How to Buy Nike Shares UK – With 0% Commission

With a market cap of over $240 billion and an operation of nearly 1,100 retail stores throughout the entire world, Nike is the most valuable and popular apparel brand in the world. But even if you own products of Nike and you’re familiar with the brand, you still need to find more information about the American multinational shoe and apparel company before you invest in this company and what’s the best way to buy Nike shares in the UK.

Step 1: Choose a Stock Broker

If you are based in the UK and want to buy Nike shares, the first thing you need to do is to find a reputable brokerage firm that supports its shares. There are plenty of online trading platforms that offer you to buy and sell Nike shares as it is one of the largest companies in the world and one of the most traded stocks in the world. That said, it is crucial that you find a stockbroker that is regulated in the UK and is offering a cost-effective way to purchase NKE shares.

To help you get the best options available – below we recommend two of the best UK brokers to buy Nike shares:

Research Nike Shares

Before you make an investment in any company, you must dig into the quality of the company and its current financial situation. As such, in this part of our guide, we’ll explore the company’s structure, revenues, earnings, dividend distributions, etc. We’ll also take a closer look at Nike’s share price over the last years, and the Nike share price outlook

What is Nike?

As of 2022, Nike, along with Adidas, is the most dominant sportswear and athletic footwear company worldwide. It operates in over 170 countries around the world and has more than 1100 stores and 75,400 worldwide employees. Ultimately, it falls under the classification of a mega-cap company with a market capitalization of above $200 billion. Nike is listed on the New York Stock Exchange (NYSE) under the ticker symbol NKE. It is also one of the components of the Dow Jones 30 Composite Average and is the 85th company in the prestigious Fortune 500 list.

Nike Share Price

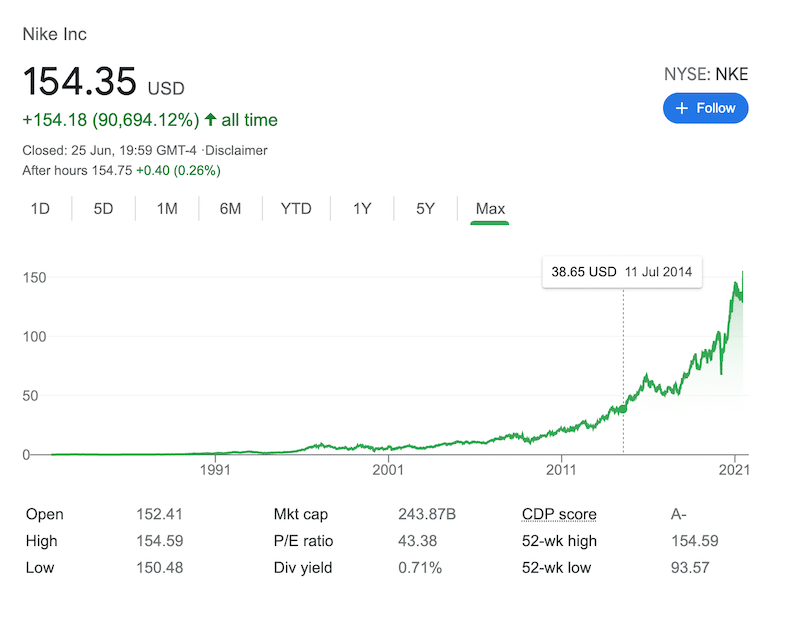

While we are most familiar with Nike for their top-quality apparel and sports products, just a few have the knowledge about the Nike company and the Nike share price performance. So, before you make any investment in Nike shares, it’s essential to analyze the stock’s past performance and get a clear vision of the current NKE market sentiment, as well as the short and long-term outlook.

Presently, one share of Nike is worth $154 per share, after the stock soared over 15% on June 25th when the company reported fourth-quarter earnings and sales, beating analysts’ estimates. Due to the monster earning reports and the record revenue in North America, NKE stock price hit a record high of $154.35, breaking the previous all-time of $146.35 it reached earlier this year in January. Nike gained 9.10% in 2021, and more impressively, at the time of writing it has a 1-year return of 64.78%.

In terms of the Price per Earnings (P/E) ratio, Nike has a forward PE ratio of 34, which is considered high by historical stock market standards and indicates investors’ expectation that Nike is likely to experience a significant amount of growth in the near future.

Nike Shares Dividends

When it comes to dividend payments, Nike is one of the best income/dividend stocks out there in the market. Since 1985, Nike has been steadily paying out quarterly cash dividend payouts to its shareholders. And, it has a very impressive annual dividend growth of around 10%-15%. In late 2020, Nike has also announced a 12% increase of its dividend payout to $1.10 per share in 2021, a significant raise of $0.40 compared to $0.95 per share in 2020.

Are Nike Shares a Good Buy?

After we’ve covered the basics of Nike, it turns out it all comes down to the question – Is it the right time to buy NKE shares? After all, just a few days ago Nike’s stock performance since the beginning of the year was negative at -5.92%. However, the recent surge in Nike’s price following the earnings report has changed the market sentiment. Consequently, according to the vast majority of analysts in the market, this might be an incredible opportunity to buy Nike shares.

With that in mind, let’s take a closer at some of the main reasons why Nike is a good long-term investment right now.

Nike Stock is Soaring after Earnings and Sales Report, Beating Analysts’ Expectations

As mentioned above, Nike stock jumped by more than 15% on Friday morning, June 25th, after the company reported better-than-expected earnings and sales, and beating wall street analyst expectations. This includes a record revenue in North America, earnings per share (EPS) of 93c compared to analysts’ expectations of 51c, and revenue of $12.34 billion compared to $11.01 billion expected. In its largest market, North America, Nike sales more than doubled to all-time record revenue of $5.38 billion.

Looking ahead, Nike’s outlook for the next year seems much brighter. The company said it is expecting to surpass an annual revenue of $50 billion in the upcoming year, above analysts expectation of $48.5 billion.

Solid Performance Despite COVID-19 Pandemic

There’s no doubt that the Covid-19 pandemic has had a negative impact on Nike sales and total revenue. In the fourth quarter of 2020, sales plunged by 38% as retail stores closed around the world and many sports events were canceled. But overall, the sportswear company has performed pretty well in 2020, and in the first quarter of its 2021 fiscal year, Nike’s earnings per share grew by 70%.

When we look ahead, it seems that Nike is well prepared for the next wave of Covid-19, if it arises.

Nike Plans to Increase Digital Sales in the Future

One of the effects of the Covid-19 pandemic has been the shift of many businesses to the digital world and the increase in online sales. In September last year, Nike said its online sales are far more profitable than retail shops, which has been proven to be true after the first-quarter earnings report that revealed a huge increase of 82% in Nike’s digital sales. The company’s CEO, John Donahoe, said the coronavirus pandemic has fueled the company’s decision to go digital. Moreover, in the last earning reports on June 25, Nike reported an increase of 41% in digital sales compared to last year and an increase of 147% from 2019.

It is also worth mentioning that Nike.com’s online site has over 114 monthly million visitors according to SimilarWeb, which makes it one of the largest sites in the world in terms of organic traffic (ranks 4th in its category and 296 in global rank).

All things considered, Nike’s digital transformation is something big right now for the company and its shareholders. The company has even been investing more and more into metaverse technology, making it one of the best metaverse stocks to buy.

Nike is a ‘Brand of China and For China’

Nike is clearly a global brand but it primarily extremely popular in China, partly due to the increasing interest of Chinese in the NBA and the popularity of the Nike’s Jordan brand in China. And, despite the concerns that Nike will suffer from the tensions between the United States and China that caused the recent boycott, Nike has reported that sales in Greater China rose by 17% to $1.93 billion. Additionally, Nike’s chief executive John Donahoe said last week that “Nike is a brand that is of China and for China,” ensuring the American company plans to increase its dominancy in China, despite the statement of Nike on Xinjiang in March 2021.

Nike Shares Buy or Sell?

Before you buy Nike shares, it is crucial that you understand the options that exist in the market – You can always buy shares of companies, however, you also have the ability to short sell stocks and thus make a profit when the price falls in value.

Once you have the option to buy or short sell Nike shares, you need to make a decision based on our conclusion in this Nike review and your own research. In our view, Nike is a strong company with strong financials and a brand that has many areas of opportunity for growth. This is especially the case after the strong quarterly earnings report and Nike’s management announcement to repurchase 50 million of NKE shares for $4.7 billion during the fiscal fourth quarter. Thus, some Wall Street analysts even believe that Nike could surge by another 50% in the near future.

So, all things considered, in the current market conditions, Nike is more a buying opportunity than a sign to stay away. The strong earnings report, the good performance in China despite the boycott, the shift to digital, and the attractive and stable dividend payout – all of these factors make Nike a great long-term investment strategy opportunity.

Buy Nike Shares UK With 0% Commission

In summary, Nike is certainly one of the best shares to buy right now. The NKE stock is currently trading at all-time high levels and the trend is expected to continue in the upcoming months. So, if you’re looking to gain exposure to Nike shares – all that is left for you to do is to find an online platform that supports its shares.

FAQs

Should I buy Nike Shares?

Even though there's some level of risk in buying stocks right now when the markets are trading at all-time levels and the Covid 19 is still a threat, Nike stock seems to be a great long term investment. The shift to digital sales has the potential to boost Nike's earnings, and the recent performance shows the resilience of the world's largest sportswear company in the world.

How much are Nike shares worth?

As of late June 2021, Nike shares are trading at $154.35 per share. This represents a market cap of $243.86 billion.

Who owns Nike?

Nike is primarily owned by the American billionaire Phillip Knight who holds 17% of shares outstanding. Additionally, some of the largest institutional holders of Nike include Vanguard Group, Inc. (8.17%), Blackrock Inc. (7.42%), and State Street Corporation (4.32%).

Who are Nike's major competitors?

Clearly, Nike's biggest competitor is Adidas, the German company that was founded in1949 and has a market cap of over $68 billion. Other Nike's competitors include Under Armour, Reebok, ASICS, Skechers, New Balance, Puma, and Converse.

Where is Nike based?

Nike is based in Beaverton, Oregon, the United States. Overall, it has 525 factories in over 41 countries.