Best Semiconductor Stocks to Watch UK

In today’s expanding digital environment, semiconductors are everywhere: computing devices, mobile phones, automobiles, ovens, washing machines, and home thermostats. With new semiconductor applications arising daily, demand for semiconductors continues to grow.

In this article, we identify some of the popular Semiconductor Stocks on the market. We’ll also highlight a few popular brokers from where users can look to invest in semiconductor stocks in the UK.

Key points on Semiconductor Stocks

- The global semiconductor industry was $452.25 billion in 2021 and is expected to expand to $803.15 billion in 2028, making semiconductor stocks an interesting proposition for many investors.

- The companies behind these stocks design and fabricate semiconductors that are critical building blocks for emerging technologies including 5G, artificial intelligence, data centers, machine learning, blockchain gaming, cloud computing, cryptocurrency mining, and advanced military applications.

- Some of the popular semiconductor stocks are Applied Mateirlas Inc, Analog Devices, Advanced Micro Devices and NVIDIA.

Popular Semiconductor Stocks List

Found below is our list of the popular semiconductor stocks for 2021:

- Applied Materials Inc. (NASDAQ: AMAT)

- Analog Devices (NASDAQ: ADI)

- Texas Instruments (NASDAQ: XLNX)

- Advanced Micro Devices, Inc. (NASDAQ: AMD)

- Skyworks Solutions Inc. (NASDAQ: SWKS)

- Cml Microsystems (LON: CML)

- NVIDIA (NASDAQ: NVDA)

- Silicon Laboratories Inc. (NASDAQ: SLAB)

- Oxford Instruments (LON: OXIG)

- IQE Plc (LON: IQEPF)

Semiconductor Stocks to Invest in US and UK – Reviewed

As you can see from the list above, there are a variety of semiconductor stocks on the market. However, let’s review 10 popular stocks in this industry to get an in-depth idea on the stocks and the company.

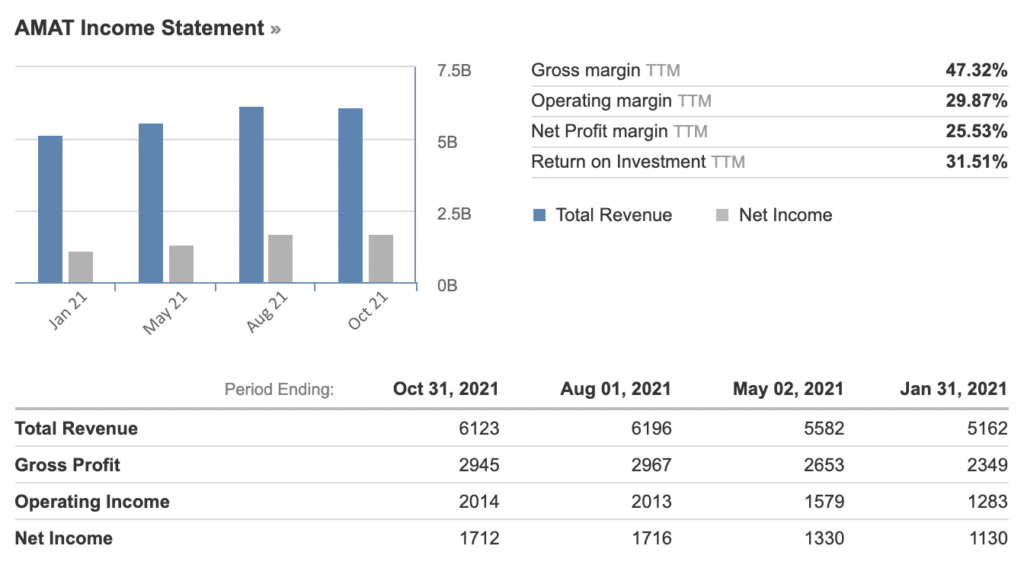

1. Applied Materials Inc. (NASDAQ: AMAT)

Applied Materials Inc. develops and manufactures hardware and software that suppliers use in the manufacturing of semiconductor devices.Applied Materials’ fiscal fourth-quarter revenue increased 32% from last year to $6.15 billion.

At the same time, earnings shot up 55% from the prior-year period to $1.94 per share. Applied Materials is strategically positioned as the leading provider of hardware and software tools to chip manufacturers who are racing to increase production capacity to meet this semiconductor shortage.

Applied Materials’ revenue growth is also consistent with what we are seeing when reviewing Applied Materials’ backlog of orders. For example, Applied Materials finished fiscal 2021 with an order backlog of $11.8 billion.

This number represents an increase of 77% over the year-ago quarter. Applied Material’s current market cap is $136.6B and has a one-year return of 72.06%. For 2020, Applied Materials generated a dividend yield of 0.64% and had a P/E ratio of 23.64 while earning a generous 6.42 EPS.

Applied Materials trades at less than 19 times earnings after a recent price decrease down to $147 from its previous all-time high. As a comparison, Applied Materials is less expensive than the S&P 500’s P/E ratio of 29.37.

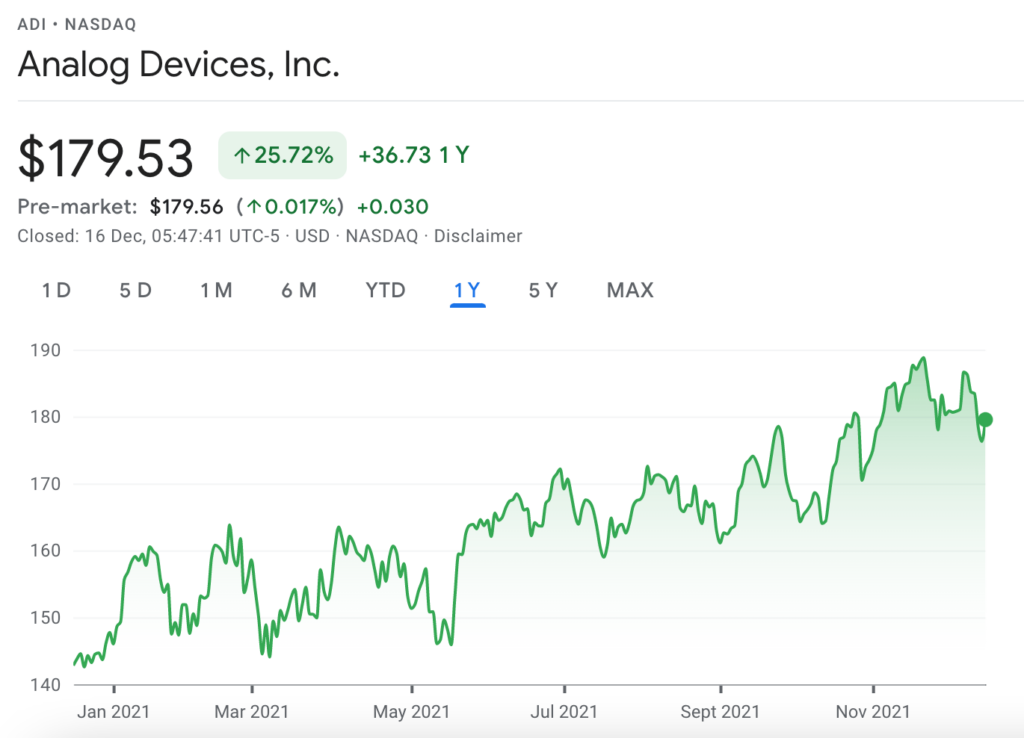

2. Analog Devices (NASDAQ : ADI)

Analog Devices designs and manufactures high performance analog, mixed-signal, and digital signal processing (DSP) integrated circuits (ICs).Recently, Analog Devices released its fiscal fourth quarter results where it earned an adjusted $1.73 per share on sales of $2.34 billion in the quarter ended October 30.

Based on last years’ numbers, Analog’s fourth quarter results represented a 20% increase in earnings coupled with an amazing 53% increase in revenues.This growth was primarily attributed to gains made in both the industrial and automotive sectors. For the current quarter, Analog Devices had an EPS of $1.73 on sales of $2.34 billion. This is impressive growth given that Analog Devices earned $1.44 a share on sales of $1.56 billion last year.

Analog’s future projections for 2022 remain strong with first quarter revenues expected to surpass $2.6 billion. This represents a $1.0 billion increase over Q4 2021 revenues. To support this aggressive growth, Analog Devices will rely on its recent acquisition of Maxim Integrated, an analog and mixed-signal integrated circuits provider.

Analog Device’s current market cap is $97.19B and it earned a respectable one-year return of 28.67%. For 2020, Analog Devices generated a dividend yield of 1.53% with a healthy 3.69 EPS. Currently, Analog Devices’ current P/E is 25.24.

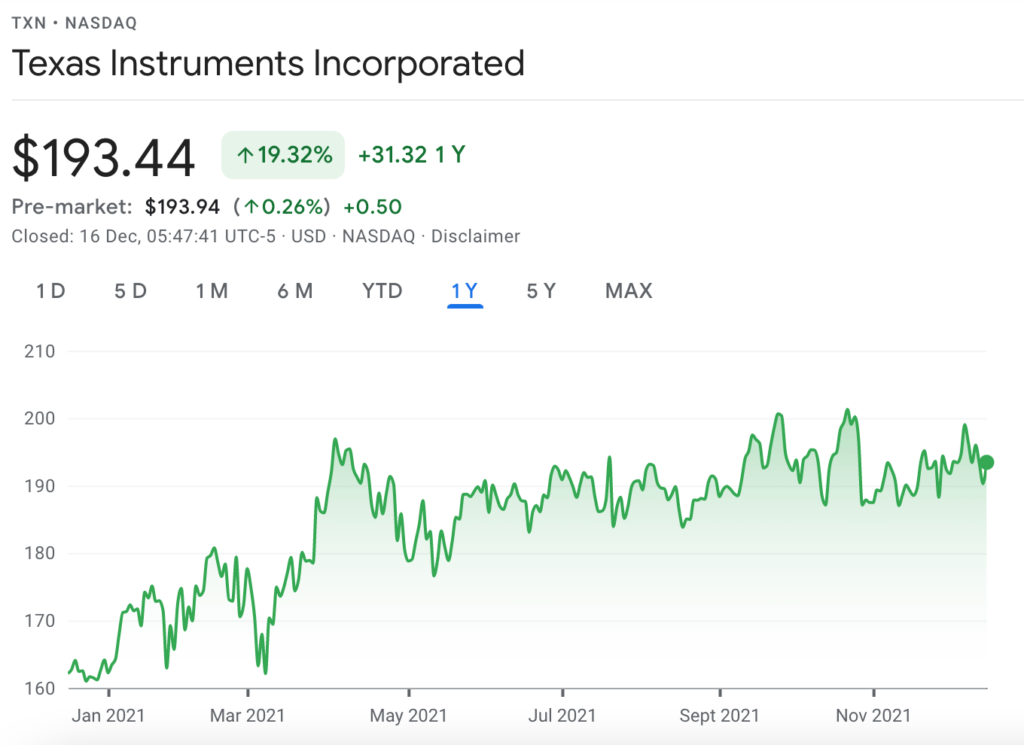

3. Texas Instruments Inc. (NASDAQ: TXN)

Texas Instruments (TI) is a US based company that designs and manufactures many of the foundational semiconductor devices in use today including analog, mixed signal and digital signal processing (DSP) integrated circuits. One key to TI is its diversification model where it produces analog and embedded chips for a wide range of industries. As an IDM (integrated device manufacturer), TI designs and manufactures its chips at its own chip producing foundries. Unlike many of its competitors, TI does not utilize third-party foundries to fabricate its devices.

Rather than focus on two or three presently emerging technology sectors, we also like the fact that TI continues to develop a diversified customer base. For example, according to TI, its 2020 revenues were split amongst the following markets: industrial equipment (36%), personal electronics (28%), carmakers (21%), communications equipment (9%), and enterprise systems (9%).

TI, with a market cap of $177.1B, is a large-cap stock. For example, between fiscal 2010 and 2020, TI’s annual revenue rose from $13.97 billion to $14.46 billion. And over a ten-year period, TI’s annual net income increased 74% from $3.23 billion in 2010 to $5.60 billion in 2020. Its annual earnings per share more than doubled from $2.62 to $5.97.

4. Advanced Micro Devices, Inc. (NASDAQ: AMD)

If you are interested in equity trading UK , then AMD is an available option in the semiconductor market. Advanced Micro Devices (AMD) is a leading provider of graphics and visualization central processing units (CPU’s) and Graphics Processing Units (GPU’s).

These semiconductors are critical to high end processing computers that demand big data output and fast processing power, such as used for gaming, data centers, and crypto mining. AMD posted third-quarter earnings with revenues of $4.31 billion, a massive 54% uptick over last years’ numbers. Its adjusted net income increased 78% to $893 million, or $0.73 per share.

For the fourth quarter, revenues are expected to increase by about 40% year over year to $4.5 billion. Growth will be driven by its graphics and consumer electronics markets, primarily the video gaming industry. Last year, the global gaming market was valued at $173.70 billion. This market is expected to explode by 2026 and reach a value of $314.40 billion.

AMD is also aggressively targeting emerging gaming technologies, such as cloud and virtual reality gaming, which are expected to continue to fuel this growth. AMD is also making inroads into the GPU market. This is another fast-growing gaming niche, as the GPU market is expected to generate $44 billion in revenue by 2023, compared to $29 billion last year.

AMD’s current market cap is $180.07B and has an incredible one-year return of 60.61%. For 2020, AMD generated a dividend yield of 0.0% and had a P/E of 46.16 with a healthy 3.23 EPS. AMD’s stock has increased 68.8% from its 2020 closing price.

5. Skyworks Solutions Inc. (NASDAQ: SWKS)

Skyworks Solutions Inc. manufactures radio frequency (RF) and mobile communications semiconductors. Many of Skyworks customers are digital technology trendsetters including Amazon, Cisco, Foxconn, General Electric, Google, Microsoft, and Motorola. Skyworks, with a present market cap of $24.8B, reported record Q3 revenue of $1.11 billion which represents a 52% increase over 2020.

Over this same time period, earnings per share increased 72% to $2.15 per share. Additionally, Skyworks is trading at 6.6 times sales right now, which is lower than its 2020 average price-to-sales (P/S) ratio of 7.7. Those seeking dividend growth will be interested to find out that Skyworks increased its quarterly dividend payout by 13% to $0.57 per share.

Skyworks’ growth is being fueled by the growing adoption of 5G technology in smartphones and other industries. 5G is being touted by Forbes as the next generation of communication. There has been a dip in the stock price over the last year with Skyworks stock now trading at around just 22 times earnings.

The stock also has a P/E of 16.6 which is lower than the S&P 500’s P/E ratio which currently stands at around 34.

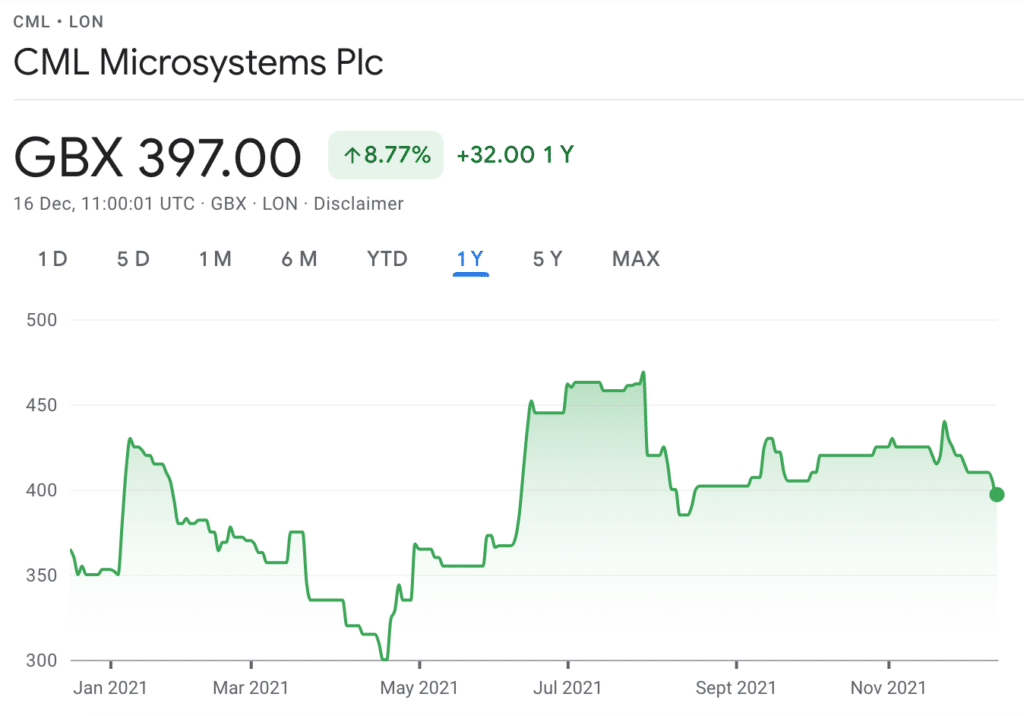

6. Cml Microsystems Plc (LON: CML)

Cml Microsystems Plc is a UK semiconductor stock. It designs, manufactures, and markets mixed-signal and Radio Frequency (RF) semiconductor products for communication markets. Primary markets that Cml serves include voice and business-critical communications, such as military, commercial, construction and transportation sectors.

Cml also services non-cellular wireless data communications. Compared to other stocks in this list, CML is a small-cap stock, with a current market cap of only $97.8 million. Although this might seem small compared to other semiconductor stocks in this list, it has a low P/E of 3.13.

Over the last twelve months, this stock has risen over 230%. However, recently its stock price has taken a bit of a hit, and the reason being is that its Return on Equity (ROE) is not very impressive at 1.5%. So, this means that for every $1 of its shareholder’s investments, the company generates only a profit of $0.015.

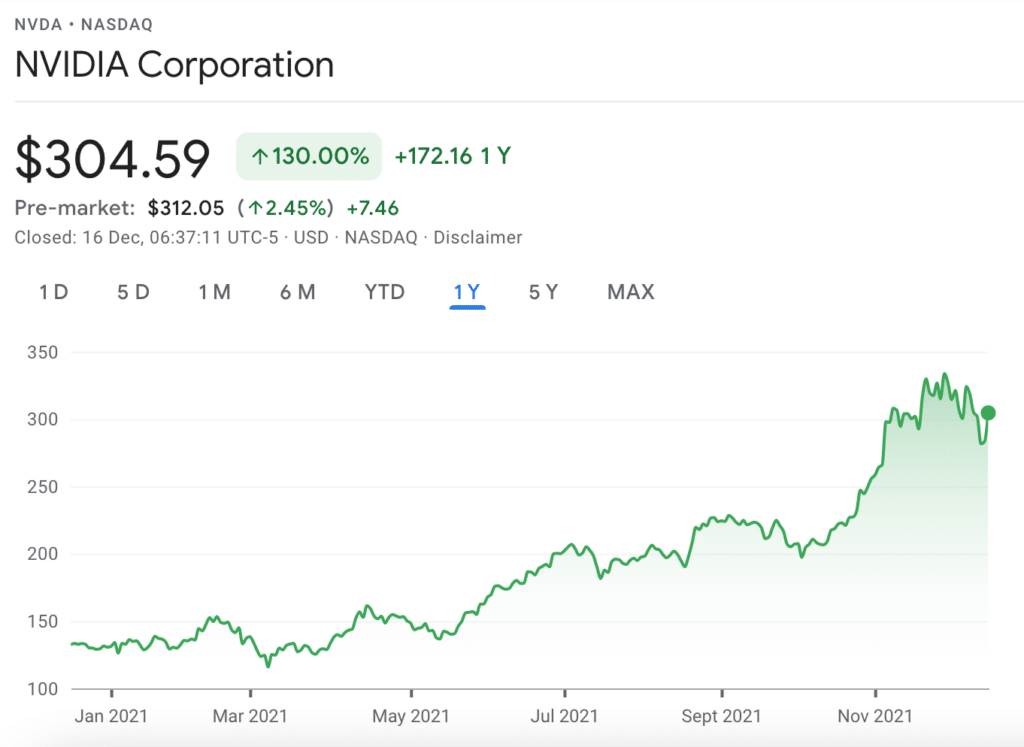

7. Nvidia (NASDAQ: NVDA)

Nvidia’s computer graphics and processors are critical to many digital technologies including gaming, computer graphics, data centers, deep learning AI and machine learning, and crypto mining. For example, Nvidia currently holds about 83% of the world-wide market share of the discrete GPU market place.

Nvidia is also strongly committed to its professional visualization product offering called Nvidia Omniverse. Omniverse is a software tool for 3D simulation and virtual world-building. With a market cap of $803B, Nvidia is slowly making its way towards milestone $1T market cap by relying on three market sectors: gaming, data centers, and, professional visualization.

In 2021, Nvidia’s stock beat an amazing 2020 performance by returning 124% year to date with an EPS of 3.24. In its 2021 fiscal third-quarter earnings report, Nvidia reported that total revenue increased an impressive 50% over last year with revenues of $7.1 billion.

Revenue from professional visualization increased by 144% over last year with revenues of $577 million.

8. Silicon Laboratories Inc. (NASDAQ: SLAB)

Silicon Labs is a US based fabless manufacturing entity. That is, Silicon Labs designs and sells hardware devices and semiconductor devices, but it outsources their fabrication to a specialized semiconductor manufacturer called a semiconductor foundry. Fabless manufacturing provides Silicon Labs the flexibility in evaluating multiple different foundries and then selecting the foundry suitable for a particular semiconductor device or manufacturing process.

Silicon Labs is a leader in wireless chips for Internet of Things (IoT) applications, but it has also diversified itself within selected markets. For example, the latest results reflect the longer-term trends continuing to boost demand for its technology for the IoT market, with strengths in home automation, smart retail, and portable products across medical, sports, and fitness. Silicon Labs represented that its top 20 purchasers accounted for only 31% of its total sales.

Third quarter revenue grew 39% year over year to $185 million. In addition, EPS was $0.34 which was more than 105% over initial expectations of $0.15. Silicon Labs remains very profitable with projected adjusted gross margins in 2021 Q4 being on the order of close to 60%. Estimated EPS also is projected to increase from about $0.50 to $0.60. Silicon Lab’s current market cap is $7.86B and sports a one-year return of 66.24%. For 2020, Silicon Labs generated a dividend yield of 0.0% and -6.81 EPS with a P/E of 4.16.

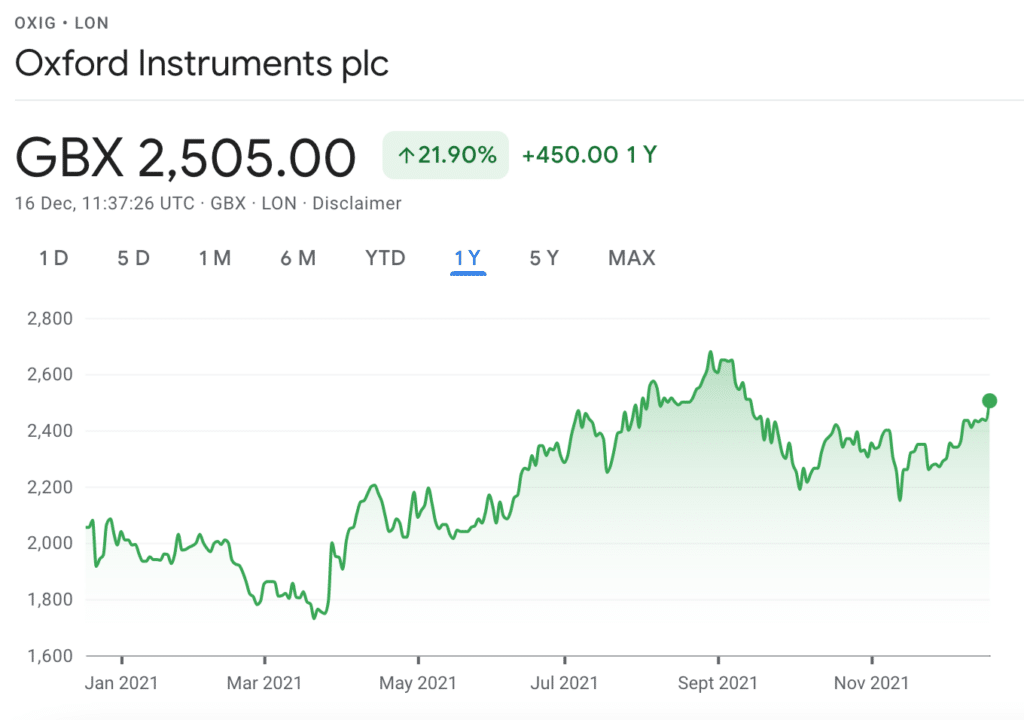

9. Oxford Instruments Plc (LON: OXIG)

Oxford Instruments participates in a number of diversified markets including quantum technologies, healthcare and life sciences, advanced materials, and semiconductors. The company’s largest market is semiconductors. For example, Oxford’s etching and deposition processes are used in a number of semiconductor devices, materials and applications.

Oxford is also a market leader in providing semiconductors that improve data speed, capacity, and energy efficiency. Its image and analysis solutions are helping customers develop the next generation of smaller silicon semiconductor devices.

With a market cap of 1.35B and P/E 31.04, Oxford had an EPS of 0.73. Oxford Instruments’ EPS has grown 29% each year. Oxford Instruments recently increased its dividend as orders have climbed amid increasing demand across semiconductors, quantum materials and advanced materials markets.

In 2020, Oxford generated a profit before tax of £52.2 million, which is an increase of 35% over the previous year’s numbers. Revenue also remains strong as they increased 0.3% to £318.5 million, or 1.7%. In addition, revenues increased 5.3% to £353.7 million.

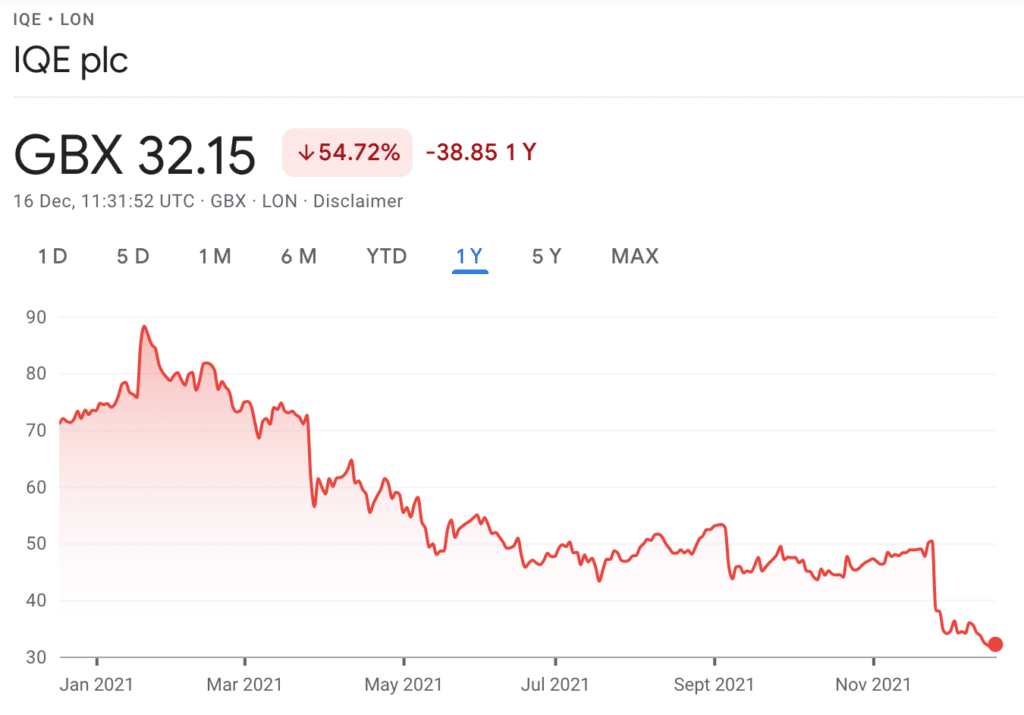

10. IQE plc: (LON : IQEPF)

IQE is another UK semiconductor stock. It is a provider of materials for semiconductor fabricators. As can be seen from the price graph below, IQE has been recently trading below its all-time high.

For example, for 2020, IQE increased total revenue to £178 million. This represents 27% growth in revenue over the previous year’s numbers. According to IQE, this growth was driven primarily by 5G gallium nitride (GaN) based infrastructure deployments and 5G gallium arsenide (GaAs) based handset market penetration.

Based on the current IQE share price, the company has a market capitalization of around £404.43 million. This market capitalization and current revenue equate to a price-to-sales ratio of 2.26. In addition, IQE’s Earnings Before Interest and Taxes Depreciation and Amortization (EBITDA) nearly doubled from £16.2 million to £30.1 million.

Are Semiconductor Stocks a Valuable Investment?

The global semiconductor industry was $452.25 billion in 2021 and is expected to expand to $803.15 billion in 2028.

The companies behind these stocks design and fabricate semiconductors that are critical building blocks for emerging technologies including 5G, artificial intelligence, data centers, machine learning, blockchain gaming, cloud computing, cryptocurrency mining, and advanced military applications.

The US government is making a massive effort to re-establish its global semiconductor dominance. For example, three years ago, the Trump Administration imposed a 25% tariff on Chinese imports, including semiconductors.

These tariffs have resulted in a 50% reduction of Chinese semiconductor imports, creating in part supply chain bottlenecks. In an effort to “rebalance” the worldwide semiconductor supply chain, the US-EU Trade Technology Counsel (TTC) is working to provide a solution to these existing bottlenecks and to bolster the US and EU “domestic semiconductor ecosystems.”

In addition, the US semiconductor industry is on the verge of receiving a massive infusion of financial support from the US government. The Biden Administration is strongly committed to enhancing the US semiconductor industry by proposing legislation that provides $35B in grants and incentives to help re-establish the US at the forefront of the US semiconductor industry. This legislation has already passed the Senate.

One thing to keep in mind is that a combative US and China relationship could negatively affect this industry. According to Statista, over the past thirty years, US semiconductor production has decreased by about 50%. As of today, roughly 75% of semiconductor chip fabrication capacity resides in China, Taiwan, Japan, and South Korea, combined. Therefore, a non-combative US/China relationship is important to keeping these East Asia supply chains open to meet the strong US demand for these semiconductors.

All these factors should be kept into consideration when analysing and researching the different semiconductor stocks. Make sure to conduct a proper analysis before investing in any stock.

What to Factor In Before Investing in Semiconductor Stocks

There are a number of financial metrics to look into before purchasing your semiconductor stocks:

Market Cap

Users may want to look at the company’s market capitalization (market cap). This metric can be used to gauge the relative size of one company versus another company. Basically, it represents how much money the company is worth. Are you interested in a newer company that has a smaller market cap or a more established company that has a larger market cap. Depending on your preferences, you should make a well-informed investment decision.

Revenue Growth

Another metric to look into is the projected sales or revenue growth of the company. Revenue growth is a ratio that looks at the current year’s estimated growth rate divided by the previous year’s revenue. For these high-tech research and development intensive semiconductor companies in our list, revenue growth helps to fund research and development spending and innovation creation.

Margins

Profit or gross margins are also important. Revenue growth is important but these revenues need to drive profits so as to create an attractive net income or earnings. Gross margins represent the difference between revenue derived from sales minus the costs to incur those sales.

This difference is then divided by the revenue and is typically represented as a percentage. An average gross margin in the semiconductor industry for 2020 was about 52.11%.

P/E Ratio

Price/Earnings ratio (P/E) is another financial metric that users tend to look at before investing. P/E is the stock price divided by the stock earnings. P/E equates to how much an investor is willing to pay for a dollar of the company’s earnings. A lower P/E is generally what users look at.

ROE

Another income-based metric you may want to look into is a stocks’ Return on Equity (ROE). This is a ratio that evaluates a company’s ability to generate income based on a shareholder’s investment in the company.

How to Invest in Semiconductor Stocks

Now that you have a number of identified semiconductor stocks and some of their financial background information, you should be able to make. a decision on your investment process. Should you choose to invest in semiconductor stocks, you may want to pick a platform that provides low fees, multiple stock options and a variety of tools & features.

After picking your suitable brokerage, here is how you can begin investing in 4 steps.

Step 1: Open Your Trading Account

Head over to the homepage of your trusted broker and begin the account set-up process. You will be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue.

Step 2: Verification

Most reputable brokers in the UK are regulated by the FCA – which is why users may be required to verify their accounts. To do this, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Step 3: Deposit funds

The next step is to deposit funds into your trading account. Most brokers may support 1 or more of the following payment methods:

- Credit card

- Debit card

- Bank transfer

- e-wallet

Choose your preferred payment option and deposit the funds into your account.

Step 4: Invest in Semiconductor Stocks

Once your account has been funded, proceed to search for any semiconductor stock you wish to purchase on your platform’s search bar. Fill in the amount you want to credit into the trade, and confirm your transaction.

Conclusion

Our guide has reviewed 10 popular semiconductor stocks that are available in the market. Make sure to conduct your own research and analysis before investing in any stock.

Should you choose to invest in this market, make sure to do so with a suitable broker that tends to all your investing needs and requirements.