How to Buy Boohoo Shares UK – Beginner’s Guide

eToro: Buy the Best Shares With 0% Commission

Launched in 2006, Boohoo is one of the fastest-growing online fashion retailers in the UK. In fact, it recently hit a market capitalization of over £6 billion. Not bad for a firm listed on the UK’s secondary exchange – the AIM.

In this article, we show you how to buy Boohoo shares online in the UK.

-

-

Find a UK Stock Broker

Although the company has a multi-billion pound capitalization, Boohoo shares are listed on the Alternative Investment Market (AIM). As the UK’s secondary stock exchange, this does make it slightly more problematic in finding a suitable stock broker.

Although the company has a multi-billion pound capitalization, Boohoo shares are listed on the Alternative Investment Market (AIM). As the UK’s secondary stock exchange, this does make it slightly more problematic in finding a suitable stock broker.For example, not only do you need to ensure that your chosen platform offers Boohoo shares, but it’s also important that it has a license from the FCA.

The good news for you is that we have sourced some of the most popular UK stock brokers currently listing Boohoo shares – which you’ll find below.

1. IG

IG is a trusted online brokerage firm that traces its roots back to 1974. On top of licenses with the FCA and ASIC, its parent company is also listed on the London Stock Exchange. In terms of its online investment services, IG covers traditional shares, CFDs, and spread betting. This gives you ample opportunities to profit from the rise and fall of stocks like Boohoo.

Its share dealing platform contains over 10,000 equities, which covers hundreds of UK companies. Outside of the UK’s LSE and AIM, you can also buy shares in international firms. This covers the US, Canada, Australia, South Africa, and Germany. If you fancy trading stock CFDs, its library hosts over 13,000 instruments. This also includes Boohoo CFDs.

When it comes to fees, you will pay an entry-level commission of £8 per trade. This means you will pay a fee when you buy shares and again when you cash them out. If you are trading large volumes, you will not get penalized with a variable rate. If you manage to place more than three orders in a single month, then you will have your commission reduced to £3.

We should also note that the spreads are very competitive at IG. At the time of writing, you are looking at a buy and sell price on Boohoo shares of 276.10p and 275.80, respectively. If you want to get started with IG, you will need to make an initial deposit of £250. You can do this with a debit card, credit card, or UK bank account.

Stock Trading Fees £8 per trade (£3 for active accounts) Deposit Fees No (0.5% – 1% for credit cards) Withdrawal Fees No (£15 for international bank transfers) Inactivity Fees £12 per month after two years Monthly Account Fees No Sponsored ad. Your capital is at risk.

Research Boohoo Shares

Boohoo has performed remarkably well since its 2014 IPO, and so early backers have been rewarded handsomely. However, it’s crucial to take a step back and perform some independent research.

To help point you in the right direction, below we have highlighted some of the main fundamentals that you need to consider when researching Boohoo shares.

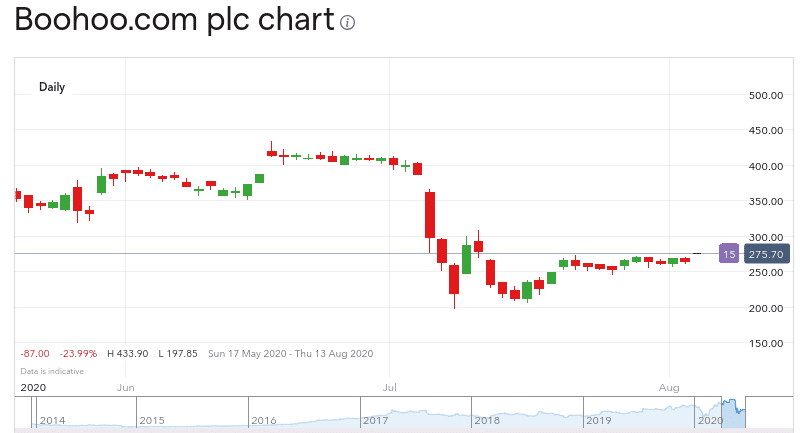

Boohoo Share Price History

Boohoo is a fashion retailer that has 16-30-year-olds as its key target market. Based in the UK and launched as recently as 2006, the firm went public in 2014. As is often the case with up-and-coming companies, Boohoo opted for the UK’s secondary exchange – the AIM. Back during its IPO, you would have been able to get your hands on Boohoo shares at just 70p.

Fast forward to 2020 and the shares are worth considerably more. Boohoo shares hit peaks in June at 433p per stock. In comparison to its 2014 IPO, this translates into growth of over 500%. Not bad for a company that has only been public for 6 years. We should note that the firm has gone through a couple of major market corrections in 2020.

Firstly – and much like the rest of the UK stock markets, Boohoo shares were impacted by the COVID-19 pandemic. In fact, between late February and mid-March, the shares went from 327p to 157p. This represents a rapid decline of 51% in just three weeks. However, the shares quickly recovered, smashing through their previous highs as soon as late April.

Crucially, although the shares were moving in a firm upward direction, this was subsequently put to a halt in July. This is because of a story uncovered by The Sunday Times alleging that Boohoo is behind slave-like working conditions. This saw the shares go from highs of 443p down to lows of 210p in a matter of weeks.

The shares have since recovered to 324p, around the same level as before the COVID-19 pandemic. However, the path to get there has been highly volatile.

Boohoo Dividend Information

With a multi-billion pound market capitalization and three-digit percentage growth since its 2014 IPO, you might assume that Boohoo pays dividends. However, the firm is still in its infancy and thus – is yet to reward its shareholders with any dividends to date. This is standard for practice for companies that are still in their growth phase, as profits are re-invested back into the firm.

Why do People Invest in Boohoo Shares?

Boohoo is often referred to as the ‘King of the AIM’, not least because it is the largest company on the exchange in terms of market capitalization. As noted earlier, it smashed through a valuation of over £6 billion before The Sunday Times story broke. With that said, Boohoo is still the most valuable stock on the AIM.

Below you will find some useful information surrounding Boohoo as an investment vehicle.

Boohoo was on an Incredible Run

As we discussed above, Boohoo shares have increased 5-fold since its 2014 IPO. Like the rest of the UK markets, the firm had to contend with the COVID-19 pandemic. That is to say, the vast majority of domestically-listed companies lost double-digit percentages in March 2020.

The key point here is that while most UK stocks are yet to recover fully, Boohoo managed to get back on track as early as April. In fact, it continued its upward trajectory right up until July – when the stock peaked at 443p.

Despite The Sunday Times publication, Boohoo has been able to recover. While the story likely hurt the brand permanently among some consumers, it seems likely that Boohoo will eventually leave the scandal behind.

Boohoo is Trading Below Yearly Highs

Leading on from the point above, Boohoo shares are worth 324p at the time of writing. This works out at 27% lower than the 52-week high it achieved in July. It’s also worth noting that the shares appeared to be heading even higher before The Sunday Times story broke.

Insider Transactions

As we often note, insider transactions should always be viewed as a vote of confidence from those running a company. After all, management wouldn’t invest their own personal funds if they didn’t believe in the firm’s long-term future.

With that in mind, it is notable that founders Mahmud Kamani and Carol Kane both invested money in the wake of The Sunday Times scandal. While the former invested £10.7 million, £4.3 million was invested by Kane.

Cost-Effective Clothing

If Boohoo’s online store is known for one thing – its cost-effective clothing. This could be absolutely pivotal in a time where UK consumers are tightening their belts. After all, it is often the case during times of economic uncertainties that the public will source cheaper alternatives. In the case of fashion. Boohoo offers highly affordable options.

The Sunday Times Scandal

As we have repeatedly made reference to, The Sunday Times newspaper published a story in early July concerning Boohoo and its poor working conditions. In a nutshell, it is alleged that a garments factory based in Leicester is paying its employees just £3.50 per hour – far below the minimum wage.

Although the factory isn’t owned by Boohoo, it does supply significant volumes to the online retailer. Not long before the publication, separate allegations were also made against Boohoo with respect to COVID-19 restrictions. More specifically, it was alleged that the factory was putting lives at risk by failing to adhere to social distancing policies, nor was it providing PPE.

Investor Sell-Off

It came as no surprise to see major shareholders offload their Boohoo stocks as a result of the aforementioned allegations. One such example of this was Standard Life Aberdeen – a top-10 Boohoo shareholder. If other major investors continue to follow suit, this could have an even bigger impact on the firm’s short-to-medium term share price.

Open an Account and Deposit Funds

So now that we have covered Bohooo shares in detail, we are now going to show you what you need to do to make an investment today. There are many brokers that you can partner with, although it’s best to choose one with an FCA license.

To get the ball rolling, you will need to visit the your broker’s website and elect to open an account. As is the case with most online brokerage sites, you will need to prove some personal information, such as:

- Full name

- Nationality

- Date of birth

- Home address

- National insurance number

- Contact details

- Username and password

If your broker is regulated by the FCA, you will now be asked to upload some documents, which could include:

- Passport or Driver’s License

- Recent Utility Bill or Bank Account Statement

Next, you will need to deposit some funds. Your broker may have a minimum deposit threshold that must be met, with popular deposit methods including credit/debit card, bank transfer, and e-wallet.

Trade Boohoo Shares

Once your deposit has been confirmed, you can proceed to trade Boohoo shares.

If it’s the former, you can opt to trade CFDs. And the latter, you can choose to buy the underlying shares in the traditional sense.

Once you search for Boohoo and land on its trading page, you will then see an order box.

Here you will be given several options.

- Firstly, you need to decide whether you think the value of Boohoo will go up (buy order) or down (sell order)

- Then, enter the amount that you wish to stake on your Boohoo trade

- If you want to apply leverage, select your multiple.

Then, all you need to do is confirm the order and your trade will be executed at the market rate.

Is It a Good Idea to Buy Boohoo Shares?

The ‘King of the AIM’ proved that it could make it through the worst of the COVID-19 pandemic. As the pandemic comes to a close, we also expect retail sales to pick up, helping Boohoo’s bottom line.

The most damaging thing that Boohoo has faced in the past year wasn’t COVID-19, but rather The Sunday Times story alleging poor working conditions. This is something that Boohoo has managed relatively well from a public relations standpoint, and the company’s share price has recovered to 324p as a result. Going forward, it would be relatively inexpensive for Boohoo to do more to monitor the working conditions in its partner factories.

If the shares can climb back to 443p apiece, that would represent a 27% gain for investors.

The Verdict

Boohoo was making gains until news broke of the alleged poor working conditions that one of its suppliers employs. This includes staff being paid just £3.50 per hour and a failure to respect social distancing regulations.

With that being said, if you wish to invest in Boohoo, you can do so with an FCA-regulated broker that offers these shares as a tradable asset. Either way, it’s important to do your due diligence and never invest more than you can afford to lose.

FAQs

How much were Boohoo shares when the firm first went public?

Boohoo had its IPO on the AIM in 2014. Back then, you would have paid just 70p per share.

What stock exchange is Boohoo listed on?

Boohoo is listed on the Alternative Investment Market (AIM). This is the UK’s secondary stock market behind the primary London Stock Exchange.

Does Boohoo pay dividends?

No, Boohoo does not pay dividends. As the firm is still in its infancy, Boohoo reinvests most of its profits into its own growth.

Who founded Boohoo?

Boohoo was founded by Mahmud Kamani and Carol Kane in 2006.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up