How to Buy Provident Shares Online in the UK

Provident Financial plc is a UK-based sub-prime lender that specializes in loans to the non-standard credit market. This financial service firm provides credit options for those whose needs are not approved by the mainstream credit market.

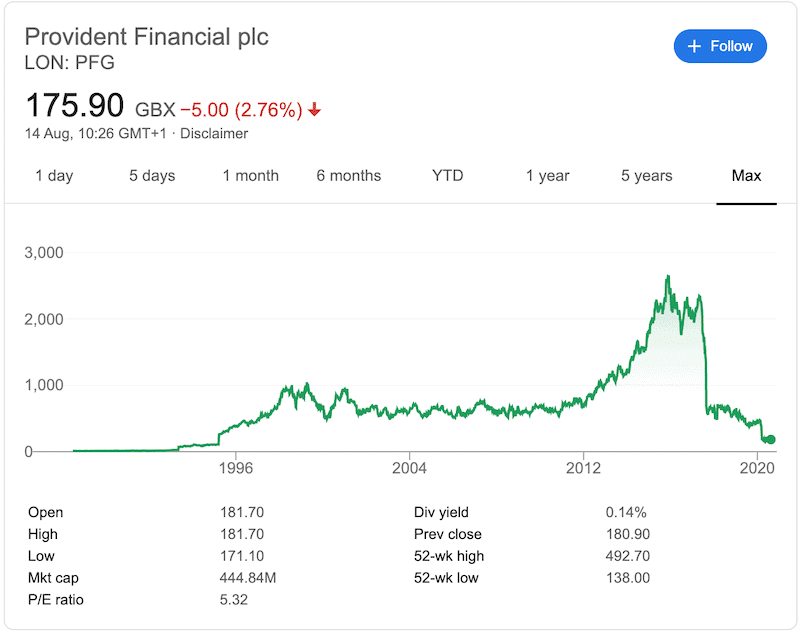

Since 2015, Provident has been on the ropes and its share price is trading on a long downtrend. So, is now a good time to buy or sell Provident shares?

If you’re a UK investor looking to buy or sell shares of Provident, this guide is for you. We’ll show you how to buy Provident shares online in the UK, suggest top brokers, and take a closer look at Provident financial’s share price and outlook for the future.

Below, we suggest regulated brokers in the UK that allow you to buy shares online in the traditional way as well as through CFDs. IG Markets is popular because it permits access to over 12,000 shares and more than 17,000 markets to trade on. This broker has a flat-fee commission structure, which starts at £8 per trade if you place less than three orders per month. Otherwise, you can reduce the commission to £3 per trade. If you prefer to trade Provident Financial shares with leverage, IG allows you to do that via CFDs. IG offers a wide range of market insights, advanced trading tools, and MetaTrader4 compatibility. If you’re looking for a trading platform for beginners, you can opt for IG’s proprietary trading software. Alternatively, IG offers the MetaTrader 4, ProRealTime, and the L2Dealer. Finally, IG holds licenses with several regulatory bodies, including the FCA in the UK and ASIC in Australia. Investors need to meet a minimum of £250 in order to open an account, which can be funded with a UK debit/credit card or bank account. Pros: Cons: Whether you’re investing in stocks of Provident of other financial companies such as Metro Bank or Lloyds, it’s always important to do your research before you put your money on the line. Since 2015, Provident Financial plc has been facing many challenges and difficulties. The company lost two-thirds of its value in one day in 2017, following a second profit warning in two months. But that’s not all, Provident Financial shares encountered a turbulent time due to the replacement of its chief executive, cancellation of a shareholder dividend payment, and the announcement of an investigation by the FCA. Shares continued the downward trend during 2020 as the negative impact of the COV-19 pandemic weighs on the markets. However, most of these have been priced into the share price. In this section, we’ll cover all the basics you need to know in order to decide if Provident is the right investment for you. Provident Financial was established in Bradford, England in 1880 by Joshua Kelley Waddilove who had the vision to provide affordable credit to families and individuals in West Yorkshire. By the time Sir Joshua died in 1920, Provident Financial plc had grown into a nationwide business with more than 5000 employees. The chain has eventually grown to 23 branches by the end of 1982. As of 2020, the company has around 2.4 million customers, and several operations in Central Europe, Mexico, Romania, the United Kingdom, and the Republic of Ireland. Provident Financial was first listed on the London Stock Exchange in 1962 and is a constituent of the FTSE 250 Index. A glance at the company’s all-time chart shows that the share had an impressive run since the early 90s, but as mentioned before, Provident Financial plc management has been trying to rebuild its business after years of market-share losses. The share peaked in late 2015 where it hit 2602.33p per share. The Provident Financial share price continued its downward trajectory since 2015 and as the COV-19 pandemic came to fruition, another drop has added fuel to the fire. Today, Provident Financial shares are priced at 175.40 as of August 2020, the lowest level since the mid-90s. As a Provident Financial plc shareholder, you will be entitled to dividends payment once a year. This company generally pays out 57% of its earnings as a dividend, which is equal to a yield of around 5.1% and in the current price, equates to about 0.25p per share. This generous dividend policy is a great incentive for investors who are looking for a fixed income in the form of earning distributions. With this in mind, it is crucial that you do some research on the company before making an investment. As such, below you will find reasons why you should buy shares of Provident Financial plc. According to analysts, Provident Financial PLC presents a relatively strong balance sheet that will help the sub-prime lender to weather the coronavirus recession and emerge into a market with fewer competitors. Some of the most notable competitors of the company such as BrightHouse, Amigo, and other payday lenders, have experienced difficulties during the past months. This will ensure that Provident Financial plc remains a dominant player in the industry whenever the coronavirus pandemic ends. The change of business model is seen as a necessary step for the company to overcome the difficulties of the past years. Since 2018, the sub-prime lender has been at the forefront of changing its business model following the FCA investigation. As such, Provident home credit has changed its employed business model and became authorized by the Financial Conduct Authority (FCA) in late 2018. It has also implemented the home credit part of the high-cost credit review in 2019. Moreover, the company announced that it has joined the Northern Powerhouse Partner Programme to increase its involvement in the North of England. In July 2020, the Board of Provident Financial plc has confirmed the appointment of ex-Minister Margot James as the new non-executive director of the company. It appears that Provident Financial has adapted well to the COVID-19 crisis and its capital and liquidity positions have remained strong. The company’s P/E ratio stands at a modest 5.48, which simply means that the share is trading at a discount or investors are pessimistic about the company’s future prospects. Nevertheless, Provident reported annual revenues of £998.30 and a net profit of £84.40 in 2019. In the same year, the company also reported EPS of 33.30p and dividend per share of 25.00p. Provident Financial plc is expected to release its half-year 2020 earnings release on August 26. It’s hard to be decisive about whether Providentshares are under or overvalued. What’s more, the coronavirus is a double-edged sword for Provident Financial plc. On the one hand, if the economy slows down, the business of Provident Financial also slows down. On the other hand, this company provides personal credit products to the non-standard lending market, which is a market that might be booming during the Covid-19 economic recession. When taking into account that the share price is on a downtrend since mid-2015 along with the wider impact of the Covid-19 pandemic, it will require investors to be extremely patients when buying this share. Ultimately, it is a legitimate investment for investors who are looking for a long-term position. This company has a high dividend yield, and analysts suggest a price target of between £195-£459. In summary, the market sentiment around Provident Financial shares has been anything but positive since 2015. Its year-to-date return stands at -61.01% and its 1-year return stands at -49.79%. While it’s not clear whether the downtrend has reached its bottom, there’s a strong feeling that Provident shares are trading at a discount. If Provident shares will return to its pre-pandemic price levels at around £400 per share, this would represent an increase of 228%. Simply click the link below to get started!

Shares of Provident Financial plc are traded on the London Stock Exchange under the ticker symbol PFG. It also has a secondary listing on the Frankfurt Stock Exchange under the ticker symbol PRVA.F.

Yes, Provident Financial typically pays dividend payments once a year. An interim dividend during November and its final dividend in the following June.

Yes, as long as you buy the CFD contract before the ex-date, you will receive a dividend payment from your broker.

Each online stockbroker will have a different policy on minimum investment amounts. If opting for CFD trading, you can buy fractional shares of a company. WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site. Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy. Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

Step 1: Find a UK Stock Broker That Offers Provident Shares

1. IG – Trusted UK Share Dealing Platform with Competitive Fees

Step 2: Research Provident Financial Shares

Provident Share Price History

Provident Shares Dividend Information

Should I Buy Provident Shares?

Strong Balance Sheet

A Change in Business Model

Strong Capital Position

Provident Financial Shares Buy or Sell?

The Verdict

FAQs

What stock exchange is Provident Financial plc listed on?

Does Provident Financial pay dividends?

Can I collect Provident Financial dividends when trading CFDs?

What is the minimum number of Provident Financial shares that I can buy?

Tom Chen