Tesla said its revenue reached $6.04 billion during the quarter, with $428 million of that from regulatory credits as the company was also hit hard by the effects of a Covid-19 pandemic on its US employees and factory operations, in particular.

On the earnings call Wednesday, Elon Musk announced that Tesla will build its next factory near Austin, Texas while dedicating its Fremont, California, car plant to the production of Model S and Model X vehicles for all markets, and for Model 3 and Model Y production for the Western half of North America. The Texas factory, Musk said, will be used for the production of the company’s Cybertruck, Semi, and Model 3 and Model Y vehicles for the Eastern half of North America.

Tesla is among the most popular stock on US retail investor platforms with $3.2billion worth of Tesla shares bought so far this year in South Korea alone, which is nearly a 13-fold increase from all of 2019.

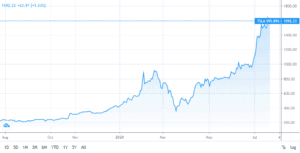

This allowed the company to achieve better-than-expected second-quarter vehicle production and delivery numbers despite automobile revenue declining by 4% year-over-year for Tesla from $5.38 billion to $5.18 billion. At this time last year, Tesla’s shares were trading around $260. Now, they’re above $1,500, making the company the most valuable auto-maker in the U.S. by market cap.

All of this gives Elon Musk plenty of reasons to remain optimistic for the automaker’s future. During a video speech at the inauguration of Shanghai’s annual World Artificial Intelligence Conference on July 9, Mr Musk claimed Tesla is “very close” to creating entirely autonomous driving cars that are able to navigate roads without a driver in what has been dubbed level 5 autonomy.

He said: “I’m extremely confident that level 5 or essentially complete autonomy will happen and I think will happen very quickly.

The autonomous vehicles come in addition to plans for an all-electric Tesla Semi, a million-mile battery, a futuristic Cybertruck, and to have 1 million robotaxi-ready vehicles on the road by the end of 2020.

The prospectus for the company remains good despite Tesla slashing its research & development spending in the second quarter to $279 million down from $324 million a year ago. The consensus amongst analysts puts it among the strongest stocks for 2020 with many investors hoping it could increase their wealth just like it did for its owner.

Question & Answers (0)