suggests, this free newsletter is sent out every Friday.

You will notice that this company focuses on stocks such as Zoom (NASDAQ:ZM), Teladoc (NYSE:TDOC), and Square (NYSE:SQ). Essentially, MyWallSt tends to focus on the stocks they are currently most interested in.

Value Investing Newsletters:

ValueWalk

Let’s start with the ValueWalk newsletter. When subscribing to this one you will receive news on large asset managers, hedge funds, and of course value investing. The publication is free. ValueWalk is very well respected within the investment space, namely due to the authoritative style of breaking financial news.

The company also investigates reports by big fund stories, concerning significant events with huge and well-known hedge funds, general performance, and personnel changes. If you are looking to have the latest breaking investment news delivered to your inbox then ValueWalk won’t disappoint you.

ValueWalk offers a strong value investment structure, and in addition to the newsletter, its website is full of valuable information. This company’s coverage of news has even been known to affect and move markets and stocks. The team behind ValueWalk are no amateurs.

For instance, the Chief Information Officer, Walid Al Hajj, has over 20 years of experience in turning out value propositions.

The Manual of Ideas newsletter was born from the hugely popular book title ‘The Manual of Ideas: The Proven Framework for Finding the Best Value Investments’ by John Mihaljevic. The vast majority of seasoned traders have heard of this investment book.

The Manual of Ideas (MOI)

MOI Global (as it also goes by) believes in creating a loyal base of investment subscribers. This newsletter wants to build a long-term and valuable service for people who are genuinely passionate about investing.

This newsletter is so popular amongst investors that it has a waiting list for new members. The company likes for its members to become part of the family (or community if you will), often hosting offline and online events.

In fact, MOI Global goes one step further and is always thinking up new ways to create opportunities for its members to interact with each other, investor to investor. If you’re eager to learn or are just passionate about investing then the MOI company’s newsletter is probably going to be worth every cent. The premium plus monthly subscription package is going to cost you $1,237.

Vintage Value

Now a mention for Vintage Value investment newsletter. It’s free of charge and will hit your email inbox every week. The company has thousands of investors subscribing to its publication. You can look forward to weekly tips and tricks, articles, strategy ideas, and value investment insight.

If you use an RSS reader then you can also add the Vintage Value blog. In doing so, you will have value investing articles delivered to your inbox on a daily basis.

Free Investment Newsletters:

Free Trade Ideas Plan -Trade of The Week

Often shortened to ‘Trade-Ideas TOW-newsletter’, subscribers to this newsletter can expect weekly trade inspiration based on statistics. It’s an idea to add these stocks to your watchlist and create a stock alert.

The free version of the newsletter enables traders’ right of entry to the ‘live trading room’ as well as the ‘channel bar’ and ‘delayed market data’ (there is a 15 to 20-minute delay). With this free insight, you will be able to research the price movements of the stocks suggested by Trade-Ideas.

There are paid versions of this newsletter offering more, but we think as free investment newsletters go – you can’t really go wrong.

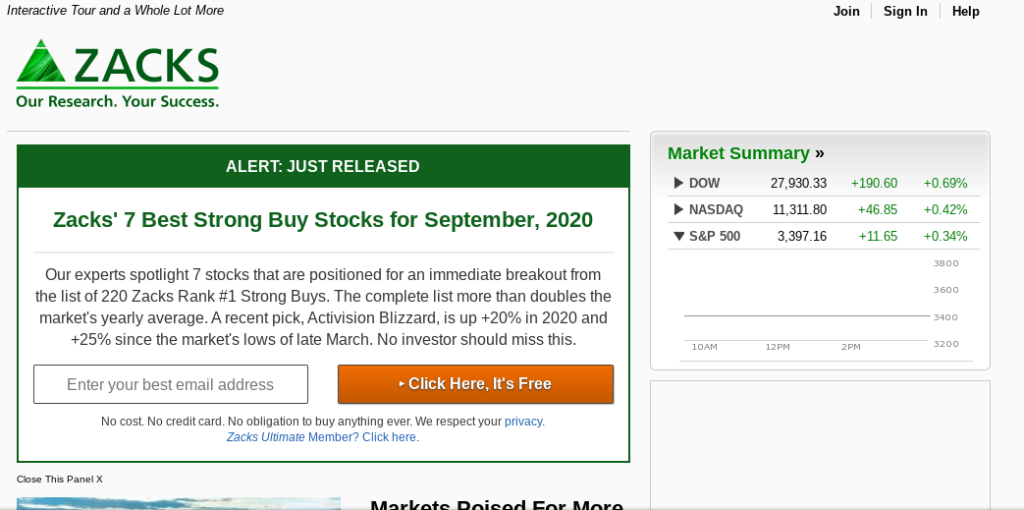

Zacks Investment Research

Zacks Investment Research is a free daily newsletter. Subscribers can expect to receive an email each day before the market opens. This company’s motto is ‘profit from the pros“. The publication includes ‘Zacks Rank’ for all mutual funds, ETFs, and mutual funds within your portfolio.

Your daily email will let you know if any of the rankings have gone up or down. This is a way to help you decide whether you want to buy more, hold or sell. The newsletters also include any changes in broker suggestions, estimated revisions on earnings, and the latest Zacks Investment Research news.

Morning Brew

A quick shout out to Morning Brew, an investment newsletter that is a little daily extra for any investor. Each day you will be updated with all of the day’s most important financial news as well as geopolitics, real-estate appraisal, and more.

Real Estate Investment Newsletters:

Coach Carson Weekly

This monthly newsletter covers everything you need to know about real estate, and it’s free of charge.

Subscribers can expect to receive advice on creating a passive income from investing in real estate and how to find deals whether the market is hot or not.

Carson’s newsletter is also helpful if you want to increase your financing and down payments. The publication will aid you in analysing numbers and create strategies that will help you to manage your properties more smoothly.

If you’re interested in real estate investing but don’t know where to begin then signing up for this newsletter is only going to help you. This publication aims to help you gain some insight into how to successfully balance investments, work, and life.

Kiplinger’s Personal Finance

Another monthly publication worth a mention in this field is Kiplinger’s Personal Finance newsletter. Every month several experts cover a selection of investing topics such as real estate, financial trends, bond investing, planning your retirement, and individual stocks.

Kiplinger sends subscribers advice on low-cost and long-term investing, which is ideal for young investors. Overall it is a very comprehensive newsletter and you can sign up for $12 per year or $34.95 for an annual subscription.

Overall Popular Investment Newsletters

When it comes to newsletters, some cover all aspects of trading, whereas some are for people specifically interested in one investment type. Investment newsletters will give you a solid framework to purchase stocks on, as well as bringing you all of the latest news.

If you are particularly passionate about investing then The Manual of Ideas (MOI) investment newsletter might be worth the hefty price tag for you. It is considered by many to be the leading newsletter of its kind.

Morningstar, who we covered further up, is an all-rounder as investment newsletters go. It covers a variety of different assets and offers some invaluable advice. The website offers investors various tools as well.

One we haven’t mentioned is the Bloomberg investment newsletter. This one is excellent for in-depth articles and news covering politics, industries, technology, finance, global economics, and markets. You can subscribe to Bloomberg for $9.99 per month.

Conclusion

There are hundreds of companies out there offering unmissable newsletters to traders. All claim that they will make you a stock and market expert. If it’s a paid newsletter it’s an idea to do some research first, as we have.

Another option is to look out for free trials to take advantage of before you commit to an annual subscription. This way, you can be more sure you are going to get value for money.

As well as these insightful newsletters, one tool for stock investors is eToro. If you’re fairly new or lacking confidence when it comes to investing then you can copy an experienced investor.

FAQs

Do I have to pay to receive investment newsletters?

Not necessarily. There are some free newsletters available, such as ‘Zacks Investment Research’ and ‘Free Trade Ideas Plan’.

Do I need to subscribe to a different newsletter for each type of investment?

No. Whilst some newsletters focus on one particular type of investment, some cover a variety. For example, Morningstar, ‘Kiplinger’s Personal Finance’ and ‘Zacks Investment Research’.

What is the an investment newsletter for financial news?

ValueWalk is said to be one of the leading resources of up to date financial and economical news when it comes to newsletters.

How can I subscribe to an investment newsletter?

Generally speaking, in order to subscribe for an investment newsletter all you have to do is go to the website and enter your name and email address.

I am new to investing. What is the right investment newsletter for me?

There are a few standout newsletters for beginners. ‘Finimize’ is one investing newsletter if you want daily updates explained in a non-complicated way. Also, it is free. ‘The Street’ and ‘Nate’s Notes’ are also aimed at beginners.

What if I don’t want to read my investment newsletter?

The vast majority of investment newsletters also come in the form of an investing podcast. Another option is to simply download a text to speech app and have someone read it to you aloud.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.