Oil stocks have been losing value for more than a month now amid weakness in the price of crude on the back of increasing concerns about the spread of the more contagious and deadly Delta variant across the world while a stronger US dollar has also capped oil’s advance during the same period.

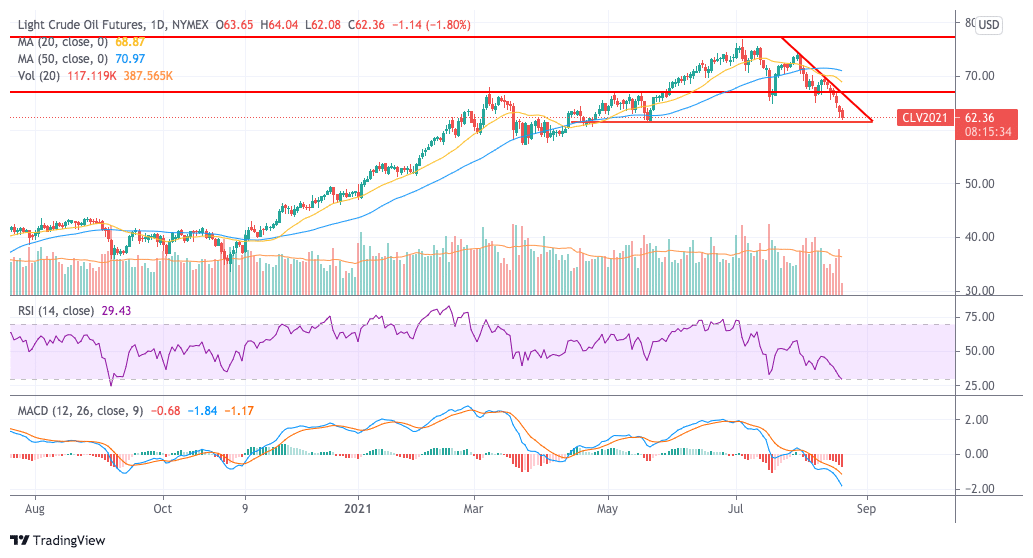

Including this morning’s oil trading action, both WTI and Brent futures are posting their seventh consecutive losing session. Meanwhile, since the month started, the price of Brent has slid 14.3% at $65.4 per barrel while WTI futures have shed 13.8% of their value at $62.5 per barrel.

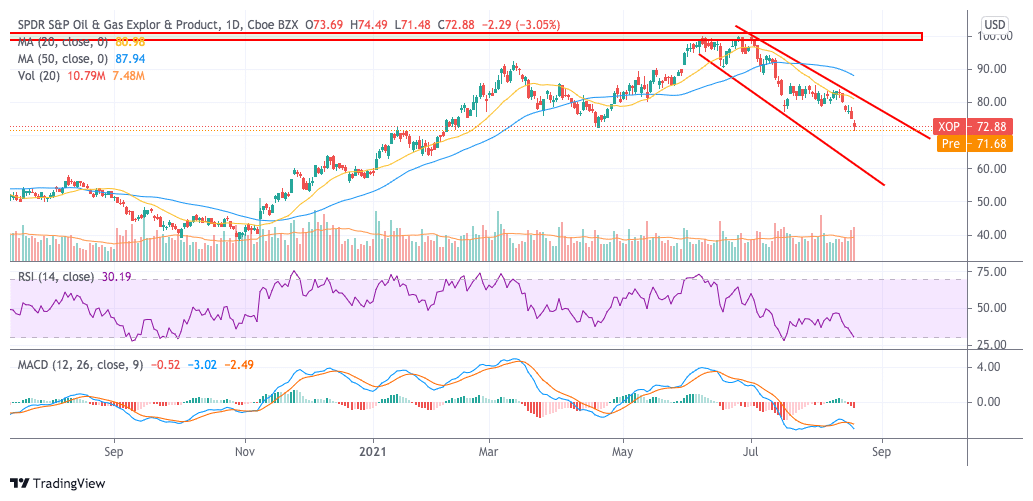

As a result, oil stocks have been embarked on a downtrend as reflected by the performance of the SPDR S&P Oil & Gas ETF (XOP), an exchange-traded fund that invests primarily in oil exploration and drilling companies like Chevron Corporation (CVX) and ConocoPhillips (COP).

So far in August, the ETF has dropped as much as 12% at $72.9 per share while it is losing 1.65% of its value this morning in pre-market stock trading action at $71.7 per share.

Weakness in the price of crude has been primarily caused by an increasing number of virus cases in key latitudes including the United States, where the 7-day average has risen to its highest levels since February this year, back when the country was facing the third and worst wave it has experienced since the pandemic started.

So far this week, the number of daily contagions has remained above 150,000 although the number of deaths is still relatively low compared to previous waves with the 7-day moving average standing at 769 deceases yesterday.

Meanwhile, other developed countries including Australia, Germany, the United Kingdom, and other nations in Europe have also experienced significant increases in the number of daily cases and this situation has resulted in a revision of oil’s demand outlook for the year.

“The latest lockdowns in major economies around the world have likely harmed the economic activities and growth forecasts in the months to come”, commented Margaret Yang from DailyFX.

The IEA lowers its demand outlook and the US dollar gains strength

On 12 August, the International Energy Agency (IEA) lowered its global demand forecast for crude by almost 500,000 barrels for the second semester of the year amid “new COVID- restrictions imposed in several major oil consuming countries, particularly in Asia”.

This revision led to a sharp correction in the price of crude while the US dollar has been steadily climbing since early June as reflected by Bloomberg’s Dollar Index (DXY).

So far in August, the benchmark, which tracks the value of the greenback against a basket of foreign currencies, has advanced 1.72% at 93.672 while reaching its highest level since November 2020. Meanwhile, since June started, the North American currency has advanced as much as 4.3% despite a sustained decline in US Treasury yields.

A strong US dollar is typically bearish for oil prices which is why this latest uptrend in the greenback is considered one of the factors driving crude prices lower. This trend reversal in the value of the dollar despite the country’s markedly high inflation readings has been attributed to expectations about an upcoming tapering of the Federal Reserve’s $120 billion asset purchase program as market participants hold the view that the central bank should start cutting the size of the program by the end of this year.

“There’s concern that the Fed will begin tapering, resulting in a stronger dollar and weaker crude prices”, said Andrew Lipow from Lipow Oil Associates.

What’s next for oil stocks?

Both WTI and Brent futures are approaching key areas of support at $61 and $64 per barrel respectively while the price action shows that a descending triangle pattern has been formed. This pattern could indicate an upcoming break of these important levels. Up next, there is another important area of support found at $57 (WTI) and $61 (Brent).

These markers should serve as plausible landing zones for crude prices on short notice as the market could have already corrected its course to incorporate the slowdown in demand caused by the rapid spread of the Delta variant.

That said, the Federal Reserve’s decision to taper could accelerate the advance of the US dollar and that could put further pressure on oil prices. For now, the outlook is not particularly bullish and oil prices may trade range-bound for a while until they find a floor at any of these levels.

As a result, the outlook for oil stocks is not bullish either. In this regard, aside from the impact that lower oil prices would have on the top-line results of firms within this sector, it is also important to note that higher US Treasury yields resulting from lower asset purchases from the Fed could also increase financing costs for oil companies and that could further depress their valuations.

The oil sector is considered a capital-intensive industry that requires important amounts of capital expenditures to be deployed every year and debt ratios are typically higher than those seen in other segments of the economy. Therefore, higher costs of capital are an important driver for oil stocks.

Question & Answers (0)