TradeOr Share Dealing Review: Platform, Features, Pros and Cons

If you’re a Bitcoin believer and want to trade a multitude of assets commission-free, then TradeOr is the broker for you.

With access to roughly 120 financial assets – including stocks, commodities, currencies, cryptocurrencies, ETFs, CFDs and indices – TradeOr is your one-stop shop for one of the best trading experiences in the marketplace.

Combining an easy-to-use interface with immense functionality, TradeOr’s platform allows you to trade anywhere and at nearly anytime. Moreover, you can begin trading with as little as £10 and customer support is always available at the click of a button.

But is there a catch?

Well, read our full TradeOr Share Dealing Review for the inside scoop!

-

-

What is TradeOr?

Through its innovative platform, TradeOr offers a unique approach to online trading. The digital broker allows you to trade stocks, commodities, currencies, cryptocurrencies, ETFs, CFDs and indices.

But separating TradeOr from the competition, the company also allows clients to finance their accounts with Bitcoin. Better yet, its zero-commission structure ensures that fees don’t eat away at your portfolio, while the company’s KYC encryption process keeps all of your data safe and protected.

TradeOr Pros and Cons

Pros

- Trade roughly 120 financial assets commission-free

- Trade stocks, commodities, currencies, cryptocurrencies, ETFs, CFDs and indices at the click of a button

- Use Bitcoin as a medium of exchange instead of fiat currencies

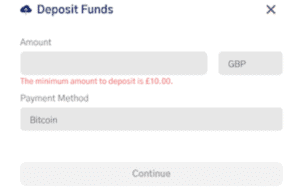

- You only need £10 to meet the deposit minimum

- Up to 500:1 leverage

- Access the latest market data and financial news right from your dashboard

- TradeOr’s proprietary ChartIQ feature provides access to advanced technical analysis indicators

- TradeOr’s watchlist keeps all of your assets organized and allows you to stay up-to-date on the latest price moves

- With TradeOr’s portfolio analysis tool, you can track your performance in real-time

- TradeOr’s KYC encryption process and Two-Factor Authentication (2FA) keeps your data safe and protected

- Customer support is available 24/7 and is easily accessible

Cons

- Not compatible with MT4

Regulation & Trust

While TradeOr does not disclose its regulatory compliance policies, the broker’s KYC encryption process ensures that all of your data stays where it belongs. Moreover, the platform’s Two-Factor Authentication (2FA) feature allows clients to receive unique verification codes via SMS or through TradeOr’s Authenticator App.

Products/Markets

Home to roughly 120 different financial assets, you can begin trading everything from stocks to cryptocurrencies with as little as £10. Moreover, through TradeOr’s watchlist feature, you can efficiently organize all of your potential targets and monitor their latest price action.

In addition, Bitcoin transactions are processed seamlessly, with deposits and withdrawals both supported. However, the only caveat is that you need to amass Bitcoin tokens from a reputable exchange before making a deposit.

Account Types

Regardless of your skill level or experience, TradeOr charges the same fees, bid-ask spreads and offers users access to the same charting tools. However, the platform does not include a practice feature (paper trading), so it’s best to hone your strategy ahead of time.

How to Open an Account

With sign up a breeze, opening a new account can be accomplished with a few simple steps. After entering your first name, last name, email address and creating a password, you’ll be asked to confirm your email address and update your personal information.

As is standard with any brokerage, you’re then asked to enter your home address, country, city, postal code, phone number, date of birth and gender. Also, for withdrawal purposes, selecting a default currency is also required.

Account Fees

With its 0% commission policy, TradeOr allows you to trade securities free of charge. In this arrangement, the company earns a profit by scalping the bid-ask spread from each transaction. In a nutshell, every time a buy or sell order occurs, TradeOr keeps a small portion for itself. In turn, this allows the broker to earn a small profit and maintain its exceptional service.

As it relates to other fees, TradeOr’s fee structure isn’t directly disclosed. As a result, it’s prudent to contact the broker directly before placing your first trade.

Regional Restrictions

Because TradeOr is a new broker, its services are not available in certain countries. The current list of regional restrictions includes:

Bahamas, Botswana, Burma(Myanmar), Cambodia, Democratic Republic of Congo, Cuba, Ethiopia, Ghana, Iran, Iraq, Japan, Kenya, Lebanon, Libya, Malta, North Korea, Pakistan, Panama, Republic of the Congo, Somalia, Sri Lanka, Sudan, Syria, Trinidad and Tobago, Tunisia, Vietnam, Yemen and Zimbabwe.

Also noteworthy, TradeOr reserves the right to add/remove jurisdictions to/from the list without prior warning. As such, you should contact TradeOr’s customer support team if you’re unsure about your country’s status.

Leverage

Offering access to 100:1 leverage (or more), TradeOr grants clients the ability to trade on margin. To explain the mechanics: leverage means that you finance a portion of your position with debt. If we use 100:1 as an example, it means that you can purchase £1,000 worth of securities for every £10 deposit.

Trading Tools & Features

Built for beginners and small traders alike, TradeOr’s online platform has a bevy of valuable features: you have access to the latest market data, U.S. and European news, and you can view your transaction history all within one convenient interface.

Case in point: navigation is structured so that all of your account features are listed on the left side on the page, while news, market quotes, deposit and trade commands remain centered for easy access.

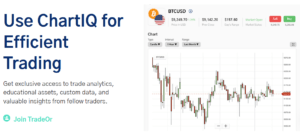

In addition, TradeOr’s proprietary ChartIQ feature grants access to the most popular technical analysis indicators. You can customize the color, style and timeframe to fit your trading style, while also marking entry and exit points directly on the chart.

For beginners, TradeOr’s platform also allows you to switch between basic and advanced charting modes. The feature is beneficial because if you’re stressed for time, the former allows for rapid analysis. For example, if you want to check on your latest trade, a quick glance at the basic chart may be all that’s needed. However, if you’re looking to plot your next move and conduct a thorough analysis, switching to the advanced chart is a breeze.

Equally important, TradeOr’s technology is fully functional on all desktop, laptop and mobile devices (through your web browser). As a result, you can update your portfolio anywhere and at nearly anytime.

To track your performance, TradeOr’s portfolio analysis tool is another must-use. The feature allows you to monitor your account balance, track your profit-and-loss (PnL) and analyze your trading history/pending orders.

Also valuable, TradeOr’s watchlist makes entering a position so much easier. Instead of having to search for an asset each time you log in to the platform, you can add it to your watchlist and monitor its behavior in real-time. More importantly, once the asset reaches your desired buy or sell target, you can capitalize on the price move without any delay.

Banking

Through the easy-to-spot icon on your dashboard (located in the top right corner of the page), you can deposit/withdraw funds to/from your account using your Bitcoin wallet. Remember, deposits can only be made with Bitcoin, so it’s important to set up your Bitcoin wallet in advance.

However, as it relates to withdrawals, it works a little bit differently. For example, if you deposit $100 in Bitcoin, you have to withdraw $100 in Bitcoin. But if your account balance exceeds the initial deposit ($100) at the time of withdrawal, you can withdraw the excess funds via any method you wish.

Keep in mind though: it takes two to five business days to process a withdrawal request, and while TradeOr doesn’t list any specific fees on its website, its terms and conditions state that withdrawal fees may apply on a case-by-case basis.

Placing Trades

To open a new position, TradeOr’s platform ensures that the process is extremely user-friendly.

Getting a Quote

If you type an asset’s name or ticker symbol into the search bar, TradeOr’s interface will list the latest prices in which you can buy and sell. If you’re unfamiliar, the figures are called “quotes” and they’re aggregated using the latest buy/sell activity from other market participants. At their core, quotes are consolidated from the latest transactional data received from TradeOr, other brokerages, exchanges and/or other trading platforms.

Placing an Order

If you decide to take the leap, you can purchase or sell the asset by entering a market order (at the designated price) or a limit order (at your preferred price) to execute the transaction. However, it’s important to remember that limit orders don’t always execute. As a result, if you want to guarantee that your order fills, it’s best to use a market order.

Once you’ve bought the asset, you also have the option to enter a stop-loss order. A staple of sound risk management, stop-loss orders give the broker the right to automatically sell your holding if the asset’s price declines to your pre-defined level.

Short selling

For more experienced traders, TradeOr also gives you the option to conduct a stock short sale. However, short sales only profit if the stock price falls, and thus, should be avoided if you’re just starting out.

User Experience

Contrary to its competitors, TradeOr’s platform requires little to no trading experience to master. Through its navigation tab, you can scroll through the latest ‘market movers’ and see which assets offer the most profitable trading opportunities.

In addition, you can select the ‘U.S. shares’ icon or ‘EU shares’ icon and view the most popular stocks within each region and their performance on that day. Moreover, the various listings also include company logos – which ensures that you won’t confuse the company with another one that has a similar ticker symbol/name – and are presented in tile format, allowing you to quickly move from one stock to the next.

In addition, the illustrations are presented clearly on all desktop, laptop and mobile devices, and TradeOr’s colour scheme ensures that everything functions without being too distracting.

Customer Service

Aiming to please, TradeOr has a dedicated customer support team that’s available at the click of a button. Whether it’s placing a trade or finalizing a deposit, you can contact TradeOr’s support staff 24 hours a day, seven days a week.

As a current or prospective client, you also have the option of opening a support Ticket via TradeOr’s website, or contacting the company through Facebook, Twitter or Instagram. As a third option, you can also submit an email inquiry by writing to [email protected].

Even more beneficial, once your account is up and running, you can correspond with TradeOr’s support team via live chat. A real time saver, through the live chat icon on your dashboard, you can connect with a service agent in a matter of minutes. Conversely, the only downside is that customer support is not available through telephone.

Conclusion

With the benefits far outweighing the costs, TradeOr’s platform is a winner in our book. Combining zero-commission trading with Bitcoin deposits and withdrawals, the dynamic allows you to diversify your portfolio without having to sell your cryptocurrency holdings.

More importantly though, the platform is easy to navigate. With company-specific illustrations and platform graphics designed to avoid potential confusion, finding the correct asset and placing a trade has never been easier. Moreover, if you happen to encounter any problems, TradeOr’s customer support team is available around the clock to answer any questions that you may have.

And while TradeOr’s lack of regulatory disclosure is less than stellar, its KYC encryption process and Two-Factor Authentication (2FA) ensures that your data is protected.

TradeOr – Buy Shares and Bitcoin With No Commission

Your capital is at risk.

Frequently Asked Questions (FAQ)

Does TradeOr accept cash deposits?

As a unique brokerage, TradeOr only accepts Bitcoin deposits and withdrawals. However, any excess profit that you earn can be withdrawn using any payment method that you choose. For example, if you deposit $100 in Bitcoin, you need to withdraw $100 in Bitcoin. However, if your account balance exceeds $100 at the time of withdrawal, the excess funds may be withdrawn in cash.

Does TradeOr offer managed accounts?

Yes. If you’re new to investing and want a professional to manage your funds, you can grant a third-party discretionary authority over your account. However, money managers are not employees of TradeOr and the company is not responsible for determining their competency.

Does TradeOr take steps to protect my privacy?

Yes. Through its KYC encryption process, customer data is protected and the company is in full compliance of the General Data Protection Regulation (EU) 2016/679 (GDPR). As a result, personal data is only revealed to third-parties when one of the following four conditions is met: 1. Where we have obtained your express consent. 2. Where processing of personal information is permitted or required by applicable law. 3. Where processing of personal information is necessary for the detection or prevention of crime and fraud. 4. Where the processing of personal information is necessary for the exercise or defense of legal rights.

What assets can I trade?

Offering access to a wide variety of securities, TradeOr allows you to trade stocks, commodities, currencies, cryptocurrencies, ETFs, CFDs and indices. With stocks, you also have the option to go both long and short, while market, limit and stop-loss orders are available to enhance your trading experience. In addition, assets are clearly labelled to avoid confusion, and the platform’s tile layout enables you to place several buy and sell orders without having to navigate through different screens.

What is the deposit minimum?

With a £10 deposit minimum, TradeOr allows you to hone your trading skills, while avoiding minimum balance fees. Moreover, with the ability to leverage your trades by 100:1 (or more), you can increase your buying power without having to deposit additional funds.

Is TradeOr’s platform available in all countries?

No. As of today, there are 28 countries currently listed on TradeOr’s restricted list and the company reserves the right to add or remove jurisdictions at its discretion. However, there are no major European or North American countries on the list, and it’s unlikely that any major and/or developed markets will be added.

Does TradeOr’s platform support different languages?

Unfortunately, the current version is only available in English. However, given the visual aids and seamless design layout, the platform is easy to navigate, even if English is not your first language.

Does TradeOr offer investor education?

As one of the few small areas where TradeOr could improve, the platform doesn’t include any education resources or trading guides. As a result, beginners have to navigate the financial markets on their own. However, TradeOr’s news section is bursting with aggregated content and reputable sources regularly update you on the latest market trends.

Michael Graw

Michael Graw is a freelance journalist based in Bellingham, Washington. He covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech. In addition to covering financial markets, Michael’s work focuses on science, the environment, and global change. He holds a Ph.D. in Oceanography from Oregon State University and worked with environmental non-profits across the US to bridge the gap between scientific research and coastal communities. Michael’s science journalism has been featured in high-profile online publications such as Salon and Pacific Standardas well as numerous print magazines over the course of his six-year career as a writer. He has also won accolades as a photographer and videographer for his work covering communities on both coasts of the US. Other publications Michael has written for include TechRadar, Tom’s Guide, StockApps, and LearnBonds.View all posts by Michael GrawWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up

Through its innovative platform, TradeOr offers a unique approach to online trading. The digital broker allows you to trade stocks, commodities, currencies, cryptocurrencies, ETFs, CFDs and indices.

Through its innovative platform, TradeOr offers a unique approach to online trading. The digital broker allows you to trade stocks, commodities, currencies, cryptocurrencies, ETFs, CFDs and indices.