The US recorded an unexpected budget surplus of $27 billion in June 2025, marking the first June surplus since 2005. This significant turnaround from a $71 billion deficit in June 2024 was primarily driven by a substantial surge in customs duties (tariffs) and a 7% reduction in government outlays.

The US government had a surprise budget surplus

The Treasury Department reported that total budget receipts for June reached a record $526 billion, a 13% increase from the previous year. This revenue boost was largely attributed to a dramatic rise in tariff collections, which quadrupled to $27.2 billion on a gross basis ($26.6 billion net) in June, hitting new records. For the first nine months of fiscal year 2025, customs duties have reached $113.3 billion gross, nearly double the collections from the prior year. The number has surpassed $100 billion for the first time in a fiscal year, which underscores the increasing role of tariffs as a significant revenue contributor for the federal government.

Notably, while the Trump administration is pushing through trade deals, a 10% minimum tariff looks here to stay. So far, while the UK has managed a trade deal with a 10% tariff, for Vietnam, the rate is 20%.

The US budget deficit has risen by 5% in the first nine months

Along with higher receipts, a 7% YoY fall in outlays also helped drive the budget surplus last month. While June saw an overall decrease in outlays, the broader fiscal year-to-date picture still shows an increase in the deficit. For the first nine months of fiscal 2025 (which began October 1, 2024), the overall deficit has increased 5% ($64 billion) to $1.337 trillion. This is due to continued rises in expenditures across several key categories.

Interest costs soar

In June, the net interest on the country’s $36 trillion national debt was $84 billion. Interest payments were the second biggest spending category after Social Security. The US spent $749 billion on interest payments in the first nine months of the fiscal year, and the number is expected to rise to $1.2 trillion in the full fiscal year.

Along with the bloated debt pile, higher interest rates are also adding to the overall interest burden and, by extension, the budget deficit. While Trump has been calling for the Fed to cut rates, the US central bank is in a wait-and-see mode, citing the uncertainty over the tariffs.

US budget deficit expected to rise further

The burgeoning US national debt and budget deficit are expected to rise even further as the Republican tax-and-spending bill, named the One Big Beautiful Bill Act (OBBBA), was signed by President Trump.

There are various estimates on how much the bill would add to the national debt. For instance, the independent Congressional Budget Office (CBO), which the White House labeled as “partisan,” estimates that the bill could add $3.4 trillion in debt over the next decade.

While CBO believes that OBBBA will boost economic growth, it estimates that the proposals would increase price levels and interest rates. As a result of higher borrowing, CBO estimates the bill will boost the ten-year Treasury yield by an average of 14 basis points – and presumably more by the end of the decade.”

The Committee for a Responsible Federal Budget’s (CRFB) central estimate for Trump’s plan is an increase of $7.75 trillion to the debt through 2035. Their low estimate is $1.65 trillion, while the high estimate stands at $15.55 trillion.

Tesla CEO Elon Musk, who was heading the Department of Government Efficiency (DOGE) in the Trump administration, has been among the most vociferous critics of the tax bill and has termed it a “disgusting abomination.” In another tweet, he labeled it “Debt Slavery Bill,” pointing to the largest ever increase in the debt ceiling.

Musk has talked about floating a new political party named America Party and aims to target a select few seats to influence the decision-making.

Moody’s cut the US sovereign credit rating

The US lost its last top credit rating in May after Moody’s cut the country’s sovereign credit rating one notch to Aa1 from Aaa. The rating agency joined its peers in slashing the US credit rating amid concerns over unsustainable US fiscal debt and the rising cost of financing the deficit.

To be sure, credit rating agencies downgrading US sovereign debt is hardly a surprise considering the precarious fiscal position.

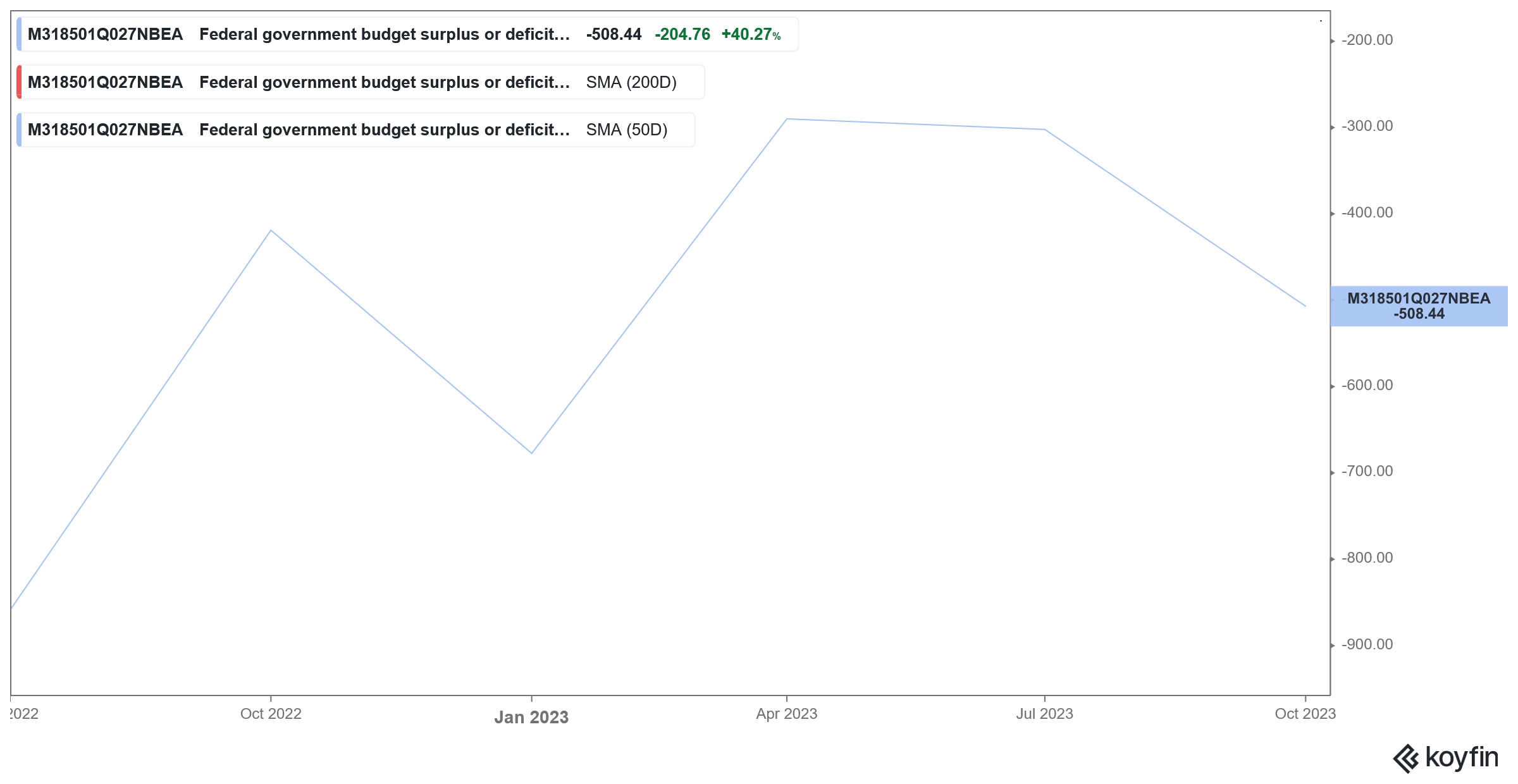

The US budget deficit has been at elevated levels since the COVID-19 pandemic

Notably, the US budget deficit hit a record high of $3.13 trillion in the fiscal year 2021. The surge was understandable as the economy needed support during the pandemic. The deficit came down to $2.77 trillion in the fiscal year 2022. It fell further to $1.38 trillion in the next fiscal year, and while it was much below the previous year, it was significantly higher than in pre-pandemic times, when the deficit was contained below $1 trillion. However, in the fiscal year 2024, the budget deficit increased to $1.8 trillion.

Several leading economists and fund managers have been warning about the soaring fiscal deficit and ballooning US national debt. At Berkshire Hathaway’s annual meeting earlier this year, chairman Warren Buffett warned that US debt has reached unsustainable levels.

Many fear that the fiscal path that the world’s biggest economy has been pursuing since the COVID-19 pandemic is unsustainable, and the country needs to bring down its burgeoning fiscal deficit that has surpassed its national GDP.

Many economists have warned of an unsustainable fiscal path

Fed chair Jerome Powell has also cautioned multiple times on the budget deficits and ever-rising fiscal debt, saying it is approaching unsustainable levels. Powell believes that politicians were taking the wrong approach by targeting discretionary spending, which he said not only contributes a small percentage of total spending but also its share in total spending has been gradually falling.

Last month, BlackRock CEO Larry Fink also joined the long and growing list of prominent people who have cautioned on the high US budget deficit and the alarming rise in the country’s national debt.

Overall, while the surprise budget surplus in June has come as a welcome break, the US still has a long way to go to address the unsustainable fiscal path that it has followed for over five years now.

Question & Answers (0)