The Biden administration raked in a fiscal deficit of $1.83 billion in the fiscal year 2024 that ended in September. It was the third-highest fiscal deficit ever and the highest outside the COVID-19 pandemic where deficits grew across the globe as governments provided various forms of support to support the economy.

In the fiscal year 2024, the US federal government spent $6.75 trillion while it collected mere $4.92 trillion in revenue.

Notably, the US fiscal deficit hit a record high of $3.13 trillion in the fiscal year 2020. The surge was understandable as the economy needed support during the pandemic. The deficit came down to $2.77 trillion in the fiscal year 2021. It fell further to $1.38 trillion in the next fiscal year and while it was much below the previous year, it was significantly higher than in pre-pandemic times when the deficit was contained below $1 trillion.

US fiscal deficit rises to third highest on record

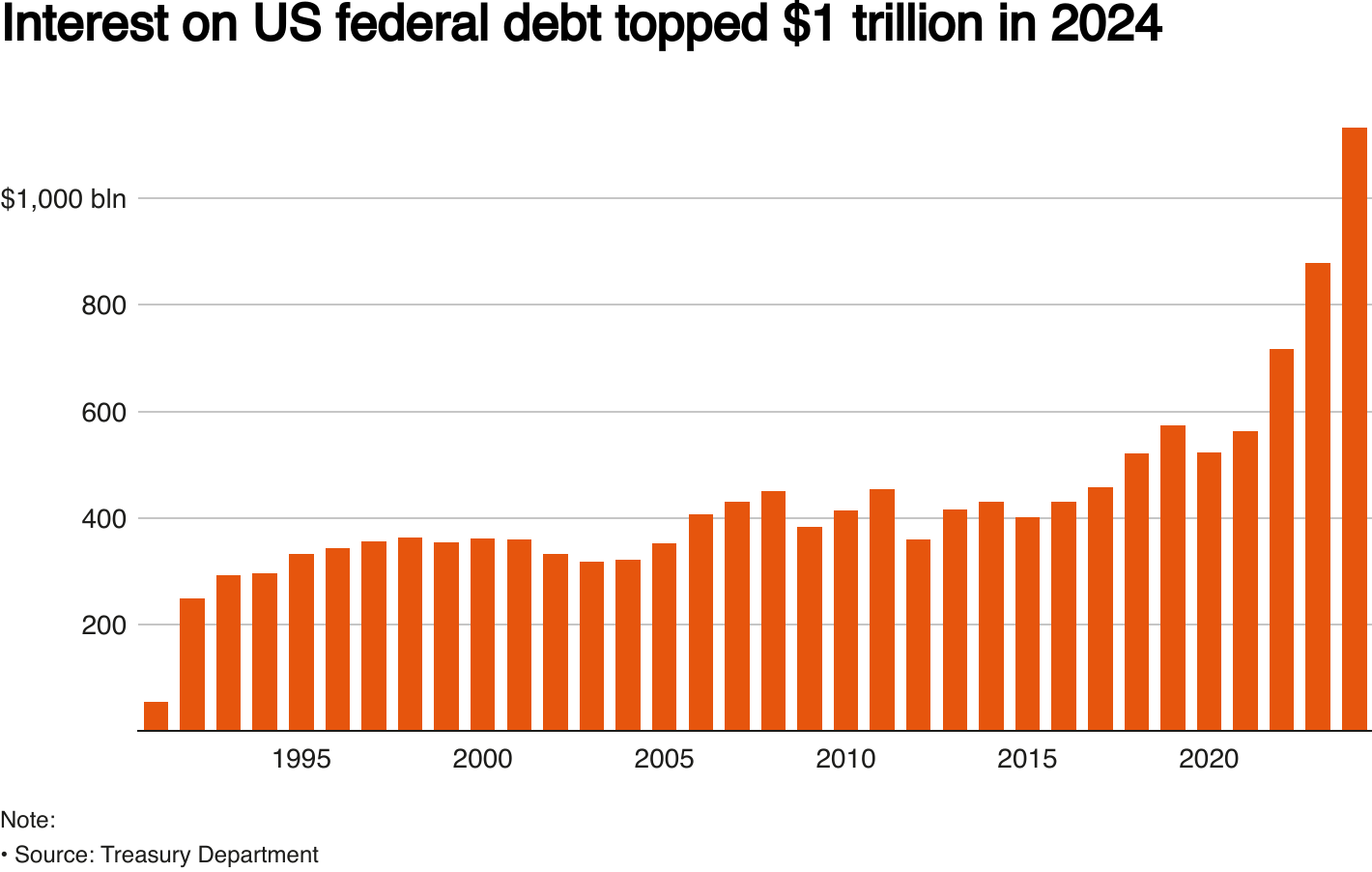

However, after the fall in fiscal year 2022, the US deficit has increased for two consecutive years. The total US national debt is now over $35.7 trillion which is around 125% of the GDP. US fiscal deficit rose 8% YoY last year led by a 29% increase in interest costs. The US government paid a record $1.133 trillion in interest on Treasury securities last fiscal year which was a record and the first time ever that annual interest expense rose over $1 trillion.

According to a senior Treasury officer, the interest cost as a percentage of GDP rose to 3.93% last fiscal year. While that number is still below the 1991 record of 4.69% it is the highest percentage since December 1998 when the metric hit 4.01%.

Meanwhile, in September, the weighted average interest rate on US federal debt was 3.32% which was down slightly from August, thanks to the Fed’s rate cut. The weighted average interest rate should continue to taper down as the Fed embarks on its rate-cut cycle. That said, in absolute terms, the US national debt continues to rise which would mean the interest costs might not fall as much as the fall in interest rates.

Most believe the US government is on an unsustainable fiscal path

Many fear that the fiscal path that the world’s biggest economy has been pursuing since the COVID-19 pandemic is unsustainable and the country needs to bring down its burgeoning fiscal deficit that has surpassed its national GDP.

In his interview with CBS 60 Minutes earlier this year, Fed chair Jerome Powell said, “The U.S. federal government is on an unsustainable fiscal path. And that just means that the debt is growing faster than the economy.”

He added, “I think the pandemic was a very special event, and it caused the government to really spend to ward off what looked like very severe downside risks. It’s probably time, or past time, to get back to an adult conversation among elected officials about getting the federal government back on a sustainable fiscal path.”

While Powell said that the Fed’s role is not to “judge” the fiscal policy, he warned, “we’re effectively — we’re borrowing from future generations. And every generation really should pay for the things that it, that it needs. It can cause the federal government to buy the things that it needs for it, but it really should pay for those things and not hand the bills to our children and grandchildren.”

Biden administration increased spending on green energy

The Biden administration enacted the Inflation Reduction Act in 2022 which set aside billions for green energy transformation. It also laid out billions more for chip manufacturing in the country. These measures have helped revive manufacturing and chipmakers like Intel are lining up to set up new plants in the country.

While these investments and grants are expected to pay off over the long term, for now, they have only worsened the fiscal deficit situation.

How can the US government lower its fiscal deficit?

Now, there are two ways through which the fiscal deficit situation can be addressed. The first is through increasing receipts for which the federal government would need to raise taxes. The second way is through cutting down on the expenditure.

Many believe that the US would need to raise capital gain taxes to increase its tax collections. Warren Buffett has been selling shares anticipating a rise in capital gain taxes

The company is sitting on a massive gain on its long-term investments like Apple and Bank of America and would stand to lose if capital gain taxes rise in the US.

“It doesn’t bother me in the least to write that check and I would really hope with all that America’s done for all of you, it shouldn’t bother you that we do it and if I’m doing it at 21% this year and we’re doing it a little higher percentage later on, I don’t think you’ll actually mind the fact that we sold a little Apple this year,” said Buffett at this year’s shareholder meeting.

US debt might rise irrespective of who wins the next election

Lowering the burgeoning debt pile and addressing the unsustainable fiscal deficit situation does not feature as a top priority for both presidential candidates. The Committee for a Responsible Federal Budget estimates that Donald Trump’s economic plans would add $7.5 trillion in new debt as the former president seeks to cut corporate taxes further. Kamala Harris fares somewhat better but her plans are also expected to add $3.5 trillion to the national debt.

All said, with the fiscal deficit now running at record levels under normal circumstances, it might be high time that politicians across the divide look at measures to address the situation. An unsustainable fiscal path in the US would not only threaten its economy but could also shake up the global financial system.

Question & Answers (0)