The burgeoning US national debt and budget deficit are expected to rise even further as the Republican tax-and-spending bill cleared the House and now looks set to become law once President Donald Trump signs it.

Many have expressed concerns that the One Big Beautiful Bill Act (OBBBA) would add trillions of dollars of new debt to the already bloated debt pile, which stands at around 122% of the GDP.

How much will the US deficit rise after Trump’s tax bill?

There are various estimates on how much the bill would add to the national debt. For instance, the independent Congressional Budget Office (CBO), which the White House labeled as “partisan,” estimates that the bill could add $3.4 trillion in debt over the next decade.

While CBO believes that OBBBA will boost economic growth, it estimates that the proposals would increase price levels and interest rates. As a result of higher borrowing, CBO estimates the bill will boost the ten-year Treasury yield by an average of 14 basis points – and presumably more by the end of the decade.”

The Committee for a Responsible Federal Budget’s (CRFB) central estimate for Trump’s plan is an increase of $7.75 trillion to the debt through 2035. Their low estimate is $1.65 trillion, while the high estimate stands at $15.55 trillion.

“The level of blatant disregard we just witnessed for our nation’s fiscal condition and budget process is a failure of responsible governing,” said CRFB president Maya MacGuineas. She added, “These are the very same lawmakers who for years have bemoaned the nation’s massive debt, voting to put another $4 trillion on the credit card.”

A new analysis from the Cato Institute, a libertarian think tank, suggests that the bill could add $6 trillion to the deficit over the next decade, accounting for factors such as interest rates and economic growth.

The deficit situation might only worsen in the coming years

“The bill schedules various tax giveaways, such as no tax on tips and no tax on overtime, and other spending increases to expire early in the ten-year window, making them appear cheaper on its face,” said policy analyst Dominik Lett in the Cato report. He added, “Future Congresses will almost certainly be tempted to extend these provisions. Making them permanent would raise the ten-year cost to about $5.4 trillion, interest included.”

Jason Furman, who served as chair of the Council of Economic Advisers under President Barack Obama, echoes similar views and believes that the deficit situation won’t get better even under a Democratic candidate.

“The next Democratic administration will want to make this in some ways fiscally better, but in more ways want to make it fiscally worse.” Said Furman. He added, “It is both worse than current policy and will prove hard to undo.”

Analysts see the growth forecast as bloated

Republicans, meanwhile, argue that the tax breaks will pay for themselves through higher economic growth. “This is jet fuel for the economy, and all boats are going to rise,” said House Speaker Mike Johnson. However, many economists find the growth estimates to be bloated.

“This bill is very clear: There are a certain number of tax cuts, there are a certain amount of spending cuts, and they don’t offset each other,” said Martha Gimbel, executive director and co-founder of the Budget Lab at Yale. She added, “No amount of assumptions about the amount of growth we’ll get will overcome the reality on the ground.”

Moody’s cut the US sovereign credit rating

The US lost its last top credit rating in May after Moody’s cut the country’s sovereign credit rating one notch to Aa1 from Aaa. The rating agency joined its peers in slashing the US credit rating amid concerns over unsustainable US fiscal debt and the rising cost of financing the deficit.

“This one-notch downgrade on our 21-notch rating scale reflects the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns,” said Moody’s in its report.

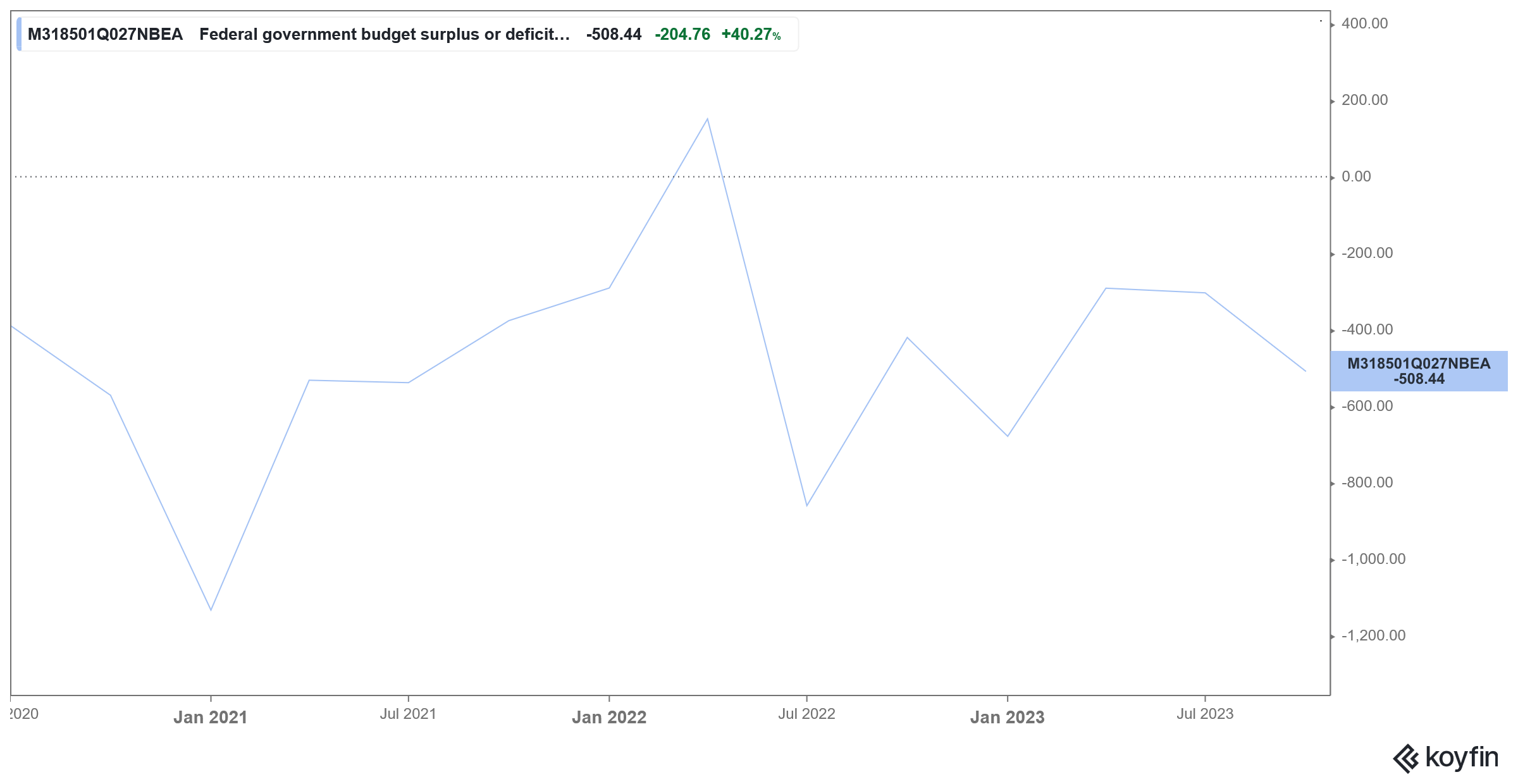

To be sure, credit rating agencies downgrading US sovereign debt is hardly a surprise considering the precarious fiscal position. In the first six months of the current fiscal year, the US government’s budget deficit rose to $1.3 trillion, which is the second highest in history for the period. The only time the deficit was higher was in the fiscal year 2021, when the deficit jumped to $1.7 trillion in the first six months due to higher spending during the COVID-19 pandemic.

US debt has skyrocketed

The total government debt has surged to $36.22 trillion and has long surpassed the national GDP. The rising debt pile has led to a massive increase in interest expense, and the Treasury Department estimates that it will spend $1.2 trillion on interest payments this year.

Notably, the US fiscal deficit hit a record high of $3.13 trillion in the fiscal year 2021. The surge was understandable as the economy needed support during the pandemic. The deficit came down to $2.77 trillion in the fiscal year 2022. It fell further to $1.38 trillion in the next fiscal year, and while it was much below the previous year, it was significantly higher than in pre-pandemic times, when the deficit was contained below $1 trillion. However, in the fiscal year 2024, the budget deficit increased to $1.8 trillion.

Several leading economists and fund managers have been warning about the soaring fiscal deficit and ballooning US national debt. At Berkshire Hathaway’s annual meeting earlier this year, chairman Warren Buffett warned that US debt has reached unsustainable levels.

“We are operating at a fiscal deficit now that is unsustainable over a very long period of time. We don’t know whether that means two years or 20 years, because there’s never been a country like the United States, but this is something that can’t go on forever,” said Buffett at the meeting, where, among others, he announced his retirement from the conglomerate.

Powell has also cautioned about the soaring deficit

Many fear that the fiscal path that the world’s biggest economy has been pursuing since the COVID-19 pandemic is unsustainable, and the country needs to bring down its burgeoning fiscal deficit that has surpassed its national GDP.

Fed chair Jerome Powell has also cautioned about the rising deficits and unsustainable fiscal position multiple times. Last month, BlackRock CEO Larry Fink also joined the long and growing list of prominent people who have cautioned on the high US budget deficit and the alarming rise in the country’s national debt

Question & Answers (0)