The price of Uber shares is dropping for a third day following the recognition of 70,000 UK drivers as workers instead of independent contractors, after the ride-hailing firm lost a five-year legal battle in the country’s Supreme Court.

The court’s ruling has forced Uber to change its policy and working practices, with the firm now agreeing to pay the minimum wage of £8.72 an hour along with some work benefits to its newly designated employee drivers, including holiday pay and a pension plan.

However, the way the company will estimate the number of hours that workers will be compensated for could possibly lead to further disputes, since, according to Uber (UBER), workers will only be paid for the time they spend in transporting passengers upon accepting a trip.

This approach seems to be going against the court’s ruling, which indicated that drivers will be considered active from the time they turn on the company’s app, and the proposal has already received pushbacks from workers as they claim to spend almost a third of their time waiting for the next trip to pop up.

James Farrar and Yaseen Aslam, the two drivers that launched the lawsuit five years ago, said that Uber “arrived to the table with this offer a day late and a dollar short”. This situation could open up the door for further disputes and legal claims as Uber’s stretched interpretation of the ruling can backfire.

Meanwhile, the ride-hailing business headed by Dara Khosrowshahi assured investors that this change in its business model in the UK will not affect the firm’s adjusted EBITDA guidance for the rest of the year, with the company still anticipating that it will post its first profitable quarter before the year ends.

However, investors don’t seem too convinced about these forecasts in light of this recent development as the firm’s shares have slid 5.5% since the ruling came out including a 3% drop in today’s early stock trading action in New York at $57.15 per share.

How have Uber (UBER) stock performed so far this year?

Uber shares are accumulating a 15.4% jump this year as the progressive advance of vaccinations in the United States and other corners of the developed world have helped in lifting the firm’s financial forecasts for the year.

Last year, Uber shares jumped as much as 72% in value, with most of that leap taking place since early November following the Pfizer (PFE) vaccine news.

That said, this latest ruling from the UK top court can result in some negative momentum for Uber, since, although the firm has assured investors that it won’t suffer financially from this legal setback, chances are that the company’s proposed model will not be approved without a fight from its beneficiaries.

Meanwhile, drivers from other corners of the world could further push local courts to rule similarly on Uber’s practice of treating drivers as independent contractors rather than workers, which could threaten the profitability of the firm’s business model.

What’s next for Uber shares?

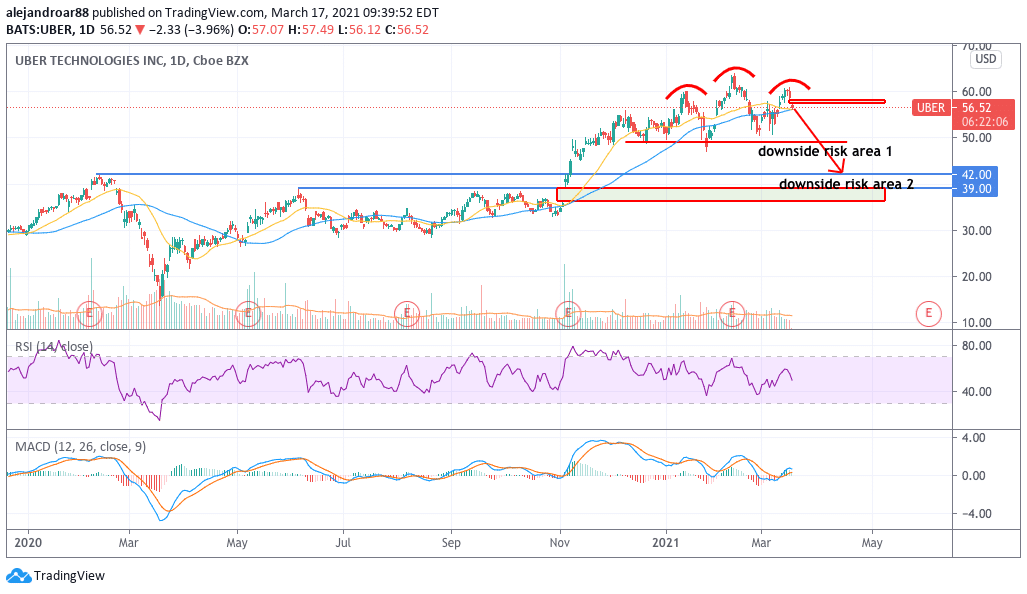

The latest price action seen by Uber shares seems to have formed what could be a potential head and shoulder pattern with two downside risk areas, one at $49 per share at the pattern’s neckline and the other at $42 per share – a former resistance level that could become support if the price keeps dropping.

Today’s early drop has resulted in the creation of a bearish price gap that could reinforce this thesis, while the momentum for the stock seems to be taking a U-turn as well.

A similar head and shoulders formation can be seen in the RSI and the MACD as well, which could result in a drop of both oscillators to negative momentum territory.

Moreover, Uber’s short-term moving averages are about to post a death cross, which increases the likelihood of a short-term downturn.

Question & Answers (0)