How to Buy Pineapple Power Shares

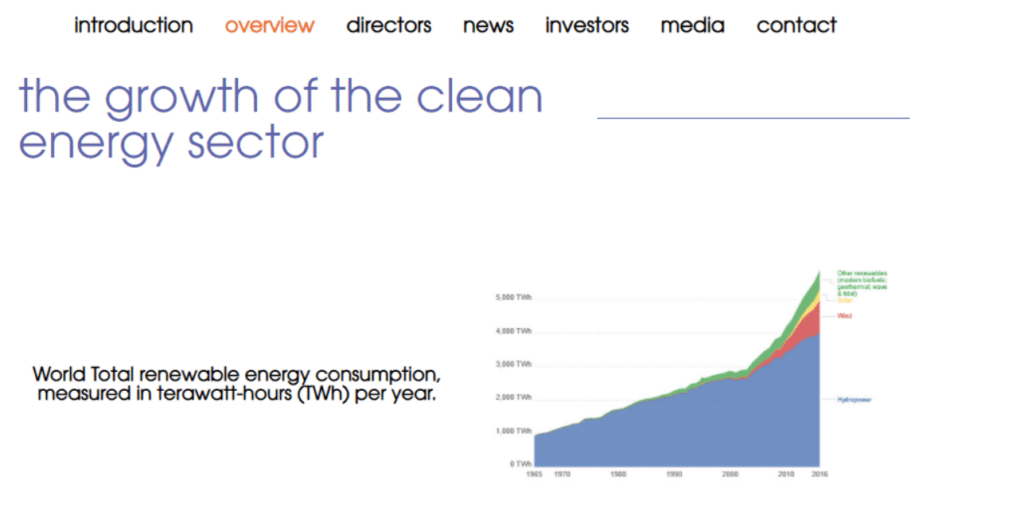

Pineapple Power is a firm focused on investing in clean and renewable energy-related businesses. The rate at which clean energy investments are growing makes Pineapple Power an attractive investment proposition.

This guide discusses How to Buy Pineapple Power Shares UK and some key elements to keep in mind when making your investment decision.

How to Buy Pineapple Power Shares UK

If you want to buy Pineapple Power shares in the UK right away, then look no further. We recommend that you use an FCA-regulated broker due to the high level of investor protection they offer. The following steps will show you how to buy Pineapple Power shares UK.

- Step 1: Open an account with a regulated broker – Visit your broker’s official website and choose to sign up. After this, create an account by entering your valid email address and pick a username and password.

- Step 2: Upload ID – Verify your account by uploading proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of your recent bank statement or utility bill).

- Step 3: Deposit – Fund your account through credit/debit card, bank transfer, or e-wallet.

- Step 4: Buy Pineapple Power Shares UK – Type the ticker symbol into the search bar and opt to trade. Input the amount you’d like to invest and click ‘Open Trade’.

Choose a Stock Broker

One of the first steps you need to take if you want to buy Pineapple Power Shares UK is to choose a broker. Brokers basically act as the ‘middleman’ in the financial markets, pairing buyers and sellers together. This is why you must choose a broker with specific qualities, including a good fee structure. This section discusses two of the most popular brokers to buy Pineapple Power Shares in the UK.

1. Fineco Bank

Fineco Bank offers a fully-fledged CFD trading facility. The bank provides leverage and short-selling facilities for traders. When trading CFDs, the Fineco offers maximum leverage of 1:30 on major forex pairs, followed by 1:20 on gold, major indices, and minor/exotic forex pairs. For stocks, Fineco offers leverage of up to 1:5. Additionally, Fineco Bank allows you to short-sell assets.

Apart from CFDs, this broker offers more than 10,000 shares to choose from, 1,000 ETFs, and more than 5,500 bonds. Notably, Fineco is a low-cost broker that charges minor non-trading fees. The platform also doesn’t charge fees for inactivity, deposit, or withdrawal. Its mobile trading platform is well-designed and user-friendly and is available for both Android and iOS. As a listed broker with a banking background, Fineco Bank scores high on safety.

| Stock Trading Fees | 0% commission on CFDs; £2.95 per trade on UK shares; $3.95 per trade on US shares |

| Deposit Fees | No |

| Withdrawal Fees | No |

| Inactivity Fees | No |

| Monthly Account Fees | No |

Sponsored ad. 68% of retail investor accounts lose money when trading CFDs with this provider.

Research Pineapple Power Shares

Pineapple Power’s focus as a renewable energy stock is a major reason why many people use it within their investment portfolio. However, you need to make sure that all aspects are covered and determine if the share price may likely rise in the future. This research stage is important for buying a company’s shares, as it will help you determine if a company is a good investment or not.

Given this, we explore what Pineapple Power aims to achieve and cover its financial track record to help you make an informed decision on whether to buy Pineapple Power shares or not.

What is Pineapple Power?

Pineapple Power Corporation is an alternative energy venture listed on the Standard Market of the London Stock Exchange (LSE) as a special purpose acquisition company (SPAC). It trades under the ‘PNPL’ ticker symbol and was founded way back in 2014.

The company aides the transition to renewable energy sources through the acquisition of clean energy companies. Given the growing interest in clean energy sources, fast-tracked by the alarming climate concerns, Pineapple Power seeks to migrate energy needs and sources to more environmentally-friendly sources. According to its overview, the continued development of solar and wind generation projects, replacement of fuel-powered vehicles, the growing awareness of the damage fossil fuels cause to the atmosphere, and the adoption of electric vehicles and advanced battery storage technologies fuels its mission.

To this end, Pineapple Power serves as a financial springboard for companies interfacing and providing more clean energy through their operations. This includes rare earth and minerals exploration and mining, research corporations involved in developing new technologies, and those who promote clean energy.

Renewable energy is a hot topic and the rave of the moment. This has mostly been buoyed by the International Energy Agency (IEA), which puts the global renewable energy capacity at 167 Giga Watts (GW). This is expected to double in 2021 as more companies and governments come under increasing pressure to develop technologies for sustainable economic growth. Founder Clive de Larrabeiti spoke on the burgeoning technology’s huge potential to become commercially viable during its listing in the stock market. He also noted that Pineapple Power is out to become a major player in the renewable energy sector.

Pineapple Power Share Price

Pineapple Power has been generating a lot of buzz in the last year, reflecting positively on its share price valuation. At press time, Pineapple Power’s share price valuation is currently at £6.99. This reflects a 115% increase from the past year. However, this is not the highest share price PNPL has posted.

At the start of the year, Pineapple Power’s share price surged to £13.10 on Jan. 19. However, interests have since waned as investors turn to other investment sources, and Pineapple Power slumped by 45% from its open year trade. Pineapple Power’s interest in the energy sector means that its share price is expected to continue posting strong returns well into the future. This is seen in its share price, which has averaged £5 despite the market downturn that has negatively impacted the stock market so far.

The company’s trading chart has been relatively quiet, with the PNPL share price indicating more bullish propensity from its opening trade of £3 last year. Even though there are no significant acquisitions yet, Pineapple Power has remained in investors’ good books, only temporarily slumping to £5 on Jan. 15.

Pineapple Power Shares Dividends

If you are interested in buying Pineapple Power shares in the UK, you would be interested in knowing if it pays dividends to shareholders. Pineapple Power does not offer a share dividend. This is because it has not yet completed a fiscal year since it was listed in December 2020. Also, there is no official statement that states dividend payments may be introduced in the future.

Pineapple Power ESG Breakdown

Ethical investments have become a major trend in the stock market as more investors become more conscious of their assets. This way, investors are on the lookout for morally and environmentally responsible companies with their operations. A suitable way to do this is by measuring the asset’s score through its environmental, social, and governance (ESG) rating.

To help us determine this, we turn to the popular ESG rating website CSR Hub to ascertain Pineapple Power’s environmental consciousness. However, the company’s data is not yet listed on the site, which could be because it recently went public. This would likely change in the future, and you will be able to measure the company’s ESG rating. Meanwhile, its focus in the renewable energy space points out that Pineapple Power is an ethical company that scores high in the environmental aspect of the rating.

Why Do People Invest in Pineapple Power Shares?

Pineapple Power’s primary focus on catalyzing the clean energy revolution means it’s a key player in an industry believed to be the next frontier of human endeavor. However, as with all shares, you must do your own research before making an investment decision.

Open an Account & Buying Shares

If you want to buy Pineapple Power shares in the UK, then you will need to create an account with an FCA-regulated broker. With that in mind, the five steps below will show you how to invest in Pineapple Power shares – all from your laptop, tablet, or smartphone.

Create a Trading Account

To get started, simply head to your chosen broker’s homepage and choose to sign up. On the signup page, simply enter your email address and choose a username and password.

Verify your Identify

Before new users are allowed to trade, they need to verify their identities. Upload a proof of ID (driver’s license or a copy of your official passport) and proof of address (a copy of a recent bank statement or utility bill). Once this is done, your broker will verify the documents and notify you when complete.

Make a Deposit

When funding your account for the first time, you’ll only have to make an initial minimum deposit.

The following options are popular for users to make deposits.

- Credit card

- Debit card

- Bank transfer

- PayPal

- Neteller

- Skrill

- Klarna

- Trustly

How to Buy Shares

Now that the deposit is made, you can buy any shares you want. To get started, type the ticker symbol into the search bar on the dashboard and click ‘Trade’ on the result that you want.

You will be redirected to an order box to enter the amount you would like to invest. You can also utilize leverage to increase your returns on investment. However, remember to put in the necessary take profit (TP) and stop-loss (SL) to reduce your exposure. Once you are done, click on ‘Open Trade’ to get started.

Is It a Good Idea to Buy Pineapple Power Shares?

So, should you buy or sell Pineapple Power shares? That largely depends on you, but the company’s focus should make for an interesting subject area. Its renewable energy investment makes for its strong suit and possible future success.

Climate change is a growing concern, and several companies are already seeking ways to transition to the new model of leveraging energy. This is apparent by the recent spike in EVs and electric-powered heavy-duty trucks. This puts Pineapple Power as one of the first SPACs to place a stake in the space and may see it become the go-to destination for renewable energy in the future.

Conclusion

Pineapple Power is an exciting project. Even though this is its first year in the fiercely competitive stock market, Pineapple Power has been able to keep its head above water. Also, its strong financial track record is another major plus for the company.

If you want to buy shares in the UK right now, we recommend using an FCA-regulated broker. These brokers allow you to trade safely and with solid investor protection.