The pound sterling is managing to shake off some of its early losses against the US dollar during early forex trading activity after the British currency made a dangerous approach to a long-dated support line.

The sterling has started the week in the red zone amid Prime Minister Boris Johnson’s decision to introduce a four-week lockdown in England, a situation that increases the prospects of negative interest rates and further fiscal stimulus to cushion the economic blow resulting from the measure.

Traders have been favoring the dollar this morning as well only a day before the long-awaited US presidential election, as the US Congress failed to push another round of stimulus before the event, which bought some time for the greenback as the economy takes the back seat – at least temporarily – in the political discussion.

The pound is also seeing similar losses against the euro, although it continues its upward path towards the upper boundary of a long-dated downward price channel.

This recent appreciation against the euro has been mostly fueled by the prospect of further monetary easing from the European Central Bank (ECB), as signaled by recent remarks from President Christine Lagarde, who stated that the bank is ready to provide support “as and when need” – similar to what the Federal Reserve has done in the United States since the outbreak started.

Forex traders coincide that the ECB is likely to take action in December if the second wave of the virus in the European continent worsens, which would favor the pound sterling to some extent – although the Bank of England (BoE) might be forced to follow through on that front.

All eyes on the US Election and Saturday’s BoE meeting

The Bank of England will be holding its Monetary Policy Committee (MPC) meeting this Saturday and the results from their discussion of the current state of affairs in the UK will be closely watched by traders as the central bank is likely to provide guidance on what may come next amid the economic impact resulting from these lockdowns.

In this regard, Japanese financial services firm Nomura said in a note to clients that “The publication of a new set of weaker economic forecasts at its November meeting would therefore be an opportune time to announce a further loosening in monetary policy”.

Meanwhile, the firm further emphasized that they do not believe that the BoE will lower rates into negative territory, although that alternative will remain on the table in case the situation worsens.

That said, Nomura does expect to see a positive stand from the British central bank in regards to the need for further monetary easing, which they believe will not be necessarily negative for the pound given that the ECB and others are likely to follow the same path.

What’s next for the pound sterling?

The US dollar has been appreciating against the sterling in the past week as Congress failed to pass another round of fiscal stimulus for the North American economy, while the greenback has also been favored from a risk-off move seen last week amid the turbulence created by the second of wave of the virus in the global economic landscape.

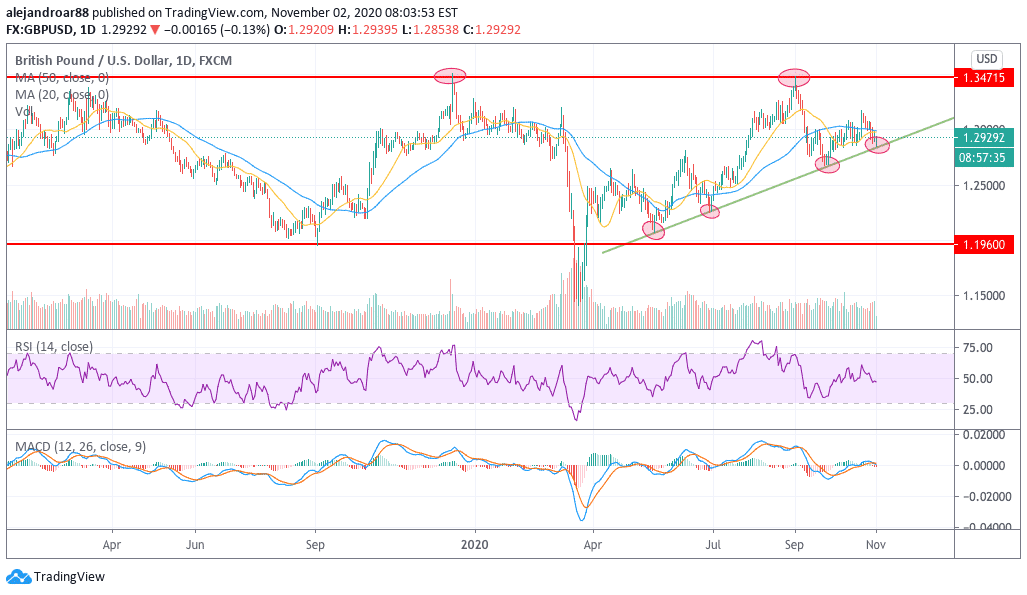

This uptick in the greenback has pushed the sterling dangerously closer to a lower trend line that emerged in early May as the United States went all-in on its monetary easing.

This support line has been respected by traders and algorithms three times in the past and it is also serving as a stronghold today, as the value of the British currency swiftly bounced off it earlier in the day.

That said, any signs of further turbulence in the financial markets such as a contested US election result or an unexpected turn of the tables in the BoE meeting that signals no further monetary easing or the potential introduction of negative rates could end up plunging the pound below this key threshold.

On the other hand, a strong rebound at this point seems a bit unlikely as the backdrop continues to play against the pound’s short-term outlook – especially as Brexit talks could be further delayed amid the virus situation.

Are you interested in learning more about forex? Check out our selection of forex courses.

Question & Answers (0)