The FTSE 100 index is heading for its eleventh losing day in the past thirteen sessions, as lockdowns continue to weigh in the short-performance of British stocks.

So far today, the index is retreating 0.8% at 6,517 in mid-day stock trading action, primarily dragged by energy, real estate, finance, and communication services factors, while the basic materials segment is advancing strongly.

Recent data from the British Retail Consortium indicated that average prices of goods sold within the United Kingdom slipped 2.2% in January compared to a year ago – the largest drop seen since the first lockdown.

This downtick in retail prices can be explained by the deflationary pressures caused by lockdowns, as consumers spend less and save more while they remain confined within their homes.

Meanwhile, a surge in online shopping – a traditionally less expensive channel to buy from – has also pressured retail prices to go down as physical stores are forced to slash their prices to attract consumers.

Moreover, only two days ago, the International Monetary Fund (IMF) slashed its 2021 forecast GDP forecast for the British economy, cutting its prediction from a previous 5.9% to 4.5% as retail sales plunged 50% in January amid a second wave of lockdowns.

The number of daily virus cases in the country has been steadily declining, moving down from its 8 January peak of 68,000 cases to 25,000 cases reported yesterday, according to data from virus-tracking website Worldometers.

That said, the UK reported its highest number of daily deaths since the pandemic started on 20 January, with 1,820 individuals passing amid the virus while yesterday’s tally ended at 1,725 deceases.

Vaccinations keep advancing but not fast enough

According to data from the National Health Service, the government has administered a first dose of the COVID-19 vaccine to a total of 6.2 million UK residents – roughly 10% of the population in the first 27 days of the year.

At this pace, it would take months for the country to fully inoculate the country’s entire population which is possibly one of the reasons why the British stock index has been moving lower in the past few days, as market players anticipate that lockdowns could endure for longer than they initially anticipated.

In this regard, it is also important to note that the number of hospitalized patients who have contracted the virus has surged above April 2020 levels, with a total of 4,000 patients currently needing mechanical ventilation beds while the number of hospitalized individuals is also standing near the 40,000 level – roughly twice the number seen in April during the first lockdown.

What’s next for the FTSE 100 index?

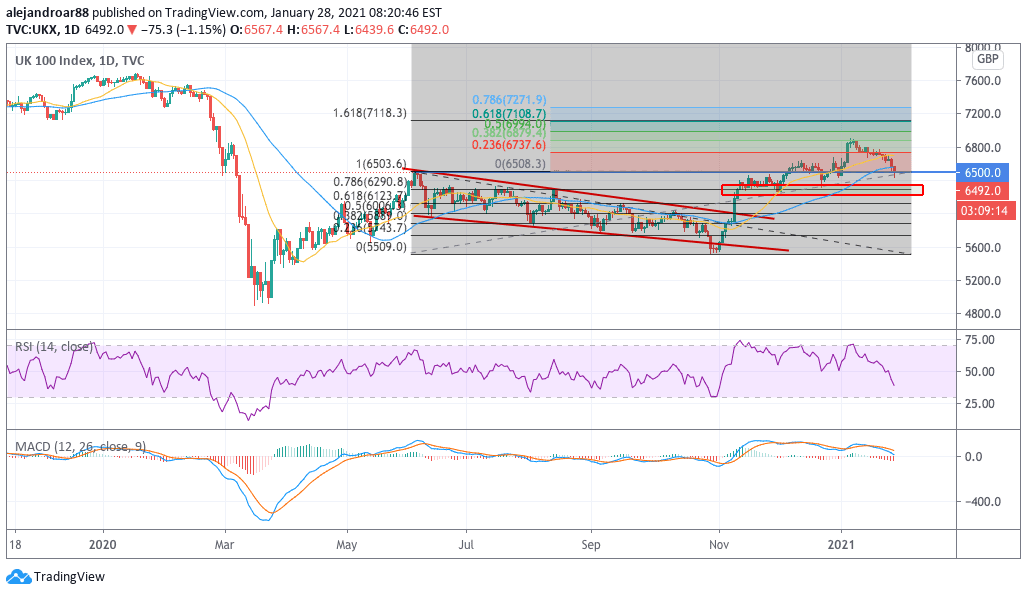

The FTSE 100 index is currently pausing at its post-pandemic June highs – a level that served as resistance previously and that appears to be serving as support today as the negative momentum continues.

The virus situation seems to be the most important driver for the index at the moment, as market players seem to be keeping an eye on how the rhythm of vaccinations advances in the first few weeks of February.

If the number of daily inoculations were to increase its pace over the coming weeks, chances are that stocks could rebound off these lows as the end of lockdowns would come quicker than expected.

However, if the virus situation worsens or vaccines prove less effective in inoculating individuals against new strains of the virus, the index could collapse below the current level.

For now, aggressive short-sellers could wait for the price action to move below the 6,500 threshold to take a short position in the index, expecting that the negative momentum might accelerate if such a break were to take place.

Meanwhile, conservative traders might wait for the price to move below the 6,300 level for further confirmation that the latest uptrend has been effectively reversed.

Question & Answers (0)