Data released by the Treasury Department showed that the US budget deficit rose to $307 billion in February 2025, which was 3.7% higher than the corresponding month last year. In the first five months of the current fiscal year that began in October, the US budget deficit rose to $1.15 billion – 38% higher than the corresponding period in the last fiscal year.

While the US government’s revenues rose a mere 2% on an adjusted basis to $1.89 trillion, the outlays rose 7% to a whooping $3.04 trillion. Looking at the breakup, Medicare accounted for $518 billion of these expenses – $124 billion higher than the previous fiscal year. The federal government spent $478 billion on interest on the ballooning national debt while Social Security spending was $663 billion in the first five months of the fiscal year.

US budget deficit soars above $1 trillion

While the Federal government spent $603 billion in February – which was the first full month under President Donald Trump – its receipts were a mere $296 billion. While both receipts and outlays hit February records, the difference ballooned. Trump has tasked the Department of Government Efficiency (DOGE), headed by Elon Musk, to advise him on cutting wasteful spending. However, so far these actions have shown up in the Federal Government’s finances.

While things might get better in March due to the tariffs that the Trump administration has imposed, the rising budget deficit has been a burning issue.

According to Maya MacGuineas, President of The Committee for a Responsible Federal Budget, the US government has been roughly borrowing $8 billion a day so far this fiscal year. She added, “What needs no confirmation is that we are almost halfway through the fiscal year and yet we have done nothing in the way of making progress toward getting our skyrocketing debt under control.”

The US national debt has surpassed GDP

The total government debt was $36.2 trillion at the end of February and has long surpassed the national GDP. The rising debt pile has led to a massive increase in interest expense, and the Treasury Department estimates that it will spend $1.2 trillion on interest payments this year.

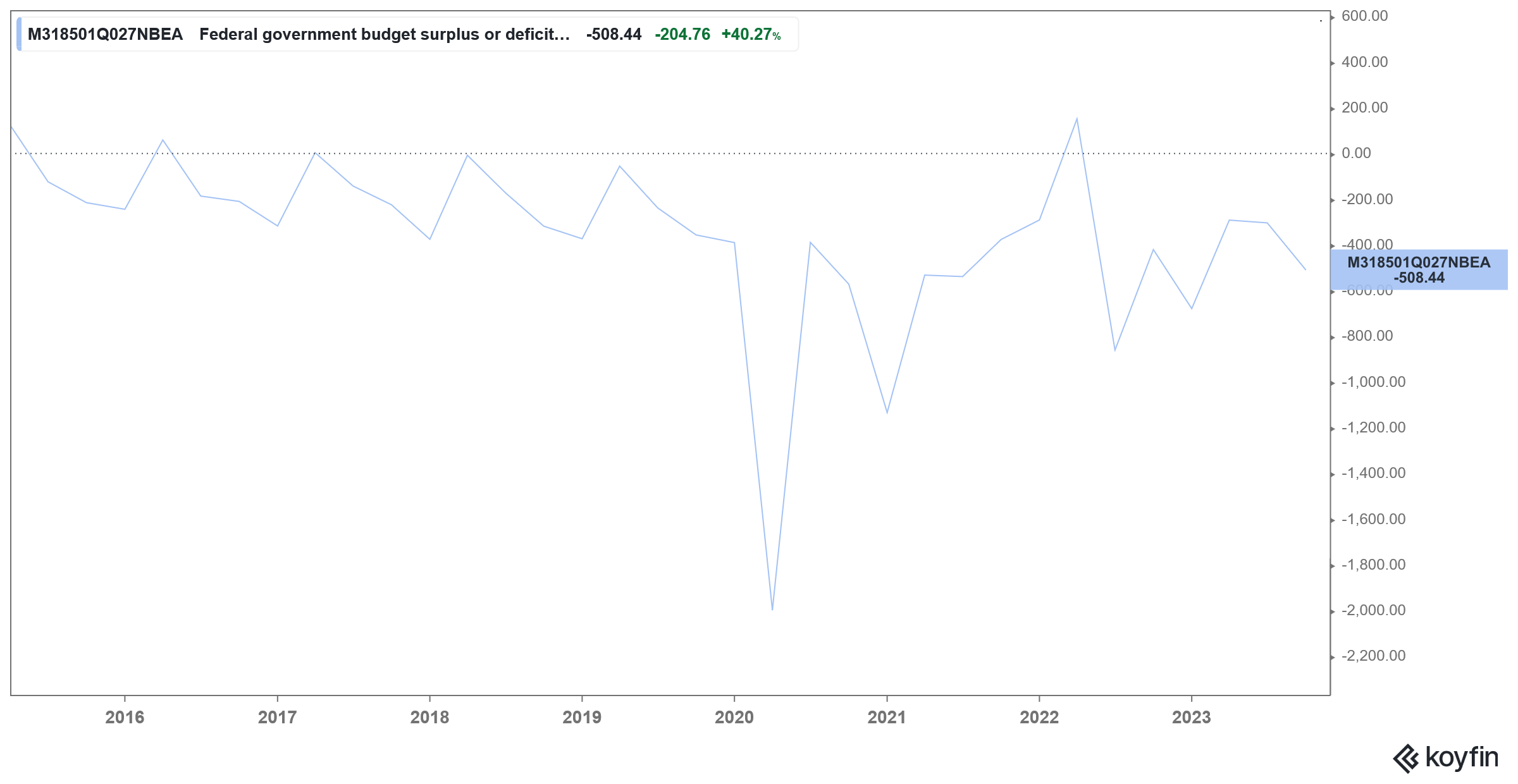

Notably, the US fiscal deficit hit a record high of $3.13 trillion in the fiscal year 2020. The surge was understandable as the economy needed support during the pandemic. The deficit came down to $2.77 trillion in the fiscal year 2021. It fell further to $1.38 trillion in the next fiscal year, and while it was much below the previous year, it was significantly higher than in pre-pandemic times when the deficit was contained below $1 trillion. However, in the fiscal year 2024, the budget deficit increases to $1.8 trillion.

Many fear that the fiscal path that the world’s biggest economy has been pursuing since the COVID-19 pandemic is unsustainable and the country needs to bring down its burgeoning fiscal deficit that has surpassed its national GDP.

Dalio has cautioned on saoring national debt.

Ray Dalio, who has been quite vocal about the need to address the burgeoning national debt and budget deficit, believes that the US needs to cut the deficit to around 3% of GDP versus the 7.2% that it currently stands at.

Speaking with CNBC’s Sara Eisen at CONVERGE LIVE in Singapore, the Bridgewater founder said the US would need “to sell a quantity of debt that the world is not going to want to buy.” He added, “That’s a big deal. You are going to see shocking developments in terms of how that’s going to be dealt with.”

In response to a question on whether the rising deficit would lead to more austerity in the US, Dalio said that the country would either need to restructure its debt, cut off payments to some creditors, or cajole other countries to buy its debt.

According to Dalio, “Just as we are seeing political and geopolitical shifts that seem unimaginable to most people, if you just look at history, you will see these things repeating over and over again.” He added, “We will be surprised by some of the developments that will seem equally shocking as those developments that we have seen.”

Previously also, Dalio “alerted” governments and people about the rising deficit and said, “I want to help, you know, and so I feel like the doctor, and then I would say everybody, politically … if this doesn’t happen, and we have the equivalent of, you know, an economic heart attack, or a heart attack of the bond market, then you know who’s responsible, because it can happen.”

Jerome Powell on the rising budget deficit

In his interview with CBS 60 Minutes last year, Fed chair Jerome Powell said, “The U.S. federal government is on an unsustainable fiscal path. And that just means that the debt is growing faster than the economy.”

He added, “I think the pandemic was a very special event, and it caused the government to really spend to ward off what looked like very severe downside risks. It’s probably time, or past time, to get back to an adult conversation among elected officials about getting the federal government back on a sustainable fiscal path.”

While Powell said that the Fed’s role is not to “judge” the fiscal policy, he warned, “we’re effectively — we’re borrowing from future generations. And every generation really should pay for the things that it, that it needs. It can cause the federal government to buy the things that it needs for it, but it really should pay for those things and not hand the bills to our children and grandchildren.”

Warren Buffett warns of high deficit.

In this year’s annual letter, Warren Buffett also sounded an alarm over higher fiscal deficits and said, “Paper money can see its value evaporate if fiscal folly prevails. In some countries, this reckless practice has become habitual, and, in our country’s short history, the U.S. has come close to the edge.”

Buffett has been furiously selling shares, and Berkshire Hathway’s cash pile rose to a fresh record high of $334 billion at the end of 2024.

The rise in cash is hardly surprising and the company’s cash pile has been rising gradually over the last few quarters since Buffett has net sold shares for nine consecutive quarters. Last year the company sold $134 billion worth of shares as Buffett offloaded stakes in top holdings Apple and Bank of America.

Question & Answers (0)