How to Buy Roblox Shares UK – With 0% Commission

One of the hottest IPOs of 2020 never happened. Instead, Roblox – a video gaming company with over 36 million users – decided to postpone its stock market debut to this year in order to get a higher valuation.

That move paid off for the company, which joined the New York Stock Exchange earlier this week through a direct listing. Roblox listed with a valuation of $31.3 billion and ended its first day of trading up a whopping 54%.

In this guide, we’ll cover everything you need to know about how to buy Roblox shares UK with 0% commission. We’ll also take a closer look at Roblox stock to help you decide whether it’s a buy right now.

-

-

Step 1: Find a UK Stock Broker to Buy Roblox Shares

In order to buy Roblox shares UK, you will need a top stock broker that offers shares from this hot IPO. Not all platforms offer trading on US IPOs right away, but some do. We’ll review two of the best UK stock brokers that offer shares of Roblox today.

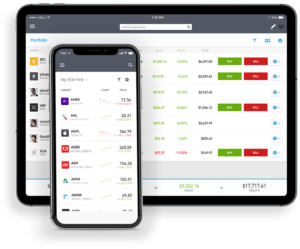

1. eToro – Buy and Sell Roblox Shares with 0% Commission

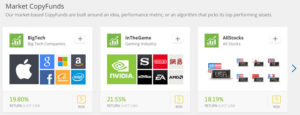

eToro is the overall best UK broker to trade Roblox stock. This platform has nearly 2,000 shares and hundreds of ETFs, and it listed Roblox shares on the first day of trading. Better yet, eToro allows you to choose between CFD trading and share dealing.

Investing in Roblox with eToro is 100% commission-free. The platform doesn’t charge deposit fees and offers very tight spreads for CFD trading. The only fees to note with this broker are small withdrawal and inactivity fees, although these can be avoided.

One of the best things about eToro is its built-in social trading network. You can see what thousands of traders around the world are buying and selling as well as share stories and trade ideas. The platform even lets you copy professional traders’ positions, so you can build a professional portfolio or start day trading in just a few clicks.

eToro also offers plenty of tools for analysing Roblox shares directly. The platform has an easy to use technical charting interface with over 100 indicators included. eToro also offers research from professional analysts, including a 12-month price target for Roblox shares.

eToro is regulated by the UK Financial Conduct Authority (FCA) and offers 24/5 customer support by phone and email. The trading platform is available on web and mobile devices.

Pros

- Nearly 2,000 shares to trade

- 100% commission-free trading

- Follow thousands of other UK traders

- Professional analyst research

- FCA-regulated with 24/5 support

Cons

- Small withdrawal and inactivity fees

67% of retail investors lose money when trading CFDs with this provider.

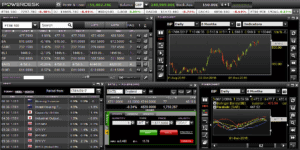

2. Fineco Bank – Top-rated UK Broker for Investing in Roblox Shares

Fineco Bank is a major Italian bank with a brokerage arm that operates in the UK. This stock broker offers both share dealing accounts and CFD trading, so it’s a great choice for long term investors and active traders alike. Better yet, Fineco Bank carries thousands of shares from around the world, including nearly all NASDAQ- and NYSE-listed shares in the US.

Share CFD trading with Fineco Bank is 100% commission-free. However, the platform does charge commissions for share dealing and ETF dealing. You’ll pay £2.95 per trade for UK shares or $3.95 per trade for US shares like Roblox. When you invest in ETFs, Fineco Bank charges an annual management fee of 0.25%.

This stock broker stands out not just for its variety of offerings, but also for its investment tools. Fineco Bank has a user-friendly mobile trading app that allows you to set up watchlists, create price alerts, and buy shares on the go. The mobile app doesn’t include technical charting capabilities, which is a downside for more experienced traders.

If you want in-depth analysis, Fineco Bank also offers the PowerDesk web trading platform. This technical platform includes dozens of studies and drawing tools. It’s also highly customisable so you can perform your own analyses or track multiple markets.

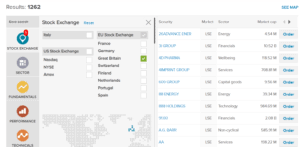

We also like Fineco Bank’s stock screener tool. This allows you to quickly find hot stocks from around the world and identify opportunities for trading.

Fineco Bank is regulated by the Bank of Italy. You can get in touch by phone or email if you need help with your account.

Pros

- Thousands of shares to trade

- Commission-free CFD trading

- User-friendly stock app

- Technical analysis with PowerDesk platform

- Built-in stock screener

Cons

- Small commission for share dealing

- Management fee for ETF investing

Your capital is at risk.

Step 2: Research Roblox Shares

Should you buy Roblox shares after the stock’s explosive IPO? Let’s take a closer look at how this company operates and how Roblox shares might climb in the future.

Roblox Stock Price History & Market Capitalisation

Roblox was founded in 2004 by David Baszucki and Erik Cassel and the platform was released to the public in 2006. The company grew slowly for the first several years of its existence, in part because it shied away from marketing. However, Roblox began to attract users in the early 2010s and exploded in popularity after the COVID-19 pandemic.

Roblox initially planned to go public via a traditional IPO in late 2020. However, the company decided to cancel the listing after seeing companies like DoorDash and Airbnb leave money on the table in the red-hot IPO market. That turned out to be a good decision, since the company earned a valuation of $29.5 billion in a private funding round at the end of last year – much higher than its planned IPO valuation.

Roblox listed on the NYSE on March 10, 2021 via a direct listing. This is a type of listing in which the company avoids the typical underwriting process and issues no new shares. Instead, employees and existing shareholders can choose to sell their shares for a preset price to the public.

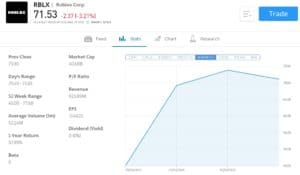

The shares listed at a price of $60.50 per share, giving Roblox a market capitalization of $31.3 billion. By the end of the first day of trading, Roblox shares had climbed 54% to $73.90 per share, giving the company a market cap of $38.3 billion.

Roblox EPS and P/E Ratio

Roblox reported earnings per share (EPS) of -$0.20 in December 2020, ahead of its IPO. The company brought in $924 million in 2020, up from $325 million in 2018.

Since Roblox does not have positive earnings, it does not report a price-to-earnings (P/E) ratio.

Roblox Stock Dividend Information

Roblox is not profitable and does not issue a dividend at this time. Investors should not expect a dividend from Roblox for many years to come.

Should I Buy Roblox Shares?

Roblox jumped 54% in its first day of trading. So, is it too late to jump on this hot new stock? Or is this just the beginning of a long upward climb for Roblox shares?

We think Roblox has a lot of potential as a long term investment. Here’s why.

Pandemic Winner

It’s hard to overstate how important the COVID-19 pandemic was for Roblox.

As a result of the lockdowns and school closures, the company saw its user base nearly double from 2019 to 2020. The Roblox virtual world became the de facto place for kids to hang out in the absence of school, which drove up user engagement with the platform to over 2.5 hours per day.

Much like Zoom, we don’t see the world’s dependence on Roblox disappearing once the pandemic is over. It may have taken the coronavirus to push Roblox to the forefront of gaming, but now that it’s here, expect it to stay dominant.

Solid Fundamentals

The first thing to know about Roblox is that it’s balance sheet is quite strong. This is worth pointing out because it hasn’t always been the case for tech IPOs over the past few years.

Roblox isn’t profitable, but it’s well on its way. The company grew revenue by more than 80% in the past two years. The net loss for 2020 was largely due to increased spending on safety, infrastructure, and marketing – all good signs for a fast-growing company, and expenses that won’t need to be maintained at such a high level in the future.

Another good sign for Roblox is that the gaming platform’s number of paid users increased markedly over the past year, from 184,000 in 2019 to 490,000 in 2020. The next test will be whether Roblox can retain all these paying users after the coronavirus pandemic ends, but we’re optimistic about that.

Virtuous User Cycle

One of the most attractive things about Roblox from an investment perspective is the virtuous user cycle the platform has created. Roblox has created a development platform that virtually anyone – even kids – can use to develop new experiences on the platform.

Since it’s so easy to create new worlds and games, developers have flocked to the platform. At the same time, more games and worlds to explore attracts users. As the number of users grows, the number of developers on Roblox grows, too. And so on – the flywheel keeps spinning.

Even better, Roblox is more than just a gaming environment. It’s also a social network, where users can invite friends onto the platform and then engage with them in virtual worlds. This engagement incentivizes Roblox users to spend more time on the platform – last year, the average user spent over 2.5 hours a day on Roblox – and to pay for access to more games and customisations.

Fast-growing Addressable Market

Another thing we like about Roblox is that its potential market is enormous. For one thing, the platform already has around 36 million active users.

That means that just 1.36% of users are currently paying. Notching the fraction of paying users up by even a single percentage point would make Roblox profitable and give it a war chest of cash to fund future growth.

On top of that, Roblox has been aggressively expanding into international markets. In fact, the company is working with Tencent, the Chinese video game marker, to get its virtual worlds in front of Chinese players. China is the world’s biggest video game market, so Roblox could more than double in size if it gains a foothold there.

One note of caution about Roblox is that it targets primarily kids and teenagers, not adults – so it’s parents of users, not users themselves, who control the purse strings. This hasn’t been an issue for Roblox’s revenue stream so far, but it is something to keep in mind as the company eventually looks to increase user monetization.

Step 3: Open an Account and Deposit Funds

Ready to buy Roblox? We’ll show you how to get started with eToro, which offers 0% commission trading, an advanced technical analysis platform, and a social trading network.

The first thing you need to do is open a new eToro account. Head to eToro’s website or download the eToro app from Google Play or the Apple App Store.

Next, click or tap ‘Join Now’ to create a new account. You can enter your email address or create a new account using your Facebook or Google login.

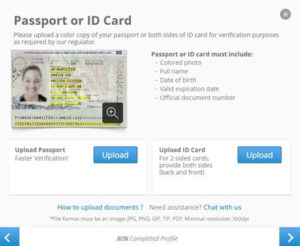

eToro is regulated by the UK FCA and follows Know Your Customer (KYC) rules. So, you must verify your identity before you can start trading. Simply upload a photo of a government-issued ID like your passport or driver’s license. Then upload a photo of a utility bill or financial statement that shows your current address.

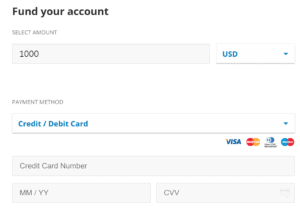

Now you can deposit funds into your account. eToro requires a minimum deposit of £160, which you can pay by debit card, credit card, PayPal, Neteller, or Skrill. You can also make a deposit by bank transfer if you deposit at least £500.

Step 4: Buy Roblox Shares

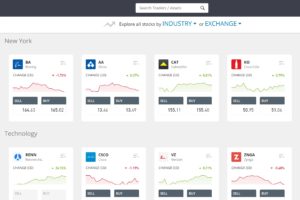

Now you’re ready to buy Roblox shares. Search for ‘Roblox’ or ‘RBLX’ in the search box at the top of the eToro dashboard (if you’re using the app, tap the magnifying glass to search). Click on the ‘Trade’ button when Roblox appears in the dropdown menu.

In the order form, enter the amount of money that you want to invest in Roblox shares. Note that eToro allows you to purchase fractional shares of Roblox, so you can invest any amount over $50 (£35). You can also select a stop loss or take profit level for your trade if it makes sense for your trading strategy.

When you’re ready, click ‘Open Trade’ to buy Roblox shares.

Roblox Shares Buy or Sell?

Roblox is a long term growth stock with a lot of upside potential. This video gaming company already has more than 36 million users, and it stands to grow rapidly if it is able to tap into enormous markets like China.

On top of that, Roblox has only monetized around 1.3% of its user base. While that could be a red flag, we see it as a savvy move by Roblox’s leadership team. The company is busy making its platform indispensable to developers and gamers, and can slowly find more ways to monetize its user base down the road.

Of course, that does mean that Roblox will likely lose money, or only turn a small profit, for some years to come. Given the favourable way that investors have viewed money-losing stocks in recent years, this shouldn’t be a problem. But, it does expose Roblox to a potential downturn in the stock market.

With that in mind, Roblox should be treated as a moderate risk investment. The business is sound and the platform is well-poised for growth, but the path to profitability could be long and may involve some ups and downs in the share price.

The Verdict

Roblox was one of the biggest winners of the coronavirus pandemic. The company saw its user base nearly double last year and its revenue has grown by over 80% in two years. Roblox has been successful in part because of the virtuous cycle it has created for users, and we expect this cycle to drive the company towards future growth.

So, despite the 54% gain on the first day of trading, we think that Roblox shares are a potential buy right now.

Ready to buy Roblox shares in the UK? Get started today with eToro and pay no commissions for your trade.

eToro – Buy Roblox Shares UK

67% of retail investors lose money when trading CFDs with this provider.

FAQs

Who is the CEO of Roblox?

The chief executive of Roblox is David Baszucki. The company’s founders, David Baszucki and Erik Cassel, co-direct the Roblox game platform.

How does Roblox make money?

Roblox makes money by allowing users to buy Robux, which is a virtual currency that can be spent on in-game experiences.

Can I buy Roblox shares in an ISA or SIPP?

Yes, you can buy Roblox shares in an individual savings account (ISA) or Self-invested personal pension (SIPP). Your broker must offer these specialised account types.

Is Roblox profitable?

Roblox is not profitable. The company reported a net loss of $194.5 million in the first 9 months of 2020.

What platforms does Roblox run on?

Roblox runs on iOS and Android mobile devices as well as computers. This means that Roblox pays 30% of revenue to the Apple App Store and Google Play.

Michael Graw

Michael Graw is a freelance journalist based in Bellingham, Washington. He covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech. In addition to covering financial markets, Michael’s work focuses on science, the environment, and global change. He holds a Ph.D. in Oceanography from Oregon State University and worked with environmental non-profits across the US to bridge the gap between scientific research and coastal communities. Michael’s science journalism has been featured in high-profile online publications such as Salon and Pacific Standardas well as numerous print magazines over the course of his six-year career as a writer. He has also won accolades as a photographer and videographer for his work covering communities on both coasts of the US. Other publications Michael has written for include TechRadar, Tom’s Guide, StockApps, and LearnBonds.View all posts by Michael GrawWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

eToro

eToro

Fineco Bank

Fineco Bank

Roblox was founded in 2004 by David Baszucki and Erik Cassel and the platform was released to the public in 2006. The company grew slowly for the first several years of its existence, in part because it shied away from marketing. However, Roblox began to attract users in the early 2010s and exploded in popularity after the COVID-19 pandemic.

Roblox was founded in 2004 by David Baszucki and Erik Cassel and the platform was released to the public in 2006. The company grew slowly for the first several years of its existence, in part because it shied away from marketing. However, Roblox began to attract users in the early 2010s and exploded in popularity after the COVID-19 pandemic.

Next, click or tap ‘Join Now’ to create a new account. You can enter your email address or create a new account using your Facebook or Google login.

Next, click or tap ‘Join Now’ to create a new account. You can enter your email address or create a new account using your Facebook or Google login.