Most Volatile Stocks to Buy UK – Invest with 0% Commission

High volatility stocks may positively impact the portfolio’s average return and investors should get acquainted with the most volatile stocks today. Before diving into the list of most volatile stocks UK, we should understand the characteristics of a volatile stock.

The value of volatile stocks may fluctuate more than less volatile stocks, making them riskier investment assets. Simply stated, the price of a high volatility stock will move in a broader range, giving traders the opportunity to make above-average returns or at least make higher returns than the potential gains of the low volatility stocks. The most volatile stocks will also experience wider price movements in a relatively short period, which becomes evident when we take a look and the selected stocks.

Investors with risk tolerance are willing to invest in these types of stocks because with higher risk comes higher reward, and by investing in volatile stocks, we have the opportunity to generate bigger returns. The good thing is that investors can earn generous returns with high volatility stocks over a short period due to the more sizeable fluctuations in their prices.

In this guide, we reveal the most volatile stocks UK and show you how to invest in them today without paying any commission.

Top Most Volatile Stocks UK 2021 List

We take a more in-depth look at the most volatile stocks UK further down this page, but to start, here’s a quick summary.

- GameStop Corp. (GME) – Invest Now

- AMC Entertainment Holdings Inc (AMC) – Invest Now

- Scottish Mortgage Investment Trust PLC (SMT) – Invest Now

- Barclays Bank PLC (BARC)

- Burberry Group (BRBY)

- British Petroleum (BP)

- BYD Company Limited

- ANSYS Inc. (ANSS)

- Alcoa (AA)

- ABM Industries Incorporated (ABM)

Best Most Volatile Stocks UK Reviewed

Now let’s take a closer look at the best volatile stocks in the UK for 2021.

1. GameStop Corp. – a movement of 250% in a single week

Investors may trade stocks that constantly experience higher volatility or decide to invest in stocks whose volatility has increased due to specific factors. An example of the latter is GameStop shares that recorded an astonishing 52-week range that moves from as low as $2.56 (£1.84) up to $481.67 (around £345), shows that the stock price has increased thousands of per cents in less than a year.

The primary reason leading to such a significant increase in stock price is the war between a Reddit group composed of retail investors and wealthy hedge funds. The hedge funds took a short position with the GameStop stock in anticipation of price decline. However, the Reddit group of retail investors (composed of a few million members) purchased the stock in an effort to put upward pressure on the stock price. The increase in the demand resulted in a significant price increase while the hedge funds that shorted the stock lost millions.

It is evident that before the war outbreak between Reddit investors and the hedge funds, GME stock price was trading within a range. However, the financial markets and Wall Street were surprised by the war that caused an extreme fluctuation in GME price. GME value experienced movements in excess of 30% within a single trading session while the price could change hundreds of per cents during the trading week.

At the time of writing, GME price hit a daily high of $142 (£101) and hit a daily low of around $85 (£61) which is a movement of approximately 38%. After hitting the daily low, the price bounced back up to $119 (£85), which is an increase of around 40% while it moved by more than 250% during the trading week. If you find GameStop shares attractive, see how you can invest in this stock with zero commissions.

2. AMC Entertainment Holdings Inc (AMC) – moving in a 200% range

The entertainment industry in which AMC entertainment operates was hit pretty hard with the pandemic’s outbreak at the beginning of 2020. The company business is centred around the physical presence of customers in its theatres and cinemas, which was obstructed with the measures implemented by the countries as a way to fight the spread of coronavirus. The expectations regarding AMC revenues were that it would experience a decrease as high as 90% in some quarters in 2020 or in monetary value. Accordingly, AMC lost more than $2 billion (£1.44 billion).

AMC chart shows its stock was moving sideways in a rather broad range from as high as $7.5 (£5.4) to as low as $2 (£1.44) until January 2021, when the price breaks out its yearly resistance level. During the first three months in 2020, AMC share lost around 70% of its price. However, in the second quarter of 2020, AMC share price has managed to recover by more than190%, reaching $6.44 (£4.62) by the end of June.

Nevertheless, by the end of July, the price plunged down to $3.8 (£2.73), losing close to 40% within a month. The price experience another major increase by the end of August when it reached a level of $7.3 (£5.24), appreciating by more than 90%. Before the major peak in 2021, the price went through another swing of around 70% when it fell down to nearly $2 (£1.44) during the second half of January 2021.

The peaks and retracements in 2020 were mostly due to the expectation about a possible relaxation of the restrictive measures based on the outlooks about the number of infected as well as the potential development of the vaccine.

The AMC stock price had a significant increase during the last week of January 2021 when it fluctuated by more than 460% from $3.5 (£2.51) up to $19.6 (£19.6) while it declined to nearly $5.2 (£3.73) until mid-February 2021. The reason behind such a drastic price swing can be found in the news related to possible relaxation or removal of restrictive measures as well as the campaign on social media that was created by the Reddit group calling on the purchase of AMC stock. The significant volatility of AMC stock makes it attractive for investors oriented toward short-term investing. Before you purchase this stock, see how you can invest in AMC stocks.

3. Scottish Mortgage Investment Trust plc (SMT) – bounced back by more than 200%

The pandemic’s outbreak had significant negative consequences for the financial markets and the investors because the majority of financial assets were faced with a significant loss in value. However, while some stocks have seen loss more than the others, there are stocks than regain their lost value and even recorded an upward trend. Looking at the price movement of Scottish Mortgage Investment Trust Plc stock, it can be noted that the stock took a hit during the first quarter of 2020 when its price fell to a level of £451 from £640. Nevertheless, the stock managed to recover from its nearly 30% dive during the outbreak of the coronavirus and bounce back by more than 200%, reaching a peak of £1,413 in the first half of February 2021.

Some of the factors behind such an impressive price fluctuation in 52 weeks may be related to this Investment trust’s holdings (i.e. portfolio structure). Shares of tech companies, pharmaceutical companies and online retailers take up nearly 50% of the investment portfolio. Accordingly, when these companies’ price increased during the coronavirus, the value of SMT also increased. This stock also shows the tendency to move more than 5% throughout the day, while investors may expect fluctuations of more than 10% during the trading week. For instance, in the last week of February, the stock fluctuated between £1329 and £1103, more than 15% movement.

4. Barclays Bank (BARC) – price fluctuation of more than 100 % during the pandemic

The financial sector is considered to be one of the most volatile sectors. Consequently, the price of financial companies may display larger fluctuations compared to some of the other sectors. Barclays Bank PLC is no exception since the price of this FTSE 100 stock plunged almost 60% in the first three months of 2020 with the start of the coronavirus. Its pre-pandemic level of £179 fell down to nearly £73, and after hitting bottom, the price of this bank shows a tendency to move in a wide price interval from as low as £73 up to £165.

While the Barclays stock experiences fluctuation of more than 100% in the 52-week period, it failed to define any major trend. Hence, traders could benefit from the constant price increases and decrease and profit from a weekly movement of more than 10%. Of course, when the economy starts to get back to its pre-pandemic activity, some financial institutions’ stocks may record increased volatility.

5. Burberry Group (BRBY) – another £418 needed to reach the pre-pandemic price level

It was believed that the stocks coming from the luxury fashion sector are resilient to economic downturns, but the experience of the financial markets shows that this is not true. On the contrary, stocks associated with the luxury fashion industry have seen an even higher decrease in value compared to other stocks due to a decrease in demand and consequently lower profits. Burberry Group stock is no exception because its price fell by approximately 55% during the pandemic. The company stock was trading at £2,330 before the coronavirus and fluctuated down to a value of £1,015 in 2020.

The yearly price chart shows a similar movement in price as it was evident with Barclays Bank stock. The Burberry Group stock price also fluctuates within a broad range without the ability to form a clearly defined long term trend. Its fluctuations show short-lasting trends but with a higher level of volatility. Since it reached a bottom price of £1,015, the stock has increased by more than 85% up to £1,912. However, the stock still needs to climb an additional £418 to reach the pre-pandemic level of £2.330. Accordingly, strengthening economic indicators may be an indication of a further price increase.

6. British Petroleum BP – potential to increase by another 70%

The Energy sector, along with the oil and gas producing companies, were severely hit with the outbreak of the coronavirus. Decrease and even stagnation of economic activities and the decrease in operating capacity of factories across the globe, especially China, had a significant negative effect on the valuation of oil companies such as British Petroleum. Aside from loss revenues from commercial customers, the companies also lost revenues from individual customers and households due to the “stay at home” measure.

BP stock had a value of nearly £497 at the beginning of 2020, but during the pandemic year, it hit two bottoms with a lower bottom at the beginning of November 2021 when the price deflated close to £188, displaying a fall of 62%.

All through the last 52-weeks, the price exhibits significant volatility, which is evident from the £188 – £425 range, representing a movement of more than 100% in as short as one year. At the time of writing, BP price was traded for £291.44, which is far below the 52-week high and even further below the pre-pandemic level of £496, showing that the price could potentially increase by an additional 70%. BP high volatility is also evident from its potential to fluctuate around 25% during a trading week, depending on the surrounding factors. Investors should also look closely for news and events related to BP, especially events such as oil spills that may have an adverse effect on the stock value. You can check the guide on how to buy BP stocks UK.

7. BYD Company Limited – recovered by more than 700%

The coronavirus also took a toll on the BYD Company stock, causing the company to lose around 37% of its value or from a price of 53 HKD (£4.90) in February 2020 down to 33 HKD (£3). Nevertheless, the popularity of the industry in which this company operates and the sectors it serves with its products enabled this company to return to the pre-pandemic level and to suppress the price of 53 HKD, reaching up to 277 HKD (£25.65). This means that BYD stock price has increased by more than 700% after hitting its bottom price.

Even though the stock has fluctuated beyond the pre-covid-19 peak price, its price goes through regular peaks while moving in a clearly defined upward trend. The multiple peaks and price retracements show that the stock price is characterised by high volatility, which is also evident from its recent price decrease of around 30% in the second half of February 2021.

8. ANSYS Inc. – a stock that appreciated 100%

As it was the case with the other stocks, the outbreak of the pandemic correspondingly didn’t spare the value of Ansys stock. In February 2020, this stock was sold for $291 (£209), but by the middle of March 2020, it was traded for $199 (£143) per share, recording depreciation beyond 30%.

The period after the pandemic outbreak, Ansys stock has recovered by slightly more than 100% hitting a high price of $411 (£295) during the first half of February 2021. Such a rapid increase in stock price comes from a variety of factors. Better financial performance and revenue increases had a positive impact on the company’s value. Also, partnership with other companies, such as the industrial tooling manufacturer Rockwell Automation is welcomed by the investors which is reflected in the price increase. The reason for such positive feedback regarding the partnership is the potential for acquiring new customers and the possibility for an additional increase in revenues.

Noteworthy mentioning is that although the stock moves in a bullish trend during the last 52-weeks, the trendy movement is interrupted with numerous and regular price swings of above 10%. It can be noticed that major price swings may occur every couple of weeks.

9. Alcoa (AA) – retracement of 28% and recovery of 50% in two months

The economic stagnation induced by the coronavirus also harmed the demand for the products produced by the Alcoa company. The former, combined with the adverse effects that the coronavirus had on the stock market, caused this company’s stock to lose close to 68% of its value depreciating from the level of $16.11 (£11.57) to a level of $5.16 (£3.71).

After reaching a multiyear bottom price induced by the Covid-19, the stock had managed to bounce back by more than 400% moving up to $27.72 (£19.91) in February 2021. The stock found its place on the list of most volatile stocks because its price may go through price retracements and bounce back by more than 20% in a month. For instance, in the first week of January 2021, the company stock was trading at around $25 (£18), but by the end of the month, it depreciated to a level of $18 (£13) per share, recording a retracement of 28%. An interesting aspect of this stock that confirms its high volatility is that by the end of February 2021, the stock bounced back to more than $27 (£19.4), representing an increase of 50% in approximately 30 days.

10. ABM Industries Incorporated (ABM) – gaining 155% in less than a year

During the first quarter of 2020, ABM industries stock noted a 50% dip in its value from January until mid-March 2020, during which its stock price decreased from $39.7 (£28.5) down to $19.6 (£14.08). However, in less than a month, the stock has managed to regain 67% in value bouncing back to nearly $33 (£23.7) per share.

Since its multiyear bottom price, the stock value has increased to nearly $50 (£35.9) in February 2021, which is an overall increase of more than 155% in 52 weeks. An interesting characteristic of this stock is that it repetitively experiences price retracements, after which the price moves back toward the original mild trend. The price may fall down by 20% in a couple of weeks, while it may bounce back by more than 20% in less than a month.

Are the Most Volatile Stocks a Good Investment?

Investors that look for an opportunity to generate above average returns should definitely consider investing in some of the most volatile stocks due to their potential to go through extreme price changes in a short period of time. As can be seen from the graphs above, the stock prices of companies with high volatility may fluctuate well over 5% throughout the day. Accordingly, the most volatile stocks have the potential to experience a movement of more than 30% in a single week.

For comparison, investors who direct their funds into the equity market and purchase low volatility stocks with stable share price may expect to generate a return of only a couple of per cents annually. This means that the price of low volatility stocks may change around 5% during the year, whereas high volatility stocks may record a fluctuation of 5% during the trading session. The potential for bigger price changes is the feature of high volatility stocks that is alluring for investors and traders willing to accept higher risk.

Hence, most volatile stocks can be thought of as a good investment because they could significantly impact the average portfolio return. However, investors should follow the money management practices to limit their exposure to volatile stocks because, after all, they do come with higher risk levels.

Most Volatile Stocks Trading Strategies

The most volatile stocks are of particular interest for day traders because it is common for these stocks to record price fluctuations in excess of 5% during the trading day and make a move above 40% in a short time (week, month or during the year). Unlike the buy-and-hold investors whose strategy is to hold the stocks in the long term, the benefit of investing in most volatile stocks is that we don’t have to wait for a decade before we see big profits. High price volatility enables day traders and short-term investors to generate larger profits which is the reason behind the attractiveness of most volatile stocks.

Accordingly, because of the major price fluctuations in a short period, some of the day trading strategies, swing trading and price action strategies may be applicable for investing in highly volatile stocks. Because the most volatile stocks exhibit wider price changes, traders may use price charts with lower time frames to identify and confirm potential signals.

- Trading breakouts from consolidations strategy

When using this strategy, investors should identify a short trend and waiting for a price consolidation to appear. The consolidation occurs when the stock price starts a sideways movement for a short period. A signal may be identified when the price breakouts of the consolidation and continues its movement toward the trend. The trader may want to enter a position when the price breaks the consolidation toward the initial trend.

Using the Scottish Mortgage Investment Trust’s price chart, we can see how a possible trading signal set up may appear. It can be seen that after moving in an upward trend (the long blue line), the price makes a retracement and consolidates for a short period (the black rectangular). After breaking out from the consolidation (the price exits the black rectangular), the price continues its movement in the original trend direction. Another signal that could be identified is right before the change of the trend. You can notice that the stock price also consolidates for two consecutive periods before it breaks out of the consolidation in the opposite direction of the original trend, which may be an indication of a potential trend reversal (eventually forming a new trend).

- Support and resistance breakout strategy

Another strategy widely used by short term traders and investors that might be used when investing in most volatile stocks is to trade using the support and resistance breakout strategy. This strategy is centred around a breakout that occurs when stock prices move bellow or beyond the support and resistance levels and start forming new highs or new lows. The price chart of BYD Company Limited shows how trading signals might appear when using this strategy.

The price chart shows possible signals when the price breaks out the support or resistance levels. The blue lines mark a signal when the price moves beyond the resistance level after it bounced back from this level on three occasions. The price continues its movement in an upward direction. The red lines show a potential signal when the price breaks down the support level and moves in a downward direction.

Best Stock Brokers to Trade Volatile Stocks

The decision to invest in certain stock is not completed when you decide which stock to buy. On the contrary, another important step that every investor should take is to select the best stock broker in the UK out of the numerous companies offering broker services. Even though there are a plethora of brokers and trading platforms, investors should ensure that the broker of their choice satisfies certain criteria. For instance, the selected broker should have the lowest fees, easy to follow steps to open and close investing positions, low capital requirements, a straightforward process to deposit and withdraw funds and the opportunity for fractional ownership.

The good thing is that you don’t have to go through each available broker and trading platform individually because we will cover some of the UK trading platforms that fulfil all of the criteria that define a good UK stock broker.

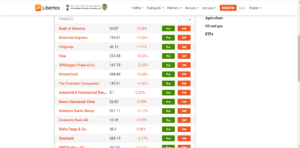

- Libertex – Trade Airline Stock CFDs with ZERO Spread and Leverage

Whenever you trade a CFD instrument, you have the opportunity to make profits from the price movements of an underlying asset without the need to directly buy or sell the specific asset.

Moreover, when trading CFD with Libertex, you also have the opportunity to benefit from bearish price movements by taking a short position with the selected stocks. Ultimately this means that you will first sell (short-sell) some of the most volatile stocks at a higher price in anticipation that the price will decrease, and you will close the position by purchasing the stock at a lower price. The difference between the selling price and the buy price is your gain.

Libertex also gives its clients leverage when opening a trading position through its platform. The UK clients are entitled to leverage of 1:5, meaning that you can open a trading position worth £1,000 with only £200 of your capital. Stated differently, if, for example, you decide to invest £700 of your capital, then you will be able to open a position worth £3,500.

The platform will charge its clients a small fee for certain markets, while there is a zero spread between the bid and the ask price. The minimum deposit amount is set at only £100, and you can use your debit or credit cards or an e-wallet to fund your account. Libertex platform is licensed by CySec, and it has the authorisation to accept traders from the UK.

Pros and cons:

- Libertex is present on the market for more than 20 years.

- The platform provides educational materials to its clients.

- A vast number of instruments to trade with CFD (stocks, crypto, commodities)

- A vast number of available markets

- Libertex zero spread policy gives traders an advantage since the bid and the ask price are the same

- Multiple trading platforms are available (Libertex, Metatrader 4 and Metatrader 5)

Cons:

- Libertex offers only CFD to its clients

- Although highly competitive, the platform charges a small commission for some markets

86% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

Investing in the most volatile stocks may bring bigger profits, but it also comes with higher risks. However, these stocks are attractive for short-term investors and traders because the stock prices may fluctuate in one day more than low volatility stock could move in an entire year. Of course, while the sectors categorised as most volatile sectors rarely change, some stocks’ volatility levels may change.

From the stocks presented in the list of most volatile stocks, it could be concluded that investors have the opportunity to make big profits trading the stock in either direction. The best thing is that smart investors can earn profits during the upward movement of a price and with the same stock’s reversal in the short run.