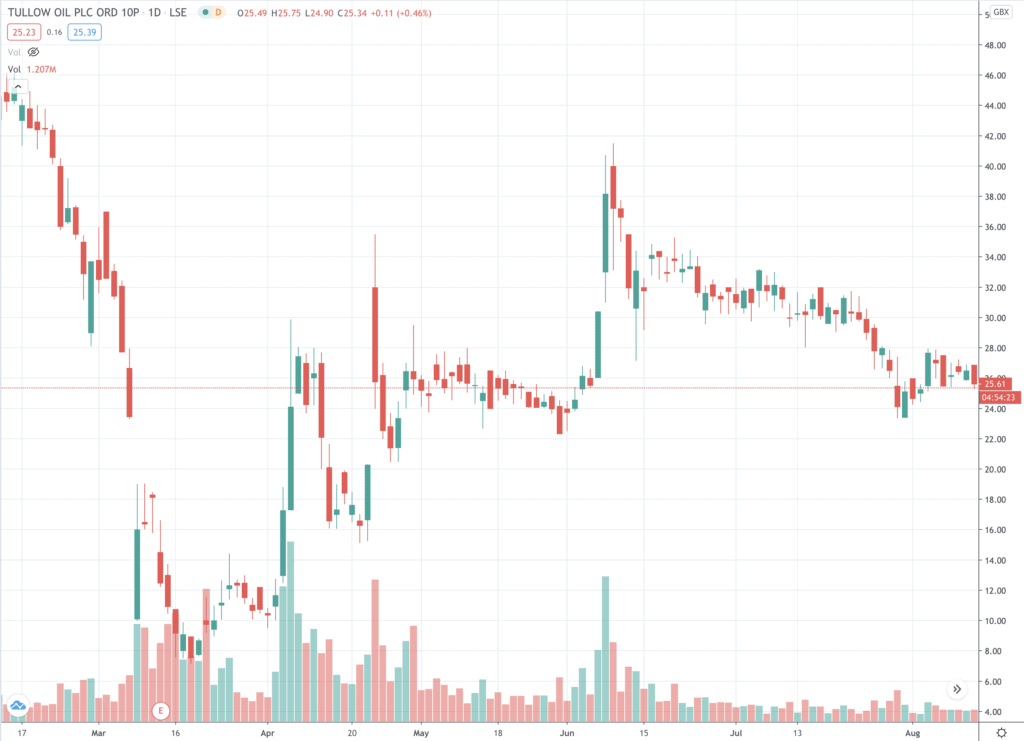

Tullow Oil (TLW) is working hard to sweat its Africa oil assets, but does the company have the time to recover? Currently priced at 25.6p, the shares were trading as high as 41p on 9 June.

Although Tullow beat forecasts for barrels of oil per day (bopd) at 77,000, with 75,000 expected in the first half, Tullow took a brutal pre-tax impairment charge of between $1.4 to $1.7 billion.

First-half revenue was $700 million on a realised oil price of $52, compared with last year’s first-half performance of $1.3 billion.

Sale of its Uganda operations will bring in $575 million in addition to “proceeds from portfolio management in what continues to be a challenging external environment for asset sales and farm downs [selling on drilling and development rights to third parties].”

There’s also the Ntomme-9 production well coming on tap this month and the company is contracting a rig for its Suriname prospect where drilling begins in the first quarter of 2021.

Meanwhile, not such good vibes from Kenya. Here its joint venture with the government has seen force majeure invoked, which has stalled the project. “Constructive discussions are ongoing with government,” Tullow says.

But with 95% up time on its main platforms “operational performance has been strong”, and production at Ghana’s Jubilee and TEN (Tweneboa Enyenra Ntomme) fields saw “good performance”, the company’s trading update confirmed.

Tullow debt pile grows

For all of its hard work though on maintaining operations at an efficient pace, the weight of past development missteps, the debt pile it already had before Covid and the new “low price oil environment”, means Tullow Oil is having to move fast and decisively to get the company back into profit.

Of the nineteen analysts surveyed by Refinitiv three have a sell, three an underperform and 10 a hold, with just one buy and two rating the stock an outperform.

That provides a reasonable summation of the consensus outlook – decidedly gloomy.

Consensus full-year revenue was $1.28 billion so the half-year is in the right ball park, but it in the debt where the black hole lurks. Net debt is a hefty $3 billion with free cash flow and “liquidity headroom” of $500 million projected at half year.

Rahul Dhir, chief executive of Tullow Oil, said: “Tullow has performed well; delivering production in line with forecast, agreeing the sale of the Ugandan assets and re-shaping the Group’s structure and cost base.”

Dhir joined Tullow as chief executive on 1 July.

He expects in the second half to keep operations in Ghana running safely and reliably, reducing debt and focusing on cost reduction.

Uganda disposal helps with repair job

Tullow is fortuitous to have the proceeds of the Uganda disposal to help repair its balance sheet. After suspending its dividend, the days when investors thought that Tullow was on the cusp of becoming a dividend cash cow feel a long way away.

Instead, Tullow is struggling with higher-than-the-average production costs in what it calls a “low-price environment”. With the firm hoping to breakeven on cash flow by year’s end, there may be light at the end of the tunnel.

However, less favourable analysis points to over-optimistic hopes on the oil price averaging $60 a barrel

Crude oil benchmark WTI is currently priced at $41.8 and Brent at $44.8. Tullow breakeven for oil production is $35.

If industrial production continues to pick up in China and the global recovery continues – or at least there are no pivotal reversals – then perhaps a $60 oil price could come into view.

Unfortunately for Tullow Oil and the other producers though, the price may not firm much more than it already has.

No plan B beyond oil for Tullow

And not being an oil major, Tullow doesn’t have the resources of say BP, to pivot to renewables (or carbon-zero). There is no plan B beyond oil for Tullow.

Advantages for Tullow include being in the fast-growing west Africa region and having its main operations in a politically stable state. Providing it can continue to reduce its cost base and embed and deepen recent operational efficiency gains, then the firm may be able to buy itself valuable time.

Looking at its oil company peers, the depth of the problems at Tullow Oil are revealed on the net income line.

Where as Tullow shows a deep loss of £1.3 billion, most others are in the black, such as Premier Oil on £118 million, Cairn Energy £91 million, Gulf Keystone £33 million and Independent Oil & Gas £15 million. Enquest, with a similar revenue number to Tullow, had negative net income of -£343 million.

Tullow Oil a sell, hold or buy?

If you already hold it, then the share price may be past the worst, but there could be a second wave that sends the oil price south again. That’s the race against time we were talking about.

If you already hold Tullow Oil, then there’s probably no good in crystallising loses at this juncture but could offload some if you think there’s more weakness ahead. Those with no interest my prefer to see the price shave some value first before betting on the oil recovery theme.

Let’s not be too alarmist here though. Tullow is strong enough to get through a deeper and longer one than that expected before the summer, judging by the fundamentals of its balance sheet.

The lack of clarity, crowded out as it is by uncertainty, means if you are committed to the oil story and think it will be a while before the world is carbon neutral, then Tullow Oil has quality assets on its books. The ability of Tullow and some other pool companies to stand the blast from a second wave of lockdowns could be in doubt.

For those considering shorting the stock using a CFD or spread betting, on 23 July Tullow Oil was the fifth most shorted share in the UK market, according to data compiled by Granite Shares.

Question & Answers (0)